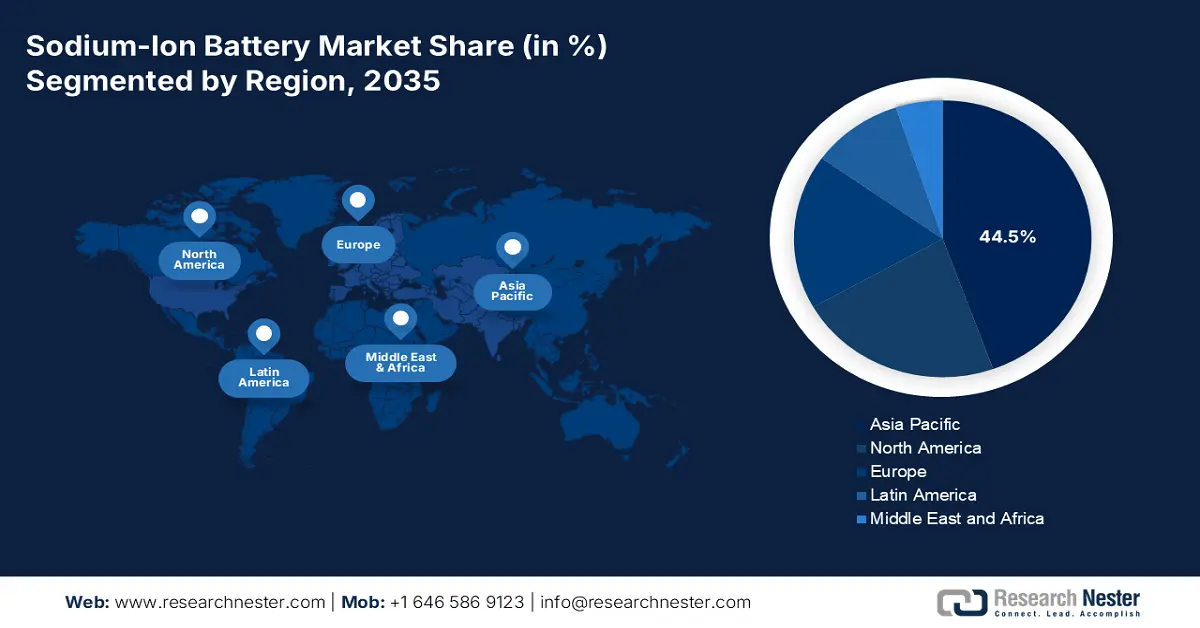

Sodium-Ion Battery Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the sodium-ion battery market is anticipated to garner the highest share of 44.5% by the end of 2035. The market’s upliftment in the region is highly attributed to sustainable chemistries, national programs for safe back-up, robust grid-storage demand, and cost advantages over lithium. In addition, South Korea, Japan, India, and China are also accelerating commercialization through research and development partnerships and manufacturing opportunities. For instance, as stated in the February 2022 NITI Aayog Government report, the government of India has readily outlined the target of 500 GW of non-fossil fuel-specific energy generation by the end of 2030. In addition, the battery’s demand in the country is projected to increase to 260 GW by the same year, which is also readily contributing to the market’s growth in the overall region.

China in the sodium-ion battery market is growing significantly, owing to the presence of ministerial and CPCIF platforms through policy coordination, which aligns with standards for safety, chemical-park development, and carbon accounting. This readily diminishes compliance and upsurges industrialization. According to an article published by the State Council in November 2025, the country comprises the largest population of more than 1.4 billion, thereby its responsibility is focused on optimizing the population's well-being and generating economic growth. Therefore, based on this objective, the nation has successfully gained the newest energy development, constituting an increase in the non-fossil energy consumption from 16.0% to 19.8% as of 2024. Besides, the overall electricity consumption between 2023 and 2024 is also driving the market’s growth in the country.

2023 and 2024 Overall Electricity Consumption Growth in China

|

Components |

2023 |

2024 |

|

Primary Industry |

11.5% |

6.3% |

|

Secondary Industry |

6.5% |

5.1% |

|

Tertiary Industry |

12.2% |

9.9% |

|

Residential |

0.9% |

10.6% |

Source: CET

India in the sodium-ion battery market is also growing due to an increase in the need for tailwinds, including rapidly growing renewable integration, along with grid-scale storage requirements. Moreover, the aspect of programmatic momentum has been highlighted in the ASPIRE assessment points to the market’s sustainability for rural reliability and distributed microgrids, that aligns with domestic energy-access and cost-effective priorities. According to a data report published by the IBEF Organization in August 2025, the country is significantly committed to achieving net zero emissions by the end of 2070, along with 50% renewable electricity by 2030, effectively marking an international climate milestone. Besides, as per the International Renewable Energy Agency (IRENA), the nation also generated 1,08,494 GWh of solar power, which has exceeded Japan’s 96,459 GWh, thereby making it suitable for the market’s upliftment.

Europe Market Insights

Europe in the sodium-ion battery market is expected to significantly emerge as the fastest-growing region during the forecast timeline. The market’s development in the region is highly propelled by the existence of the regional policy pressure that has tightened the lifecycle rules under the Battery Regulation, along with Horizon Europe funding for sustainable and safe design chemicals, and the Green Deal decarbonization targets. For instance, according to an article published by the CORDIS in January 2024, the EU-funded SSbD4CheM project constitutes the objective of ensuring a safe and sustainable design framework for the next-generation materials and chemicals, by spending EUR 7,498,762.5. This framework aims to ensure emerging and digitalized technologies through innovation and science-driven approaches for targeting advanced materials and safe chemicals, along with efficient hazard screening, alternative exposure models, and innovative LCA methods.

