Sulfur Dust Market Outlook:

Sulfur Dust Market size was valued at USD 1.32 billion in 2025 and is expected to reach USD 1.99 billion by 2035, expanding at around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sulfur dust is assessed at USD 1.37 billion.

The sulfur dust market is experiencing growth due to the expanding global population, increasing demand for food, and the agricultural industry's ongoing pursuit of enhanced crop yield optimization methods. The United Nations Organization expects the global population to rise from 8 billion in 2022 to 9.7 billion in 2050, an almost 2 billion increase in just 30 years. Between 59% and 98% more food will be consumed by humans by 2050.

Sulfur dust is essential for enhancing plant health and maximizing harvests; it is mostly utilized as a fungicide and soil supplement. It is an important part of modern farming owing to its capacity to manage pests and remedy deficiencies in the soil. The increased emphasis on increasing crop yields drives demand for sulfur dust and establishes it as a major factor driving the industry. Additionally, the rising awareness about sustainable agricultural practices and organic farming has boosted the demand for sulfur dust as a natural and eco-friendly pesticide.

Key Sulfur Dust Market Insights Summary:

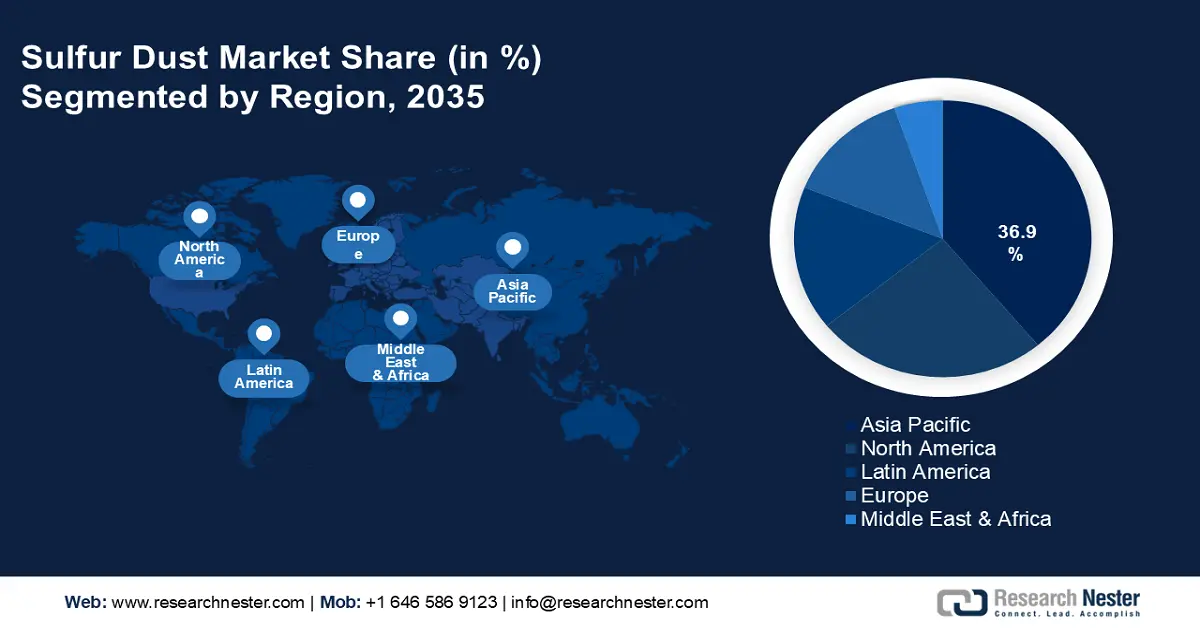

Regional Highlights:

- Asia Pacific leads the Sulfur Dust Market with a 36.9% share, propelled by a rapidly growing agricultural sector that heavily depends on sulfur-based fertilizers and insecticides, fostering strong growth through 2026–2035.

- North America holds a significant share in the Sulfur Dust Market, with strong growth projected through 2026–2035, attributed to expanding agricultural and industrial sectors that rely heavily on sulfur dust.

Segment Insights:

- The Precipitated sulfur segment is projected to hold a substantial share by 2035, fueled by its high purity and effectiveness in agricultural and industrial applications.

- The Medium Purity (95%-99.8%) segment is poised for substantial growth from 2026-2035, driven by its cost-effectiveness and performance across multiple applications.

Key Growth Trends:

- Increased adoption in agricultural practices

- Growing use in divergent industrial processes

Major Challenges:

- Availability of alternative fertilizers

- Risks associated with the chemical nature of sulfur

- Key Players: American Elements, Georgia Gulf Sulfur Corporation, Lyten, Inc., BASF SE, Grupa Azoty S.A., Jaishil Sulfur and Chemical Industries, Jordan Sulfur, SML Limited, Saeed Ghodran Group, Maruti Corporation.

