Power Distribution Unit Market Outlook:

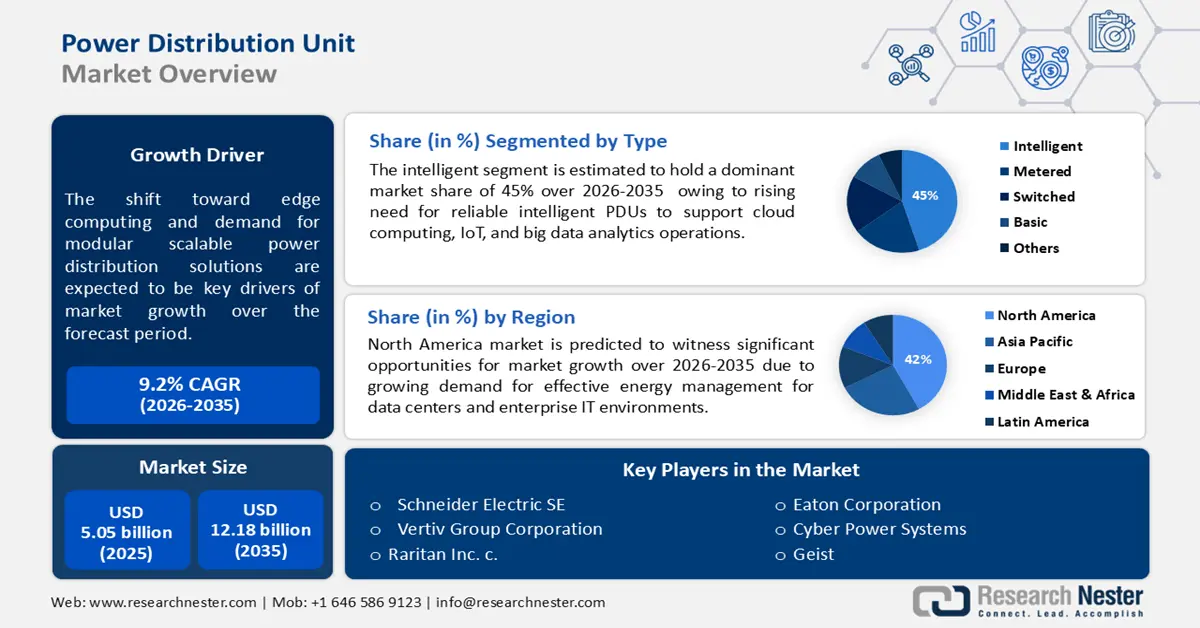

Power Distribution Unit Market size was over USD 5.05 billion in 2025 and is projected to reach USD 12.18 billion by 2035, witnessing around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power distribution unit is evaluated at USD 5.47 billion.

The surge is driven by the rapid expansion of data centers and the growing adoption of cloud computing services. Continuous growth reflects IT infrastructure’s increasing need for efficient power management solutions, including power distribution units (PDU). The shift toward edge computing and demand for modular scalable power distribution solutions are expected to drive the power distribution unit market forecast period. For example, Google Cloud announced its plans in 2022 to invest USD 9.5 billion in data centers and offices all over the U.S. to expand its cloud infrastructure and address rising demand while advancing sustainability efforts. More importantly, the adoption of intelligent PDUs is rising at a considerable rate due to the high focus on sustainability and energy conservation in data center operations.

Key Power Distribution Unit Market Insights Summary:

Regional Highlights:

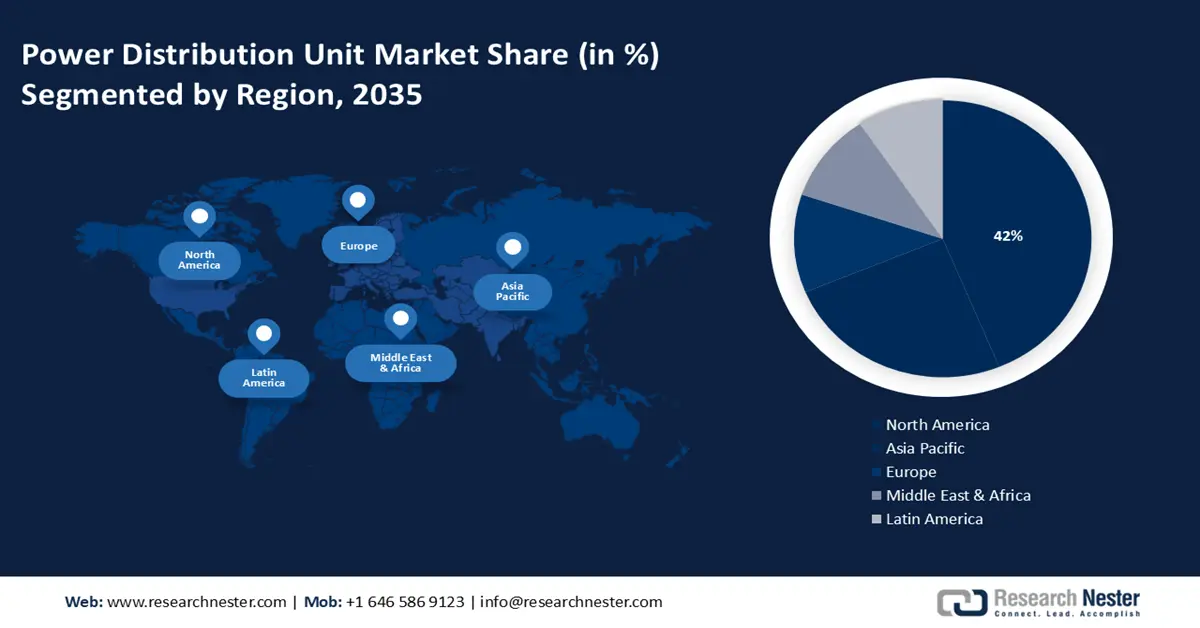

- The North America power distribution unit market achieves a 42% share by 2035, driven by advanced technology infrastructure, rapid digitalization, and growing demand for effective energy management for data centers.

- The Asia Pacific market grows rapidly with a strong CAGR during 2026-2035, driven by expanding IT infrastructure and booming e-commerce driving investments in data centers.

Segment Insights:

- The intelligent segment in the power distribution unit market is anticipated to grow significantly by 2035, fueled by demand for sophisticated power management solutions in data centers and enterprise IT.

- The triple-phase segment (power distribution unit market) segment in the power distribution unit market is expected to achieve a remarkable CAGR through 2035, influenced by increasing adoption of high-density computing and growing power needs of modern IT equipment.

Key Growth Trends:

- Growing acceptance of smart PDU solutions

- Growth of modular and scalable PDU designs

Major Challenges:

- Aging infrastructure strains PDU efficiency and reliability

- PDU performance is challenged by high current variations

Key Players: Schneider Electric SE, Eaton Corporation, Leviton Manufacturing Co., Inc., Cisco Systems Inc., Tripp Lite, Legrand SA, and Server Technology, Inc. are some leading companies.

Global Power Distribution Unit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.05 billion

- 2026 Market Size: USD 5.47 billion

- Projected Market Size: USD 12.18 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Singapore

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 17 September, 2025

Power Distribution Unit Market Growth Drivers and Challenges:

Growth Drivers

- Growing acceptance of smart PDU solutions - The adoption of smart PDUs is witnessing a spike due to the rising importance of energy efficiency in managing data center facilities. This transition to smart PDU solutions is due to the urgent need for monitoring and managing power distribution in data centers and other essential facilities. Due to the growing emphasis on energy conservation and operational excellence in organizations, this trend is expected to continue to rise.

An example of this movement is Schneider Electric’s significant enhancement of its EcoStruxure Resource Advisor, which it launched in July 2024. Such innovations highlight the industry’s focus on creating complex solutions that not only enhance the management of power distribution but also serve the greater purpose of sustainability, laying down the best practices for energy management. - Growth of modular and scalable PDU designs - The demand for modular and scalable designs has increased the need for flexibility and adaptability in power distribution. There has been an increasing call for PDUs to scale up or down with changing data centers and other mission-critical infrastructures. In May 2023, Legrand announced the rollout of smart rack power distribution units designed to meet today's dynamic data center requirements.

Modularity and scalability are some of the important design features that enable companies to be easily absorbed by existing infrastructures, making data centers adjust swiftly to the power needs. - Rapidly growing importance of energy efficiency and sustainability- The increasing significance of environmental sustainability and the necessity to cut energy consumption is driving a trend towards energy-efficient, sustainable PDUs. As companies strive to reduce their carbon footprint, there is an increasing demand for PDUs that are designed with the principle of energy efficiency in mind.

For example, Eaton, a leading global power management company, set ambitious 2023 sustainability targets, including cutting GHG emissions by half and achieving zero-waste-to-landfill certification across all manufacturing sites by 2030. This reflects that commitment towards reducing climate change effects through efficient utilization of electricity in firms has gained more prominence now than before.

