Phosphorus Trichloride Market Outlook:

Phosphorus Trichloride Market size was valued at USD 2.12 billion in 2025 and is likely to cross USD 3.14 billion by 2035, expanding at more than 4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of phosphorus trichloride is assessed at USD 2.2 billion.

A major driver of the phosphorus trichloride market is the compound’s position as a key intermediate in the production of herbicides and organophosphorus pesticides. For instance, in October 2024, the U.S. Department of Agriculture reported that the quality of modern pesticides, including herbicides, has improved and estimated an increase in pesticide use over time owing to a relative fall in its prices. With a surge in the global population leading to rising requirements for food production, advancements in phosphorus-based pesticides are poised to assist the growth of the sector.

In addition to its expanding role in agrochemicals, phosphorus trichloride is positioned as a critical component in the production of flame retardants. For instance, in October 2022, research published in Progress in Organic Coatings analyzed the recent developments in the preparation of phosphorus-based flame-retardant compounds and estimated that the majority of the phosphorus-based treatments were developed for cotton in protective textiles. Additionally, the increasing need for safer and more sustainable materials has solidified the compound’s position in end use sectors such as agrochemicals, construction, automotive, electronics, etc.

An indication of the profitability of the phosphorus trichloride sector is the expanding revenue shares of key market players. For instance, in October 2024, Merck announced the FY24 third-quarter results highlighting worldwide sales worth USD 16.7 billion and a 4% growth for the third quarter of FY23. The growth underscores the sustained market expansion within the phosphorus trichloride industry and strengthens the global supply chain, with Merck being one of the major suppliers of the compound.

Key Phosphorus Trichloride Market Insights Summary:

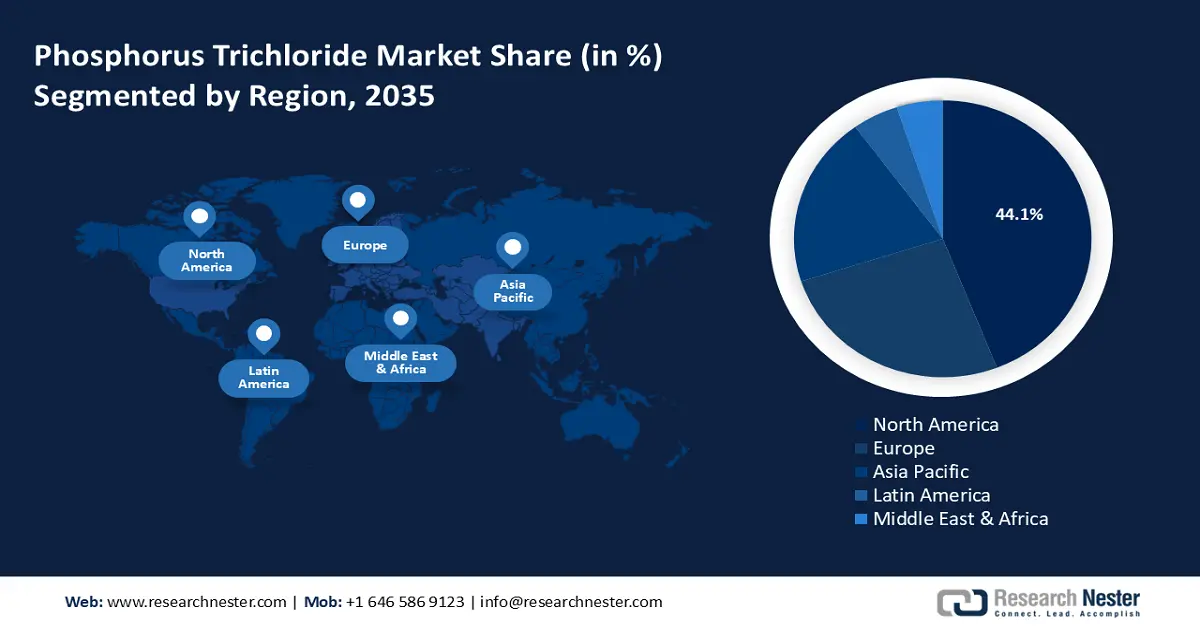

Regional Highlights:

- North America dominates the Phosphorus Trichloride Market with a 44.1% share, fueled by the well-established agrochemical industry and the U.S.'s position as a major importer and exporter of phosphorus trichloride, ensuring strong growth by 2035.

