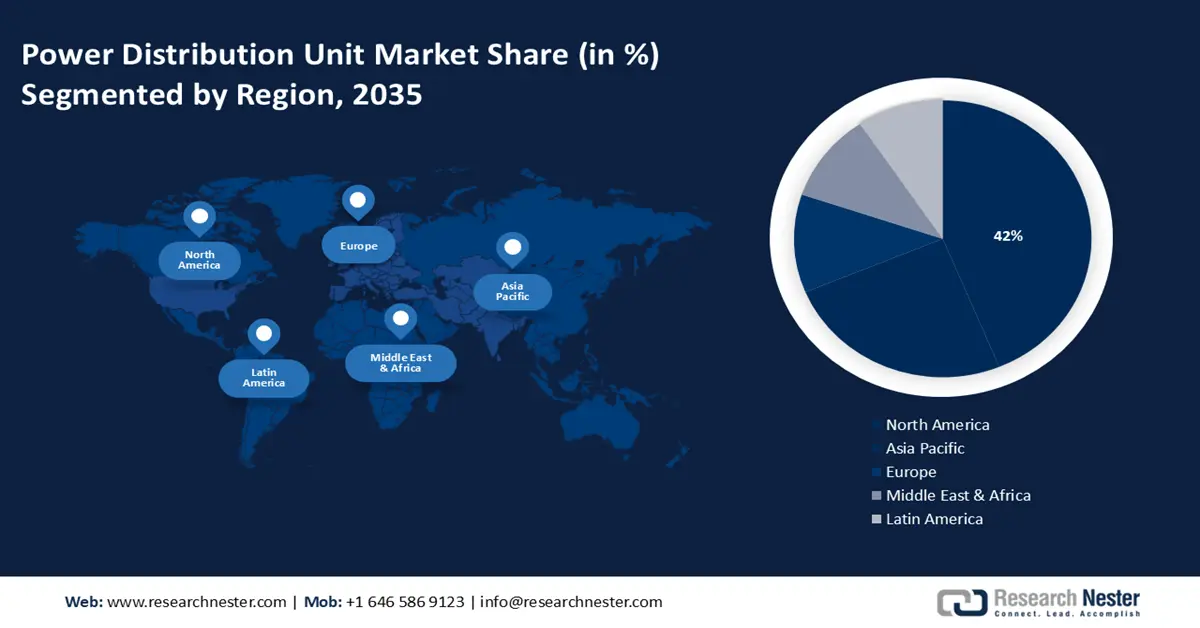

Power Distribution Unit Market Regional Analysis:

North America Market Insights

North America industry is anticipated to account for largest revenue share of 42% by 2035. This is because of the advanced technology infrastructure, rapid digitalization across industries, and growing demand for effective energy management for data centers. These factors are supplemented by rapidly growing cloud computing, IoT, and big data analytics that have fueled the need for reliable intelligent PDUs in North America.

The PDU market in the U.S. is likely to rise at a CAGR of 8.2% during the projected period. This growth reflects certain factors: the dynamism of the IT sector, expanding data centers, and a focus on energy-efficient power distribution systems. For example, in December 2023, Siemens introduced SIRIUS 3UGS line monitoring relays, incorporating innovation in grid monitoring technology. These advanced relays enable advanced quality monitoring and grid stability, thereby providing smoother system operations and extending the lifetime of key equipment. Such innovation further fuels demand for PDUs in the United States, powering smart infrastructure growth.

While several digital transformation initiatives are boosting the growth of Canada's power distribution unit market, the heavy investment in digital infrastructure and the bourgeoning tech ecosystem accompanying them accelerate demand for advanced power distribution. This tends to strengthen the country's position across the global digital economy. Schneider Electric Canada announced a similar development in December 2023. In partnership with Google, ASM, and HP, Schneider Electric increases access to renewable energy across the global semiconductor value chain through the Catalyze program. This is expected to help achieve the required energy for the tech sector in Canada and create a more sustainable digital future.

Asia Pacific Market Insights

The Asia Pacific power distribution unit market is likely to witness a rapid spike through the forecast period due to expanding IT infrastructure and booming e-commerce, which increases investments in data center facilities. Digitalization in this region has been steady, so the demand for effective power management solutions across industries has also increased rapidly with increasing cloud service adoption.

Considering its huge manufacturing capability and rapidly growing data center industry, China is one of the key revenue generators in the Asia Pacific power distribution unit [PDU] market. These aggressive plans for digital transformation and smart city development present significant opportunities for PDU manufacturers within this country. In a milestone move, Huawei Technologies launched its next-generation intelligent PDUs in September 2023, equipped with AI-powered energy optimization algorithms tailored to the dynamic requirements of China's hyperscale data centers.

India is turning into one of the lucrative PDU market, accredited to the Digital India initiative of the government and rapid growth in its IT and telecommunications sectors. Growing engagement in the integration of renewable energy and a reliable power distribution requirement in the rapidly growing data center power distribution unit market of the country drive PDU adoption. For example, in December 2023, Elcom International, India, launched a new manufacturing assembly of PDUs with enhanced technology and safety features. The products will be designed to tend toward international safety standards and provide reliable and advanced power distribution for a connected future.

Japan’s PDU market has been projected to occupy a prominent share during the forecast period. The country's emphasis on energy efficiency and novel power management solutions propels the industry growth. Demand for high-end PDUs is growing due to the advancement of Japan's sophisticated manufacturing sector and acceptance of Industry 4.0. Japanese Government has recently augmented its Green Innovation Fund, which reflects this commitment.

Early 2024 saw another top-up of approximately 2 trillion yen to the fund if the projects proposed were cutting greenhouse gases. It is an investment in driving the next generation—especially PDUs and smart grid technologies—cementing Japan's status as a pioneer in efficient and sustainable power distribution.