Specialty Monomers Market Outlook:

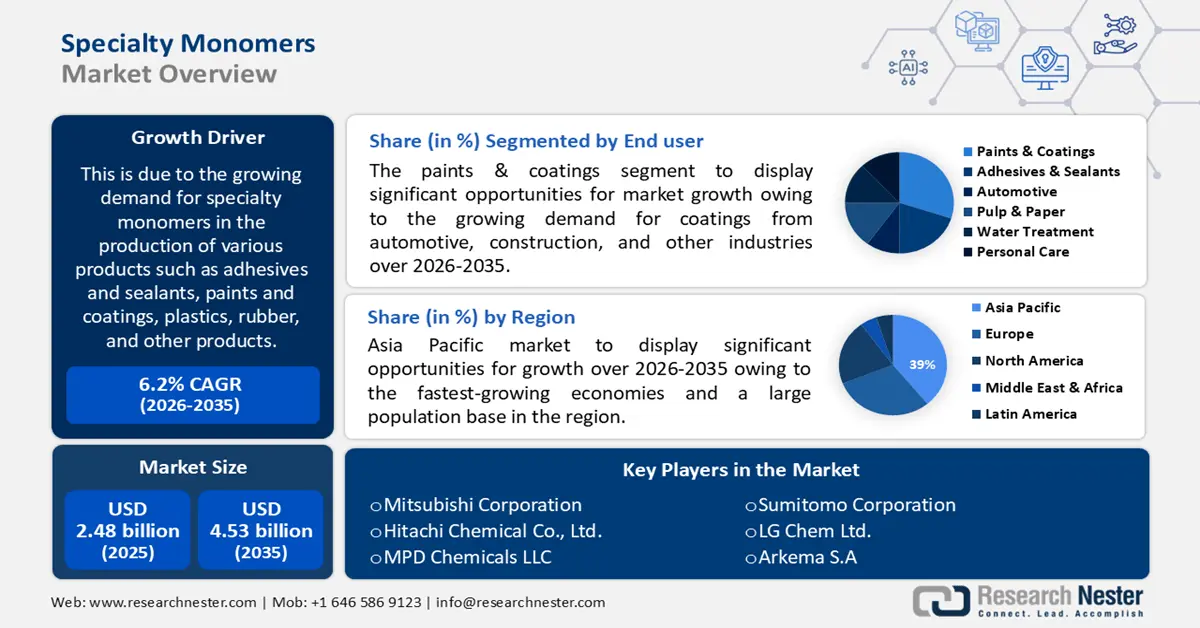

Specialty Monomers Market size was valued at USD 2.48 billion in 2025 and is likely to cross USD 4.53 billion by 2035, expanding at more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of specialty monomers is estimated at USD 2.62 billion.

This is due to the growing demand for specialty monomers in the production of various products such as adhesives and sealants, paints and coatings, plastics, rubber, and other products. The production of rubber is increasing worldwide owing to its versatility and usefulness in a variety of everyday applications. It is a cost-effective material which can be used to manufacture items such as tires, rubber bands, seals and gaskets, and many other products. In 2018, there were about 14 million metric tons of natural rubber produced worldwide. Approximately 37% of the world's total natural rubber production is produced in Thailand, the world's biggest rubber producing country. Specialty monomers can be used to modify the properties of the rubber, such as its heat resistance, durability, and flexibility. This can be especially beneficial for industrial applications, where rubber needs to be able to withstand extreme temperatures and conditions.

These monomers can also be used to improve the aesthetic properties of a material, like making it shinier or more opaque, or to make it more durable, so it can withstand wear and tear for a longer period of time. In addition, they can be used to reduce the amount of energy needed for production and make the material more biodegradable. These monomers can be tailored to give specific properties such as better adhesion, improved flexibility, better weathering resistance and better heat and chemical resistance.

Specialty monomers can also be used to reduce volatile organic compounds (VOCs) in the finished product. VOCs are pollutants that are released into the air as a result of certain manufacturing processes, and can be harmful to the environment. Specialty monomers are designed to react with the VOCs and reduce their presence, making the finished product more environmentally friendly.

In addition to these, factors that are believed to fuel the market growth of specialty monomers include increasing demand for consumer goods, technological advancements such as 3D printing, and rising demand from various end-use industries such as automotive, electronics, and healthcare. Consumer goods are becoming increasingly sophisticated, requiring new materials to be developed. 3D printing is creating new possibilities for the manufacturing of goods, and industries like automotive, electronics and healthcare are all looking for materials that can provide them with better performance and efficiency. Specialty Monomers are able to meet these demands, and as a result, the demand for them is increasing.