Specialty Monomers Market Outlook:

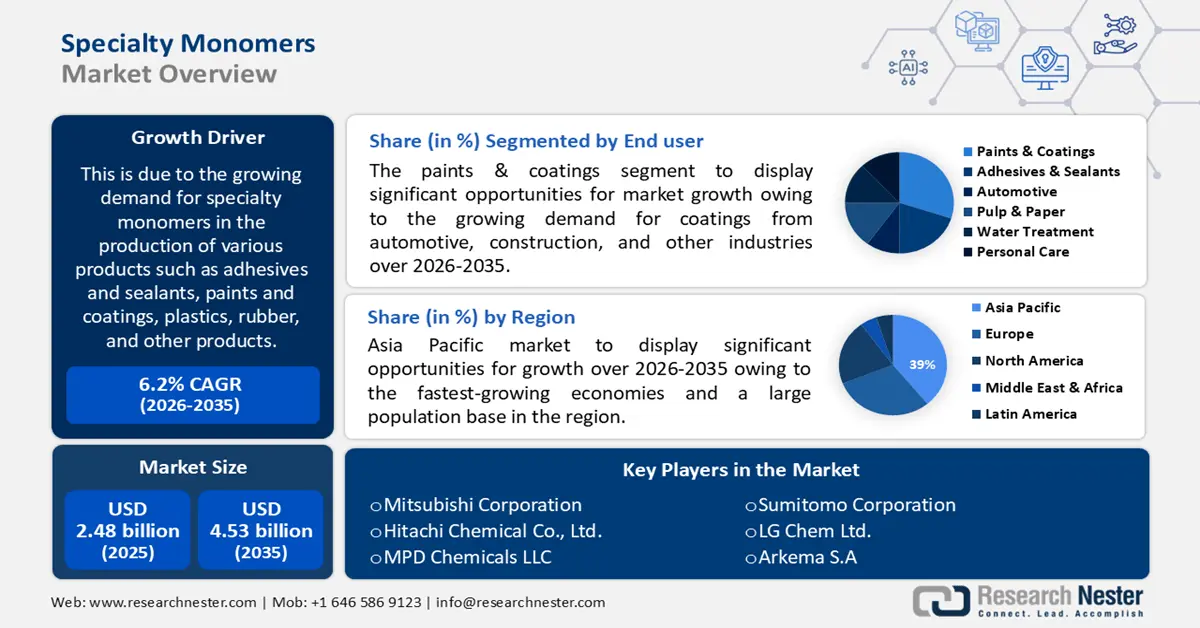

Specialty Monomers Market size was valued at USD 2.48 billion in 2025 and is likely to cross USD 4.53 billion by 2035, expanding at more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of specialty monomers is estimated at USD 2.62 billion.

This is due to the growing demand for specialty monomers in the production of various products such as adhesives and sealants, paints and coatings, plastics, rubber, and other products. The production of rubber is increasing worldwide owing to its versatility and usefulness in a variety of everyday applications. It is a cost-effective material which can be used to manufacture items such as tires, rubber bands, seals and gaskets, and many other products. In 2018, there were about 14 million metric tons of natural rubber produced worldwide. Approximately 37% of the world's total natural rubber production is produced in Thailand, the world's biggest rubber producing country. Specialty monomers can be used to modify the properties of the rubber, such as its heat resistance, durability, and flexibility. This can be especially beneficial for industrial applications, where rubber needs to be able to withstand extreme temperatures and conditions.

These monomers can also be used to improve the aesthetic properties of a material, like making it shinier or more opaque, or to make it more durable, so it can withstand wear and tear for a longer period of time. In addition, they can be used to reduce the amount of energy needed for production and make the material more biodegradable. These monomers can be tailored to give specific properties such as better adhesion, improved flexibility, better weathering resistance and better heat and chemical resistance.

Specialty monomers can also be used to reduce volatile organic compounds (VOCs) in the finished product. VOCs are pollutants that are released into the air as a result of certain manufacturing processes, and can be harmful to the environment. Specialty monomers are designed to react with the VOCs and reduce their presence, making the finished product more environmentally friendly.

