Perfusion Radiology Market Outlook:

Perfusion Radiology Market size was over USD 2.69 billion in 2025 and is anticipated to cross USD 4.02 billion by 2035, witnessing more than 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of perfusion radiology is assessed at USD 2.79 billion.

The growing prevalence of cardiovascular and neurological diseases is igniting adoption in the market. According to an NLM article, published in December 2023, the global age-standardized DALY of ischemic heart disease accounted to be at 2,275.9 per 100,000. It was further followed by intracerebral hemorrhage and ischemic stroke mortality rates. Thus, the incidence rate and impact of life-threatening conditions such as stroke, heart disease, and tumors are concerning global public health organizations, pushing them to invest in better diagnostic solutions. Such enforcement of radiological innovations in healthcare facilities due to enhanced patient outcomes has prepared a well-established marketplace for this sector.

The suitable trading environment has further inflated the demand for diagnostic instruments, contributing to the growth of the perfusion radiology market. The enlarged dimension of this industry is subsequently stimulating profitable business in this sector. According to a report published by the Global Electronics Council, in June 2022, the global medical imaging equipment industry reached USD 43 billion in 2021. It is further expected to grow with a CAGR of 5%, gaining USD 52.2 billion by 2025, where radiography captured 49% of the total sales in 2021. This is further inspiring global leaders to participate in this sector and expand their product portfolio by extending applications over various medical needs.

Key Perfusion Radiology Market Insights Summary:

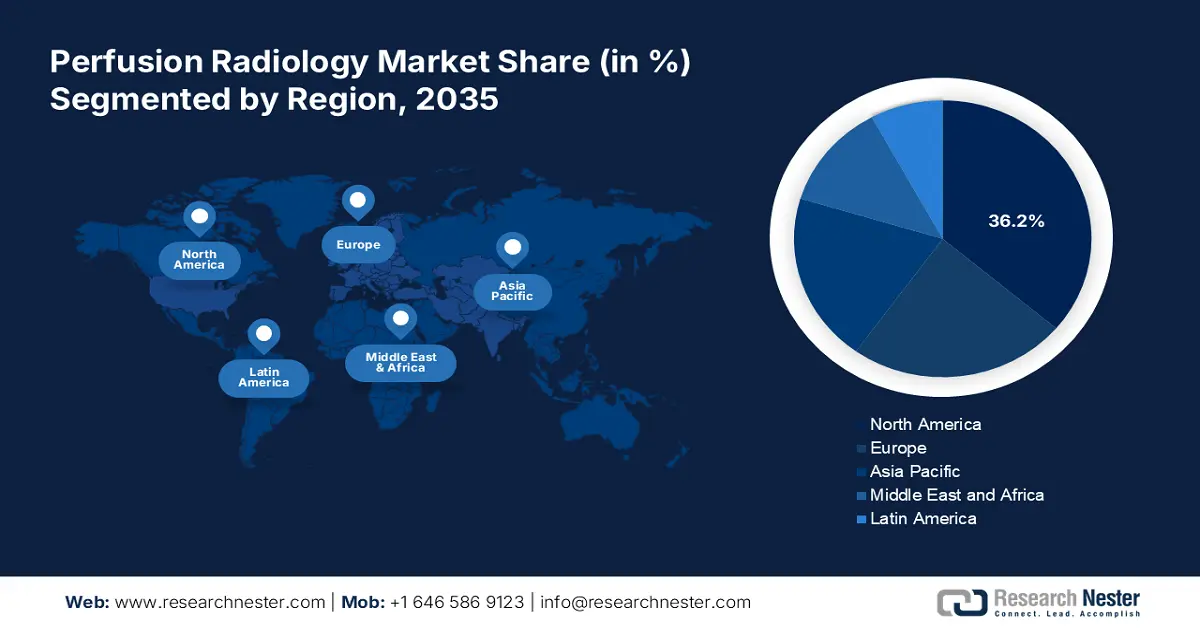

Regional Highlights:

- North America holds a 36.2% share in the Perfusion Radiology Market, driven by its developed and adaptive healthcare industry, positioning it for significant growth through 2035.

Segment Insights:

- The Cardiovascular Imaging segment is set to grow significantly through 2035, driven by increased use of perfusion imaging for non-invasive cardiac disease diagnosis.