- Europe’s phosphorus trichloride market is projected to grow rapidly by 2035, driven by increasing production of phosphorus trichloride and rising demand from various end-use industries, especially lubricants.

Segment Insights:

- The Agrochemicals segment is expected to hold a 46.03% market share by 2035, fueled by increasing demand for organophosphorus pesticides and herbicides.

- Chemical Intermediates Phosphorus Trichloride segment is projected to hold a significant share by 2035, driven by rising demand for versatile intermediates in high-performance materials and polymers.

Key Growth Trends:

- Expansion of the pharmaceutical sector

- Growing industrial applications

Major Challenges:

- Stringent environmental and safety regulations

- Competitions from substitute chemicals

- Key Players: Lanxess, BASF Corporation, Solvay, Merck, ICL, Oakwood Products, Inc., Monsanto Company, Guangzhou Zoron Chemical Technology Co, Italmatch Chemicals Group, Akzo Nobel N.V.

Global Phosphorus Trichloride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.12 billion

- 2026 Market Size: USD 2.2 billion

- Projected Market Size: USD 3.14 billion by 2035

- Growth Forecasts: 4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Phosphorus Trichloride Market Growth Drivers and Challenges:

Growth Drivers

-

Expansion of the pharmaceutical sector: The versatility of phosphorus trichloride (PCI3) in pharmaceutical synthesis has opened new avenues for market growth by enabling use in the development of life-saving drugs. Antimalarial, antibiotics, and anti-inflammatory drugs use phosphorus trichloride in the production process as an intermediate.

With increasing investments in R&D and expansion of the global pharmaceutical industry, phosphorus trichloride’s application in creating active pharmaceutical ingredients (API) is expected to experience growth. The increase in revenues of key market players supplying pharmaceutical-grade phosphorus trichloride is poised to benefit the sector’s growth by reinforcing the supply chains owing to heightened production capabilities. For instance, Gateway Distriparks Limited, a key supplier of pharmaceutical-grade phosphorus trichloride, announced their annual reports for 2023-2024, indicating consolidated operational revenue worth USD 1.89 billion. As a leading logistics company, the expansion of Distriparks annual revenue share stands to benefit the efficient transportation of phosphorus trichloride. -

Growing industrial applications: The phosphorus trichloride market is set to benefit from the extensive usage of the compound in the production of specialty chemicals such as stabilizers for plasticizers and additives for lubricants. The expanding end use of specialty chemicals in industries such as automotive, construction, and electronics is a significant driver of the sector’s growth. The demand for phosphorus trichloride as a raw material is expected to grow as industries seek high-performance materials.

Additionally, increasing the production of plasticizers is beneficial for the phosphorus trichloride market. For instance, in October 2024, Evonik Oxeno announced the expansion of production capabilities for the INA-based plasticizers. The recent development has the potential to boost demand for organophosphorus compounds, assisting the potential increase in the supply of phosphorus trichloride. -

Advancements in chemical manufacturing: Advancements in manufacturing processes and technology are driving the production of phosphorus trichloride. Advancements in flow synthesis and reaction engineering allow for a more controlled, and scalable production process. For instance, in June 2024, research published in Chemical Communications indicated that continuous flow synthesis has emerged as a promising alternative to overcome limitations such as long reaction times, poor reproducibility, and limited scalability.

Additionally, improvements in sustainability protocols of phosphorus trichloride production plants can lead to increased market trust. In July 2024, the Science Based Target Initiative (SBTi) approved Italmatch’s emission reduction targets. Italmatch Deutschland GmbH produces phosphorus trichloride and has a vast portfolio of innovative phosphorus-based solutions, and adhering to emission guidelines is poised to open opportunities to tap into emerging phosphorus trichloride markets that prioritize sustainability.

Challenges

-

Stringent environmental and safety regulations: Phosphorus trichloride is a highly reactive and toxic chemical, requiring efficient safety protocols in production, and transport. Despite being a commonly traded chemical, phosphorus trichloride is subject to international controls such as Schedule 3 of the Chemical Weapons Convention (CWC). The risks associated with production can deter chemical manufacturing companies from producing large batches of phosphorus trichloride.

