Sodium-Ion Battery Market Outlook:

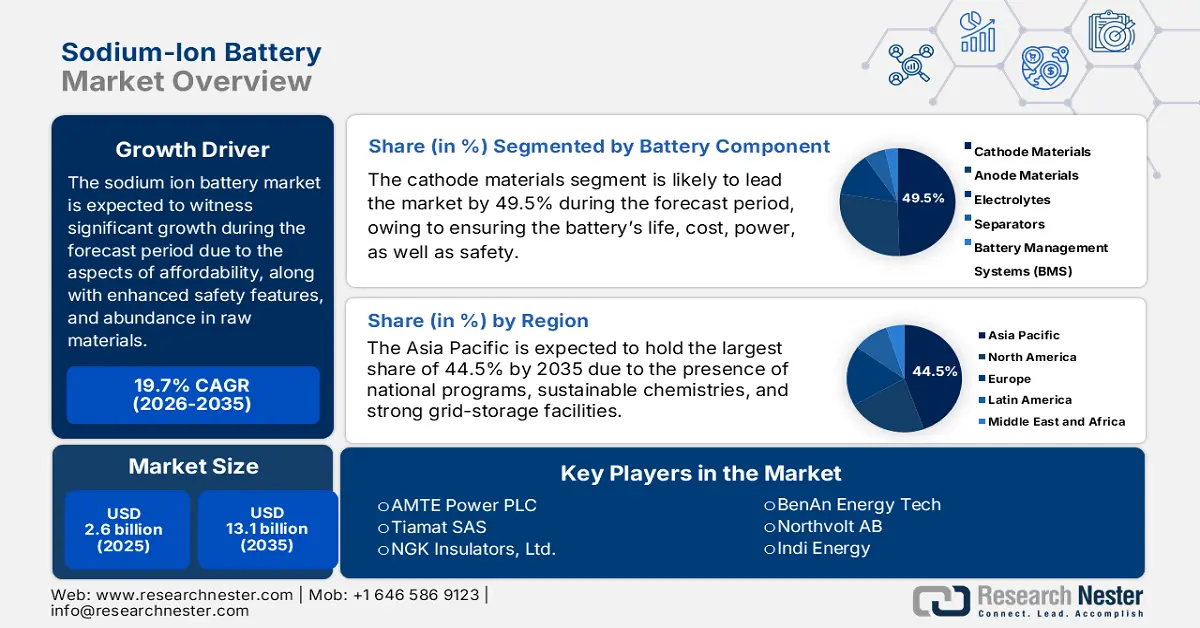

Sodium-Ion Battery Market size was over USD 2.6 billion in 2025 and is estimated to reach USD 13.1 billion by the end of 2035, expanding at a CAGR of 19.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of sodium-ion battery is assessed at USD 3.1 billion.