Key Growth Trends:

- Advancements in diagnostic technologies

- Better patient outcomes due to infusion

Major Challenges:

- Expensive treatment and equipment

- Lack of skilled operators

- Key Players: GE Healthcare, Advantis Medical Imaging, Koninklijke Philips N.V., Siemens Healthineers AG, Lantheus Medical Imaging, Inc., Neusoft Corporation, Perimed, Bracco Diagnostic, Inc., .

Global Perfusion Radiology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.69 billion

- 2026 Market Size: USD 2.79 billion

- Projected Market Size: USD 4.02 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Perfusion Radiology Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in diagnostic technologies: The introduction of supportive analytic technologies to cope with the needs of modern healthcare has helped the perfusion radiology market to stretch its territories. Many medical data management service providers are unveiling user-friendly interfaces to increase interpretation among healthcare institutions, encouraging them to invest more in this sector. For instance, in December 2024, Cercare Medical announced its plans to commercialize its FDA-approved CT perfusion imaging software, Cercare Medical Neurosuite (CMN). This package can enable clinicians to gain improved visualization and analytics of perfusion images, establishing enhanced stroke care.

-

Better patient outcomes due to infusion: Widespread endorsement of precision and accuracy in medical proceedings have heavily inspired healthcare institutions to invest in the perfusion radiology market. The complementing nature of these systems with conventional radiology such as CT and MRI make them preferable in treating conditions related to blood flow. For instance, in August 2024, a study report was published to evaluate the use and benefits of perfusion imaging (PI) in anterior large vessel occlusion treatment. Results revealed that the PI use rates increased by 4.3% in the late window of 49,449 acute ischemic stroke patients, presenting within 24 hours of onset from 2011 to 2021.

Challenges

-

Expensive treatment and equipment: Installing advanced diagnostic equipment requires a significant initial cost, which may become a hurdle for optimum adoption in the perfusion radiology market. Smaller healthcare organizations often struggle to afford such equipment due to their limited budget and insufficient infrastructure to support their operations. In addition, the unavoidable expenses may add up to the service pricing, making it difficult for patients to pay for such tests and restricting market expansion in price-sensitive regions.

-

Lack of skilled operators: The complex interpretation of data from these tests needs expert analysis to offer complete utility. Operating facilities often fail to allocate such trained professionals, particularly for conditions such as stroke, heart disease, and cancer due to the lack of available personnel. This can hinder the effectiveness of these systems, diluting consumer interest in investing in the perfusion radiology market. Additionally, the shortage of skilled radiologists may cause delays in diagnosis and treatment, refraining service providers from adopting.

Perfusion Radiology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 2.69 billion |

|

Forecast Year Market Size (2035) |

USD 4.02 billion |

|

Regional Scope |

|

Perfusion Radiology Market Segmentation:

Application (Brain Imaging, Ventilation Imaging, Cardiovascular Imaging)

The cardiovascular imaging segment is likely to capture perfusion radiology market share of over 41.5% by 2035. The segment is highly stimulated by the influence of the increasing PI usage in treating heart-related diseases. The efficiency of this technology to assess blood flow in heart muscle eliminated the need for surgical intervention, making it convenient and faster for both service providers and patients. This has inflated the demand for advanced perfusion equipment for better management and treatment of cardiac diseases. According to a report published by NLM in March 2023, with 78% sensitivity and 73% specificity, CT perfusion is comparatively a cost-effective method of diagnosing CVD patients.

End user (Diagnostic Centers, Hospitals)

In terms of end users, the hospitals segment is projected to capture a significant share in the perfusion radiology market during the forecast period. The presence of expert radiologists and adequate infrastructure is the major growth factor of this segment. Hospitals are the first contact point for both patients and distributors, making it an essential revenue generator of this sector. Such a well-managed marketplace is further inspiring global leaders to concentrate on fostering more advanced and suitable technologies for hospitals. For instance, in February 2024, Royal Phillips introduced AI-powered fully interoperable smart imaging solutions for hospitals in ECR 2024. The company stated its plans to unveil next-generation radiology to enhance workflow and connectivity between various departments.

Our in-depth analysis of the global perfusion radiology market includes the following segments:

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Perfusion Radiology Market Regional Analysis:

North America Market Analysis

By 2035, North America perfusion radiology market is likely to capture over 36.2% share due to its developed and adaptive healthcare industry. The general availability of advanced medical facilities and diagnosing services across the region is the pivotal driving factor of this sector. Changing lifestyles in developed countries such as the U.S. and Canada have increased the prevalence of cardiac fatalities, making them the major investors in this field. According to an article released by the NLM, in December 2023, the CVD mortality rate in North America ranged between 99.4 and 191.6 per 10,000 in 2o22. The top contributors of CVD-caused age-standardized DALYs were ischemic heart disease, all stroke subtypes, and hypertensive heart disease.