-

Competitions from substitute chemicals: New research seeking to synthesize organophosphorus compounds to advance the safety and sustainability of chemical processes can prove to be a challenge to the commercial applications of phosphorus trichloride. Manufacturers constantly seek cost-effective applications to decrease operational costs, and the advent of safer chemistry that will decrease energy consumption and minimize waste can hinder the phosphorus trichloride market’s growth.

Phosphorus Trichloride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4% |

|

Base Year Market Size (2025) |

USD 2.12 billion |

|

Forecast Year Market Size (2035) |

USD 3.14 billion |

|

Regional Scope |

|

Phosphorus Trichloride Market Segmentation:

Application (Agrochemicals, Chemical Intermediates, Gasoline Additives, Plasticizers, Pharmaceuticals, Others)

Agrochemicals segment is likely to dominate phosphorus trichloride market share of over 46.03% by 2035. A key driver of the segment is the increasing application of phosphorus trichloride in the agrochemicals industry as an intermediate in the production of organophosphorus pesticides and herbicides.

The increasing demand for effective crop protection solutions drives demand for pesticides. Additionally, the rise in global food demand is positioned to drive demand for pesticide production to be used in precision farming practices. For instance, as per a September 2023 report by the U.S. Department of Agriculture indicated that the production of world crop calories increased by 47% from 2011 to 2050. The increased demand can benefit the application of phosphorus trichloride in agrochemicals, as a key intermediate in the synthesis of various organophosphorus compounds.

The chemical intermediates segment of the phosphorus trichloride market is positioned to hold a significant revenue share during the forecast period. The segment’s growth is due to the rising demand for versatile intermediates that support advancements in polymers, and high-performance materials. The applications span from producing plasticizers and solvents to manufacturing surfactants and specialty chemicals.

Additionally, the rising demand for flexible packaging is poised to drive demand for an increase in the production of plasticizers, which in turn boosts demand for phosphorus trichloride as a chemical intermediate. For instance, in December 2024, Dow completed a USD 150 million sale of flexible packaging adhesives business to Arkema. The market developments can lead to an increase in demand for raw materials and intermediates, including phosphorus trichloride-based compounds.

Gasoline additives are an emerging segment of the phosphorus trichloride market. Gasoline additives serve as a precursor in manufacturing additives that improve combustion efficiency expanding the scope of application. Additionally, advancements in additive formulations can continue to create steady opportunities for phosphorus trichloride application. Companies are investing in the fuel additives segment and the increasing production is expected to drive demand for phosphorus trichloride as an intermediate for synthesis of antioxidants that can improve gasoline performance.

For instance, in May 2024, Braskem expanded its fuel additive business portfolio to serve the premium automotive fuels phosphorus trichloride market worldwide. The expansion holds the potential to trigger demand for raw materials and intermediates to support its growth benefiting the phosphorus trichloride sector.

Our in-depth analysis of the global phosphorus trichloride market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phosphorus Trichloride Market Regional Analysis:

North America Market Forecast

North America phosphorus trichloride market is expected to account for revenue share of more than 44.1% by the end of 2035. The well-established agrochemical industry in the region drives demand for phosphorus trichloride as an intermediate in the production of herbicides and pesticides. The regional market benefits from the position of the U.S. as a major player in the import and export of phosphorus trichloride. For instance, the U.N. Comtrade Data estimated the U.S. as the third-largest importer and the fourth-largest exporter of the compound in global trade data compiled from 2017 to 2021.

The North America phosphorus trichloride market is dominated by the U.S. owing to decreasing energy prices that reduce the production expenses of manufacturers. For instance, in April 2023, the U.S. Bureau of Labor Statistics reported that energy prices decreased by 6.4% from March 2022 to March 2023, creating opportunities to scale up phosphorus trichloride production. Reduced production costs lead to lower selling prices, making the compound more affordable for downstream industries. Additionally, the U.S. has established itself as a significant player in the global supply chain of phosphorus trichloride leading to emerging opportunities for investments in the domestic market.

Furthermore, the increase in herbicide-resistant crops boosts the application of herbicides in the thriving agricultural sector in the country, creating potential opportunities to scale up phosphorus trichloride production and increase profit margins. For instance, the U.S. Department of Agriculture reported that herbicide-tolerant (HT) soybean acreage reached its highest adoption of 96% and HT cotton acreage was at 93% adoption in 2024. The trends are beneficial for an increase in the use of glyphosate-based herbicides which in turn assists growth of the phosphorus trichloride market in the U.S.