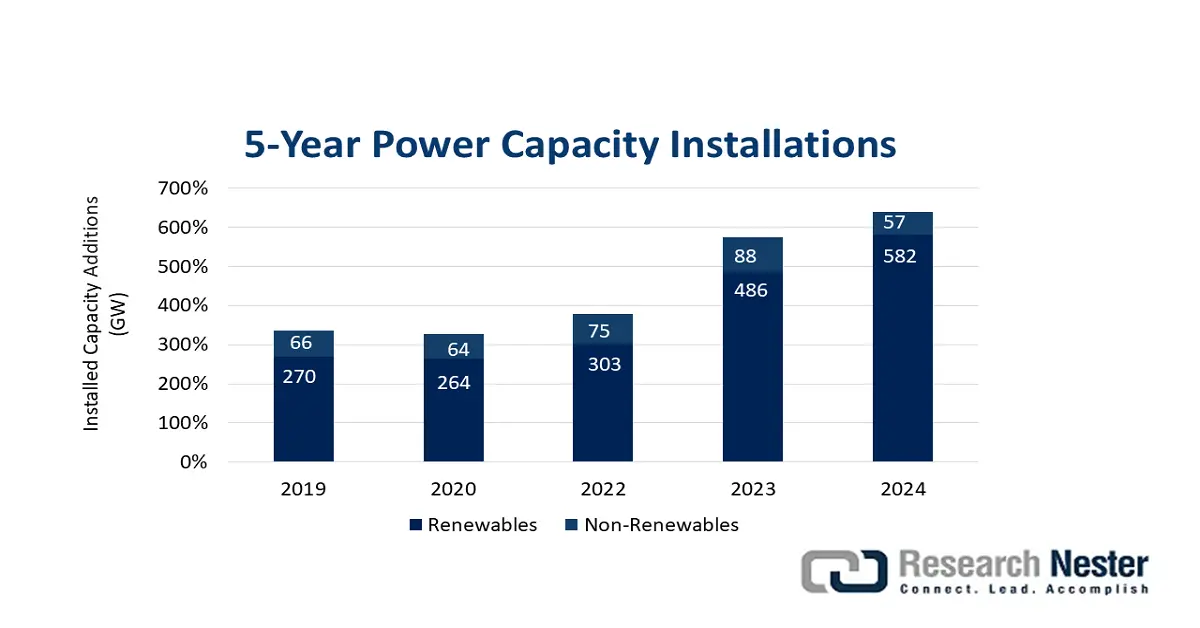

The international sodium-ion battery market is evolving as a robust alternative to lithium ion, which is fueled by cost efficiency, enhanced safety features, and abundant raw materials. With industries and governments globally investing in sustainable energy storage solutions, the sodium ion technology is readily gaining traction in industrial backup systems, electric mobility, and grid applications. According to a data report published by the IRENA Organization in 2025, the market is presently in its nascent stage and the production capacity can reach to GWh every year by the end of 2025, which is further projected to expand to 400 GWh per year by the end of 2030. Besides, the worldwide electric vehicle battery demand is also expected to reach almost 4,300 GWh every year by the end of the same year. Besides, progress in renewable power technology capacity installation is also driving the sodium-ion battery market globally.

Furthermore, the commercialization momentum, grid storage adoption, global partnerships, increased focus on sustainability and safety, as well as diversification of applications are other factors which are also fueling the sodium-ion battery market. As per a report published by the NREL Government in 2025, the overall grid economy caters to almost 20% of variable generation on a yearly basis without the demand for energy storage. In addition, this also constitutes nearly 35% of variable generation with the launch of low-cost flexibility options, including an increased utilization of demand response. Besides, NREL’s renewable electricity futures study has demonstrated more than a 50% increase in the demand for flexible options, such as energy storage. Moreover, the aspect of cost modeling across different regions is extremely competitive in the case of automotive lithium-ion battery manufacturing is also fueling the market’s development.

Regional Cost Modeling for Lithium-ion Battery Manufacturing (2025)

|

Region |

Cost (USD per kWh) |

|

Japan |

395 |

|

Korea |

363 |

|

China Tier 1 |

349 |

|

China Tier 2 |

378 |

|

Mexico Transplant (Japan) |

333 |

|

U.S. Future |

363 |

Source: NREL Government

Key Sodium-ion Battery Market Insights Summary:

Regional Highlights:

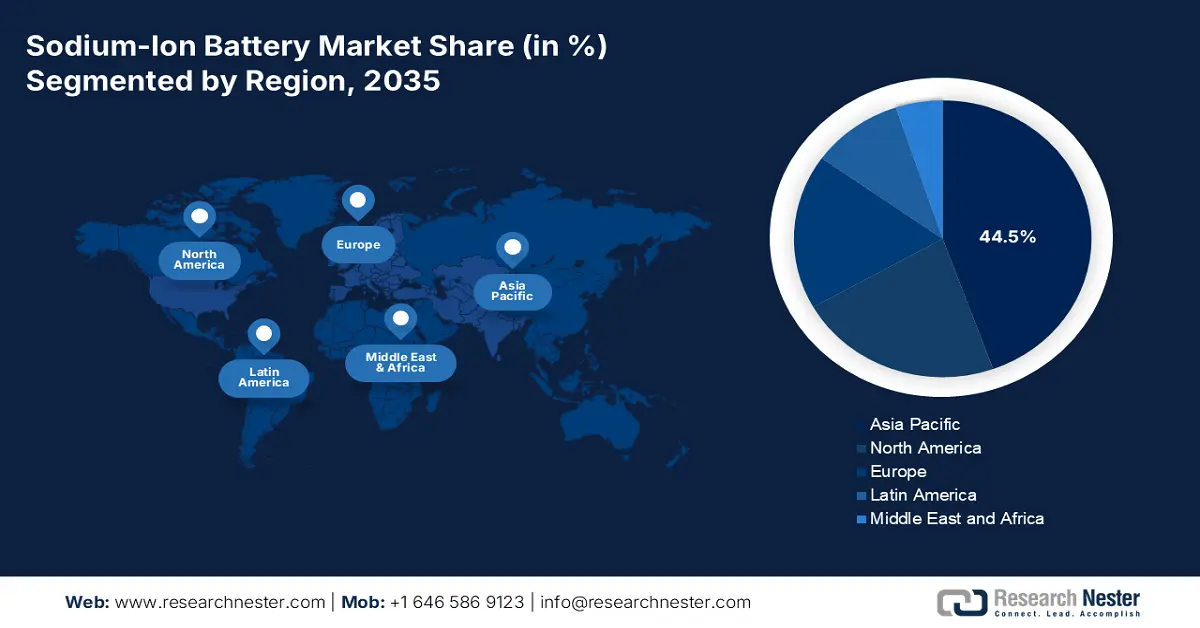

- By 2035, Asia Pacific is anticipated to capture a 44.5% share of the sodium-ion battery market, arising from sustainable chemistries, national backup-safety programs, strong grid-storage demand, and competitive cost advantages over lithium.

- Europe is set to emerge as the fastest-growing region, fostered by stringent lifecycle rules under the Battery Regulation, Horizon Europe funding for safer chemistries, and Green Deal-aligned decarbonization targets.

Segment Insights:

- By 2035, the cathode materials segment is projected to command a 49.5% share of the sodium-ion battery market, propelled by its critical role in defining battery cost, lifespan, safety, power, and energy density.

- The medium voltage (60 V to 300 V) segment is expected to secure the second-largest share, supported by its capability to bridge low-voltage consumer uses with higher-voltage industrial and automotive systems.

Key Growth Trends:

- Abundance in raw materials

- Increase in technological advancements

Major Challenges:

- Restricted industrial supply chains and manufacturing scale

- Market perception and commercial adoption gaps

Key Players: CATL (China), BYD Company Limited (China), HiNa Battery Technology Co., Ltd. (China), Faradion Limited (U.K.), Reliance New Energy (India), Altris AB (Sweden), AMTE Power PLC (U.K.), Tiamat SAS (France), NGK Insulators, Ltd. (Japan), Natron Energy Inc. (U.S.), BenAn Energy Tech (China), Northvolt AB (Sweden), Indi Energy (India), LionVolt (Netherlands), Aquion Energy (U.S.), Sumitomo Electric Industries, Ltd. (Japan), Samsung SDI (South Korea), LG Energy Solution (South Korea), Energy Renaissance (Australia), Malaysian Petrochemicals Association-backed consortium (Malaysia)

Global Sodium-ion Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 3.1 billion

- Projected Market Size: USD 13.1 billion by 2035

- Growth Forecasts: 19.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.5% share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: India, United Kingdom, France, Canada, Australia

Last updated on : 10 December, 2025

Sodium-Ion Battery Market - Growth Drivers and Challenges

Growth Drivers

- Abundance in raw materials: The availability of sodium is comprehensively available and cheap in comparison to lithium, which has successfully reduced supply chain risks, thereby bolstering the sodium-ion battery market’s growth and demand. According to an article published by the U.S. Department of Energy in July 2023, sodium batteries are readily manufactured by NGK and are distributed in collaboration with international chemical manufacturer BASF, comprising over 720 MW/4.9 GWh of the overall deployed storage. This is possible with large-scale deployments, which are exemplified by the 108 MW / 648 MWh system in Abu Dhabi. Besides, the ongoing sodium supply chain across different countries is also fueling the market’s growth.

2023 Sodium Export and Import

Countries

Export (USD)

Import (USD)

France

48.4 million

-

China

34.4 million

-

Belgium

2.5 million

-

U.S

-

31.2 million

India

-

19.6 million

Germany

-

8.0 million

Global Trade Valuation

93.8 million

Global Trade Share

More than 0.005%

OEC

- Increase in technological advancements: The aspect of optimization in anode and cathode materials is effectively bolstering the energy density as well as the cycle life, which in turn has denoted an optimistic outlook for the overall sodium-ion battery market. As per an article published by the ANL Government in November 2024, a USD 50 million consortium is expected to develop sodium ion batteries, which are poised to be extremely low-cost and sustainable compared to lithium-ion technology. In addition, this is commencing the fostering of an industrial ecosystem for sodium ion batteries, particularly in the U.S. Moreover, the nation is exceptionally focused on supplying raw materials as well as innovation for sodium ion technology, since there is a huge and substantial production of the world’s sodium chloride.