In addition to these, factors that are believed to fuel the market growth of specialty monomers include increasing demand for consumer goods, technological advancements such as 3D printing, and rising demand from various end-use industries such as automotive, electronics, and healthcare. Consumer goods are becoming increasingly sophisticated, requiring new materials to be developed. 3D printing is creating new possibilities for the manufacturing of goods, and industries like automotive, electronics and healthcare are all looking for materials that can provide them with better performance and efficiency. Specialty Monomers are able to meet these demands, and as a result, the demand for them is increasing.

Key Specialty Monomers Market Insights Summary:

Regional Highlights:

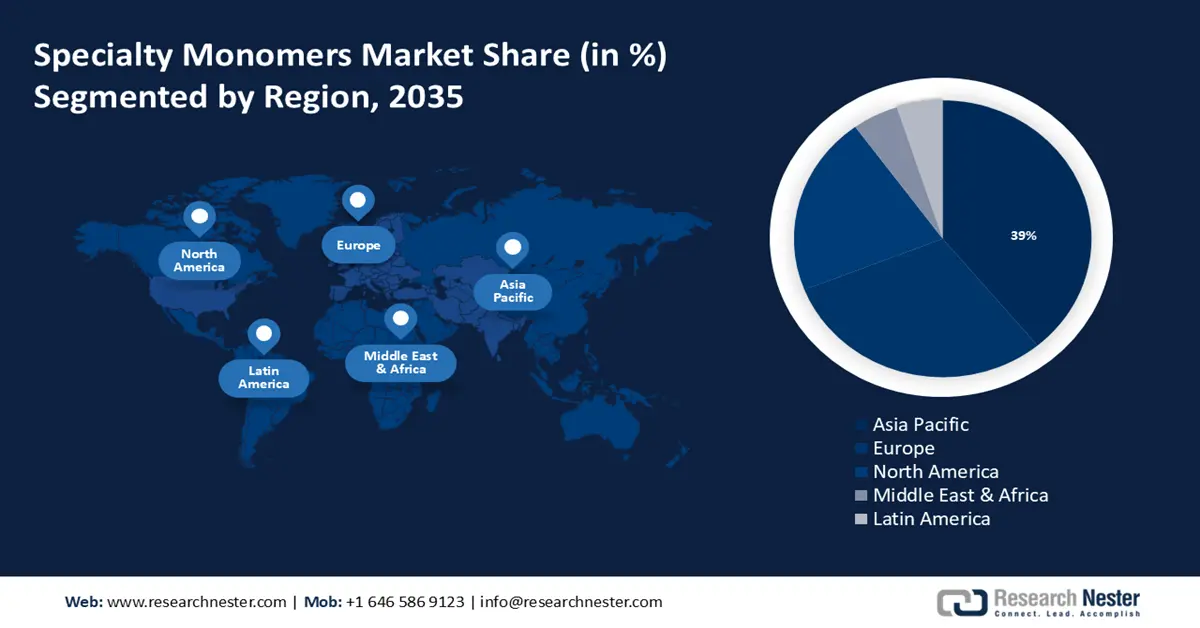

- Across 2026–2035, the Asia Pacific region is anticipated to command a 39% share of the Specialty Monomers Market by 2035, spurred by rising demand for eco-friendly monomers and increased R&D investments in advanced chemical production.

- Europe is expected to retain the second-largest share by 2035, bolstered by escalating PVC and PU consumption as well as heightened automotive R&D activity owing to increasing demand for polyvinyl chloride (PVC) and polyurethane (PU).

Segment Insights:

- By 2035, the paints & coatings segment is projected to capture the largest share of the Specialty Monomers Market, underlined by the rise of water-based formulations and advanced coating technologies propelled by growing demand for coatings from automotive, construction, and other industries.

- The acrylate monomers segment is forecast to dominate by 2035, strengthened by its extensive use in plastics, adhesives, and coatings applications impelled by the increasing demand for acrylate monomers in the coatings and adhesives industries.