The U.S. is among those high-income countries that significantly contribute to the growth of the regional perfusion radiology market. In addition, the availability of extensive insurance coverage is among the key influencers, encouraging both patients and service providers to engage their capital in this field. Domestic tech firms are now showing interest in developing advanced management solutions to automate the processing of complex analytical imaging data. For instance, in November 2022, Viz.ai partnered with Cercare Medical to integrate fully automated, simple-to-use, patient-specific perfusion software in its platform, broadening the company’s imaging portfolio.

Canada is accumulating financial and promotional forces to invest heavily in the perfusion radiology market to revamp the gap between survival rates and radiology resources. The country is now focusing on utilizing advanced technology as a financial cushion for its declining healthcare share in GDP. The governing authorities are now being pushed to draft roadmaps to multiply and leverage their medical imaging facilities for reduced wait times and improved patient outcomes. According to a plan, published by the Canadian Association of Radiologists, in August 2023, 9 out of 10 citizens of the country recommended the Federal Government to invest in healthcare imaging. It further outlined a USD 2 billion funding for radiology equipment.

APAC Market Statistics

Asia Pacific is one of the fastest-growing regions in the perfusion radiology market and is estimated to generate notable revenue by the end of 2035. The region is highly focused on upgrading its medical accommodations by investing in infrastructure and research. In addition, dedicated and collaborative R&D projects empower radiology with digitalization to deliver more accurate and effective results. For instance, in November 2022, a team of researchers at Kyushu University developed a revolutionary technology to visualize pulmonary hemodynamics by using Dynamic Digital Radiography (DDR) from Konica Minolta. The newly introduced pulmonary perfusion imaging technique can diagnose chronic thromboembolic pulmonary hypertension without the need for contrast media.

India is estimated to gain traction in the perfusion radiology market due to the notable expansion of the medical device industry in this country. With the government-released initiatives and subsidiary policies around the Made in India campaign, it is cultivating domestic resources to empower its manufacturing capacity of radiology devices. According to the IBEF data, published in August 2024, the government of India launched a new scheme for domestic medical imaging device component manufacturers to eliminate their reliance on imports. It confirmed a 20% capital subsidy on marginal investments for companies associated with manufacturing essential parts for digital X-ray, CT scan, and MRI machines.

China, with a strong emphasis on the manufacturing and assembling industry, is fostering opportunities for the perfusion radiology market. Besides supplying its own patient population and healthcare institutes, the country is also proactively associated with the international trading of medical equipment. According to 2022 OEC data, China ranked among the top 5 largest exporters of medical devices in the world with an export value of USD 12 billion. The country also secured an import value of USD 10.1 billion for this industry in the same year. This is an indication of a healthy marketplace for medical device businesses including perfusion imaging systems, inspiring domestic companies to upscale production.

Key Perfusion Radiology Market Players:

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Advantis Medical Imaging

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Lantheus Medical Imaging, Inc.

- Neusoft Corporation

- Perimed

- Bracco Diagnostic, Inc.

- RapidAI

The perfusion radiology market is progressing with steady but continuous growth due to ongoing innovations and business achievements. In addition, continuous efforts made by global leaders to improve imaging techniques by integrating next-generation technologies such as AI is attracting a large consumer base for this sector. Moreover, their strategic investments and collaborations are bringing new applications by infusing each other’s knowledge and assets. For instance, in December 2024, Bridge to Life Ltd. acquired VitaSmart Hypothermic Oxygenated Machine Perfusion System from Medica S.p.A. to promote its effectiveness in organ preservation globally. The acquisition includes exclusive global trademark rights, solidifying its position in this technology worldwide. Such key players include:

Recent Developments

- In July 2024, Bracco partnered with BURL Concepts, Inc. to elevate diagnostic imaging solutions for better ischemic stroke detection and treatment. The strategic partnership plans to develop a microbubble solution for the portable SONAS device, leveraging non-invasive assessment of brain blood perfusion.

- In May 2024, RapidAI received 510(k)clearance from the FDA for AngioFlow, delivering perfusion imaging analysis in the Angiography Suite. The new clinical module can facilitate assistance to healthcare providers in decision-making for neuro-interventional procedures, marking milestones in stroke AI imaging.

- Report ID: 6961

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Perfusion Radiology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.