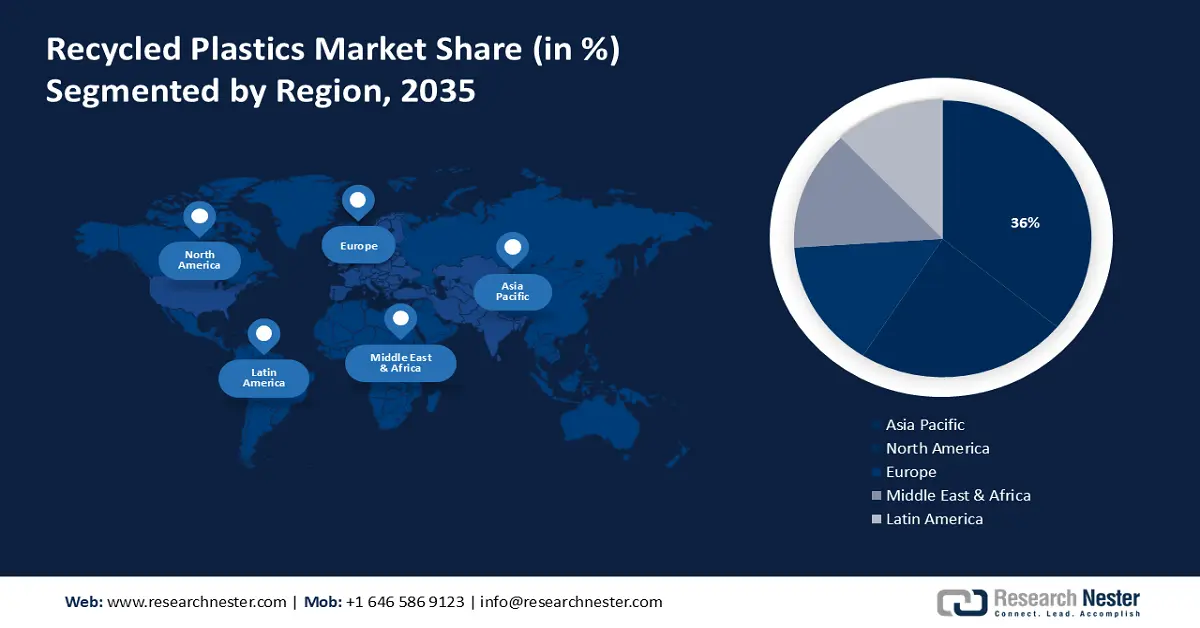

Recycled Plastics Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 36% by 2035. The market growth in the region is also expected on account of the increasing population leading to higher demand for plastic products in various industries. Additionally, inadequate collection of waste and processing infrastructures are the major drivers of plastic pollution in the APAC region. Conversion of plastic waste into sustainable packaging materials helps in reducing the plastic waste present in the region. According to a recent report, around half of the world's plastics (52% of 390.7Mt globally) are generated in the Asia-Pacific (APAC) region in 2021.

Increasing consumer awareness regarding the sustainable use of recycled plastic in Indonesia is resulting the growth of recycled plastics market. Plastic waste generation is quite high in the region as it’s a tourist place. According to the World Bank, Indonesia generates around 7.8 million tons of plastic waste annually out of which 4.9 million tons of plastic waste is not properly managed.

The recycled plastics market in China is growing due to the conversion of plastic waste into fuel. According to the State Council report issued in 2022, China's complete focus is on plastic recycling which has helped reduce crude oil consumption by 510 million tons and prevented 61.2 million tons of carbon dioxide emissions. These measures taken by the government also prevented 90 million tons of solid waste from being generated.

North American Market Insights

The North America region will also encounter huge growth for the recycled plastics market during the forecast period and will hold the second position owing to the fast development of the building & construction industry with increasing demand for recycled plastic in these industries having significantly contributed towards the growth of the recycled plastics market in the region.

According to the Associated General Contractors (AGC) of America, more than 919,000 construction establishments took place in the U.S. in the 1st quarter of 2023 which has given employment to 8.0 million employees and created nearly USD 2.1 trillion worth of structures each year. With the growing construction rate, demand for recycled plastics is gradually increasing.

In the US, recycled plastic is majorly used in making fibers, sheet and film, strapping, food and beverage bottles, and nonfood containers. The country has a huge potential to convert recycled plastics into useful products. For instance, only 5% to 6% of plastics get recycled in the United States as plastic consumption is very high in the region.

The recycled plastics market in Canada is growing as the region is completely focusing on recycling plastic. According to the government of Canada, the country can recycle around 9% of its plastic waste every year, while producing more than 3 million tons annually.