Seed Coating Materials Market Outlook:

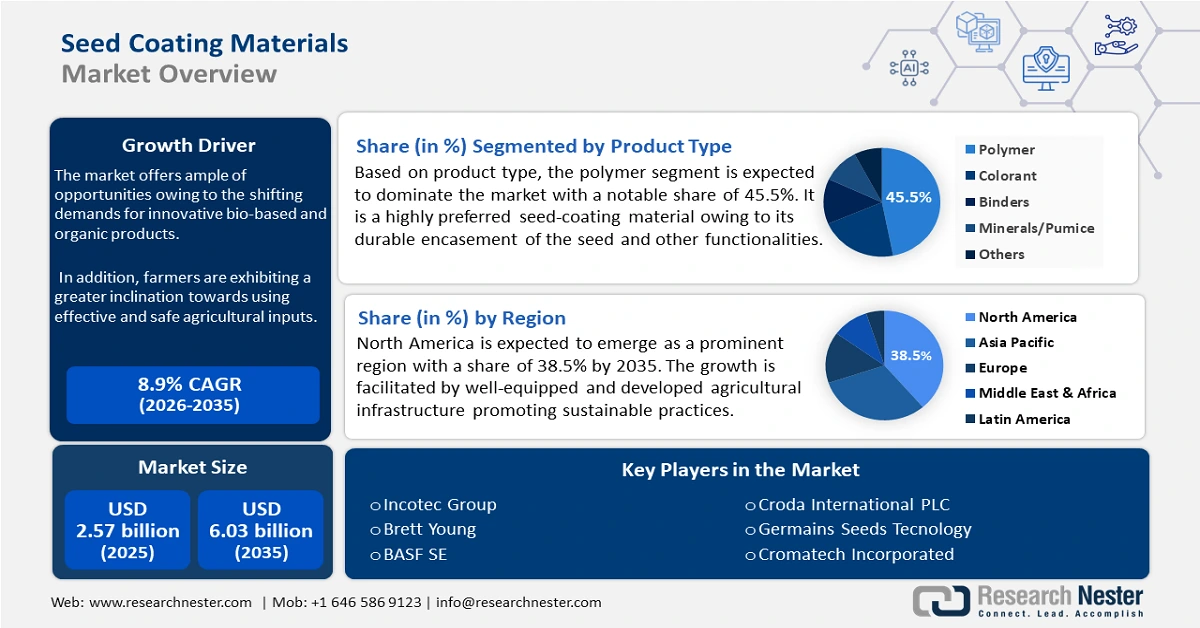

Seed Coating Materials Market size was over USD 2.57 billion in 2025 and is anticipated to cross USD 6.03 billion by 2035, witnessing more than 8.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of seed coating materials is estimated at USD 2.78 billion.

The growth can be attributed to more affinity for precision agriculture, a growing concern over crop yield improvement, and environmental sustainability. Seed coating enhances crop yield by nearly 15-20% when combined with the standard package of practices, with increasing profitability.

Furthermore, the demand for organic and specialty crops with supreme quality is constantly rising, thus presenting opportunities for growth in the seed coating materials market. This trend is contributing to the development of improved crop varieties that have the potential to increase productivity by 50–90% while, ideally, tending to meet the requirements of the end-user. In addition, the changing perception towards the adoption of coatings, more protection, nutrient delivery, and safety against pests and diseases can be facilitated.

Moreover, advances in biotechnology in the seed coating materials market have included pest-resistant seed varieties that have helped fortify crop resilience. For instance, in September 2021, the multi-event SmartStax technology, by Bayer and Dow AgroSciences was made commercially accessible for the growing season of 2022. In settings with medium to high corn rootworm pressure, it offers an additional instrument to help minimize damage caused by corn rootworms. This results in the qualitative crop harvesting of farmers and leads to profit maximization.

Key Seed Coating Materials Market Insights Summary:

Regional Highlights:

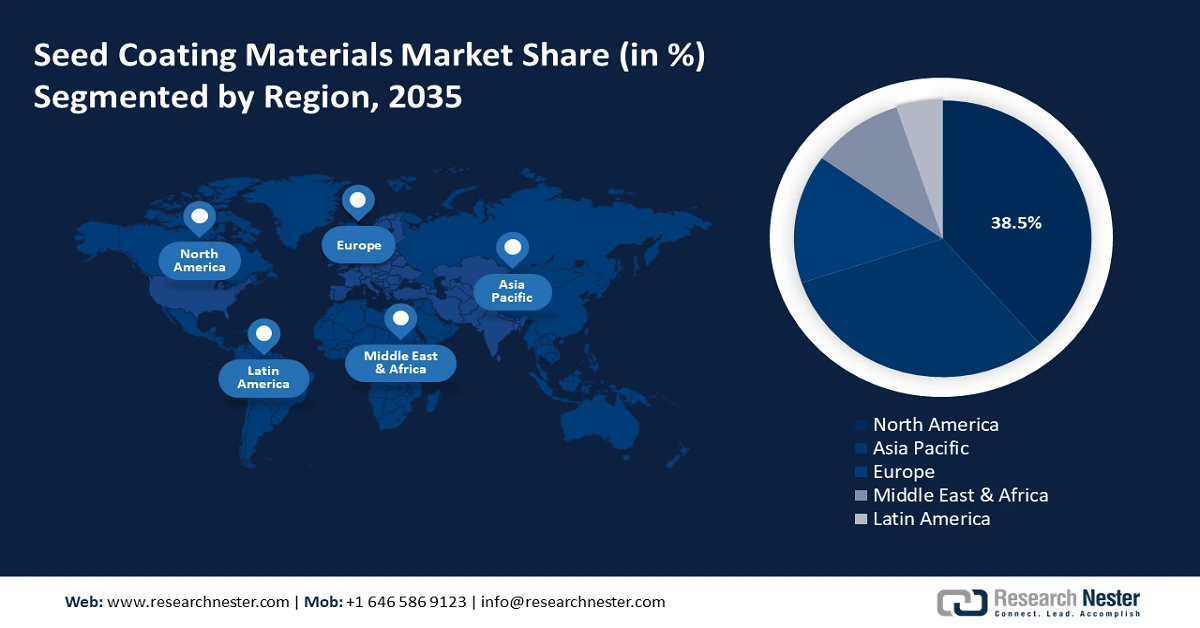

- North America holds a 41.5% share in the Seed Coating Materials Market, propelled by advancements in agricultural practices and increased farmer awareness, driving growth through 2035.

- Asia Pacific's Seed Coating Materials Market is projected to experience rapid growth by 2035, attributed to high acceptance of modern farming and need for increased productivity.

Segment Insights:

- The Cereals & Grains segment is poised to dominate the market from 2026 to 2035, fueled by increasing food demand and support for sustainable agriculture.

- The Polymer segment is expected to capture 45.5% market share by 2035, fueled by its adaptability, biodegradability, and support for precision agriculture.

Key Growth Trends:

- Increased agricultural productivity

- Focus on crop protection

Major Challenges:

- Changing consumer preference

- Short product life cycle

- Key Players: Clariant International, Croda International PLC, FMC Corporation, Germains Seed Technology, Incotec Group.

Global Seed Coating Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.57 billion

- 2026 Market Size: USD 2.78 billion

- Projected Market Size: USD 6.03 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

Seed Coating Materials Market Growth Drivers and Challenges:

Growth Drivers

- Increased agricultural productivity: The advancements in agricultural technology, such as genetically modified organisms, and precision farming have accelerated agricultural activities in the seed coating materials market. It assists in improving crop yield and optimizing resource usage. For instance, in August 2024, with significant enhancements to its soybean seed treatment offering, Corteva AgriscienceTM strengthened its industry-leading LumiGEN seed treatment portfolio. The insecticide and fungicide seed treatments have been added to soybean's LumiGEN seed treatment portfolio.

- Focus on crop protection: The growing safety concerns over the crops have sparked intense scrutiny in the seed coating materials market, with protecting agricultural outputs from pests and diseases. For instance, in May 2024 BASF unveiled an insecticide named Efficon. This insecticide assists farmers in tackling sucking pests and making it an efficient tool for insecticide resistivity. Effective crop protection plays a critical role in ensuring that yield stability is maintained, and continuous development accelerates improved growth of crops under harsh climatic situations.

Challenges

- Changing consumer preference: The emerging trends in lifestyle and evolving consumer needs are the most significant barriers to entering into the seed coating materials market. As demand for sustainable and organic agriculture is on the rise, consumers are opting for food products that contain no synthetic chemicals or GMOs. For instance, a report produced by the National Retail Federation in April 2023, suggests that 78% of the consumers have extensively broadened their spending to 5% more towards products that are sourced or produced sustainably. This compels farmers to change towards agricultural practices with no synthetics.

- Short product life cycle: Products can soon become outdated with the acceleration of biotechnology and seed treatment techniques in the seed coating materials market. This results in constant investment in research and development, which complicates manufacturers to renew their products routinely. This hinders the growth of farmers to stay competitive and fulfill the fast-changing requirements for agriculture. Thus, the rapid pace of change puzzles market forecasting and inventory management as firms find it unpredictable which technologies would popularize and limit further growth.

Seed Coating Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 2.57 billion |

|

Forecast Year Market Size (2035) |

USD 6.03 billion |

|

Regional Scope |

|

Seed Coating Materials Market Segmentation:

Product Type (Polymer, Colorant, Binders, Minerals/Pumice, Others)

Polymer segment is likely to capture around 45.5% seed coating materials market share by the end of 2035, owing to its excellent properties and versatility. Moreover, the awareness of environmentally friendly practices has created a new wave of interest in biodegradable polymers as alternatives to traditional coatings. Precision agriculture further boosts demand for complex polymer coatings that allow nutrient delivery in a tailored way to improve seed establishment under various conditions of the soil. For instance, in October 2024, at the Euroseeds Congress in Copenhagen, Denmark, Incotec launched Disco Blue L-1523, the company's newest microplastic-free film coat for sunflower seeds.