Canada is expanding its revenue share in the North America phosphorus trichloride market due to its robust agricultural sector. The domestic market is susceptible to supply chain disruptions owing to reliance on imports for raw materials such as elemental phosphorus, but government-backed plans encourage businesses to invest to increase domestic manufacturing capabilities. For instance, Canada provides incentives such as the Accelerated Investment Incentive that allows businesses to write off a large share of manufacturing and processing equipment purchases that can assist chemical companies seeking to expand to the market.

Furthermore, the growing chlorine exports from Canada hold the potential to boost phosphorus trichloride production in the country. For instance, the Observatory of Economic Complexity estimated Canada to be the largest exporter of Chlorine in 2022 with exports worth USD 128 million. The increased chlorine production can lead to a stable and reliable supply line, reducing production costs for phosphorus trichloride.

Europe Market Forecast

The Europe phosphorus trichloride market is set to register the fastest growth during the forecast period. A key driver of the market in Europe is increasing production of phosphorus trichloride and rising demand from various end-use industries. The push to develop a circular economy for lubricants in Europe can assist the sector’s growth.

For instance, in June 2024, TotalEnergies announces the acquisition of Tecoil in a bid to develop the circular economy for lubricants in Europe and accelerate the use of Re-Refined Base Oils (RRBOs) in the production of high-end lubricants. Phosphorus trichloride is used as an intermediate in the production of additives in lubricants, and businesses are expanding lubricant portfolios in Europe through acquisitions creating opportunities for phosphorus trichloride suppliers.

Germany is a dominant sector in the phosphorus trichloride market of Europe. The increasing production capabilities in Germany boost the market’s growth. Italmatch Deutschland GmbH leads the production in the country providing phosphorus-based solutions to various end-use industries ranging from agriculture to pharmaceuticals.

Furthermore, the sector can benefit from an increase in demand for lubricant additives. For instance, in September 2024, BRB Lube Oil Additives & Chemicals launched Petrolad 133LS (limited slip) globally at the lubricant expo organized in Germany indicating the expansion of the gear additive product portfolio. Numerous gear additives rely on organophosphorus compounds, creating profitable opportunities to scale up the production of phosphorus trichloride with a looming expansion of end-use industries.

France is an emerging sector in the phosphorus trichloride market. Rising demand for specialty chemicals creates opportunities for the sector’s growth in the country. The use of glyphosate-based herbicides is debated in the country but the extensive use drives demand for phosphorus trichloride in the production process. Furthermore, advancements in sustainable flame retardants are expected to increase the application of the PC13 compound as an intermediate in the production of flame-retardant additives.

Key Phosphorus Trichloride Market Players:

- Lanxess

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF Corporation

- Solvay

- Merck

- ICL

- Oakwood Products, Inc.

- Monsanto Company

- Guangzhou Zoron Chemical Technology Co

- Italmatch Chemicals Group

- Akzo Nobel N.V

The phosphorus trichloride market is poised to exhibit steady growth during the forecast period. Key market players are leveraging strategic expansions and strengthening supply chains to mitigate disruptions caused by geopolitical tensions. Furthermore, companies are investing in expanding distribution networks and building sustainable manufacturing processes amidst rising scrutiny for eco-friendly practices.

Here are some key players in the phosphorus trichloride market:

Recent Developments

- In September 2024, ICL expanded further into the supply chain of North America by partnering with Orbia Fluor and Energy Materials. The Memorandum of Understanding (MoU) signed between the two companies established a framework for ICL’s Industrial Products division to supply phosphorus trichloride to Orbia Flour & Energy Materials to utilize in the production of lithium hexafluorophosphate.

- In January 2024, Esim Chemicals announced the expansion of its technology portfolio with phosphorus trichloride reactions. Esim Chemicals has enhanced its portfolio in the Linz Chemical Park with a state-of-the-art facility for synthesizing sensitive phosphorus compounds, and the production unit enables the conversion of phosphorus trichloride with various reaction partners to cater to rising market demand.

- Report ID: 6824

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phosphorus Trichloride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.