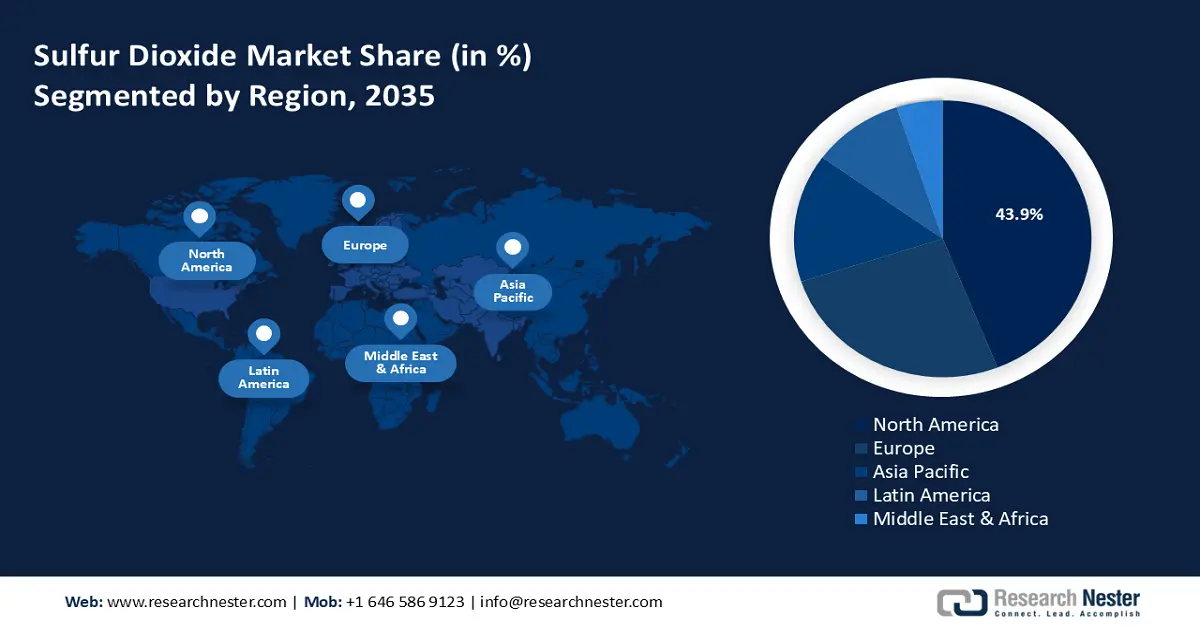

Sulfur Dioxide Market Regional Analysis:

North America Market Insights

In sulfur dioxide market, North America region is poised to capture over 43.9% share by 2035 and is poised to hold a leading position by the end of the forecast period. A diverse industrial base drives the market and environmental regulations have spurred investments in sulfur recovery. The U.S. and Canada lead the revenue share of the North America sulfur dioxide market.

Sulfur dioxide is expected to find increasing applications as a feedstock for sulfuric acid in fertilizer production for the growing agricultural sector in North America. Additionally, the food & beverage industry in the region is poised to drive demand owing to increasing sales of processed food. The U.S. Department of Agriculture estimates a total export value of USD 36.61 billion for processed foods. This creates a steady demand for sulfur dioxide to be used as an additive to extend the shelf life of processed foods.

The U.S. holds a dominant share in the North America sulfur dioxide market. The food & beverages sector is expected to remain the largest end user of sulfur dioxide while the market is poised to expand owing to the rise of specialty applications, creating opportunities to supply sulfur dioxide. For instance, in October 2024, Lyten announced plans to build the world’s first lithium-sulfur gigafactory in the U.S. Lithium-sulfur batteries would depend on sulfur-based compounds for energy storage and as production scales up, the sulfur dioxide market is poised to find a new revenue stream.

Canada is positioned to expand its market share in the sulfur dioxide market of North America by the end of the forecast period. The agricultural sector of Canada is expected to drive demand for sulfur-based fertilizer solutions. Furthermore, the advent of advanced gas treatment solutions is poised to boost sulfur recovery, creating additional supply streams for the market. For instance, in May 2023, CSV Midstream Solutions Corp. selected Axens to supply the technologies for the sulfur recovery unit for the Albright Sour Gas processing plant in Canada. Additionally, it indicates emerging demand for advanced sulfur recovery solutions that companies can leverage within the market.

Europe Market Insights

The Europe sulfur dioxide market is poised to register the fastest growth during the forecast period. The chemical industry of Europe is poised to remain a significant consumer of sulfur dioxide. Additionally, Europe has a robust winemaking sector led by France, Spain, and Italy that bolsters demand for the use of sulfur dioxide in the aging process. Germany and France are two major markets of Europe.

Furthermore, advancements by companies based in Europe to provide innovative sulfur recovery technology are poised to boost the sector’s growth. For instance, in September 2024, NEXTCHEM (Maire), from Italy, announced that they would execute a technological assessment and a process design package to upgrade the existing sulfur recovery unit of the HAOR complex in Azerbaijan. The contracts indicate burgeoning opportunities for companies based in Europe to provide sulfur recovery solutions and bolster the supply chain in the region.

Germany is a major contributor to the Europe sulfur dioxide market. The presence of industry-leading chemical companies in the country benefits the sulfur dioxide sector. In March 2024, Evonik announced the expansion of sustainable catalyst offerings with Octamax which will be a cost-efficient solution to improve sulfur removal and maximize octane retention. The expansion of refineries is poised to provide opportunities for businesses in the region to provide advanced sulfur recovery solutions.

France is an emerging in the Europe sulfur dioxide market. The wine sector of France is renowned worldwide, and sulfur dioxide is expected to experience a steady demand from winemakers in the country, boosting the sector’s growth. The European Union (EU) imposes strict regulations on the amount of sulfur dioxide in wines, with red wine restricted to no more than 150 mg/L and white wine at 200 mg/L. In July 2023, research published in MDPI indicated sulfur dioxide to continue representing an essential preservative in the wine-making process, despite challenges from alternative products, and stated that an adequate concentration of sulfur dioxide is vital for the stability of wine and preserving its aroma. The study is a reassurance for sulfur dioxide suppliers who are navigating the challenges of sulfur dioxide becoming obsolete for the wine industry.