Global Sulfur Dust Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.32 billion

- 2026 Market Size: USD 1.37 billion

- Projected Market Size: USD 1.99 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, Australia

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 14 August, 2025

Sulfur Dust Market Growth Drivers and Challenges:

Growth Drivers

-

Increased adoption in agricultural practices: The growing demand for high-purity sulfur products, fueled by the need for more effective and ecologically friendly industrial and agricultural processes, is driving the sulfur dust industry. The need for precipitated sulfur dust is increasing due to its high purity and efficient performance, which aligns with the growing significance of sustainable farming techniques and strict environmental requirements.

For instance, to achieve the objectives of the Climate and Environmental Plan (CAP) and adhere to the Green Deal targets, especially those outlined in the Farm to Fork Strategy and the Biodiversity Strategy for 2030, CAP Strategic Plans in Europe are incorporating stricter conditions, eco-friendly initiatives, farm advisory services, as well as agricultural and environmental measures and investments. Therefore, the market is witnessing enormous growth due to the ongoing trend, forcing producers to innovate and raise the standard of their precipitated sulfur products to meet changing industry requirements. -

Growing use in divergent industrial processes: Sulfur dust is necessary for the vulcanization process, which improves the performance and longevity of rubber goods, and is crucial to many industrial uses, including rubber manufacturing. Sulfur dust is also utilized in the synthesis of sulfuric acid, an essential chemical intermediary in a wide range of industrial processes, including chemical manufacturing and metal processing.

Its industrial significance is further highlighted by its involvement in producing sulfur-based compounds and petrochemical refining. Therefore, sulfur dust is widely used in industrial sectors, increasing market demand and emphasizing its importance in various manufacturing and processing processes. -

Advances in lithium-sulfur batteries: Lithium-sulfur batteries are gaining momentum for researchers seeking alternate energy storage due to their lower cost and higher theoretical energy density than conventional lithium-ion batteries. These batteries' cathode relies heavily on sulfur, which fuels the market for high-purity sulfur dust.

Increased use of lithium-sulfur batteries in grid energy storage systems, portable devices, and electric cars will accelerate the market for sulfur dust. The International Energy Agency (IEA) reported that the sales of electric vehicles increased by 3.5 million in 2023 compared to 2022, or a 35% annual rise, indicating a surge in demand for these batteries. Additionally, there are possibilities for continued expansion and innovation in the sulfur dust sector due to continuing research and development initiatives focused on improving the longevity and performance of lithium-sulfur batteries.

Challenges

-

Availability of alternative fertilizers: The agricultural sector is turning to more efficient fertilizers with enhanced nutrient delivery and environmental benefits which may impede the widespread adoption of sulfur dust. Alternatives including nitrogen-based or phosphorus-based fertilizers offer better results, making them suitable for farmers seeking yield enhancements. Therefore, the growing shift towards these alternatives may hinder the market growth.

-

Risks associated with the chemical nature of sulfur: Since sulfur dust is explosive, handling and storing it poses a risk of fire and explosion, necessitating strict safety procedures and specific equipment. Furthermore, as sulfur dust burns, harmful sulfur dioxide gas releases, adding to air pollution and health risks. Environmental management is more difficult due to sulfur dust runoff contaminating soil and water sources. Resolving these dangerous situations demands thorough risk assessment procedures, appropriate storage facilities, and observance of safety laws, all of which can raise operating expenses and restrict market expansion.

Sulfur Dust Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 1.32 billion |

|

Forecast Year Market Size (2035) |

USD 1.99 billion |

|

Regional Scope |

|

Sulfur Dust Market Segmentation:

Form (Precipitated, Sublimed)

Precipitated segment is set to account for more than 64.7% sulfur dust market share by the end of 2035. The segment growth can be attributed to the growing use of precipitated sulfur in agricultural applications such as pesticides and fungicides due to its high purity and fine particle size. Precipitated sulfur is also preferred due to its consistent reactivity and efficiency in industrial processes comprising chemical synthesis and rubber vulcanization. The versatility and effectiveness of this product in agricultural and industrial applications firmly establish its dominant position in the market.

Purity (Medium Purity (95%-99.8%), High Purity (99.9% and above), Low Purity (below 95%))

By the end of 2035, medium purity (95%-99.8%) segment is estimated to account for more than 53.6% sulfur dust market share. The segment is growing due to its high performance and cost-effectiveness. It is less expensive than high-purity sulfur and yields good results in industrial and agricultural applications. This purity level is sufficiently effective for various applications, including chemical intermediates and fertilizers, without coming with the higher prices of ultra-high-purity alternatives.

