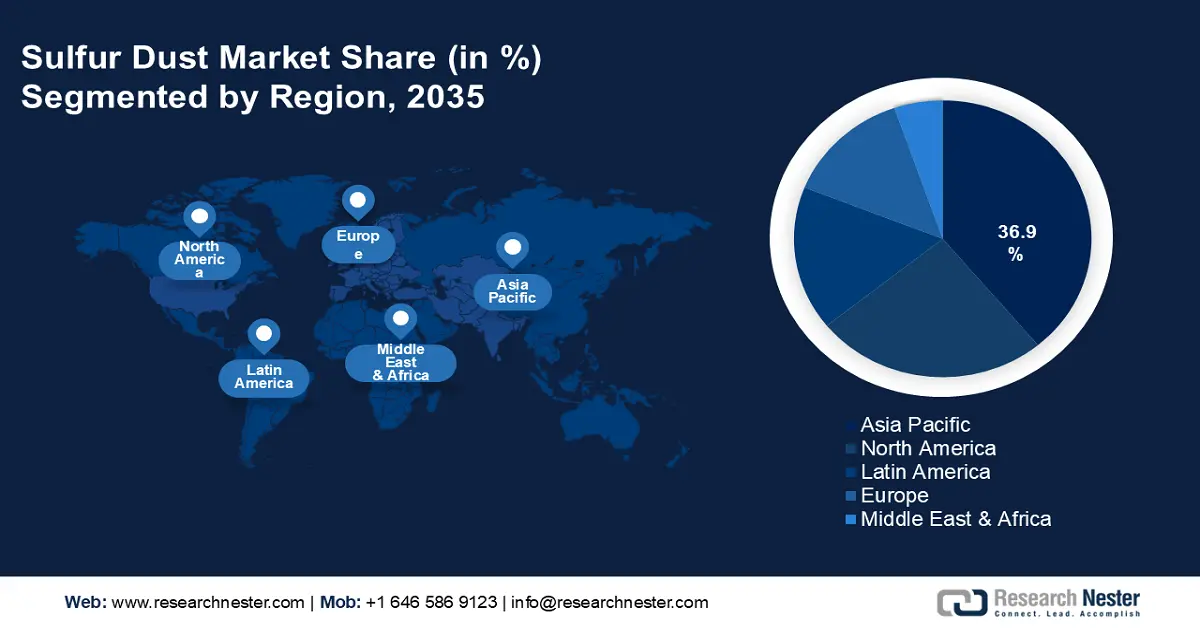

Sulfur Dust Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is estimated to hold largest revenue share of 36.9% by 2035. The market is growing in the region due to its vast and quickly growing agricultural sector, which mostly depends on sulfur-based insecticides and fertilizers to increase crop yields and provide food security for its enormous population. According to an economic survey on the agricultural sector in 2024, published by the Press Information Bureau (PIB), it was stated that the Indian agriculture sector offers livelihood support to 42.3% of the population and accounts for 18.2% of the country's GDP at constant prices. The sector has been vibrant, as seen by an average annual growth rate of 4.18% at constant prices over the last five years, and the agriculture sector's growth rate is valued to be 1.4% in 2023-2024. Also, major factors including strong agricultural demand, continuous industrialization, and rising investments in agricultural infrastructure and technologies are accelerating the market growth.

Due to its extensive agricultural sector and strong industrial base, China is a key player in the high consumption of sulfur dust for manufacturing and farming purposes. Moreover, China faces increasing environmental regulations, pushing industries and agriculture to adopt more sustainable practices. Sulfur dust, with its low environmental impact, is gaining preference as part of China’s efforts to reduce reliance on synthetic agrochemicals.

In India, the sulfur dust market is observing expansion as businesses are collaborating with academic institutions to create environmentally friendly sulfur-based insecticides and fertilizers. To improve crop yields and soil health sustainably, government initiatives seek to encourage balanced fertilization methods and raise sulfur usage efficiency in agriculture. For instance, the government offers farmers subsidized nutrient-rich fertilizers through several programs, including Indigenous P&K, Imported P&K, Indigenous Urea, and Imported Urea, to guarantee that fertilizer use is balanced. Additionally, the government has approved Market Development Assistance (MDA) at USD 17.86/MT, to encourage organic fertilizers.

Furthermore, South Korea's sophisticated manufacturing sectors, which use sulfur dust in specific applications, accelerate the market growth. Also, by tightening regulations and utilizing new technologies, the government aims to lower sulfur emissions and increase sulfur recovery rates in refining processes.

North America Market Analysis

North America will hold a significant share by the end of 2035. Oil sands and sour natural gas are processed to yield sulfur. The chemical, manufacturing, and agricultural sectors are some businesses that use sulfur dust in North America. Also, the region is a major user of sulfur due to its constantly expanding agricultural and industrial sectors.

In the U.S., sulfur dust manufacturers are investing in cutting-edge manufacturing techniques to improve product quality and satisfy strict environmental regulations. For instance, in December 2023, the production capacity of LANXESS, a specialty chemicals firm, was expanded by several kilotons to produce sustainable light-color sulfur carriers. The project, which required investments in the double-digit millions, was finished in around two years at the Mannheim location. Moreover, the government programs aim to support innovative sulfur-based products for several industrial applications and advance sustainable sulfur management techniques.