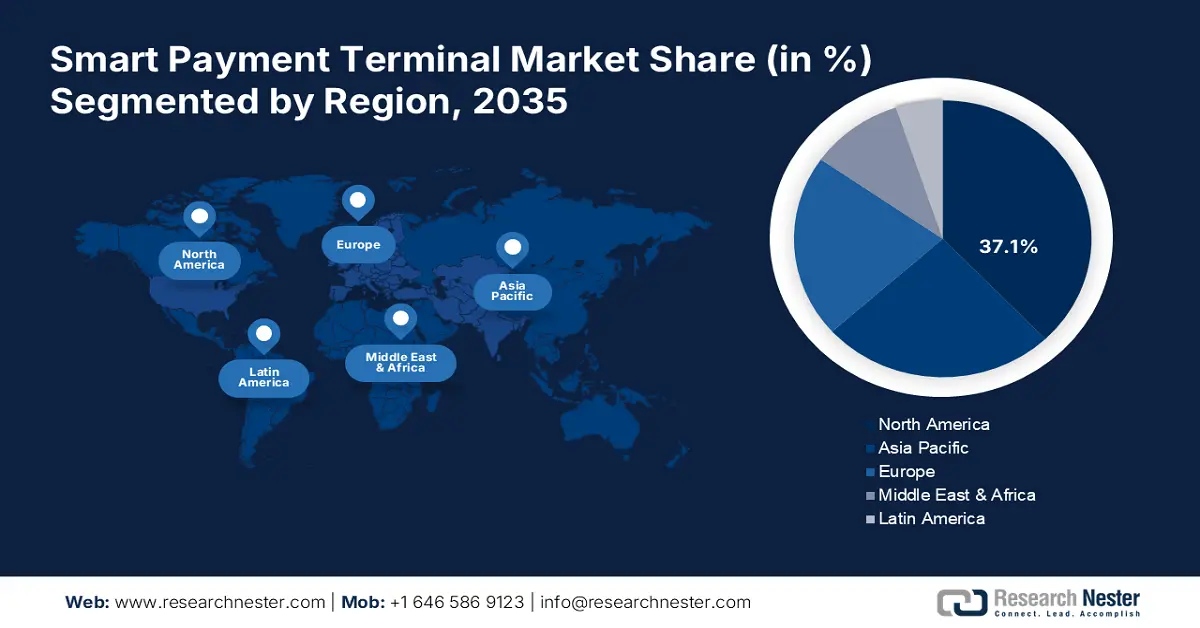

Smart Payment Terminals Market Regional Analysis:

North America Market Insights

North America in smart payment terminals market is estimated to account for more than 37.1% revenue share by the end of 2035. This region boasts of highly advanced electronic payment infrastructure, due to the high adoption of advanced technology for businesses and customers. Increased adoption of contactless payment solutions has presently strengthened the use of smart terminals further, thereby increasing the velocity and convenience of transactions. Additionally, the continually increasing demand for digital payment alternatives from consumers, of which e-commerce and mobile transactions form a steadily increasing part, further accelerates smart payment terminals market growth.

Moreover, the policy environment in North America that fosters innovation and competition among the providers of payment solutions ensures continuous innovation in terminal technology. Also, security, especially with the acceptance of EMV standards, adds consumer confidence and encourages a shift in moving from cash to digital channels. Value-added services such as the integration of analytical and customer engagement tools at smart terminals in this region have also been motivating factors for embracing improved payment systems. Altogether, all these factors fuel North America's positioning in the smart payment terminals market.

In the U.S., the market is driven by an increasing inclination toward contactless payment modes and stable security features which is fueling the market to grow by revolutionizing the consumer behavior pattern and also evolving its financial scenario. For instance, in June 2024, Square Inc. launched its latest designed mPOS reader that features a built-in display that allows merchants to showcase the transactions, accept signatures, and streamline the process.

Asia Pacific Market Insights

Asia Pacific is recently witnessing a steady growth in smart payment terminals, owing to the key drivers for this spurt such as the penetration of smartphones and internet connectivity. Digital payments are being adopted heavily by consumers and businesses in this region. Also, there have been conducive regulations and initiatives promoted by the government in promoting cashless economies and the usage of electronic payment systems. In addition, growth in e-commerce sectors drives this demand with further improvement of innovative payment solutions that ultimately improve transaction speed and security. Improved technology through Near Field Communication and contactless payment features has made smart payment terminals gradually more accessible and user-friendly. Moreover, increased focus on customers and their experience through innovative payment options leads to higher investments in smart payment infrastructure. Taken together, these elements outline the potential of Asia Pacific as a dynamic smart payment terminals market and pivotal component in the overall global landscape of smart payment terminals.

The launch of improved technology solutions as part of the Global Smart City Suite, which includes NEC Mi-Command, NEC Mi-City, NEC Mi-Eye, and NEC Mi-WareSync, has been announced by NEC Corporation in India. These solutions are designed to ensure smooth operations between organizations and authorities, improve experiences for businesses, communities, and citizens, and give transparency and visibility for effective management and decision-making. The technological innovations developed by NEC have been central to India's infrastructure growth, improving the lives of the populace.