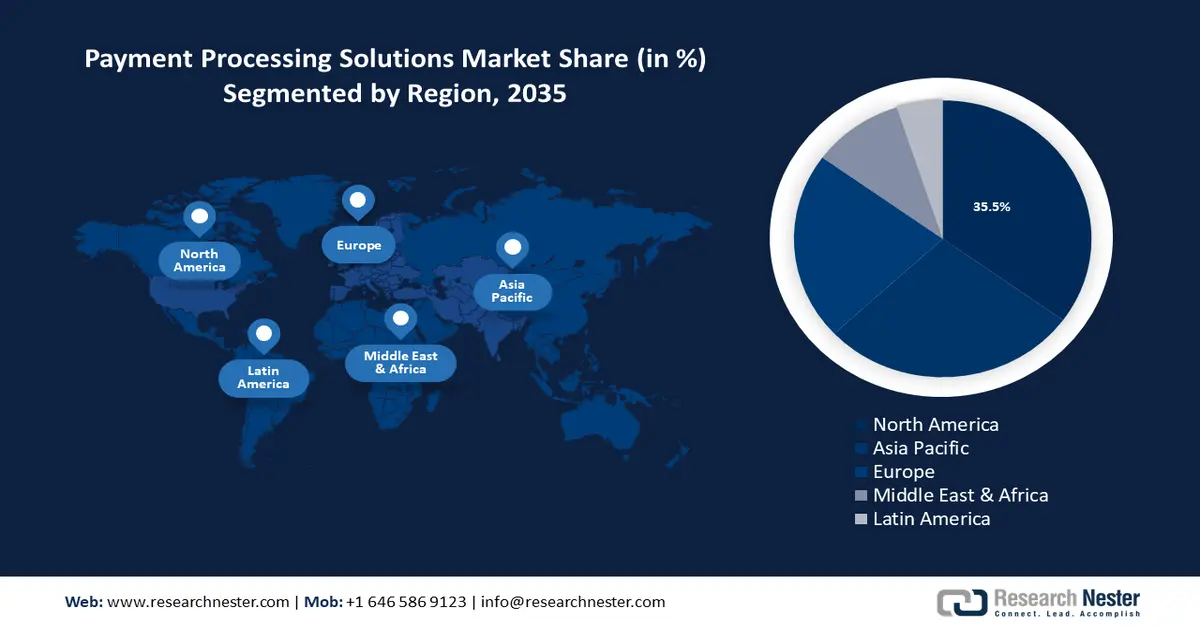

Payment Processing Solutions Market Regional Analysis:

North America Market Insights

The North America industry is anticipated to account for largest revenue share of 36% by 2035. As a result, the demand for payment processing solutions may rise as it allows companies to take payments with checks, debit cards, credit cards, and digital wallets. By 2030, it is anticipated that the number of cashless transactions in North America will rise by over 30%.

The market for payment processing solutions is expected to expand in the U.S., as the use of mobile wallets is increasing, and this trend is predicted to continue as more individuals adopt contactless point-of-sale systems that enable cardholders to make purchases without entering a PIN by just tapping their payment cards against a device.

The need for payment processing solutions is rising in Canada as a result of the development of digital banking and the rising use of mobile banking apps. In the first quarter of 2024, more than 55% of all bank account holders in Canada processed banking transactions through mobile applications.

APAC Market Insights

The Asia Pacific payment processing solutions market is predicted to have a notable growth during the forecast period, encouraged by the expanding retail industry. Among the world's most promising retail markets are those in the Asia-Pacific, which is dramatically expanding as a result of rising population, urbanization, and increased disposable income. Retail payment processing can help businesses optimize their processes, as the majority of retail establishments have adopted digital payment systems to permit faster and more secure transaction fees. With a population of more than 4 billion, Asia is a massive market for retail with plenty of room for growth for both physical and virtual stores.

In China, the demand for dynamic payment processing solutions has arisen due to the increasing adoption of digital and mobile payment applications such as Alipay and WeChat Pay. Particularly, in China, more than 950 million individuals were using mobile payments as of December 2023.

India has seen a significant rise in digital payment adoption, fueled by government initiatives such as Digital India and the increasing use of mobile wallets and Unified Payments Interface (UPI). According to the National Payments Corporation of India (NPCI), total transactions processed by UPI transactions in the country stood at 117.6 billion in 2023.