Wealthtech Solutions Market Outlook:

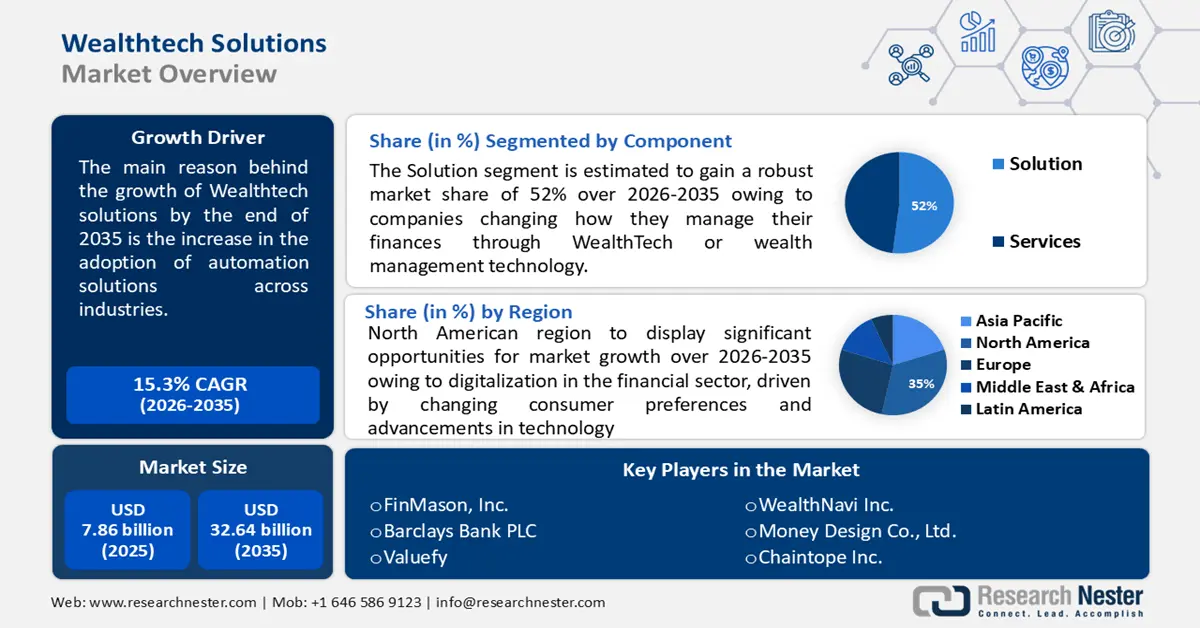

Wealthtech Solutions Market size was over USD 7.86 billion in 2025 and is projected to reach USD 32.64 billion by 2035, growing at around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wealthtech solutions is evaluated at USD 8.94 billion.

The increase in the adoption of automation solutions across industries is fueling the growth of the wealthtech solution market. By using wealthtech solutions, companies and banks can understand new-generation client demands, such as tech-enabled financial solutions, automatic rebalancing, and portfolio building. As per the statistics of US Census Bureau, working with cutting-edge technologies for automation might expose about 30% of all workers.

Moreover, wealthtech solutions help companies discover the demands of the next generation of customers, including those for tech-enabled financial solutions, automatic rebalancing, and portfolio development.

Key WealthTech Solutions Market Insights Summary:

Regional Highlights:

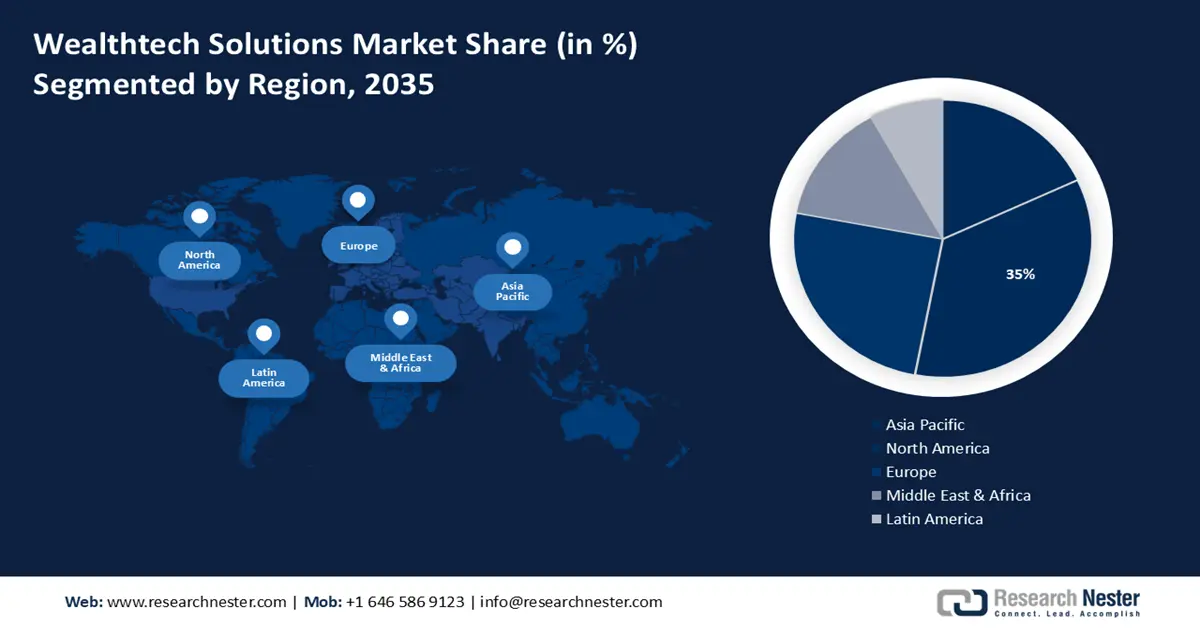

- North America wealthtech solutions market will dominate around 35% share by 2035, driven by digitalization in the financial sector, driven by consumer preferences and technological advancements.

- Europe market will achieve substantial CAGR during 2026-2035, fueled by demand for digital financial services, supported by technological advancements and regulatory reforms.

Segment Insights:

- The solution segment in the wealthtech solutions market is anticipated to hold a 54% share by 2035, driven by the adoption of digital financial tools like AI and SaaS in wealth management.

- The wealth management firms segment in the wealthtech solutions market is expected to achieve lucrative growth till 2035, fueled by the rising demand for sophisticated digital wealth management tools and personalized services.

Key Growth Trends:

- Growing demand for predictive analytics technology

- Rise in fintech sector

Major Challenges:

- Security concerns

- Miscellaneous issues

Key Players: BlackRock, Inc., InvestCloud, Inc., Wealthfront Corporation., FinMason, Inc., Barclays Bank PLC, Valuefy, Advisor Software, DriveWealth, LLC, Trackinsight SAS, WealthNavi Inc..

Global WealthTech Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.86 billion

- 2026 Market Size: USD 8.94 billion

- Projected Market Size: USD 32.64 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Wealthtech Solutions Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for predictive analytics technology - Predictive analytics in wealthtech management derive relevant information that gives advisors insight into their current clients and potential financial needs. In addition, predictive analytics technology is critical to wealthtech company survival as it helps to win insights into client behavior and their needs so they can improve services and products.

Furthermore, the implementation of predictive analytics technology will the revenue of wealthtech solution providers in the upcoming years. Therefore, these factors will provide major lucrative opportunities for the growth of the WealthTech solutions market share. As per a survey conducted, it was found that 31% of respondents already use predictive analytics, and 48% are to be in use in the next few years.

- Rise in fintech sector - FinTechs use online and mobile channels to deliver fast, convenient, and cheap solutions. Also, the Fintech-As-A-Service Platform is gaining popularity and has gained trust among banks, insurance, asset and wealth managers, investors, and consumers. Banks and insurance acquire FinTechs to appeal to new customers. Investors fuel the growth of FinTechs.

The companies offer unique solutions for worldwide access. They focus on improving investment management services with customized solutions to reduce costs and increase revenue potential.

Thus, driving the Wealthtech Solutions market’s growth. Also, between 2010 and 2019, when the total value of investment in fintech companies worldwide reached USD 216.8 billion, these investments increased significantly. Global financial support for fintech’s amounted to USD 105 billion by 2020. The fintech sector was worth USD 179 billion by 2023.

- Integration with artificial intelligence and machine learning- AI and ML technologies enable wealthtech solutions to provide personalized investment recommendations, risk assessments, and predictive analytics. These technologies improve the efficiency and accuracy of wealth management processes, attracting both investors and financial institutions to adopt wealthtech solutions.

- innovative wealthtech solution providers have developed numerous automation solutions for incumbents to enhance their operation and increase income by harnessing the potential of cutting-edge technologies like AI, machine learning, and blockchain. Therefore, this is a major growth factor for the wealthtech solutions market size. In 2024, assets under management in the Robo-Advisors industry are expected to reach USD 11,800 billion.

Challenges

- Security concerns - The handling of sensitive financial data and transactions makes security a paramount concern for wealthtech solutions. Ensuring robust cybersecurity measures to protect against data breaches, identity theft, and unauthorized access in crucial to maintaining user trust and regulatory compliance.

- Miscellaneous issues - Lack of trust and transparency and other issues may impede the growth of wealthtech solutions market. Wealthtech platforms face challenges in managing investment risks and navigating market volatility effectively.

Wealthtech Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 7.86 billion |

|

Forecast Year Market Size (2035) |

USD 32.64 billion |

|

Regional Scope |

|

Wealthtech Solutions Market Segmentation:

Component Segment Analysis

Solution segment is poised to capture over 54% wealthtech solutions market share by 2035. The segment growth can be attributed to companies changing how they manage their finances through WealthTech or wealth management technology. The digital financial ecosystem, which includes tools such as SaaS, big data, and AI, is now controlling the global flow of money.