Crop Type (Cereals & Grains, Fruits & Vegetables, Flowers & Ornaments, Oilseeds & Pulses, Others)

Cereals & grains in the seed coating materials market have the potential to dominate the crop type segment, owing to high-quality seed demand and the increasing adoption of precision agriculture. In December 2023, the world's population is expected to reach 10 billion by the end of 2050, as a result, there will be a significant increase in demand for rice in the coming decades. To feed the world's growing population and maintain food security, cereal output with proper coating is expected to rise drastically. Cereals and grains would continue to lead demand as sustainable agricultural practices along with high-yielding crop varieties continue to gain ground. In addition, it improves resistance to environmental stressors and increases seed germination rates.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Crop Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Seed Coating Materials Market Regional Analysis:

North America Market Statistics

North America industry is likely to hold largest revenue share of 41.5% by 2035 with remarkable growth opportunities. Advancement in agricultural practice and significance to crop yield improvement by introducing technology drives innovation in the market. Demand for the product is surging owing to farmers' awareness of the seed treatment benefits, including higher yield, germination rates, pest resistance, and improved nutrient uptake. Furthermore, regulations supporting the use of eco-friendly and sustainable agricultural inputs are increasingly influencing market dynamics in the region.

The U.S. continues to strive towards biological and innovative seed treatments in the seed coating materials market. Furthermore, collaborations between private and public entities are driving market growth. For instance, in February 2022, Cambridge University and Croda International Plc partnered to create next-generation seed coatings that are biodegradable and free of microplastics. This partnership is supported by the National Institute of Agricultural Botany and the UK government. Consequently, it strengthens the company's focus on using crop science innovation to support crop and seed enhancement to lessen the effects of a changing climate and land degradation.

Canada is eliciting support through funding from several private and public entities to strengthen its agricultural activities. For instance, in November 2023, Lucent Bio received over USD 3.6 million in funding through PacifiCan's Business Scale-up and Productivity program. The funds were allocated to improve Nutroe's (biodegradable and micro-plastic free seed coating) formulation and efficacy as it develops from a lab concept to a product that is ready to be commercialized. It aimed at encouraging robust crop establishment and germination while assisting in the switch from conventional agricultural inputs to sustainable substitutes. Thus, the main focus of the country lies in expanding its niche through continuous development.

Asia Pacific Market Analysis

The primary underlying factors driving the shift in the Asia Pacific in the seed coating materials market are the high acceptance of modern farming practices and the need to increase agricultural productivity to keep pace with population growth needs. The different crop types and varied climatic conditions of the region have contributed to the increasing application of seed coatings. Such materials can be engineered to improve certain specific performance characteristics of a seed under local conditions. The market is certainly going to witness rapid market expansion.

In India, farmers are assisted through government farm subsidies and irrigation projects. In addition, in the seed coating materials market, they are progressively adopting coated seeds that are commercially hybrid through acquisitions and partnerships. In December 2023, Fowler Westrup India announced the acquisition of Seed Processing Holland (SPH), from H2 Equity Partners. The company stated that with this strategic acquisition, Fowler Westrup became the top seed and grain processing company in the world. It aimed to provide its clients in the vegetable and field crop seed processing segments with an expanded product portfolio and cutting-edge solutions.

China will be an opportunistic country in the seed coating materials market during the forecast period owing to the local government which is actively boosting agricultural productivity by mitigating pesticide usage within industry. For instance, in November 2022, Bayer's Crop Science Division set up an installation in the crop and seeds subsection to highlight its vast germplasm pool and R&D capabilities. These developments are supporting China's seed industry's high-quality, innovation-driven development by increasing the likelihood of value-added growth.

Key Seed Coating Materials Market Players:

- Chromatech Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Centor Group

- Clariant International

- Croda International PLC

- FMC Corporation

- Germains Seed Technology

- Incotec Group

- Mahendra Overseas

- Precision Laboratories

- Verdesian Life Sciences

- Xampla

- Brett Young

The company landscape in the seed coating materials market is scattered with manufacturers, research institutions, and distributors. These market players have been very keen to collaborate for innovation and the development of seed coating technologies to achieve sustainability and efficiency. For instance, in July 2021, the Solvay group acquired the global coatings business SeedGrowth from Bayer. Through this acquisition, Bayer was offered the opportunity to invest in Solvay and expand its portfolio of bio-based solutions. Here is the list of companies:

Recent Developments

- In September 2024, FMC Corporation announced the introduction of three state-of-the-art crop protection solutions in India. It added a new fungicide (Velzo), and herbicide (Vayobel & Ambriva) to its already extensive insecticide portfolio. This demonstrates the company's dedication to providing science- and innovation-driven crop solutions that meet the changing needs of Indian farmers.

- In November 2023, a collaborative partnership was established between BIOWEG and Bayer to develop novel biodegradable seed coatings and formulation materials. The main aim was the creation and testing of environmentally friendly seed coating formulation materials. In addition, encapsulation of biobased and biodegradable controlled-release plant protection products.

- Report ID: 6597

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Seed Coating Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.