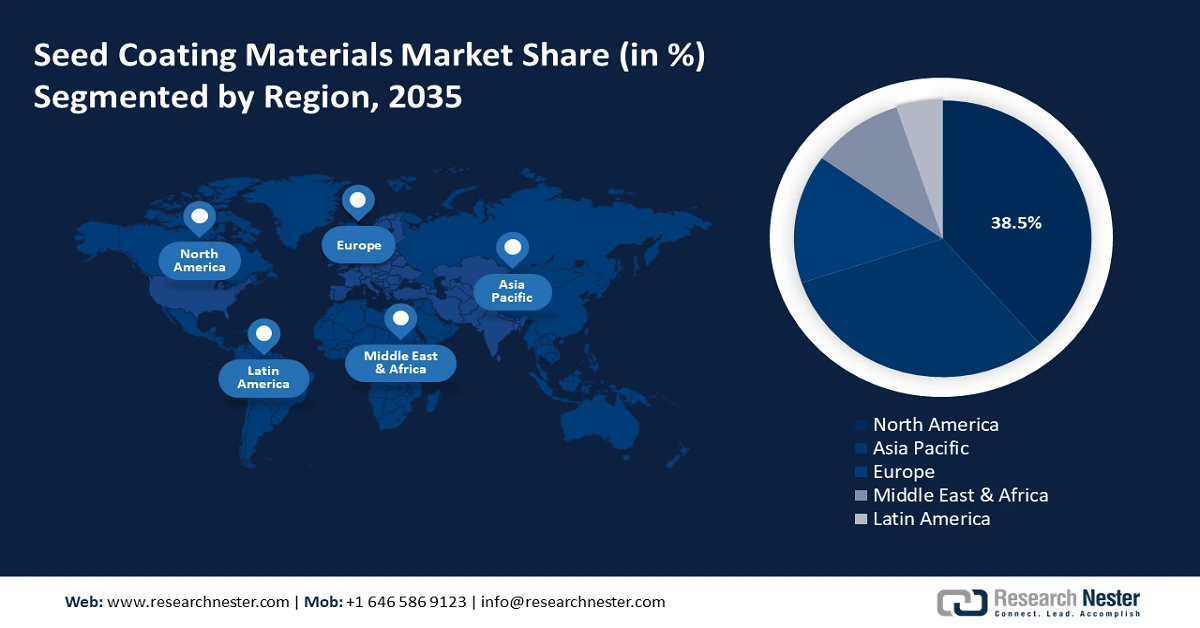

Seed Coating Materials Market Regional Analysis:

North America Market Statistics

North America industry is likely to hold largest revenue share of 41.5% by 2035 with remarkable growth opportunities. Advancement in agricultural practice and significance to crop yield improvement by introducing technology drives innovation in the market. Demand for the product is surging owing to farmers' awareness of the seed treatment benefits, including higher yield, germination rates, pest resistance, and improved nutrient uptake. Furthermore, regulations supporting the use of eco-friendly and sustainable agricultural inputs are increasingly influencing market dynamics in the region.

The U.S. continues to strive towards biological and innovative seed treatments in the seed coating materials market. Furthermore, collaborations between private and public entities are driving market growth. For instance, in February 2022, Cambridge University and Croda International Plc partnered to create next-generation seed coatings that are biodegradable and free of microplastics. This partnership is supported by the National Institute of Agricultural Botany and the UK government. Consequently, it strengthens the company's focus on using crop science innovation to support crop and seed enhancement to lessen the effects of a changing climate and land degradation.

Canada is eliciting support through funding from several private and public entities to strengthen its agricultural activities. For instance, in November 2023, Lucent Bio received over USD 3.6 million in funding through PacifiCan's Business Scale-up and Productivity program. The funds were allocated to improve Nutroe's (biodegradable and micro-plastic free seed coating) formulation and efficacy as it develops from a lab concept to a product that is ready to be commercialized. It aimed at encouraging robust crop establishment and germination while assisting in the switch from conventional agricultural inputs to sustainable substitutes. Thus, the main focus of the country lies in expanding its niche through continuous development.

Asia Pacific Market Analysis

The primary underlying factors driving the shift in the Asia Pacific in the seed coating materials market are the high acceptance of modern farming practices and the need to increase agricultural productivity to keep pace with population growth needs. The different crop types and varied climatic conditions of the region have contributed to the increasing application of seed coatings. Such materials can be engineered to improve certain specific performance characteristics of a seed under local conditions. The market is certainly going to witness rapid market expansion.

In India, farmers are assisted through government farm subsidies and irrigation projects. In addition, in the seed coating materials market, they are progressively adopting coated seeds that are commercially hybrid through acquisitions and partnerships. In December 2023, Fowler Westrup India announced the acquisition of Seed Processing Holland (SPH), from H2 Equity Partners. The company stated that with this strategic acquisition, Fowler Westrup became the top seed and grain processing company in the world. It aimed to provide its clients in the vegetable and field crop seed processing segments with an expanded product portfolio and cutting-edge solutions.

China will be an opportunistic country in the seed coating materials market during the forecast period owing to the local government which is actively boosting agricultural productivity by mitigating pesticide usage within industry. For instance, in November 2022, Bayer's Crop Science Division set up an installation in the crop and seeds subsection to highlight its vast germplasm pool and R&D capabilities. These developments are supporting China's seed industry's high-quality, innovation-driven development by increasing the likelihood of value-added growth.