Key Growth Trends:

- The Rising Need for Wastewater Treatment And Cleaning

- Increasing Popularity Of Personal Care Products

Major Challenges:

- Availability of cheaper alternatives

- Stringent government regulations, and environmental concerns

Key Players: Mitsubishi Corporation, Evonik Industries AG, The Dow Chemical Company, Eastman Chemical Company, Sumitomo Corporation, LG Chem Ltd., Arkema S.A., Hitachi Chemical Co., Ltd., MPD Chemicals LLC, Nippon Chemical Industrial Co., Ltd.

Global Specialty Monomers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.48 billion

- 2026 Market Size: USD 2.62 billion

- Projected Market Size: USD 4.53 billion by 2035

- Growth Forecasts: 6.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 20 November, 2025

Specialty Monomers Market - Growth Drivers and Challenges

Growth Drivers

-

The Rising Need for Wastewater Treatment And Cleaning- The wastewater treatment plants in high-income countries are estimated to treat approximately 68% of the wastewater generated by them. Lower-middle-income countries have a water treatment ratio of 27%, upper-middle-income countries have a treatment ratio of 37%, and low-income countries have a treatment ratio of 7%. Specialty monomers are molecules that have been specifically designed to target and remove specific pollutants from water. They are often used in water treatment processes as they are highly efficient at removing contaminants and don't produce any by-products that could be harmful to the environment.

- Increasing Popularity Of Personal Care Products- It is estimated that 450-500 million consumers in Europe consume cosmetics and personal care products every day in order to maintain their health and wellbeing. Specialty monomers are used in personal care products to provide characteristics such as improved water resistance, improved flexibility, and improved color stability. They can also provide improved solubility, increased UV protection, and increased durability.

- A Rapid Increase In The Production Of Pulp And Consumption Of Paper- It was observed that around 37% of harvested trees are used to manufacture paper around the world, resulting in a 400% increase in paper consumption over the past 40 years. These Monomers are used to modify the properties of paper produced from pulp. They can be used to increase strength, brightness, opacity, and to reduce the amount of ink absorbed into the paper.

- Growing Industrial Production Around The World - According to a recent report, it is estimated that the manufacturing output worldwide amounted to approximately USD 16,047 billion in 2021. This represents an increase of 18.25% from 2020. Industrial production requires a wide range of specialty monomers, such as polymers, resins, and plasticizers, for a variety of applications, including automotive, electronics, packaging, and construction. With the increase in industrial production, the demand for these specialty monomers is expected to increase significantly.

- Global Automotive Industry Demand for Specialty Monomers Along with Increasing Automobile Production - A total of 80 million motor vehicles were manufactured across the world in 2021, an increase of 1.4% over the previous year. For the automotive industry, these monomers are often used to improve the strength and durability of the materials used in the manufacture of vehicles, making them more resilient to wear and tear and harsh weather conditions.

Challenges

-

Availability of cheaper alternatives - Low-cost alternatives are readily available, which makes them more attractive to consumers, who are looking for more affordable options. This competition has caused some manufacturers to reduce their prices, resulting in a decrease in overall profit margins and a slowdown in the market.

-

Stringent government regulations, and environmental concerns

-

Rising costs of raw materials and fluctuating prices of the end-products

Specialty Monomers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 2.48 billion |

|

Forecast Year Market Size (2035) |

USD 4.53 billion |

|

Regional Scope |

|

Specialty Monomers Market Segmentation:

End-user Segment Analysis

The global specialty monomers market is segmented and analyzed for demand and supply by end use into paints & coatings, adhesives & sealants, automotive, pulp & paper, water treatment, personal care, and others. Out of these segments, the paints & coatings segment is estimated to gain the largest market share by the end of year 2035. Growing demand for coatings from automotive, construction, and other industries, which is expected to drive demand for specialty monomers in paints and coatings. It is estimated that approximately 57% of coats produced worldwide are applied to new construction, as well as to existing buildings for decoration and protection. The increasing demand for water-based paints and coatings, as they are less hazardous than solvent-based coatings along with the rapid expansion of the coatings sector, is also expected to contribute to the growth of the segment. Additionally, the development of advanced technologies such as UV curable coatings and powder coatings is also expected to contribute to the growth of this segment.

