Transformers Market Outlook:

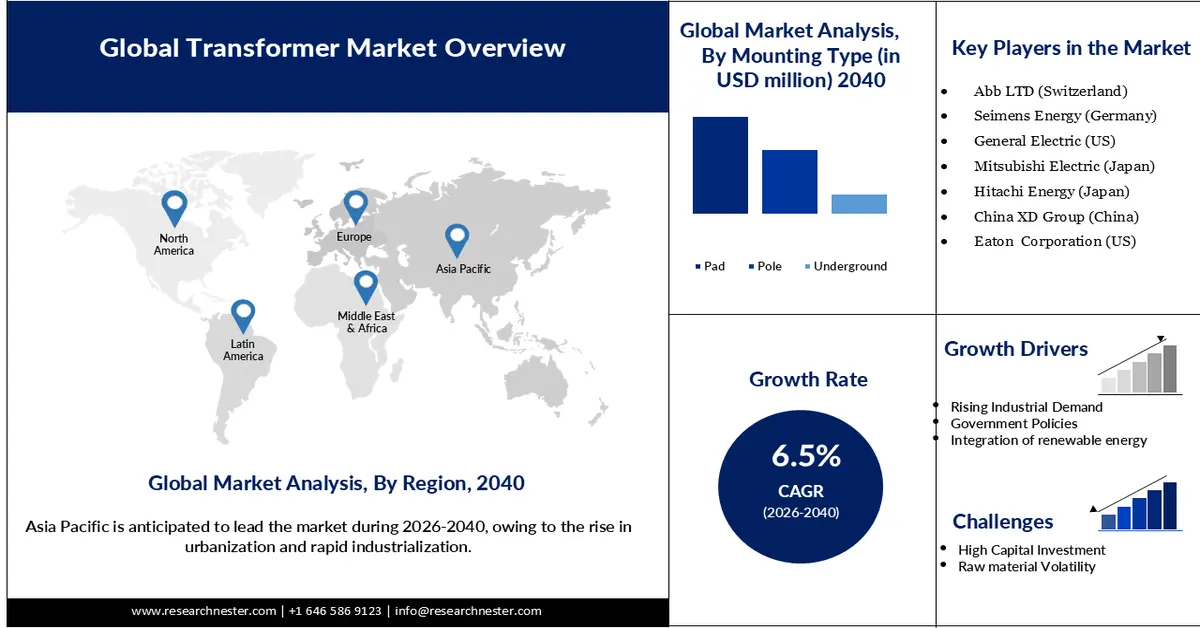

Transformers Market is estimated to be valued at USD 65.64 billion in 2025 and is expected to grow to USD 175.4 billion by 2040, registering a CAGR of 6.5% during the forecast year 2026-2040. In 2026, the industry size of transformers is estimated at USD 69.97 billion.

The growing demand for modernized power infrastructure is fueling the growth of the global transformers market. Emerging countries and regions are increasingly upgrading their power grids by deploying transformers, which help supply electricity at a stable rate. Rapid population growth has increased the need for high-voltage transformers to enable efficient power transmission and distribution. Demand for transformers in the U.S. is exceptionally high, creating a highly competitive and supply-constrained transformers market. According to estimates from the National Renewable Energy Laboratory, supported by the U.S. Department of Energy’s Office of Electricity and Office of Policy, the U.S. power system comprised approximately 60 to 80 million distribution transformers in late 2024. Furthermore, demand for these transformers is projected to increase by as much as 260% by 2050 compared to 2021 levels, driven by grid modernization, electrification, and rising electricity consumption. Traditional transformers offered limited power capacity, which led to frequent short circuits and restricted service areas. As population levels increased, high-voltage transformers were introduced, enabling wider adoption of transformers. Moreover, improved reliability and reduced maintenance requirements of modern transformers are helping to lower the capital expenditure for governments and utilities. Modernized power systems also incorporate biodegradable oils in coatings, ensuring safety and sustainability, which further supports market growth.

Key Transformer Market Insights Summary:

Regional Highlights:

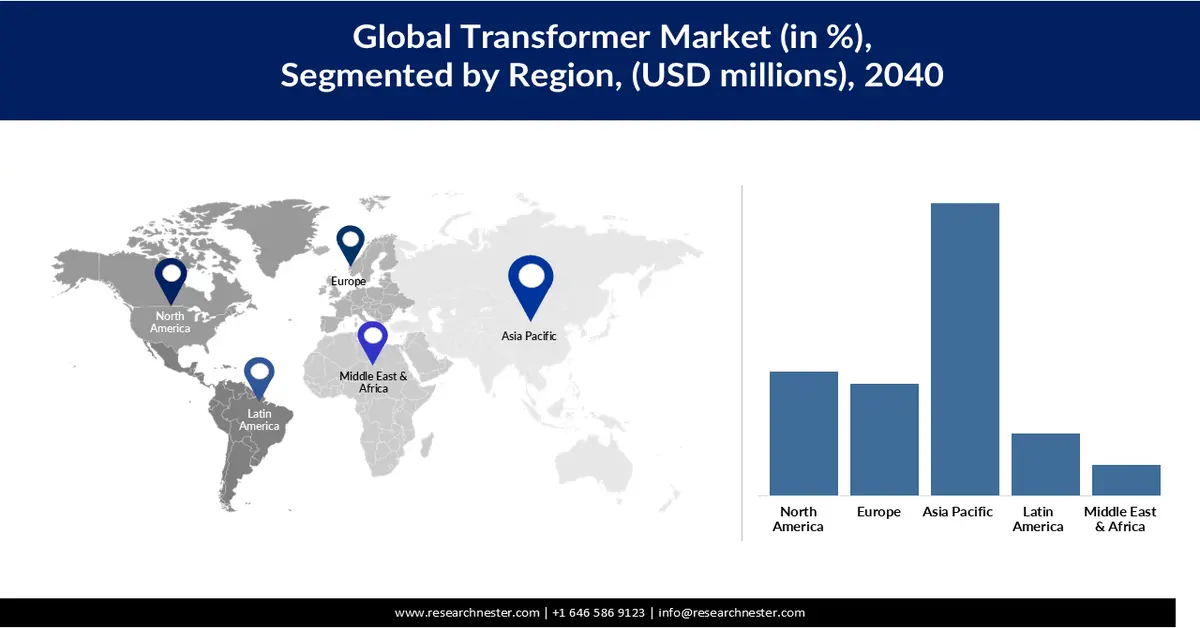

- Asia Pacific in the transformer market is forecast to account for nearly 47% share by 2040, supported by accelerating urbanization, rapid industrial expansion, and dense manufacturing networks that intensify demand for new grid infrastructure.

- North America is estimated to represent around 20% share by 2040, underpinned by large-scale replacement of aging transformer systems and growing integration of renewable energy into modern power grids.

Segment Insights:

- The pad-mounted transformer segment in the transformer market is expected to capture about 55% share by 2040, aided by its enclosed steel design that enhances safety, resilience, and operational reliability across utility networks.

- The power utilities segment is projected to hold nearly 42% share by 2040, reinforced by expanding urbanization and industrialization that continuously elevate electricity consumption levels.

Key Growth Trends:

- Rising demand for electricity in industrial usage

- Government policies on grid expansion and sustainability

Major Challenges:

- High capital investment

- Raw material volatility

Key Players: Abb LTD, Siemens Energy, General Electric, Mitsubishi Electric, Hitachi Energy, China XD Group, Eaton Corporation

Global Transformer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 65.64 billion

- 2026 Market Size: USD 69.97 billion

- Projected Market Size: USD 175.4 billion by 2040

- Growth Forecasts: 6.5% CAGR (2026-2040)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2040)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 22 December, 2025

Transformers Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for electricity in industrial usage: Electricity demand from industrial sectors continues to grow as manufacturing and production activities expand globally. Industries increasingly depend on reliable electricity to operate machinery, process materials, and maintain continuous production cycles. Transmission and distribution infrastructure is also expanding to support these needs, with many facilities requiring direct conversion of AC to DC power and the use of high-power transformers to regulate current flow and manage heavy electrical loads. As rapid industrialization accelerates, electricity consumption rises correspondingly. According to the U.S. Energy Information Administration (EIA), in 2022, the U.S., as a highly industrialized nation, saw its industrial sector consume 35% of the country’s total end-use energy and account for 33% of overall energy consumption.

- Government policies on grid expansion and sustainability: The government has increased the adoption of power grid systems to meet rising population demands. Moreover, the capacity expansion plans and initiatives are also propelling the growth of the transformers market across the globe as the government is aiming to provide electricity for free to residents, ensuring they have the necessities of sustenance. These initiatives are increasing the setup of transformers in wide locations, enabling better electricity flow and limited voltage fluctuations due to great demand in single time. Japan has aimed to achieve carbon carbon-neutral nature by 2050, which will increase the demand for high-power transformers as they are widely used in renewable power sources such as wind and hydro electricity generators, where the current is received and then systematically distributed to the different sub-power outlets.

- Integration of renewable energy: Renewable energy sources, such as solar and wind power, need transformers to receive AC and supply DC to consumers. Countries across the globe are preferring sustainability, which is highly impacting the growth of the transformers market. The conventional transformer models may not be able to handle variable input and bidirectional flows, which may tend to bring voltage fluctuations. Countries like India have raised their capacity to 38 GW from 74 GW during 2024-2025, owing to the rising dominance of the high-performance transformers to power the growing electricity demand.

