Power Sports Market Outlook:

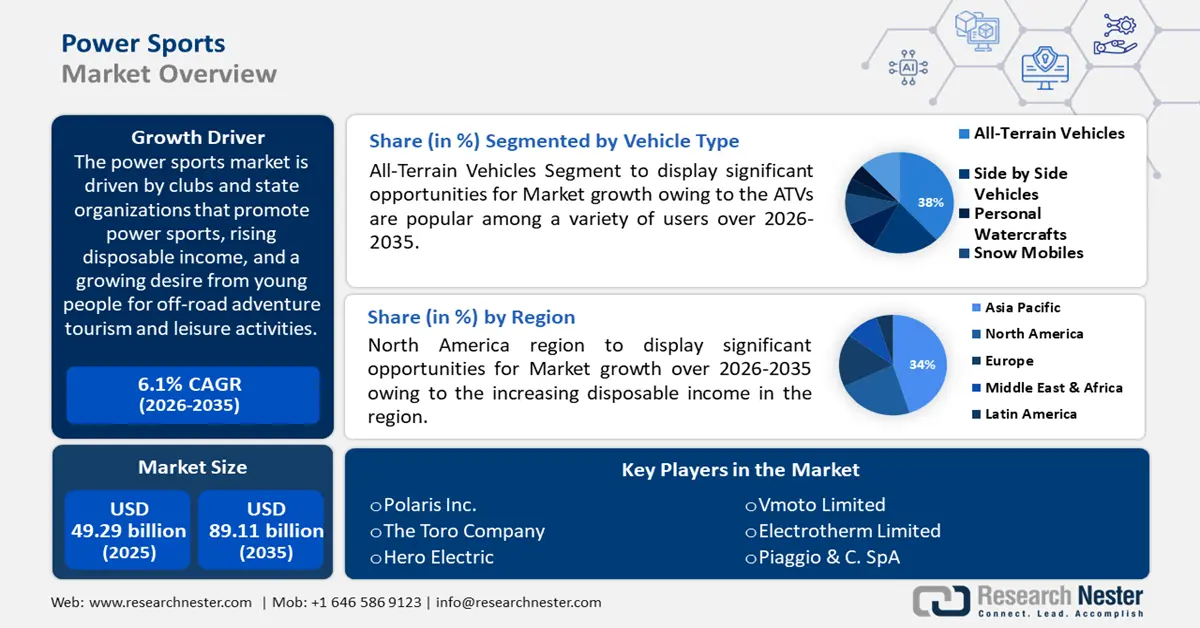

Power Sports Market size was over USD 49.29 billion in 2025 and is anticipated to cross USD 89.11 billion by 2035, growing at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power sports is assessed at USD 52 billion.

The market is driven by clubs and state organizations that promote powersports, rising disposable income, and a growing desire from young people for off-road adventure tourism and leisure activities. The median annual expenditure of an individual in all states on leisure activities is USD 487.

Key Power Sports Market Insights Summary:

Regional Highlights:

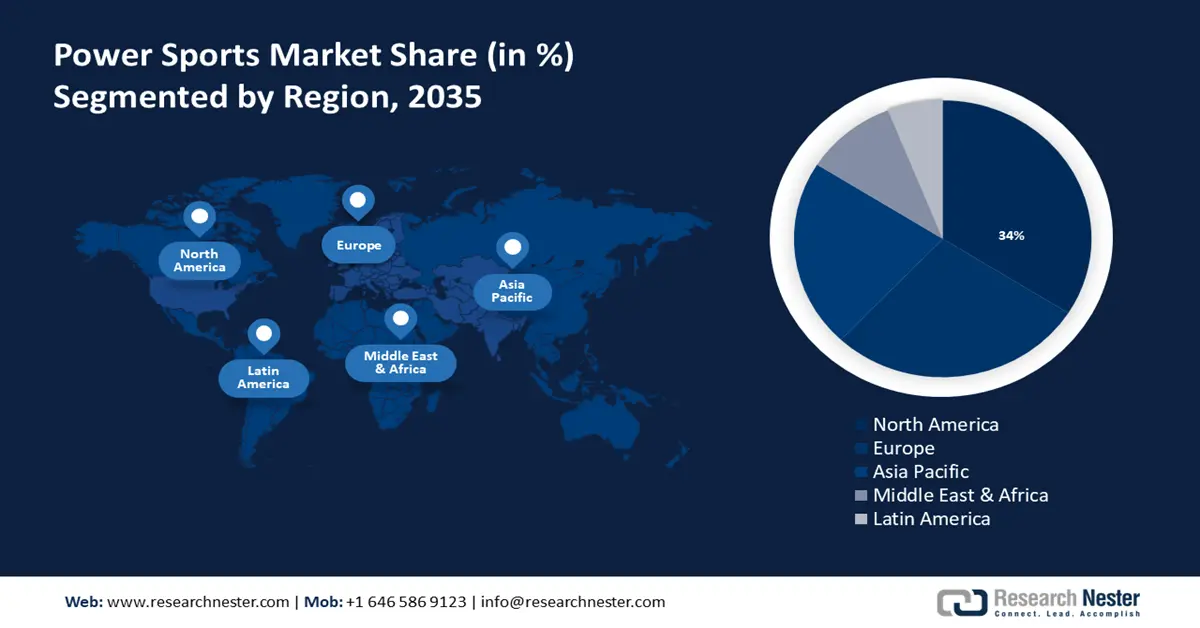

- North America power sports market will secure over 34% share by 2035, attributed to rising disposable incomes and increased spending on leisure activities and power sports equipment.

