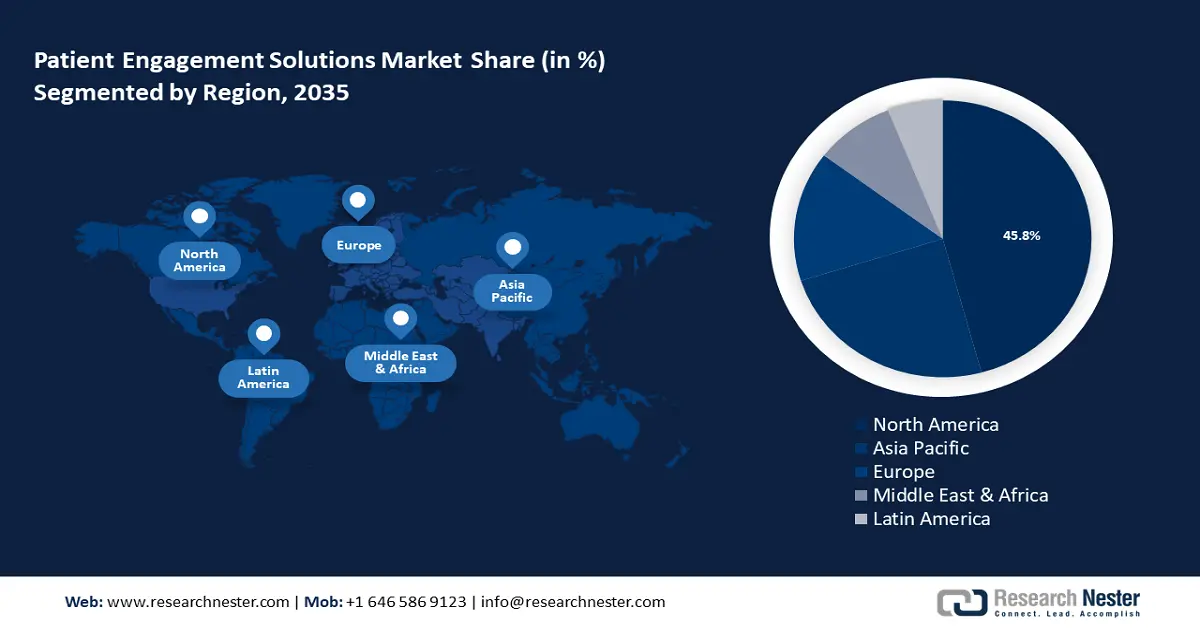

Patient Engagement Solutions Market Regional Analysis:

North America Market Analysis

North America industry is expected to dominate majority revenue share of 45.8% by 2035. Rapid IoT integration in every industry of this region has influenced massive growth. Deployment of software has allowed infrastructural development in the healthcare sector. This is further influencing the government to take supporting initiatives for adopting EHRs and other patient engagement tools. Continued advancement in digitalization has also made a positive impression on the regional landscape. In August 2023, Orion Health launched an AI-powered digital front door, Virtuosa. The Orion-DFD is offering preventive, proactive, and predictive healthcare to the 15 million people of North America.

The U.S. is holding one of the biggest market spaces in this region due to its well-established healthcare system. The adoption of advanced facilities has helped this country to deliver world-class services globally. The U.S. government issued regulations including HITECH Act, encouraging hospitals to adopt patient engagement practices. According to a report published by OECD, in September 2023, patient engagement reduced cost and death rates in hospitals significantly in the U.S. In March 2023, Amwell partnered with DarioHealth to expand its digital clinical programs. The expansion is connecting patients with chronic diseases to offer personalized digital therapeutic solutions.

Canada also holds promising growth potential in the patient engagement solutions market in upcoming years. The country is allocating extensive investments in research and development to strengthen its healthcare infrastructure. Innovative technologies are being implemented to support disease procurement. Enhanced patient management capabilities are fostering advancement in data analytic systems. Strategic partnerships among companies are expanding their portfolio to supply such innovative solutions. For instance, in March 2022, UST partnered with Well-Beat to launch a digital patient engagement solution. The SaaS solution can replicate human behavior by using AI to deliver more sensible conversational guidelines to clinicians.

APAC Market Statistics

Asia Pacific is expected to hold a large consumer base for the patient engagement solutions market. The open market dynamics of this region create opportunities for global players to outstretch their reach. The increasing aging population demands remote healthcare solutions, increasing online patient engagement. Leading pharmaceutical companies are also collaborating with tech leaders to leverage the development using consumer feedback. For instance, in July 2022, MedAdvisor acquired 100% share of GuideLink to develop a digital platform for pharmacies in Australia. The platform allowed the consumer base in the Pharmacy Guild of Australia with patient bookings, clinical services, vaccinations, and medication management.

The patient engagement solutions market in India shows great potential to grow bigger with the influence of governmental initiatives. Programs such as the National Digital Health Mission focus on improving the healthcare infrastructure through patient engagement. Leaders including Practo, BestDoc, and Clinion are making strategic investments and partnerships to emphasize the domestic market. According to the 2024 financial report of Practo, it achieved a 90% improvement in EBITDA, marking a 22% growth in revenue than 2023. Such growth of individual companies is contributing to add-up in the country’s patient engagement industry.

The China patient engagement solutions market is growing due to the increasing demand for patient-centric healthcare services. The country’s medical industry is highly influenced by digital health integration. Mobile health apps and telemedicine platforms are transforming the way patients interact with healthcare providers. Government initiatives such as the Healthy China 2030 plan are contributing to improving access and efficiency of engagement solutions. Companies are utilizing patient-engaging solutions to offer digital mental health services. For instance, in May 2024, JD launched a series of AI-driven service projects to offer therapeutic and healing solutions to manage mental disorders.