- Focus on cost competitiveness: The component of reduced or limited production expenses has made the sodium-ion battery market significantly attractive for large-scale budget and storage electric vehicle. As stated in a report published by the IEA Organization in 2025, the battery demand for storage applications and electric vehicle batteries has readily reached the 1 TWh milestone as of 2024. In addition, this demand is highly fueled by the continuous growth in electric vehicle sales, since the demand for electric vehicle batteries surged to more than 950 GWh, denoting a 25% rise in 2023. Moreover, electric cars have emerged as the principal aspect behind this particular battery demand, accounting for more than 85%, thereby making it suitable for boosting the market’s growth internationally.

Challenges

- Restricted industrial supply chains and manufacturing scale: This is one of the major challenges of the sodium-ion battery market, attributed to the underdeveloped supply chain and limited manufacturing scale for sodium‑ion batteries. Unlike lithium‑ion, sodium‑ion remains in its early commercialization phase. Besides, few large‑scale production facilities exist, with most activity concentrated in China and selective Europe-based innovators. This particular geographic concentration has created risks of supply bottlenecks and uneven adoption across regions. Without comprehensive manufacturing facilities, economies of scale are difficult to achieve, keeping expenses higher than expected despite sodium’s raw material abundance.

- Market perception and commercial adoption gaps: The sodium-ion battery market is also facing challenges related to market perception and adoption. Despite their benefits in cost, safety, and sustainability, sodium ion are frequently viewed as an experimental or second‑tier technology in comparison to lithium‑ion. This particular perception is effectively reinforced by the dominance of lithium‑ion in electric vehicles, consumer electronics, and grid storage, wherein sodium‑ion has yet to prove itself at scale. Besides, investors and end‑users remain cautious, focusing on established technologies with suitable and standard track records. Moreover, the absence of standardized performance benchmarks and certification frameworks for sodium‑ion batteries also complicates procurement decisions for utilities and OEMs, thus negatively impacting the overall market’s growth.

Sodium-Ion Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.7% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 13.1 billion |

|

Regional Scope |

|

Sodium-Ion Battery Market Segmentation:

Battery Component Segment Analysis

The cathode materials segment, which is part of the battery component, is anticipated to hold the highest share of 49.5% in the sodium-ion battery market by the end of 2035. The segment’s exposure is highly attributed to its importance in dictating a battery’s cost, lifespan, safety, power, and energy density. Based on these, it readily acts as the positive electrode, wherein ions are effectively stored during charging and released during the discharging phase. According to a report published by the UNCTAD Organization in 2023, developing nations hold the largest reserves of minerals, such as lithium, graphite, cobalt, manganese, and others, with countries in Africa comprising almost 35% of the international reserve, further including 19% of those demanded for electric vehicles. Besides, the Democratic Republic of the Congo constitutes 68% of cobalt imports, thus denoting a huge exposure for the sodium-ion battery market’s growth.

Voltage Class Segment Analysis

Based on the voltage segment, the medium voltage (60 V to 300 V) sub-segment is expected to cater to the second-largest share in the sodium-ion battery market during the forecast duration. The sub-segment’s upliftment is highly driven by the aspect of bridging low‑voltage consumer applications and high‑voltage automotive or industrial systems. This particular range is suited for light electric vehicles, telecom backup, and distributed energy storage systems, wherein safety, cost, and reliability outweigh ultra‑high energy density. Therefore, sodium‑ion batteries in this voltage class benefit from abundant sodium resources, enabling affordable production in comparison to lithium‑ion. Besides, their inherent thermal stability diminishes fire risks, thus making them attractive for telecom towers, rural electrification, and industrial backup power. Application Segment Analysis

The stationary energy storage segment, part of the application, is projected to account for the third-highest share in the sodium-ion battery market by the end of the stipulated timeline. The segment’s development is extremely fueled by the international transition toward renewable integration and grid stability. Unlike lithium‑ion, sodium‑ion provides cost benefits and safer operation, making it suitable for large‑scale storage where energy density is less critical. Besides, utilities and grid operators are increasingly deploying sodium‑ion systems to balance intermittent renewable sources, such as solar and wind, thus ensuring a reliable power supply. Moreover, the chemistry’s resilience at lower temperatures and diminished reliance on scarce raw materials further strengthen its appeal for stationary applications.