Challenges

- High capital investment: High voltage transformers are expensive to install and use because of high voltage capacity integrations and specialized electrical units, which require high upfront costs. Smaller entrants can find challenges in manufacturing because of other large costs involved, such as testing and R&D, the financial barrier to manufacturing and installing high-voltage transformers. Government subsidies and support in the adoption, to some extent, however, for entity-based users, the adoption remains slow, slowing down the transformers market growth.

- Raw material volatility: The volatility of the raw materials often tends to create a barrier for the manufacturers. Certain components of the transformers, such as copper, steel, and insulation materials, tend to fluctuate a lot because of inflation and compliance. Moreover, the reliance on global component manufacturers and the delay in receiving the components creates a strong challenge in project timelines, further impacting the manufacturing process, leading to consumers seeking traditional transformers. This is significantly slowing down the transformers market adoption rate.

Transformers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2040 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 65.64 billion |

|

Forecast Year Market Size (2040) |

USD 175.4 billion |

|

Regional Scope |

|

Transformers Market Segmentation:

Mounting Type Segment Analysis

The pad-mounted transformer is projected to hold the largest transformers market share of 55% in 2040, demonstrating the rising demand of the segment. Pad-mounted segment is confined in a steel container that ensures safety from animals and other objects that can damage the transformer or cause a malfunction in it. High voltage transformers are often installed in an open for easier access and maintenance, which makes them vulnerable to the weather and adulteration. Thus, the pad-mounted transformers cover the entire unit in a steel container, ensuring zero remittance of any foreign object to could damage the transformer. The pole-mounted transformers are also driven by their adoption in rural areas where the infrastructure is not poor. The pole-mounted transformers ensure limited access for people and can work efficiently during floods and other natural disasters.

End Use Segment Analysis

The power utilities segment is expected to hold the largest transformers market share of 42% owing to the expansion in urbanization and industrialization, which demands more power. Businesses engaged in power utilities are constantly leveraging the government initiative to build a strong network of customers and dominate their global position. The rise in demand is also a result of increased manufacturing capacity of manufacturers, where they aim to meet the demand of the rising population and enhance their production capacity. Other segments, such as residential, also show consistent growth owing to the increase in urban shelters and government-aided residential. However, the majority of the demand is coming from the power utilities segment. The demand for global electricity increased by 4.3% in 2024, demonstrating the rise in population levels and electrification across various sectors, fuelling the adoption of the power and utility segment.

Capacity Range Segment Analysis

The small capacity segment will dominate the market with promising demand in the future, owing to the rise in construction and urbanization. Construction sites often employ small-sized transformers as distribution centres for the power that act as the sub-power segment, which is used to power small components and equipment. Furthermore, residential areas are also increasingly adopting the small capacity transformers that can power a small area and can be repaired with ease in case of severe faults. The medium segment is also growing and is being adopted widely in factories and warehouses that consume a high amount of power. The small capacity segment will, however, dominate the transformers market and maintain a strong position throughout the forecast period.

Our in-depth analysis of the global transformers market includes the following segments:

|

Segment |

Subsegment

|

|

Mounting Type |

|

|

Insulation Type |

|

|

Phase |

|

|

Transformer Type |

|

|

End User |

|

|

Capacity |

|

|

Installation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transformers Market - Regional Analysis

Asia Pacific Market Insights

The region is expected to hold the largest transformers market share of 47% by 2040. The demand is directly driven by the rise in urbanization and rapid industrialization in the region. Furthermore, the strong manufacturing capabilities and connected networks have further advanced the development of production facilities that demand huge power. To meet the increasing demand, medium and small capacity transformers are being employed, which is directly fuelling he market expansion. Asia Pacific is also recognized as a region with the largest number of manufacturing hubs, which organically drives the demand for new grid systems, expanding the transformers market.

China is leading in terms of the global transformers market because the government's strategy in introducing ultra-high voltage transmission and clean energy integration is leading to higher utilization of transformers to effectively distribute the power to different consumers, which is fueling the market expansion. Southern China Power Grid made an investment of JPY 6,000 billion in 2025 to increase its capacity by 2030. These factors successfully imply the transformer as UHV adjustments can only be done through a transformer to ensure the required current flow.

Japan is witnessing transformation and upgradation in the electrical systems in order to meet the modern power requirements. The population level of Japan is increasing at a fast pace and held more than 123,00 million people in 2025, which will further increase the demand for power and renewable energy. Cities like Tokyo will experience a major surge and will consume greater electricity owing to a rapid increase in population.