Segment Insights:

- The all-terrain vehicles segment in the power sports market is expected to experience significant growth till 2035, driven by their versatility in recreation, agriculture, and industrial applications.

Key Growth Trends:

- High demand for adding extra accessories to vehicle modifications

- Growing the number of people engaging in leisure activities

Major Challenges:

- Safety concerns and the environment

- Several connected to motorsports automobiles

Key Players: Polaris Inc., The Toro Company, Hero Electric, Vmoto Limited, Electrotherm Limited, Jiangsu Xinri E-Vehicle Co., Ltd., Energica Motor Company Inc., Piaggio & C. SpA, Niu International, Mahindra & Mahindra Ltd.

Global Power Sports Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 49.29 billion

- 2026 Market Size: USD 52 billion

- Projected Market Size: USD 89.11 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, Germany, Canada

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Power Sports Market Growth Drivers and Challenges:

Growth Drivers

- High demand for adding extra accessories to vehicle modifications - Powersports vehicles are utilized for a variety of purposes in a variety of terrains. For both off-road and on-road aficionados, optimizing functionality through utility-oriented modifications is an absolute priority. During the projected period, it is also anticipated that the trend of car electrification will continue to develop.

Since ATVs, heavy motorcycles, jet skis, and snowmobiles are among the vehicles that major OEM manufacturers hope to offer in electric form, the introduction of electric models will further lessen reliance on fossil fuels because these vehicles have greater fuel consumption rates.

In order to support sustainable development and green energy, major automakers are concentrating on creating electric vehicle versions of their vehicles. In just three years, the percentage of electric vehicles in overall sales has more than tripled, rising from 4% in 2020 to 14% in 2022. - Growing the number of people engaging in leisure activities - The increasing popularity of recreational activities like off-road biking and snowmobiling would generate a lot of potential prospects for the industry. People that engage in recreational activities during their vacation or free time do so to mentally and physically rejuvenate. Power sports vehicles, including boats, bikes, and other devices and vehicles, are necessary for activities like off-road biking and snowmobiling. For instance, according to survey, in 2020 conventional outdoor recreation made up 37.4% of all outdoor recreation in the country, up from 30.6% in 2019.

- Growing consumer desire for affordable and practical motorcycles - The demand for these vehicles is growing quickly because younger purchasers are more likely to purchase motorcycles. Additionally, low maintenance costs, affordability, and convenience are some of the important reasons that are expected to boost up demand for motorbikes. Furthermore, a shift in customer tastes toward lightweight, more accessible, fuel-efficient, and environmentally friendly motorcycles is the reason for the increase in motorcycle sales. As a result, rising consumer demand for practical and affordable motorcycles is anticipated to fuel market expansion. By 2023, the worldwide motorcycle industry would have grown from about USD 133 billion to almost USD 136 billion.

Challenges

- Safety concerns and the environment - The majority of powersport vehicles have extremely polluting engines and run on conventional fuel. Particularly heavyweight motorcycles use a lot of fuel and produce more emissions. Sales are declining as a result of regulations designed to lessen the negative effects of these cars and increased consumer demand for fuel-efficient automobiles. The high rate of rollover and accident occurrences while off-roading is linked to inadequate safety equipment. Therefore, the market growth is being restrained by heightened awareness of the negative effects these vehicles have on the environment and how children's careless use of them contributes to high mortality. All these factors are impeding the power sports market growth.

- Several connected to motorsports automobiles - The majority of power sports cars are powered by conventional gasoline and extremely polluting engines. Large two-wheeled vehicles in particular use a lot of fuel and produce a lot of pollution. Because falls and collisions involving power sports vehicles are so common, this vehicle lacks the necessary safety equipment. Numerous deaths have occurred as a result of growing awareness of the environmental effects of these vehicles and children's unrestrained use.

Power Sports Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 49.29 billion |

|

Forecast Year Market Size (2035) |

USD 89.11 billion |

|

Regional Scope |

|

Power Sports Market Segmentation:

Vehicle Type

All-terrain vehicles segment is set to hold more than 38% power sports market share by 2035. The segment growth can be because ATVs are popular among a variety of users, including recreational riders, outdoor enthusiasts, farmers, ranchers, and industrial workers. They are known for their adaptability and capacity to navigate a variety of terrains, including mud, snow, sand, and rough tracks.

