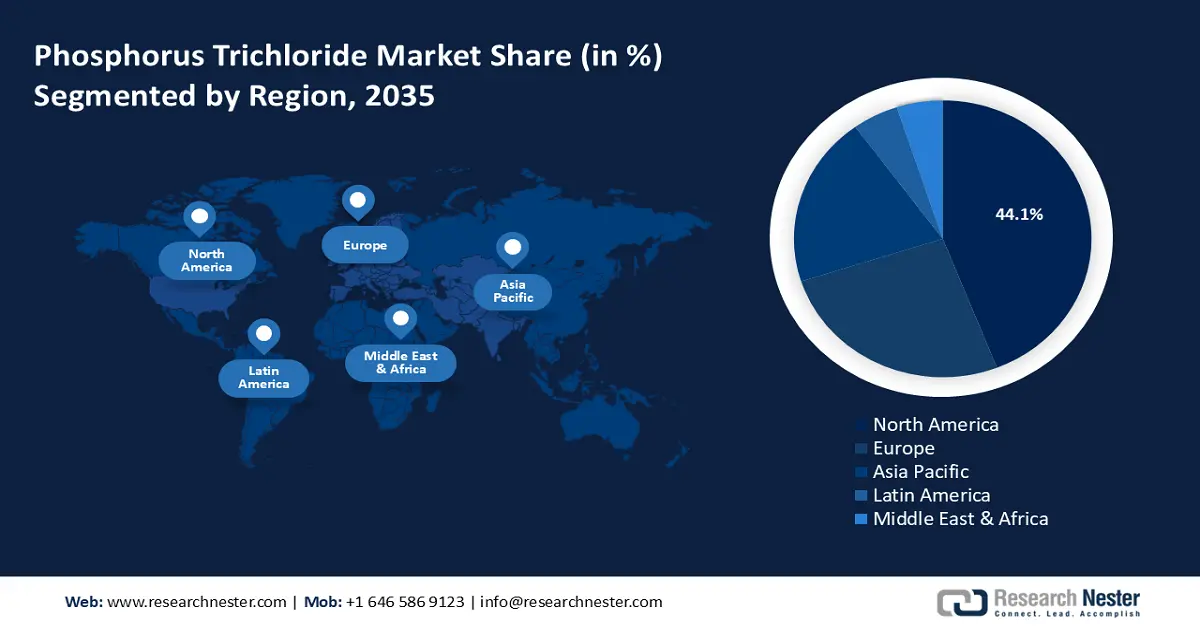

Phosphorus Trichloride Market Regional Analysis:

North America Market Forecast

North America phosphorus trichloride market is expected to account for revenue share of more than 44.1% by the end of 2035. The well-established agrochemical industry in the region drives demand for phosphorus trichloride as an intermediate in the production of herbicides and pesticides. The regional market benefits from the position of the U.S. as a major player in the import and export of phosphorus trichloride. For instance, the U.N. Comtrade Data estimated the U.S. as the third-largest importer and the fourth-largest exporter of the compound in global trade data compiled from 2017 to 2021.

The North America phosphorus trichloride market is dominated by the U.S. owing to decreasing energy prices that reduce the production expenses of manufacturers. For instance, in April 2023, the U.S. Bureau of Labor Statistics reported that energy prices decreased by 6.4% from March 2022 to March 2023, creating opportunities to scale up phosphorus trichloride production. Reduced production costs lead to lower selling prices, making the compound more affordable for downstream industries. Additionally, the U.S. has established itself as a significant player in the global supply chain of phosphorus trichloride leading to emerging opportunities for investments in the domestic market.

Furthermore, the increase in herbicide-resistant crops boosts the application of herbicides in the thriving agricultural sector in the country, creating potential opportunities to scale up phosphorus trichloride production and increase profit margins. For instance, the U.S. Department of Agriculture reported that herbicide-tolerant (HT) soybean acreage reached its highest adoption of 96% and HT cotton acreage was at 93% adoption in 2024. The trends are beneficial for an increase in the use of glyphosate-based herbicides which in turn assists growth of the phosphorus trichloride market in the U.S.

Canada is expanding its revenue share in the North America phosphorus trichloride market due to its robust agricultural sector. The domestic market is susceptible to supply chain disruptions owing to reliance on imports for raw materials such as elemental phosphorus, but government-backed plans encourage businesses to invest to increase domestic manufacturing capabilities. For instance, Canada provides incentives such as the Accelerated Investment Incentive that allows businesses to write off a large share of manufacturing and processing equipment purchases that can assist chemical companies seeking to expand to the market.

Furthermore, the growing chlorine exports from Canada hold the potential to boost phosphorus trichloride production in the country. For instance, the Observatory of Economic Complexity estimated Canada to be the largest exporter of Chlorine in 2022 with exports worth USD 128 million. The increased chlorine production can lead to a stable and reliable supply line, reducing production costs for phosphorus trichloride.

Europe Market Forecast

The Europe phosphorus trichloride market is set to register the fastest growth during the forecast period. A key driver of the market in Europe is increasing production of phosphorus trichloride and rising demand from various end-use industries. The push to develop a circular economy for lubricants in Europe can assist the sector’s growth.

For instance, in June 2024, TotalEnergies announces the acquisition of Tecoil in a bid to develop the circular economy for lubricants in Europe and accelerate the use of Re-Refined Base Oils (RRBOs) in the production of high-end lubricants. Phosphorus trichloride is used as an intermediate in the production of additives in lubricants, and businesses are expanding lubricant portfolios in Europe through acquisitions creating opportunities for phosphorus trichloride suppliers.

Germany is a dominant sector in the phosphorus trichloride market of Europe. The increasing production capabilities in Germany boost the market’s growth. Italmatch Deutschland GmbH leads the production in the country providing phosphorus-based solutions to various end-use industries ranging from agriculture to pharmaceuticals.

Furthermore, the sector can benefit from an increase in demand for lubricant additives. For instance, in September 2024, BRB Lube Oil Additives & Chemicals launched Petrolad 133LS (limited slip) globally at the lubricant expo organized in Germany indicating the expansion of the gear additive product portfolio. Numerous gear additives rely on organophosphorus compounds, creating profitable opportunities to scale up the production of phosphorus trichloride with a looming expansion of end-use industries.

France is an emerging sector in the phosphorus trichloride market. Rising demand for specialty chemicals creates opportunities for the sector’s growth in the country. The use of glyphosate-based herbicides is debated in the country but the extensive use drives demand for phosphorus trichloride in the production process. Furthermore, advancements in sustainable flame retardants are expected to increase the application of the PC13 compound as an intermediate in the production of flame-retardant additives.