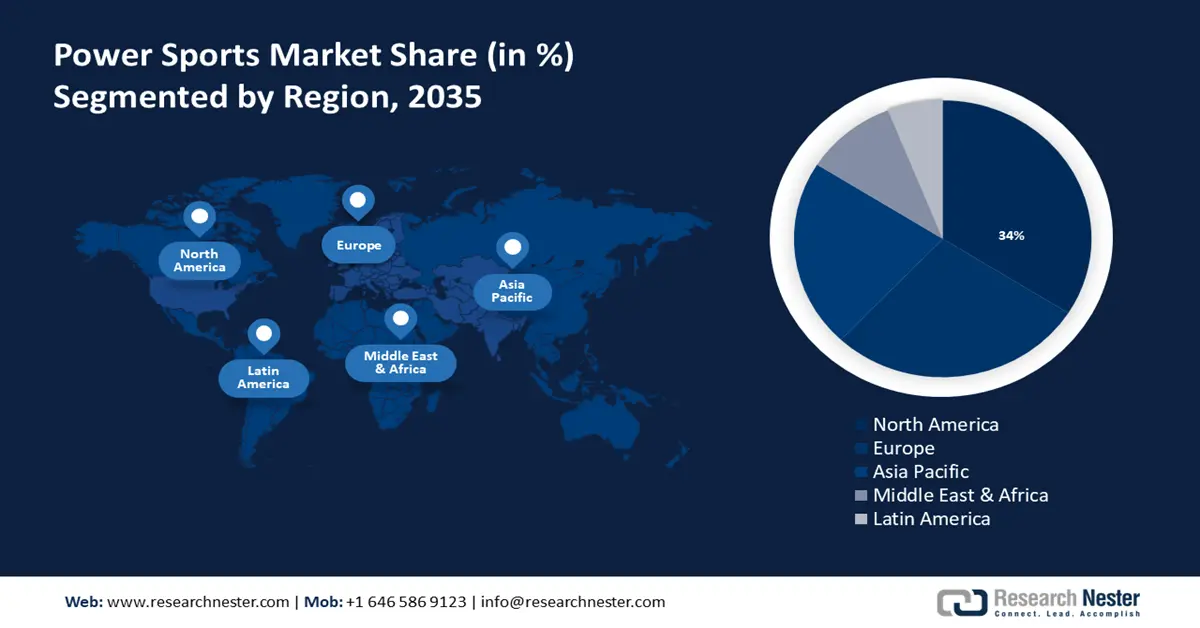

Power Sports Market Regional Analysis:

North America Market Insights

North America region in power sports market is set to account for around 34% revenue share by 2035. The market growth in the region is due to increasing people disposable income that they can spend on leisure pursuits and power sports equipment like all-terrain vehicles (ATV), motorbikes, snowmobiles, and personal watercraft. Power sports cars draw enthusiasts who appreciate off-roading, water sports, and recreational riding because they provide thrilling and heart-pounding experiences. 103,650 Harley-Davidson bikes were sold in the North America in 2020.

State and federal governments in the United States will provide substantial support for power sports activities because of their substantial economic impact. RideNow is the biggest power sports dealer in United States, and RumbleOn Inc. has agreed to purchase it. The USD 5.4 billion transaction will combine RideNow's retail brand and broad reach with RumbleOn's technology.

European Market Insights

The European region will also encounter huge growth for the power sports market during the forecast period owing to the owing to the growth of recreational clubs and regional organizations that actively promote off-road & recreational leisure activities in this region. To gain a larger market share, a number of important companies are launching the newest technology products in the industry. The total amount of general government spending in the EU on sports and recreation in 2022 was USD 60.3 billion, or 0.8% of total government spending.

Germany hold significant hare because more people are engaging in off-road recreational activities. Approximately 17.6 million German-speaking individuals who were 14 years of age or older went backpacking in 2023.

Growing investement for motorized sports equipment such as ATVs, motorcycles, snowmobiles, and personal watercraft are propelling the industry in France. Motorcycle retail made up only 2.7% of this total revenue; the remaining 2.8% came from wholesale.

Continuous technological developments in power sports cars are propelling the United Kingdom market. A car manufacturer named Polaris presented their 2022 snowmobile portfolio, which includes 22 new models based on the rider-first Matryx platform. At sea level and at 10,000 feet above the 850 Patriot, the SmartBoost technology's combustion stability produces 10% and 50% greater power, respectively.