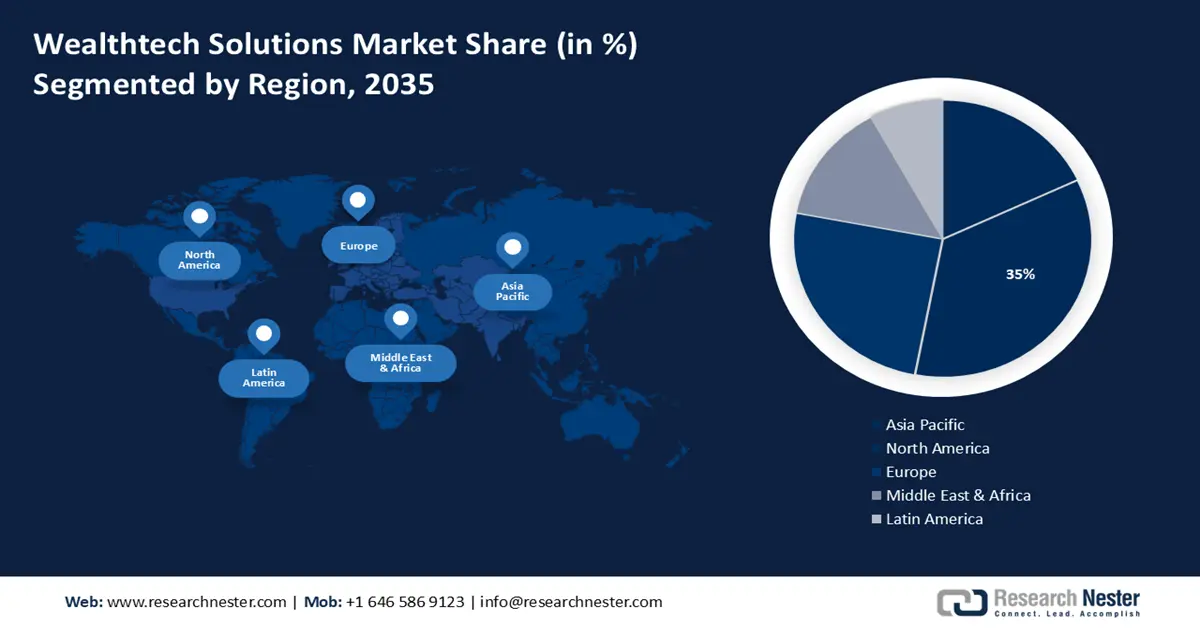

Wealthtech Solutions Market Regional Analysis:

North America Market Insights

North America industry is expected to hold largest revenue share of 35% by 2035. The market growth in the region is also expected on account of digitalization in the financial sector, driven by changing consumer preferences and advancements in technology. The size of the North American digital banking sector reached USD 500 billion in 2019 and is anticipated to grow by more than 4% from 2020 to 2026.

Furthermore, in the United States, the market is booming forefront, as around USD 21 billion was spent on wealthtech services in 2020. Also, wealthtech funding totaled USD 14 billion in 2021, with 75% of Americans already using wealthtech services.

In asset management, wealth planning, or direct investing, the wealth technology market has expanded at a never-before-seen rate. One market niche stands out in the midst of that massive upsurge in innovation and adoption. At CG Wealth, generative AI is another area of great interest. Among the nearly endless potential uses

European Market Insights

Europe region is projected to register substantial growth through 2035 owing to demand for digital financial services, driven by changing consumer preferences, technological advancements, and regulatory reforms, growing at a CAGR of around 14%. By 2025, its technology infrastructure is expected to provide coverage for 5G networks in 75 % of the population. Wealthtech solutions cater to this demand by offering digital platforms and tools for investment management, financial planning, and portfolio analysis, contributing to the growth of the market in the region.

The wealthtech solutions market in Germany is anticipated to garner significant market figure, owing to develop in the fintech sector, Digital assets with an AUM of USD 3,208.00 million in 2024 will be the most important market.

Over the previous five years, French FinTech has had tremendous growth. The CAGR of French FinTech investment climbed to 52.2% between 2018 and 2022. France is now firmly established as one of Europe's leading FinTech nations.