Challenges

- Aging infrastructure strains PDU efficiency and reliability- Power distribution units (PDUs) efficiency and reliability can be negatively impacted by old infrastructural systems. To address this issue, governments are focused on spending extensive resources to improve power infrastructure so that it works better and becomes more reliable.

For example, in November 2023, the Biden-Harris Administration announced that it would direct over USD 3.9 billion into upgrading and expanding the U.S. power network through the Grid Resilience and Innovation Partnerships Program. The Bipartisan Infrastructure Law funded this program under the leadership of the Grid Deployment Office intending to improve grid resilience and flexibility against extreme weather events such as hurricanes and climate change impacts. This investment emphasizes the need to upgrade infrastructures, driving the demand for modern PDUs. - PDU performance is challenged by high current variations- High current variations and abnormal voltages pose significant challenges to PDU manufacturers as they limit the ability to effectively manage power supply. Such fluctuations may destroy sensitive equipment while reducing the overall efficiency of power distributor systems. To address this, companies are investing in new technologies to enhance the reliability and performance of PDUs for various energy loads across diverse applications. For instance, Panduit launched its Power Distribution Units (PDUs) in February 2024. Innovations like ES2P PDU reflect the growing demand for energy-efficient solutions amid increasing environmental sustainability concerns.

Power Distribution Unit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 5.05 billion |

|

Forecast Year Market Size (2035) |

USD 12.18 billion |

|

Regional Scope |

|

Power Distribution Unit Market Segmentation:

Type Segment Analysis

Intelligent segment is anticipated to capture power distribution unit market share of over 45.0% by 2035 and expand at a rapid CAGR by the end of 2035. The increase in demand for sophisticated power management solutions in data centers and enterprise IT environments is fueling this growth. Several advantages are associated with intelligent PDUs, including real-time power monitoring, remote management capabilities, and integration with data center infrastructure management systems (DCIMs). Consequently, these devices offer detailed insights into how energy usage is distributed so that companies can optimize it and enhance operational efficacy while minimizing costs.

In June 2024, Vertiv and Ballard Power Systems announced a strategic technology partnership focused on developing fuel cell backup power solutions for data centers and critical infrastructure. The joint venture aims to create scalable solutions ranging from 200kW to multiple megawatts. This partnership is a testament to the industry’s commitment to developing intelligent PDUs that can cater to the intricate power distribution needs of next-gen IT infrastructure.

Power Phase Segment Analysis

The triple-phase segment of the power distribution unit market is anticipated to experience remarkable growth during the forecast period. This development is associated with the increasing adoption of high-density computing environments and growing power requirements of modern IT equipment. Triple-phase PDUs have several advantages over single-phase types, such as higher power capacity, improved load balancing, and more efficient power distribution techniques.

Rapidly increasing demand for accurate power distribution in data centers has led to the adoption of triple-phase PDUs. To underline this trend, Eaton acquired Royal Power Solutions in January 2022. Through this move, Eaton effectively bolstered its eMobility business unit by incorporating highly precise electrical connectivity components into its portfolio. For Eaton, Royal Power Solutions brought manufacturing prowess, more than four hundred fifty workers, and a strong market presence; enabling the company to expand its footprint in data center space further.

Application Segment Analysis

The IT & telecom segment is estimated to lead the power distribution unit market due to the increasing infrastructural and commercial projects in developing economies. This has been observed across various industries including data centers, IT & telecoms, and healthcare. The expansion of cloud computing services, digitization of companies as well as the proliferation of internet-of-things (IoT) devices are among the factors driving demand for strong power distribution methodologies within the commercial setting. Furthermore, modern PDUs with intelligent power management capabilities are becoming popular due to growing concern about energy efficiency and sustainability through optimized facilities operations.

Our in-depth analysis of the PDU market includes the following segments:

|

Type |

|

|

Power Phase |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Distribution Unit Market Regional Analysis:

North America Market Insights

North America industry is anticipated to account for largest revenue share of 42% by 2035. This is because of the advanced technology infrastructure, rapid digitalization across industries, and growing demand for effective energy management for data centers. These factors are supplemented by rapidly growing cloud computing, IoT, and big data analytics that have fueled the need for reliable intelligent PDUs in North America.

The PDU market in the U.S. is likely to rise at a CAGR of 8.2% during the projected period. This growth reflects certain factors: the dynamism of the IT sector, expanding data centers, and a focus on energy-efficient power distribution systems. For example, in December 2023, Siemens introduced SIRIUS 3UGS line monitoring relays, incorporating innovation in grid monitoring technology. These advanced relays enable advanced quality monitoring and grid stability, thereby providing smoother system operations and extending the lifetime of key equipment. Such innovation further fuels demand for PDUs in the United States, powering smart infrastructure growth.