Our in-depth analysis of the sodium-ion battery market includes the following segments:

|

Segment |

Subsegments |

|

Battery Component |

|

|

Voltage Class |

|

|

Application |

|

|

End use Industry |

|

|

Form Factor |

|

|

Technology/Chemistry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sodium-Ion Battery Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the sodium-ion battery market is anticipated to garner the highest share of 44.5% by the end of 2035. The market’s upliftment in the region is highly attributed to sustainable chemistries, national programs for safe back-up, robust grid-storage demand, and cost advantages over lithium. In addition, South Korea, Japan, India, and China are also accelerating commercialization through research and development partnerships and manufacturing opportunities. For instance, as stated in the February 2022 NITI Aayog Government report, the government of India has readily outlined the target of 500 GW of non-fossil fuel-specific energy generation by the end of 2030. In addition, the battery’s demand in the country is projected to increase to 260 GW by the same year, which is also readily contributing to the market’s growth in the overall region.

China in the sodium-ion battery market is growing significantly, owing to the presence of ministerial and CPCIF platforms through policy coordination, which aligns with standards for safety, chemical-park development, and carbon accounting. This readily diminishes compliance and upsurges industrialization. According to an article published by the State Council in November 2025, the country comprises the largest population of more than 1.4 billion, thereby its responsibility is focused on optimizing the population's well-being and generating economic growth. Therefore, based on this objective, the nation has successfully gained the newest energy development, constituting an increase in the non-fossil energy consumption from 16.0% to 19.8% as of 2024. Besides, the overall electricity consumption between 2023 and 2024 is also driving the market’s growth in the country.

2023 and 2024 Overall Electricity Consumption Growth in China

|

Components |

2023 |

2024 |

|

Primary Industry |

11.5% |

6.3% |

|

Secondary Industry |

6.5% |

5.1% |

|

Tertiary Industry |

12.2% |

9.9% |

|

Residential |

0.9% |

10.6% |

Source: CET

India in the sodium-ion battery market is also growing due to an increase in the need for tailwinds, including rapidly growing renewable integration, along with grid-scale storage requirements. Moreover, the aspect of programmatic momentum has been highlighted in the ASPIRE assessment points to the market’s sustainability for rural reliability and distributed microgrids, that aligns with domestic energy-access and cost-effective priorities. According to a data report published by the IBEF Organization in August 2025, the country is significantly committed to achieving net zero emissions by the end of 2070, along with 50% renewable electricity by 2030, effectively marking an international climate milestone. Besides, as per the International Renewable Energy Agency (IRENA), the nation also generated 1,08,494 GWh of solar power, which has exceeded Japan’s 96,459 GWh, thereby making it suitable for the market’s upliftment.

Europe Market Insights

Europe in the sodium-ion battery market is expected to significantly emerge as the fastest-growing region during the forecast timeline. The market’s development in the region is highly propelled by the existence of the regional policy pressure that has tightened the lifecycle rules under the Battery Regulation, along with Horizon Europe funding for sustainable and safe design chemicals, and the Green Deal decarbonization targets. For instance, according to an article published by the CORDIS in January 2024, the EU-funded SSbD4CheM project constitutes the objective of ensuring a safe and sustainable design framework for the next-generation materials and chemicals, by spending EUR 7,498,762.5. This framework aims to ensure emerging and digitalized technologies through innovation and science-driven approaches for targeting advanced materials and safe chemicals, along with efficient hazard screening, alternative exposure models, and innovative LCA methods.

