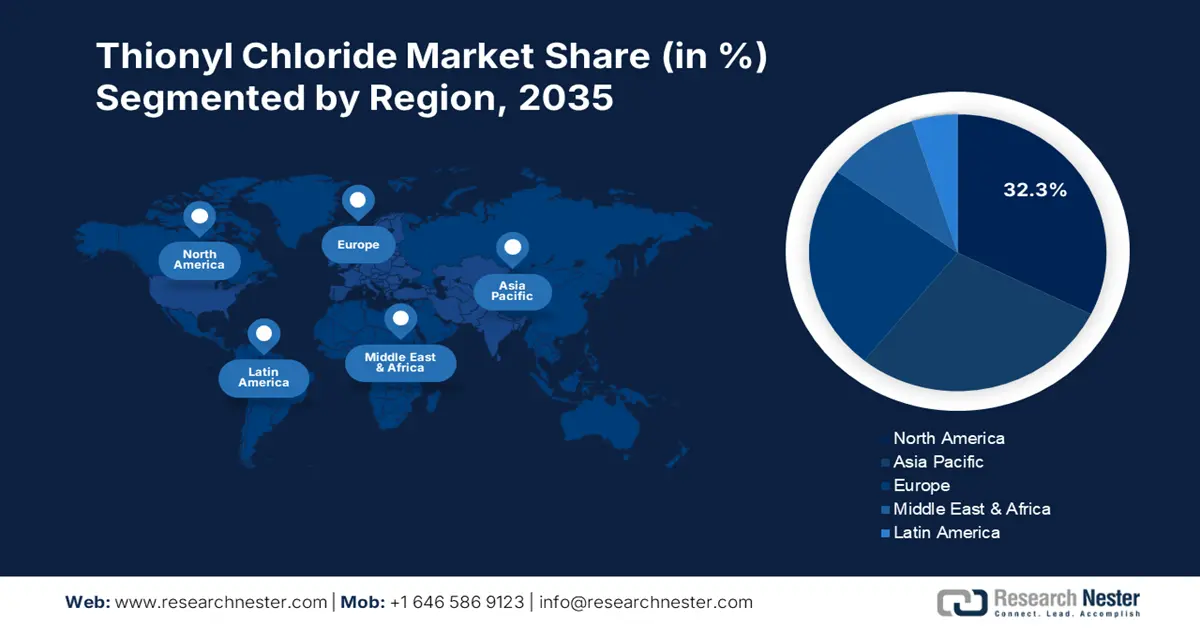

Thionyl Chloride Market Regional Analysis:

North America Market Analysis

North America industry is estimated to hold largest revenue share of 32.3% by 2035. The pharmaceutical and agrochemical industries are highly prevalent in this region. Research and development of advanced chemicals is also given much importance in this region, which in turn has enhanced the demand for quality reagents such as thionyl chloride. Innovation in drug development and productivity in agriculture are the key growth drivers that support market growth.

The U.S. is expected to account for the largest share due to vigorous pharmaceutical and chemical manufacturing. The well-developed pharmaceutical infrastructure, along with continued research and development, supports increased use of the intermediate thionyl chloride. This further contributes to the rise in thionyl chloride applications in the U.S., encompassing specialty chemicals and agrochemicals, considering that American companies hold strong innovation commitments and rigorously observe safety protocols.

Canada is also witnessing an increased demand for thionyl chloride supported by strong regulations by the government to ensure chemical safety. For example, the regulatory framework under the Canadian Environmental Protection Act (CEPA) requires chemicals such as thionyl chloride to undergo a rigorous environmental assessment, which points toward the country's concern for producing the chemical safely. The regulatory thrust helps in producing this chemical in the least environmentally damaging method so that thionyl chloride can help maintain

Asia Pacific Market Analysis

In thionyl chloride market, Asia Pacific region is set to observe lucrative CAGR till 2035. This growth is driven by rapid industrialization and economic developments in countries like China and India. Expansion in the pharmaceutical, agrochemical, and electronics markets increases the demand for the production of thionyl chloride. Furthermore, the availability of raw materials and low-cost production increase the prospects in this market.

China is among the leading producers and consumers of thionyl chloride worldwide, majorly propelled by its gigantic chemical manufacturing structure. In the agrochemical industry, the country caters to its gigantic agricultural needs, hence boosting the consumption of thionyl chloride in pesticide manufacture. Moreover, the country dominated countries such as the U.S. with massive investments in chemical industry capital. The country’s investments amounted to 46% in the year 2022, surpassing other competitors compared to 10% for the USMCA (United States-Mexico-Canada Agreement). This trend has underlined the significant resource allocation that the country is making towards the production of chemicals, reinforcing its demand for thionyl chloride.

India also witnessed a rise in the demand for thionyl chloride due to pharmaceutical industries encouraged by the Production Linked Incentive (PLI) scheme under the government. The government of India 2024-25 Interim Budget also shows this priority, allocating Rs. 1,000 crore (US$ 120 million) for bulk drug parks, which is a significant increase to strengthen the domestic supply chain. As India continues to expand its pharmaceutical sector and further cements its position as a global production base, thionyl chloride consumption is expected to increase in support of mass-scale drug synthesis.