Payment Processing Solutions Market Outlook:

Payment Processing Solutions Market size was over USD 72.96 billion in 2025 and is poised to exceed USD 302.95 billion by 2035, growing at over 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of payment processing solutions is estimated at USD 83.01 billion.

The primary growth driver for the payment processing solutions market is the increasing adoption of digital and mobile payment technologies. As more consumers and businesses shift away from traditional cash and card payments towards mobile wallets, and contactless payments, there is a growing demand for advanced payment processing solutions to ensure safe transactions. According to the World Bank Group, two-thirds of adults globally make or receive digital payments, with developing economies accounting for 57% in 2021, up from 35% in 2014. Additionally, the rise in e-commerce and the need for seamless, fast, and secure payment experiences are also significant factors driving market growth.

Key Payment Processing Solutions Market Insights Summary:

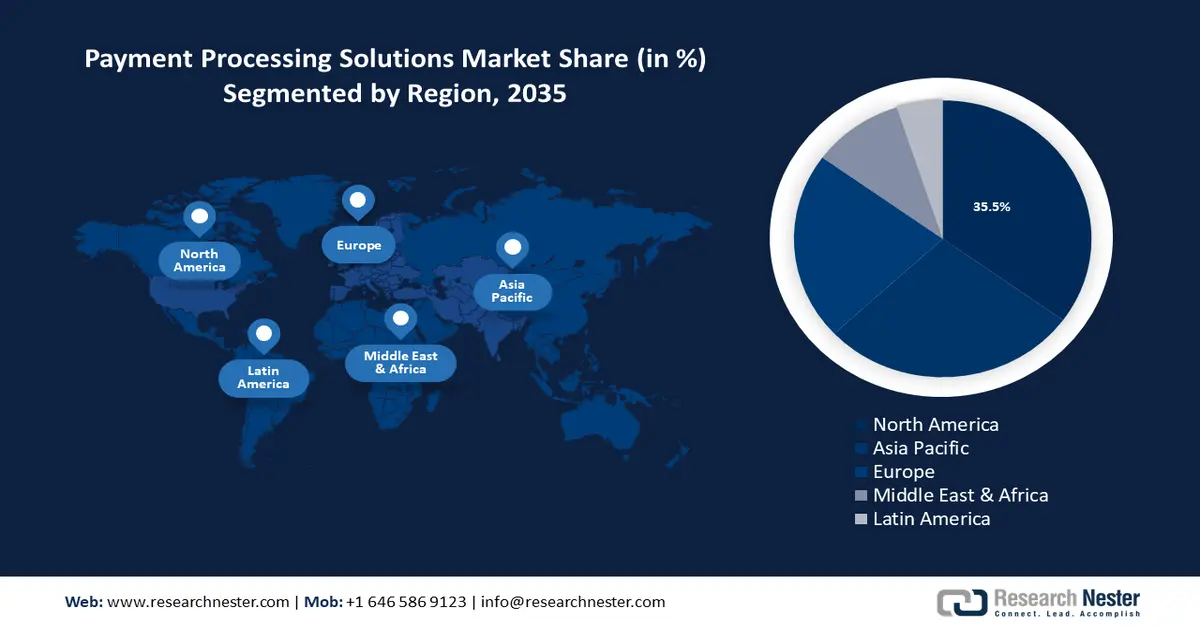

Regional Highlights:

- The North America payment processing solutions market achieves a 36% share by 2035, driven by rising demand for payment processing solutions fueled by increasing mobile wallet adoption.

Segment Insights:

- The credit card segment in the payment processing solutions market is forecasted to maintain a 45.10% share by 2035, driven by increasing global credit card ownership and usage.

- The travel and hospitality segment in the payment processing solutions market is projected to achieve a 40.5% share by 2035, fueled by increased hotel occupancy and payment transaction needs.

Key Growth Trends:

- Rising cybersecurity concerns

- E-commerce expansion

Major Challenges:

- Complex regulatory environmen t

- Fraud and cybersecurity

Key Players: PayPal Holdings, Inc., Stripe, Inc., Square, Inc. (Block, Inc.), Adyen N.V., Fiserv, Inc., Global Payments Inc., Worldpay, Inc. (FIS), Mastercard Incorporated, Visa Inc., PayU (Naspers).

Global Payment Processing Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 72.96 billion

- 2026 Market Size: USD 83.01 billion

- Projected Market Size: USD 302.95 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Payment Processing Solutions Market Growth Drivers and Challenges:

Growth Drivers

- Rising cybersecurity concerns: Businesses and financial institutions are investing in advanced payment processing solutions that offer enhanced security features, such as real-time fraud detection, biometric authentication, and advanced encryption, in response to the growing threat of fraud and cyber threats. These solutions help mitigate risks, protect sensitive information, and ensure secure transactions, which are driving the demand for more sophisticated payment processing technologies. Since 2021, more than 5.52% of organizations with at least USD 10 billion in yearly revenue have encountered fraudulent activity.

- E-commerce expansion: As e-commerce continues to grow, the volume of online transactions rises, creating a higher demand for scalable and reliable payment processing solutions. For instance, global retail e-commerce revenues are predicted to surpass USD 6 trillion in 2024. Additionally, e-commerce platforms often require various payment methods, including credit/debit, digital wallets, and alternative payments. This drives the demand for versatile payment processing solutions.