Germany in the sodium-ion battery market is gaining increased traction, owing to in-depth research and development for manufacturing ecosystems, grid modernization demands, and an increase in its industrial scale. According to an article published by the Bundesministerium in November 2025, the Federal Environment Minister Carsten Schneider has taken into consideration to harness the increased growth in electricity, constituting nearly 3,000 GW of energy from renewable projects. These are readily connected to the grid, owing to the absence of power lines and current grids. Besides, international partners hold the intention of implementing the Global Energy Storage and Grids Pledge to add 25 million km of power lines and develop 1,500 GW of storage capacity by the end of 2030. Therefore, with such a strategy, there is a huge growth opportunity for the sodium-ion battery market in the country.

France, in the sodium-ion battery market, is also developing due to the circular economy regulation uplifting recycling and safer chemistries, industrial decarbonization programs, and coordination of national research and development strategies. Besides, in June 2025, TIAMAT announced Endeavour LLC's investment to ensure funding for the sodium-ion battery in the country. Based on this, the company is projected to construct a giga-factory, which is dedicated to producing sodium ion-based batteries, with a 1.5 GW power output capacity, which is poised to eventually increase to 5 GW. Moreover, the facility in Hauts-De France is projected to commence construction by the end of 2025, and significantly employ 2,000 people for fulfilling orders for stationary storage and power tools market. Therefore, with such intentions, the market in the country is continuously flourishing.

North America Market Insights

North America in the sodium-ion battery market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is highly driven by the presence of domestic manufacturing incentives, utility decarbonization objectives, and grid-scale storage demand. As per an article published by the Energy Innovation Organization in July 2024, the Inflation Reduction Act (IRA) offers USD 369 billion in expenditure for transitioning from fossil fuels, which readily boosts clean energy projects. In addition, Goldman Sachs has estimated that USD 2.9 trillion is cumulatively invested in this transition. Moreover, the IRA has developed over 313,000 new employment opportunities by catalyzing investments for clean energy and more than USD 360 billion in project declaration, especially across low-income and rural communities, thus suitable for the market’s growth in the region.

The sodium-ion battery market in the U.S. is gaining increased exposure, driven by rising demand for grid storage, a surge in federal spending, ongoing export and import of minerals, and contributions from administrative organizations. As stated in a report published by the USGS Government in February 2022, the approximate overall value of non-fuel mineral production in the country was USD 105 billion, representing a 4% increase from the revised total of USD 101 billion as of 2021. Besides, the estimated metal production valuation was 34.9 billion as of 2023, along with USD 69.9 billion for industrial minerals production, which denoted a 7% increase from USD 65.3 billion in 2022. Therefore, an increase in the production of minerals readily contributes to the overall non-fuel mineral production in the country, which denotes an optimistic impact on the market’s growth.

Yearly Mineral Production, Employment, and Earnings in the U.S. (2019-2023)

|

Components |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Overall Mine Production (USD Million) |

|

|

|

|

|

|

Metals |

26,900 |

27,600 |

36,900 |

35,400 |

34,900 |

|

Industrial Minerals |

56,500 |

54,000 |

58,200 |

65,300 |

69,900 |

|

Coal |

25,500 |

16,800 |

21,000 |

32,300 |

31,700 |

|

Employment |

|

|

|

|

|

|

Coal Mining |

51,000 |

40,000 |

38,000 |

40,000 |

41,000 |

|

Non-Fuel Mineral Mining |

140,000 |

136,000 |

138,000 |

143,000 |

150,000 |

|

Chemicals |

559,000 |

537,000 |

541,000 |

570,000 |

570,000 |

|

Stone, Clay, and Glass Products |

312,000 |

296,000 |

300,000 |

315,000 |

310,000 |

|

Primary Metal Industries |

301,000 |

272,000 |

270,000 |

282,000 |

290,000 |

|

Average Earnings of Workers (USD) |

|

|

|

|

|

|

Coal Mining |

1,617 |

1,517 |

1,618 |

1,762 |

1,800 |

|

Chemicals and Allied Products |

1,066 |

1,065 |

1,103 |

1,119 |

1,200 |

|

Stone, Clay, and Glass Products |

968 |

981 |

1,017 |

1,086 |

1,100 |

|

Primary Metal Industries |

1,027 |

1,006 |

1,073 |

1,172 |

1,200 |

Source: USGS Government

The sodium-ion battery market in Canada is also growing, owing to the existence of government clean energy policies, abundance in raw materials and affordability, an increase in the grid-scale energy storage demand, technological progressions, along with electric mobility and sustainability. As per an article published by the Government of Canada in January 2025, the Emerging Renewable Power Program (ERPP) offers almost USD 200 million to extend the commercially viable renewable energy sources portfolio that is readily available to territories and provinces. The ultimate aim is to diminish greenhouse gas emissions from the electricity sector, which is positively impacting the overall market’s exposure. As per the 2025 WestRock Canada article, the pricing of 24 Volt 75 Amp Hour Sodium Ion Batteries is worth USD 1,299, denoting a decrease from USD 2,099. Likewise, it is USD 2,5999 for 48 Volt 75 Amp Hour Sodium Ion Batteries, displaying a reduction from USD 4,299.