Type Segment Analysis

The global specialty monomers market is also segmented and analyzed for demand and supply by type into acrylate monomers, methacrylate monomers, acrylamide monomers, and others. Out of these segments, the acrylate monomers segment is estimated to gain the largest market share by the end of year 2035. The growth of the segment can be attributed to the increasing demand for acrylate monomers in the coatings and adhesives industries, as well as its use as a raw material in the production of a variety of products, such as paints, sealants, and plastics. There is an increase in the production of plastic worldwide. From 2000 to 2019, the global production of plastics increased by double to reach 450 million tonnes. Acrylate monomers are used in the production of plastic products because they are lightweight, durable, and highly resistant to chemicals and temperature. Acrylate monomers also have excellent optical properties, making them ideal for the production of clear plastics. In addition, acrylate monomers offer a variety of advantages, such as excellent adhesion properties, good durability, high flexibility, and low cost. As a result, they are increasingly being used in a variety of industries, including the construction, automotive, and electrical and electronics industries.

Our in-depth analysis of the global market includes the following segments:

|

By End Use |

|

|

By Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Specialty Monomers Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 39% by 2035. The region is home to some of the world's fastest-growing economies and has a large population base, which increases the demand for specialty monomers for a variety of applications. Additionally, there has been a shift in the region towards the usage of biobased and eco-friendly monomers, which is driving the growth of the market. Furthermore, the increased demand for chemical products in the region has caused chemical companies to invest in the research and development of more effective, specialized monomers. These monomers can be used in the production of a variety of products, such as pharmaceuticals and plastics, which are in high demand in the Asia-Pacific region. For instance, IOCL (Indian Oil Corporation) announced in November 2021 that the company would invest USD 494 million in the construction of the nation's first mega-scale maleic anhydride production plant at the Panipat Refinery in Haryana in order to manufacture high-value specialty chemicals. Additionally, the growing demand for lightweight and durable materials in consumer electronics is expected to drive the market growth in the region.

Europe Market Insights

The European specialty monomers market, amongst the market in all the other regions, is projected to hold the second largest share during the forecast period. The growth of the market can be attributed the increasing demand for polyvinyl chloride (PVC) and polyurethane (PU). PVC and PU are two of the most commonly used polymers in the region, and they require specialty monomers in their production. Moreover, automotive manufacturers in the Europe region are increasingly investing in research and development activities to develop new materials that can help improve the fuel efficiency and performance of vehicles. This increased R&D spending is leading to increased demand for specialty monomers that are used in production of these materials, thus driving the growth of specialty monomers market in the Europe region. Based on data for 2018, the European Union's investment in research and development by the automobile and part sectors grew by a significant amount, with 7.4% more than in 2017.

North American Market Insights

Further, the specialty monomers market in the North America, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The North American market is highly influenced by the presence of large-scale polymer production facilities and the availability of raw materials. Additionally, the region has witnessed significant growth in the automotive and packaging industries, which is expected to drive the demand for specialty polymers. Specialty monomers are an important part of the packaging industry, as they can provide properties such as increased strength, higher heat resistance, and improved barrier properties. In addition, they can provide lower costs and greater sustainability, making them ideal for use in packaging applications.

Specialty Monomers Market Players:

- Mitsubishi Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- The Dow Chemical Company

- Eastman Chemical Company

- Sumitomo Corporation

- LG Chem Ltd.

- Arkema S.A.

- Hitachi Chemical Co., Ltd.

- MPD Chemicals LLC

- Nippon Chemical Industrial Co., Ltd.

Recent Developments

-

An Asian company, Mitsubishi Gas Chemical Company, Inc., announced the expansion of its Meta-xylenediamine (MXDA) production in Europe. As a result, the region will have a greater supply of epoxy, polyamide, and isocyanate to meet its growing demand.

-

A basic agreement was reached between Nippon Shokubai and Sanyo Chemical Industries with a view to forming a holding company and centralizing both companies' activities.

- Report ID: 3848

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Specialty Monomers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.