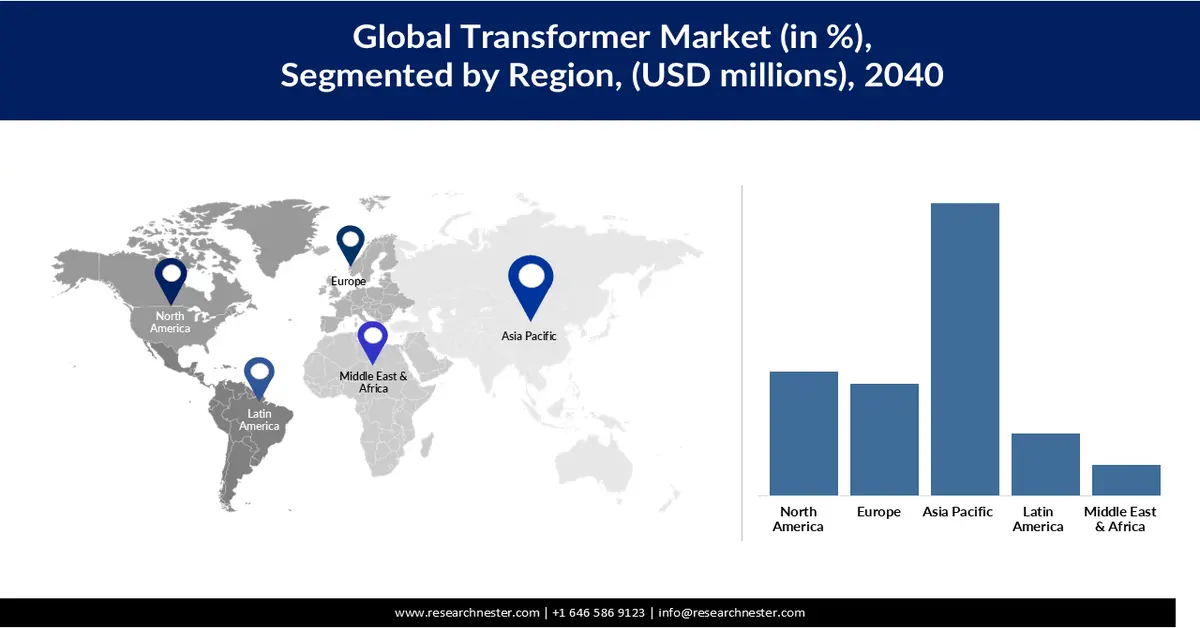

Transformers Market - Regional Analysis

Asia Pacific Market Insights

The region is expected to hold the largest transformers market share of 47% by 2040. The demand is directly driven by the rise in urbanization and rapid industrialization in the region. Furthermore, the strong manufacturing capabilities and connected networks have further advanced the development of production facilities that demand huge power. To meet the increasing demand, medium and small capacity transformers are being employed, which is directly fuelling he market expansion. Asia Pacific is also recognized as a region with the largest number of manufacturing hubs, which organically drives the demand for new grid systems, expanding the transformers market.

China is leading in terms of the global transformers market because the government's strategy in introducing ultra-high voltage transmission and clean energy integration is leading to higher utilization of transformers to effectively distribute the power to different consumers, which is fueling the market expansion. Southern China Power Grid made an investment of JPY 6,000 billion in 2025 to increase its capacity by 2030. These factors successfully imply the transformer as UHV adjustments can only be done through a transformer to ensure the required current flow.

Japan is witnessing transformation and upgradation in the electrical systems in order to meet the modern power requirements. The population level of Japan is increasing at a fast pace and held more than 123,00 million people in 2025, which will further increase the demand for power and renewable energy. Cities like Tokyo will experience a major surge and will consume greater electricity owing to a rapid increase in population.

North America Market Insights

The region holds around 20% of the entire global market share, owing to the rising demand of urbanisation, where modern developments are taking place every day. The older transformer systems have become obsolete and often cause maintenance issues. The new grid systems are powered by high-voltage transformers that significantly improve the power flow and minimise the chances of voltage fluctuations. The adoption of green energy has also increased significantly, which is furthermore impacting market expansion. It is estimated that more than 90% of the electricity in the US is now generated through renewable sources such as solar and wind, which tends to reduce costs significantly.

The U.S. is booming in terms of renewable sources of energy, which is significantly increasing the adoption of transformers. Solar power can be converted into DC through transformers that are small in capacity and can be installed locally in the home. The government's sustainable energy initiatives are pushing consumers to adopt renewable sources of energy, as prices per watt are rising globally, fuelling the expansion of the market.

Canada is highly adoptive of smart grid systems, which is leading to a reduction in the operational costs of the country and enabling better fiscal management. Energy-efficient transformers are in high demand, which is leading to market expansion because of the low maintenance cost and durable operations post-installation. Moreover, to meet the rising demand of the urban population, smart grids and high-performance grids are being used consistently.

Europe Market Insights

Europe also holds a mature market with a high focus on renewable sources of energy, especially in wind energy, which is believed to change the financial plans and strategies of the region. The large-scale manufacturing plants have further fueled the demand for transformers. The manufacturing units require high-voltage step-up power to meet the consistent demand of an effective flow of electricity. The sustainability initiatives and the rapid urbanisation in the region have contributed to the expansion of the market.

Germany holds the largest market in the region, owing to the rising efficiency and regulations of the country. To limit the over expenses and rising electricity cost, the government has subsidized the prices of alternative sources and is encouraging consumers to adopt renewable sources of energy. Germany is quite conservative even terms of pollution arising from noise and chemical release. Thus, to enhance urban comfort and minimize pollution levels, Germany has successfully evolved to modern-day transformers.

The UK transformers market is growing at a CAGR of 6.6% because of the rise in electrification of industries that previously relied on fossil fuels, leading to widespread utilization of high-powered transformers. The electrification of the industrial estates is a strategy of the government to reduce reliance on imported fuels and minimize operational costs. Electrification tends to reduce the cost of consumers while constantly providing sustainability measures to sustain the environment. The UK holds a mature manufacturing and production facility that operates on multiple shifts, which requires the usage of high voltage transformers to power the high-capacity machines and equipment, raising demand for the global transformers market