Key Sodium-Ion Battery Market Players:

- CATL (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BYD Company Limited (China)

- HiNa Battery Technology Co., Ltd. (China)

- Faradion Limited (U.K.)

- Reliance New Energy (India)

- Altris AB (Sweden)

- AMTE Power PLC (U.K.)

- Tiamat SAS (France)

- NGK Insulators, Ltd. (Japan)

- Natron Energy Inc. (U.S.)

- BenAn Energy Tech (China)

- Northvolt AB (Sweden)

- Indi Energy (India)

- LionVolt (Netherlands)

- Aquion Energy (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- Samsung SDI (South Korea)

- LG Energy Solution (South Korea)

- Energy Renaissance (Australia)

- Malaysian Petrochemicals Association-backed consortium (Malaysia)

- CATL is an international leader in the sodium‑ion battery commercialization, having announced mass production plans and introduced its Naxtra sodium‑ion cells for EVs and stationary storage. The organization’s scale and supply‑chain integration make it the anchor player driving global adoption.

- BYD Company Limited is proactively exploring sodium‑ion technology as a suitable complement to its lithium‑ion portfolio, by targeting cost-effective electric vehicles and grid storage. Its robust and domestic market presence and government support have positioned it to accelerate sodium‑ion deployment, particularly in China.

- HiNa Battery Technology Co., Ltd., which is a spin‑off from the China-based Academy of Sciences, is one of the earliest sodium‑ion innovators that focuses on pilot production and stationary storage applications. The organization has readily deployed demonstration projects, demonstrating sodium‑ion’s safety and cost advantages.

- Faradion Limited constitutes a pioneering commercial sodium‑ion technology, emphasizing affordable, safe, and sustainable alternatives to lithium‑ion. Its acquisition by Reliance New Energy extended the international reach and manufacturing potential, especially in Asia.

- Reliance New Energy is scaling sodium‑ion technology in India through its acquisition of Faradion, aiming to localize production for EVs and grid storage. The company leverages India’s clean‑energy push and industrial policy to accelerate sodium‑ion adoption.

Here is a list of key players operating in the global sodium-ion battery market:

The international sodium-ion battery market is extremely competitive, with China readily dominating through HiNa, BYD, and CATL, while Europe has made advancements with Tiamat, Altris, and Faradion. Besides, in Japan, Sumitomo Electric and NGK have focused on progression, and U.S.-based firms, such as Aquion Energy and Natron Energy, have emphasized commercialization. Moreover, tactical approaches include mass production scaling, research and development partnerships, and government‑backed funding programs in India and South Korea. Further, in May 2025, Biwatt successfully introduced the 155 kWh sodium-ion battery energy storage systems for industrial and commercial consumers. This is considered safe than rival energy storage systems, since its cells are thermally inert, thereby not leading self-ignition, which in turn, is boosting the sodium-ion battery market globally.

Corporate Landscape of the Sodium-Ion Battery Market:

Recent Developments

- In November 2025, Sinopec Group and LG Chem readily signed a deal to jointly create notable materials for sodium ion batteries. These two organizations have collaborated on creating standard materials, such as anode and cathode materials, and expand cooperation to new energy fields.

- In January 2024, Stellantis Ventures declared its participation as the tactical investor in Tiamat for commercializing and developing sodium-ion battery technology. This investment is suitable for ensuring cost-effective, safe, and clean mobility with a comprehensive portfolio of battery chemistries.

- In January 2024, Clarios and Altris notified the joint creation of an advanced partnership, aiming at developing low-voltage sodium ion batteries for the automotive sector and making advancements, with a focus on sustainability.

- Report ID: 6419

- Published Date: Dec 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sodium-ion Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.