Application (Pesticides & Fungicides, Fertilizers & Soil Amendments, Chemical Intermediates, Rubber Processing, Pharmaceuticals, Metal Processing)

In sulfur dust market, pesticides & fungicides segment is poised to capture over 34.7% revenue share by 2035. The segment is experiencing growth due to the widespread adoption of sulfur to control agricultural pests and diseases. Its use in agriculture is well-established, and sulfur is a dependable and reasonably priced solution. Its predominant position in the market is mostly due to its extensive use and crucial function in preserving plant health.

Our in-depth analysis of the sulfur dust market includes the following segments:

|

Form |

|

|

Purity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sulfur Dust Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is estimated to hold largest revenue share of 36.9% by 2035. The market is growing in the region due to its vast and quickly growing agricultural sector, which mostly depends on sulfur-based insecticides and fertilizers to increase crop yields and provide food security for its enormous population. According to an economic survey on the agricultural sector in 2024, published by the Press Information Bureau (PIB), it was stated that the Indian agriculture sector offers livelihood support to 42.3% of the population and accounts for 18.2% of the country's GDP at constant prices. The sector has been vibrant, as seen by an average annual growth rate of 4.18% at constant prices over the last five years, and the agriculture sector's growth rate is valued to be 1.4% in 2023-2024. Also, major factors including strong agricultural demand, continuous industrialization, and rising investments in agricultural infrastructure and technologies are accelerating the market growth.

Due to its extensive agricultural sector and strong industrial base, China is a key player in the high consumption of sulfur dust for manufacturing and farming purposes. Moreover, China faces increasing environmental regulations, pushing industries and agriculture to adopt more sustainable practices. Sulfur dust, with its low environmental impact, is gaining preference as part of China’s efforts to reduce reliance on synthetic agrochemicals.

In India, the sulfur dust market is observing expansion as businesses are collaborating with academic institutions to create environmentally friendly sulfur-based insecticides and fertilizers. To improve crop yields and soil health sustainably, government initiatives seek to encourage balanced fertilization methods and raise sulfur usage efficiency in agriculture. For instance, the government offers farmers subsidized nutrient-rich fertilizers through several programs, including Indigenous P&K, Imported P&K, Indigenous Urea, and Imported Urea, to guarantee that fertilizer use is balanced. Additionally, the government has approved Market Development Assistance (MDA) at USD 17.86/MT, to encourage organic fertilizers.

Furthermore, South Korea's sophisticated manufacturing sectors, which use sulfur dust in specific applications, accelerate the market growth. Also, by tightening regulations and utilizing new technologies, the government aims to lower sulfur emissions and increase sulfur recovery rates in refining processes.

North America Market Analysis

North America will hold a significant share by the end of 2035. Oil sands and sour natural gas are processed to yield sulfur. The chemical, manufacturing, and agricultural sectors are some businesses that use sulfur dust in North America. Also, the region is a major user of sulfur due to its constantly expanding agricultural and industrial sectors.

In the U.S., sulfur dust manufacturers are investing in cutting-edge manufacturing techniques to improve product quality and satisfy strict environmental regulations. For instance, in December 2023, the production capacity of LANXESS, a specialty chemicals firm, was expanded by several kilotons to produce sustainable light-color sulfur carriers. The project, which required investments in the double-digit millions, was finished in around two years at the Mannheim location. Moreover, the government programs aim to support innovative sulfur-based products for several industrial applications and advance sustainable sulfur management techniques.

Key Sulfur Dust Market Players:

- American Elements

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Georgia Gulf Sulfur Corporation

- Lyten, Inc.

- BASF SE

- Grupa Azoty S.A.

- Jaishil Sulfur and Chemical Industries

- Jordan Sulfur

- SML Limited

- Saeed Ghodran Group

- Maruti Corporation

The market leaders shape the competitive environment of the sulfur dust market, fostering innovation, establishing benchmarks, and satisfying the changing needs of consumers worldwide. By prioritizing research and development, technical innovations, and strategic alliances, these businesses keep growing their market share and solidifying their positions in important regions.

Recent Developments

- In September 2024, Lyten, a supermaterial applications business and global pioneer in lithium-sulfur battery technology, announced that its rechargeable lithium-sulfur battery cells have been chosen for testing onboard the International Space Station (ISS).

- In July 2024, BASF and NGK INSULATORS developed an advanced container-type NAS battery (sodium-sulfur battery). The customers can save approximately 20% on project lifetime costs and their initial investment in battery storage systems by using the NAS MODEL L24.

- Report ID: 6596

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sulfur Dust Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.