The use of artificial intelligence is now being used by 32 % of financial service providers. By 2023, AI will create more than $450 billion of value in banking. The use of artificial intelligence for custom 52% er service has been planned by 50% of banks. Chatbots are viewed as a means of transforming the customer experience by 54% of financial services providers

These digital tools have become major factors in the growth of the wealthtech solutions market. Moreover, conventional wealthtech solutions interfaces are becoming simpler to use, thanks to the implementation of more dynamic UI and UX features, which are improving the end-user experience. The software solution vendors are dedicated to offering private banking departments, asset, and wealth managers cloud-based solutions to increase customer satisfaction, simplify and digitize the entire value chain, improve reporting, and restore margins. All of these factors are driving the growth of the segment in the market.

End-User Segment Analysis

Wealth management firms segment in the wealthtech solutions market is estimated to witness lucrative growth rate till 2035. These firms directly cater to the needs of high-net-worth individuals and institutional investors, who demand sophisticated digital wealth management tools and personalized services.

Weathtech solutions enable wealth management firms to streamline operations, deliver tailored investment strategies, and enhance client engagement, driving their adoption. Additionally, wealth management firms have greater flexibility and resources to invest in technology, making them well-positioned to capitalize on the growing demand for digital wealth management solutions globally.

Deployment Mode Segment Analysis

Cloud segment is poised to gain significant wealthtech solutions market growth, over the forecast period. Wealth management companies may grow their operations with ease thanks to cloud technology, which offers nearly infinite storage and computing power that can be modified based on demand. As observed, 55% of organization that prioritize cloud cost optimization.

Furthermore, wealth management companies can use cutting-edge technology like machine learning and artificial intelligence with cloud computing. These technologies greatly increase the operational efficiency of the firms by helping to improve client profile, streamline portfolio management, and automate procedures.

Our in-depth analysis of the market includes the following segments:

|

Components |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wealthtech Solutions Market Regional Analysis:

North America Market Insights

North America industry is expected to hold largest revenue share of 35% by 2035. The market growth in the region is also expected on account of digitalization in the financial sector, driven by changing consumer preferences and advancements in technology. The size of the North American digital banking sector reached USD 500 billion in 2019 and is anticipated to grow by more than 4% from 2020 to 2026.

Furthermore, in the United States, the market is booming forefront, as around USD 21 billion was spent on wealthtech services in 2020. Also, wealthtech funding totaled USD 14 billion in 2021, with 75% of Americans already using wealthtech services.

In asset management, wealth planning, or direct investing, the wealth technology market has expanded at a never-before-seen rate. One market niche stands out in the midst of that massive upsurge in innovation and adoption. At CG Wealth, generative AI is another area of great interest. Among the nearly endless potential uses

European Market Insights

Europe region is projected to register substantial growth through 2035 owing to demand for digital financial services, driven by changing consumer preferences, technological advancements, and regulatory reforms, growing at a CAGR of around 14%. By 2025, its technology infrastructure is expected to provide coverage for 5G networks in 75 % of the population. Wealthtech solutions cater to this demand by offering digital platforms and tools for investment management, financial planning, and portfolio analysis, contributing to the growth of the market in the region.

The wealthtech solutions market in Germany is anticipated to garner significant market figure, owing to develop in the fintech sector, Digital assets with an AUM of USD 3,208.00 million in 2024 will be the most important market.

Over the previous five years, French FinTech has had tremendous growth. The CAGR of French FinTech investment climbed to 52.2% between 2018 and 2022. France is now firmly established as one of Europe's leading FinTech nations.

Wealthtech Solutions Market Players:

- aixigo AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BlackRock, Inc.

- InvestCloud, Inc.

- Wealthfront Corporation.

- FinMason, Inc.

- Barclays Bank PLC

- Valuefy

- Advisor Software

- Bridge Financial Technology Inc.

- DriveWealth, LLC

- Trackinsight SAS

Recent Developments

- BridgeFT, an API-first, cloud-native software company that focuses on wealth infrastructure enables financial institutions, fintech innovators, and registered investment advisors to deliver data-driven outcomes for their clients. The company, named BridgeFT, recently announced that the total assets under management powered by its WealthTech API across its client network grew by more than 100% in 2023. This was the first full year since WealthTech API was made available to firms and fintech companies seeking an API-first approach to handle multi-custodial data.

- Aixigo, a leading platform provider of wealth management and retail banking technology in Europe, has announced its inclusion in the WealthTech 100 list for the year 2024. The WealthTech 100 is an annual list curated by a panel of industry experts and analysts, showcasing the most innovative companies in the wealth technology sector. Aixigo is honored to be among the selected companies.

- Report ID: 6065

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

WealthTech Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.