Moreover, they can be used for trail riding, racing, hunting, and exploring off-road regions. When searching for outdoor leisure activities, many individuals and families are drawn to ATV riding because of its thrill and adventure. A record 168.1 million people participated in outdoor recreation in 2022, an increase of 2.3 percent.

Furthermore, ATVs are frequently used for utility, particularly in agricultural and rural environments. All-Terrain Vehicles (ATV) are very useful for utility applications because of their capacity to tow large loads and negotiate difficult terrain. The ATV sector is expanding as a result of the increase of adventure tourism and consumer demand for distinctive experiences.

End Use

Commercial vehicles segment in the power sports market is estimated to observe healthy growth through 2035. The primary factors driving demand for commercial vehicles include the global economy's recovery and increased disposable income, as well as an increase in travel and leisure time, off-road vehicle technology developments, and the growing use of off-road vehicles for both military and recreational purposes. The inclination toward adventure and leisure activities, as well as the proliferation of 4WD and AWD vehicles, are expected to fuel the expansion of the commercial off-road vehicle landscape.

The total number of sales of commercial vehicles rose from 7,16,566 to 9,62,468 units. In comparison to the prior year, sales of Light Commercial Vehicles climbed from 4,75,989 to 6,03,465 units, while Sales of Medium and Heavy Commercial Vehicles increased from 2,40,577 to 3,59,003 units in FY-2022–2023.

Our in-depth analysis of the power sports market includes the following segments:

|

Vehicle Type |

|

|

Model |

|

|

Propulsion |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Sports Market Regional Analysis:

North America Market Insights

North America region in power sports market is set to account for around 34% revenue share by 2035. The market growth in the region is due to increasing people disposable income that they can spend on leisure pursuits and power sports equipment like all-terrain vehicles (ATV), motorbikes, snowmobiles, and personal watercraft. Power sports cars draw enthusiasts who appreciate off-roading, water sports, and recreational riding because they provide thrilling and heart-pounding experiences. 103,650 Harley-Davidson bikes were sold in the North America in 2020.

State and federal governments in the United States will provide substantial support for power sports activities because of their substantial economic impact. RideNow is the biggest power sports dealer in United States, and RumbleOn Inc. has agreed to purchase it. The USD 5.4 billion transaction will combine RideNow's retail brand and broad reach with RumbleOn's technology.

European Market Insights

The European region will also encounter huge growth for the power sports market during the forecast period owing to the owing to the growth of recreational clubs and regional organizations that actively promote off-road & recreational leisure activities in this region. To gain a larger market share, a number of important companies are launching the newest technology products in the industry. The total amount of general government spending in the EU on sports and recreation in 2022 was USD 60.3 billion, or 0.8% of total government spending.

Germany hold significant hare because more people are engaging in off-road recreational activities. Approximately 17.6 million German-speaking individuals who were 14 years of age or older went backpacking in 2023.

Growing investement for motorized sports equipment such as ATVs, motorcycles, snowmobiles, and personal watercraft are propelling the industry in France. Motorcycle retail made up only 2.7% of this total revenue; the remaining 2.8% came from wholesale.

Continuous technological developments in power sports cars are propelling the United Kingdom market. A car manufacturer named Polaris presented their 2022 snowmobile portfolio, which includes 22 new models based on the rider-first Matryx platform. At sea level and at 10,000 feet above the 850 Patriot, the SmartBoost technology's combustion stability produces 10% and 50% greater power, respectively.

Power Sports Market Players:

- Polaris Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Toro Company

- Hero Electric

- Vmoto Limited

- Electrotherm Limited

- Jiangsu Xinri E-Vehicle Co.,Ltd.

- Energica Motor Company Inc.

- Piaggio & C. SpA

- Niu International

- Mahindra & Mahindra Ltd.

The power sports market is dominated by key market players who are gaining traction in the market by adopting several strategies including merger and acquisitions.

Recent Developments

- Toro Company has purchased the privately held Intimidator Group, which is based in Batesville, Arkansas. The Intimidator Group designs and manufactures the professional line of zero-turn mowers known as Spartan Mowers, which are renowned for their exceptional performance, toughness, and unique look. Sold through a well-established dealer network, Spartan Mowers is a well-known brand in the southern United States, drawing in customers with large estates and rural markets. Additionally, Intimidator Group creates an attractive range of capable, versatile side-by-side utility vehicles that perform magnificently even in the roughest terrain. This is the report from MarketResearchFuture.com on the Powersports Market.

- Polaris Inc. unveiled RideReady, the first on-demand digital service platform in the sector. By utilizing digital technology and solutions, this new RideReady digital strategy seeks to provide industry-leading capabilities that remove obstacles to fostering affinity, ownership, and loyalty among current clients. Through RideReady, Indian Motorcycle and power sports dealers and owners may quickly schedule online maintenance appointments.

- Report ID: 6057

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Sports Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.