While several digital transformation initiatives are boosting the growth of Canada's power distribution unit market, the heavy investment in digital infrastructure and the bourgeoning tech ecosystem accompanying them accelerate demand for advanced power distribution. This tends to strengthen the country's position across the global digital economy. Schneider Electric Canada announced a similar development in December 2023. In partnership with Google, ASM, and HP, Schneider Electric increases access to renewable energy across the global semiconductor value chain through the Catalyze program. This is expected to help achieve the required energy for the tech sector in Canada and create a more sustainable digital future.

Asia Pacific Market Insights

The Asia Pacific power distribution unit market is likely to witness a rapid spike through the forecast period due to expanding IT infrastructure and booming e-commerce, which increases investments in data center facilities. Digitalization in this region has been steady, so the demand for effective power management solutions across industries has also increased rapidly with increasing cloud service adoption.

Considering its huge manufacturing capability and rapidly growing data center industry, China is one of the key revenue generators in the Asia Pacific power distribution unit [PDU] market. These aggressive plans for digital transformation and smart city development present significant opportunities for PDU manufacturers within this country. In a milestone move, Huawei Technologies launched its next-generation intelligent PDUs in September 2023, equipped with AI-powered energy optimization algorithms tailored to the dynamic requirements of China's hyperscale data centers.

India is turning into one of the lucrative PDU market, accredited to the Digital India initiative of the government and rapid growth in its IT and telecommunications sectors. Growing engagement in the integration of renewable energy and a reliable power distribution requirement in the rapidly growing data center power distribution unit market of the country drive PDU adoption. For example, in December 2023, Elcom International, India, launched a new manufacturing assembly of PDUs with enhanced technology and safety features. The products will be designed to tend toward international safety standards and provide reliable and advanced power distribution for a connected future.

Japan’s PDU market has been projected to occupy a prominent share during the forecast period. The country's emphasis on energy efficiency and novel power management solutions propels the industry growth. Demand for high-end PDUs is growing due to the advancement of Japan's sophisticated manufacturing sector and acceptance of Industry 4.0. Japanese Government has recently augmented its Green Innovation Fund, which reflects this commitment.

Early 2024 saw another top-up of approximately 2 trillion yen to the fund if the projects proposed were cutting greenhouse gases. It is an investment in driving the next generation—especially PDUs and smart grid technologies—cementing Japan's status as a pioneer in efficient and sustainable power distribution.

Power Distribution Unit Market Players:

- Schneider Electric SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton Corporation

- Vertiv Group Corporation

- Raritan Inc.

- Cyber Power Systems Inc.

- Geist

- Leviton Manufacturing Co., Inc.

- Cisco Systems Inc.

- Tripp Lite

- Legrand SA

- Server Technology, Inc.

The global power distribution unit [PDU] market is highly competitive, with established giants competing with innovative new entrants. Companies like Eaton Corporation, Schneider Electric, Vertiv Group Corp., and ABB Ltd. are dominating the industry because of their vast portfolios of products, solid R&D capabilities, and presence across the globe. Such industries focus on constant upgrades in PDU technology; further, they take initiatives to develop intelligent, energy-efficient solutions for data centers and IT infrastructure.

Emerging companies such as Legrand, Tripp Lite (now part of Eaton), and CyberPower Systems are building momentum via their specialized offerings and focus on particular power distribution unit [PDU] market segments. Regional players within Asia-Pacific are becoming more aggressive, offering local production and solutions tailored toward capturing power distribution unit market share. With growing interest in edge computing and modular data centers, more PDU manufacturers are now partnering with cloud service providers for integrated power management solutions. This is an innovative field for AI-powered energy optimization, predictive maintenance, and advanced features of cybersecurity in PDUs.

Recent Developments

- In June 2023, Siemens launched SICAM 8, a highly scalable power automation platform. SICAM 8, through promoting renewable energy integration and fast-tracking substation extensions, enabled Siemens to become a key player in the global transition towards green electricity.

- In January 2023, Leviton augmented residential energy management by releasing the advanced Whole Home Energy Monitor and 2nd Gen Smart Circuit Breakers. It is a complete solution that provides homeowners with valuable insights into energy usage and production generated by different sources allowing them to make better decisions on optimizing energy consumption.

- Report ID: 6304

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Distribution Unit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.