Third Party Risk Management Market Outlook:

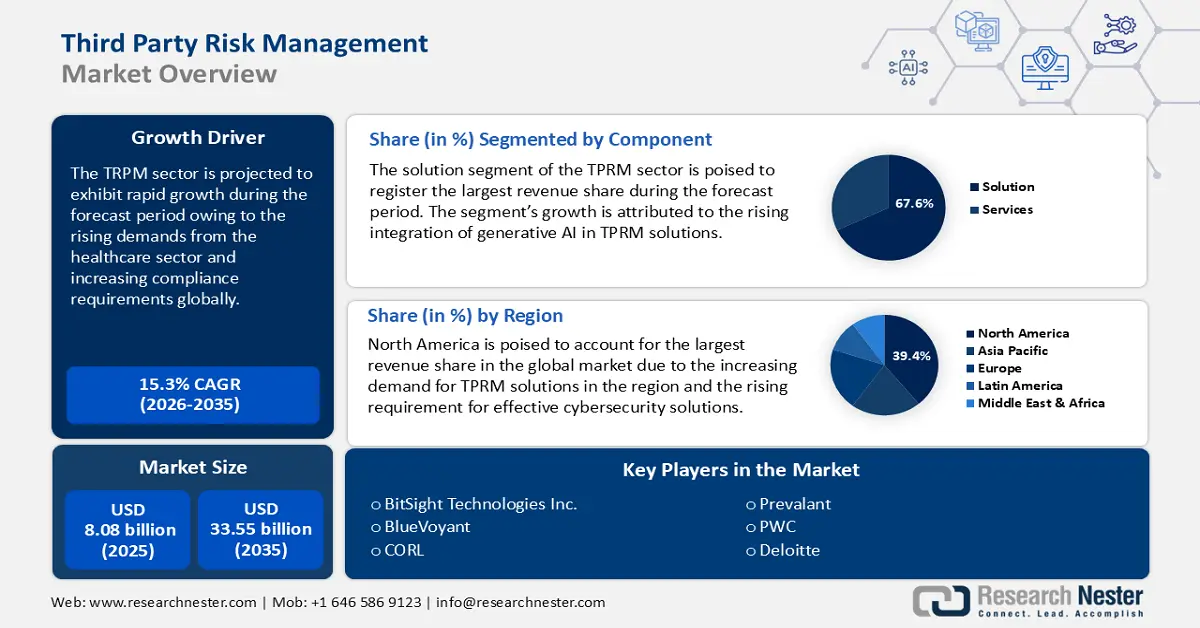

Third Party Risk Management Market size was over USD 8.08 billion in 2025 and is projected to reach USD 33.55 billion by 2035, growing at around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of third party risk management is evaluated at USD 9.19 billion.

The third party risk management sector’s growth is due to rising reliance on external vendors to manage sectors that heavily rely on sensitive data such as the financial and healthcare sector. Third party risk management solutions provide diligent background checks and financial assessments while assisting organizations comply with regulatory requirements. For instance, in May 2024, the Office of the Comptroller of the Currency (OCC) of the U.S. Department of Treasury released a TPRM guidance for the community banks in the country, which will benefit the larger adoption of TPRM solutions in the BFSI sector.

The global supply chain risk management is a major driver of adopting TPRM services. The rising interdependency of supply chains has led to investments in mitigating risks. The COVID-19-related supply chain disruptions have further necessitated investments to secure the global supply chain and rising threats of geopolitical instability and cybersecurity risks bolster the need for TPRM solutions to proactively identify supply chain vulnerabilities. The rising opportunities for third party supply chain management are evident by businesses expanding their portfolios to offer innovative solutions. For instance, in May 2024, Kharon and Exiger announced a strategic partnership to help businesses and government organizations secure fragile global supply chains.

The third party risk management market is poised to provide lucrative opportunities to small and medium-sized enterprises by providing solutions for risk protection, creating a profitable segment for the service providers. Additionally, industrial expansion in emerging economies is positioned to enable TPRM service providers opportunities to expand their portfolios and leverage new revenue streams in the global market. For instance, in October 2024, the African Development Bank released a contract to select a company for acquisition, implementation, maintenance, and training of third party risk management solutions. Such lucrative contracts are positioned to boost the robust growth of the sector and tailored region-specific or industry-specific solutions are poised to provide a steady stream of opportunities in the TPRM market.