Germany in the sodium-ion battery market is gaining increased traction, owing to in-depth research and development for manufacturing ecosystems, grid modernization demands, and an increase in its industrial scale. According to an article published by the Bundesministerium in November 2025, the Federal Environment Minister Carsten Schneider has taken into consideration to harness the increased growth in electricity, constituting nearly 3,000 GW of energy from renewable projects. These are readily connected to the grid, owing to the absence of power lines and current grids. Besides, international partners hold the intention of implementing the Global Energy Storage and Grids Pledge to add 25 million km of power lines and develop 1,500 GW of storage capacity by the end of 2030. Therefore, with such a strategy, there is a huge growth opportunity for the sodium-ion battery market in the country.

France, in the sodium-ion battery market, is also developing due to the circular economy regulation uplifting recycling and safer chemistries, industrial decarbonization programs, and coordination of national research and development strategies. Besides, in June 2025, TIAMAT announced Endeavour LLC's investment to ensure funding for the sodium-ion battery in the country. Based on this, the company is projected to construct a giga-factory, which is dedicated to producing sodium ion-based batteries, with a 1.5 GW power output capacity, which is poised to eventually increase to 5 GW. Moreover, the facility in Hauts-De France is projected to commence construction by the end of 2025, and significantly employ 2,000 people for fulfilling orders for stationary storage and power tools market. Therefore, with such intentions, the market in the country is continuously flourishing.

North America Market Insights

North America in the sodium-ion battery market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is highly driven by the presence of domestic manufacturing incentives, utility decarbonization objectives, and grid-scale storage demand. As per an article published by the Energy Innovation Organization in July 2024, the Inflation Reduction Act (IRA) offers USD 369 billion in expenditure for transitioning from fossil fuels, which readily boosts clean energy projects. In addition, Goldman Sachs has estimated that USD 2.9 trillion is cumulatively invested in this transition. Moreover, the IRA has developed over 313,000 new employment opportunities by catalyzing investments for clean energy and more than USD 360 billion in project declaration, especially across low-income and rural communities, thus suitable for the market’s growth in the region.

The sodium-ion battery market in the U.S. is gaining increased exposure, driven by rising demand for grid storage, a surge in federal spending, ongoing export and import of minerals, and contributions from administrative organizations. As stated in a report published by the USGS Government in February 2022, the approximate overall value of non-fuel mineral production in the country was USD 105 billion, representing a 4% increase from the revised total of USD 101 billion as of 2021. Besides, the estimated metal production valuation was 34.9 billion as of 2023, along with USD 69.9 billion for industrial minerals production, which denoted a 7% increase from USD 65.3 billion in 2022. Therefore, an increase in the production of minerals readily contributes to the overall non-fuel mineral production in the country, which denotes an optimistic impact on the market’s growth.

Yearly Mineral Production, Employment, and Earnings in the U.S. (2019-2023)

|

Components |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Overall Mine Production (USD Million) |

|

|

|

|

|

|

Metals |

26,900 |

27,600 |

36,900 |

35,400 |

34,900 |

|

Industrial Minerals |

56,500 |

54,000 |

58,200 |

65,300 |

69,900 |

|

Coal |

25,500 |

16,800 |

21,000 |

32,300 |

31,700 |

|

Employment |

|

|

|

|

|

|

Coal Mining |

51,000 |

40,000 |

38,000 |

40,000 |

41,000 |

|

Non-Fuel Mineral Mining |

140,000 |

136,000 |

138,000 |

143,000 |

150,000 |

|

Chemicals |

559,000 |

537,000 |

541,000 |

570,000 |

570,000 |

|

Stone, Clay, and Glass Products |

312,000 |

296,000 |

300,000 |

315,000 |

310,000 |

|

Primary Metal Industries |

301,000 |

272,000 |

270,000 |

282,000 |

290,000 |

|

Average Earnings of Workers (USD) |

|

|

|

|

|

|

Coal Mining |

1,617 |

1,517 |

1,618 |

1,762 |

1,800 |

|

Chemicals and Allied Products |

1,066 |

1,065 |

1,103 |

1,119 |

1,200 |

|

Stone, Clay, and Glass Products |

968 |

981 |

1,017 |

1,086 |

1,100 |

|

Primary Metal Industries |

1,027 |

1,006 |

1,073 |

1,172 |

1,200 |

Source: USGS Government

The sodium-ion battery market in Canada is also growing, owing to the existence of government clean energy policies, abundance in raw materials and affordability, an increase in the grid-scale energy storage demand, technological progressions, along with electric mobility and sustainability. As per an article published by the Government of Canada in January 2025, the Emerging Renewable Power Program (ERPP) offers almost USD 200 million to extend the commercially viable renewable energy sources portfolio that is readily available to territories and provinces. The ultimate aim is to diminish greenhouse gas emissions from the electricity sector, which is positively impacting the overall market’s exposure. As per the 2025 WestRock Canada article, the pricing of 24 Volt 75 Amp Hour Sodium Ion Batteries is worth USD 1,299, denoting a decrease from USD 2,099. Likewise, it is USD 2,5999 for 48 Volt 75 Amp Hour Sodium Ion Batteries, displaying a reduction from USD 4,299.