North America Market Insights

The region holds around 20% of the entire global market share, owing to the rising demand of urbanisation, where modern developments are taking place every day. The older transformer systems have become obsolete and often cause maintenance issues. The new grid systems are powered by high-voltage transformers that significantly improve the power flow and minimise the chances of voltage fluctuations. The adoption of green energy has also increased significantly, which is furthermore impacting market expansion. It is estimated that more than 90% of the electricity in the US is now generated through renewable sources such as solar and wind, which tends to reduce costs significantly.

The U.S. is booming in terms of renewable sources of energy, which is significantly increasing the adoption of transformers. Solar power can be converted into DC through transformers that are small in capacity and can be installed locally in the home. The government's sustainable energy initiatives are pushing consumers to adopt renewable sources of energy, as prices per watt are rising globally, fuelling the expansion of the market.

Canada is highly adoptive of smart grid systems, which is leading to a reduction in the operational costs of the country and enabling better fiscal management. Energy-efficient transformers are in high demand, which is leading to market expansion because of the low maintenance cost and durable operations post-installation. Moreover, to meet the rising demand of the urban population, smart grids and high-performance grids are being used consistently.

Europe Market Insights

Europe also holds a mature market with a high focus on renewable sources of energy, especially in wind energy, which is believed to change the financial plans and strategies of the region. The large-scale manufacturing plants have further fueled the demand for transformers. The manufacturing units require high-voltage step-up power to meet the consistent demand of an effective flow of electricity. The sustainability initiatives and the rapid urbanisation in the region have contributed to the expansion of the market.

Germany holds the largest market in the region, owing to the rising efficiency and regulations of the country. To limit the over expenses and rising electricity cost, the government has subsidized the prices of alternative sources and is encouraging consumers to adopt renewable sources of energy. Germany is quite conservative even terms of pollution arising from noise and chemical release. Thus, to enhance urban comfort and minimize pollution levels, Germany has successfully evolved to modern-day transformers.

The UK transformers market is growing at a CAGR of 6.6% because of the rise in electrification of industries that previously relied on fossil fuels, leading to widespread utilization of high-powered transformers. The electrification of the industrial estates is a strategy of the government to reduce reliance on imported fuels and minimize operational costs. Electrification tends to reduce the cost of consumers while constantly providing sustainability measures to sustain the environment. The UK holds a mature manufacturing and production facility that operates on multiple shifts, which requires the usage of high voltage transformers to power the high-capacity machines and equipment, raising demand for the global transformers market

Key Transformers Market Key Players:

- Abb LTD (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Energy (Germany)

- General Electric (U.S.)

- Mitsubishi Electric (Japan)

- Hitachi Energy (Japan)

- China XD Group (China)

- Eaton Corporation (U.S.)

- Mitsubishi Electric is one of the oldest manufacturers of electrical and electronics, which has raised its business position. The focus of the business has been on large-sized transformers and distribution transformers catering to larger areas for electricity distribution. With global footprints, the business holds approximately 150,000 employees as of 2025.

- Hitachi Energy is popular for its wide array of transformers. Hitachi has made products with dry and liquid-filled transformers as a measure to insulate against heat dissipation. The firm has furthermore focused on sustainability and innovation, which is reflected in its business performance. The core strength of the business lies in high-voltage transformers.

- China XD Group, a government-owned entity that specializes in power transmissions and transformers. Some of the core products include high voltage reactors, switchgears, and other related peripherals. The business operates globally with sound knowledge of the market. It has participated in some of the national grid power initiatives.

- Eaton Corporation has diversified into a power management company that sells and distributes high and low-voltage transformer systems with a strong market in North America. The business aims to develop a compact and sustainable power system that can significantly lower the electricity cost and power an accurate flow of electricity to the residents.

Below is the list of some prominent players operating in the global transformers market:

The players operating in the global transformers market are expected to face intense competition during the forecast period. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Competitive Landscape of the Global Transformers Market

Recent Developments

- In December 2025, Hitachi Energy signed an MoU with Omexom that will accelerate the connections of high-voltage power across the UK by collaborating on EPC delivery skills and advanced grid technology. The collaboration between the two companies will significantly reduce the environmental damage and bring better sustainability. Hitachi further claims that the installation of high-voltage power connections will also restore reliability and the distribution network, making it accessible for all.

- In February 2025, Mitsubishi Electricals claimed of forming a joint venture that is entirely focused on solar energy. The intention is to support carbon-neutral goals, which will distribute energy resources. The solar Panel manufacturing and installation will significantly reduce the CO2 emissions and will help maintain carbon neutrality sooner.

- Report ID: 6674

- Published Date: Dec 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Transformer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.