- Advancements in technology: In recent years, the payment sector has seen revolutionary changes due to advancements in technology, which are likely to drive the development of complex payment processing systems. For instance, to facilitate safe and efficient cross-border payments, a growing number of banks and businesses intend to integrate blockchain payment systems into their operations as it offers speedier and more efficient transactions by greatly streamlining payment operations.

Challenges

- Complex regulatory environment: Businesses need to abide by several important payment processing standards, which are designed to make sure payment service providers (PSPs) carry out thorough due diligence to reduce the risk of financial fraud. To remain competitive, payment processors must maneuver through a difficult environment, which can be difficult owing to its intricacies, which include currency translations, global rules, and a variety of payment options.

In addition, merchants in high-risk businesses have the burden of complying with strict regulations. Significant penalties, fines, harm to one's reputation, and legal repercussions might arise from breaking regulatory regulations. - Fraud and cybersecurity: Managing private financial information while processing payments, increases the risk of money laundering and fraud which entails unsanctioned or dishonest actions intended to profit financially from the payment system.

Payment Processing Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 72.96 billion |

|

Forecast Year Market Size (2035) |

USD 302.95 billion |

|

Regional Scope |

|

Payment Processing Solutions Market Segmentation:

Payment Mode Segment Analysis

The credit card segment in the payment processing solutions market is estimated to gain the largest revenue share of 45.1% by the end of 2035 on account of the growing credit card ownership and usage. More than 1 billion people worldwide own credit cards, accounting for around 15% of the entire population. This leads to a higher demand for efficient and reliable payment processing solutions that support the full array of card-related services. An ERP system with integrated credit card processing is a crucial tool for streamlining financial procedures and improving client experiences since it prevents data redundancy by sending data continuously via an integrated credit card payment processing solution, which can also automate regular billing, accept online payments, and let clients manage their accounts.

End use Segment Analysis

The travel and hospitality segment is projected to register a significant payment processing solutions market share of 40.5% during the projected timeframe, impelled by the rising rate of hotel occupancy across the globe. Higher hotel occupancy leads to more bookings which may increase the number of transactions necessitating the need for reliable payment processing solutions. In 2020, the global hotel occupancy rate was 45%. In 2021, the global occupancy rate for luxury hotels was 29% and that of budget hotels was 47%. Hotels are aware of the benefits of integrated payment processing; these solutions guarantee effectiveness and security, and eliminate the need for extraneous third parties, to accept payments.

Our in-depth analysis of the payment processing solutions market includes the following segments:

|

Payment Mode |

|

|

Deployment Mode |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Payment Processing Solutions Market Regional Analysis:

North America Market Insights

The North America industry is anticipated to account for largest revenue share of 36% by 2035. As a result, the demand for payment processing solutions may rise as it allows companies to take payments with checks, debit cards, credit cards, and digital wallets. By 2030, it is anticipated that the number of cashless transactions in North America will rise by over 30%.

The market for payment processing solutions is expected to expand in the U.S., as the use of mobile wallets is increasing, and this trend is predicted to continue as more individuals adopt contactless point-of-sale systems that enable cardholders to make purchases without entering a PIN by just tapping their payment cards against a device.

The need for payment processing solutions is rising in Canada as a result of the development of digital banking and the rising use of mobile banking apps. In the first quarter of 2024, more than 55% of all bank account holders in Canada processed banking transactions through mobile applications.

APAC Market Insights

The Asia Pacific payment processing solutions market is predicted to have a notable growth during the forecast period, encouraged by the expanding retail industry. Among the world's most promising retail markets are those in the Asia-Pacific, which is dramatically expanding as a result of rising population, urbanization, and increased disposable income. Retail payment processing can help businesses optimize their processes, as the majority of retail establishments have adopted digital payment systems to permit faster and more secure transaction fees. With a population of more than 4 billion, Asia is a massive market for retail with plenty of room for growth for both physical and virtual stores.

In China, the demand for dynamic payment processing solutions has arisen due to the increasing adoption of digital and mobile payment applications such as Alipay and WeChat Pay. Particularly, in China, more than 950 million individuals were using mobile payments as of December 2023.

India has seen a significant rise in digital payment adoption, fueled by government initiatives such as Digital India and the increasing use of mobile wallets and Unified Payments Interface (UPI). According to the National Payments Corporation of India (NPCI), total transactions processed by UPI transactions in the country stood at 117.6 billion in 2023.

Payment Processing Solutions Market Players:

- PayPal Holdings, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PayU

- SecurePay

- Stripe, Inc.

- Adyen

- Alipay

- Amazon Pay

- Authorize.Net

- Apple Inc.

- Alphabet Inc.

Major key players invest heavily in developing advanced technologies, such as AI for fraud detection, blockchain for secure transactions, and enhanced encryption methods. Strategic partnerships and acquisitions help key players expand their market presence and enhance their technological capabilities.

Recent Developments

- In January 2024, Alphabet Inc. collaborated with the mobile-based payment system in India, which processes billions of transactions each month to make foreign payments easier for Indian tourists, and also help other nations set up digital payment systems similar to UPI.

- In March 2022, Apple Inc. announced the development of its infrastructure and technology for payment processing to gradually lessen its dependency on outside partners.

- Report ID: 6375

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Payment Processing Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.