Patient Engagement Solutions Market Outlook:

Patient Engagement Solutions Market size was over USD 27.69 billion in 2025 and is projected to reach USD 152.46 billion by 2035, growing at around 18.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of patient engagement solutions is assessed at USD 32.33 billion.

The growth is driven by the increasing demand for digitalization of healthcare services. AI adoption in medical communication systems is accelerating patient engagement in this sector. According to a report published by NLM in September 2023, LLMs (Large Language Models) are being implemented by healthcare facilities. This text-based communication system uses machine learning techniques to process large data sets for seamless patient interaction.

The success of telehealth services is influencing the healthcare industry to invest in advanced facilities, such as chatbots, HRA, care gaps, and others. Autogenerated messaging including lab notifications, and medication reminders can elevate patient relations. Such improvement in direct communication also helps medical facilities to incorporate patient inputs in improvising their services. The shift towards value-based care is influencing companies to introduce tracking technologies, raising greater investments in the patient engagement solutions market. In January 2023, Asahi Technologies launched a new digital health ecosystem, which allows patients to track their medications and health conditions.

Key Patient Engagement Solutions Market Insights Summary:

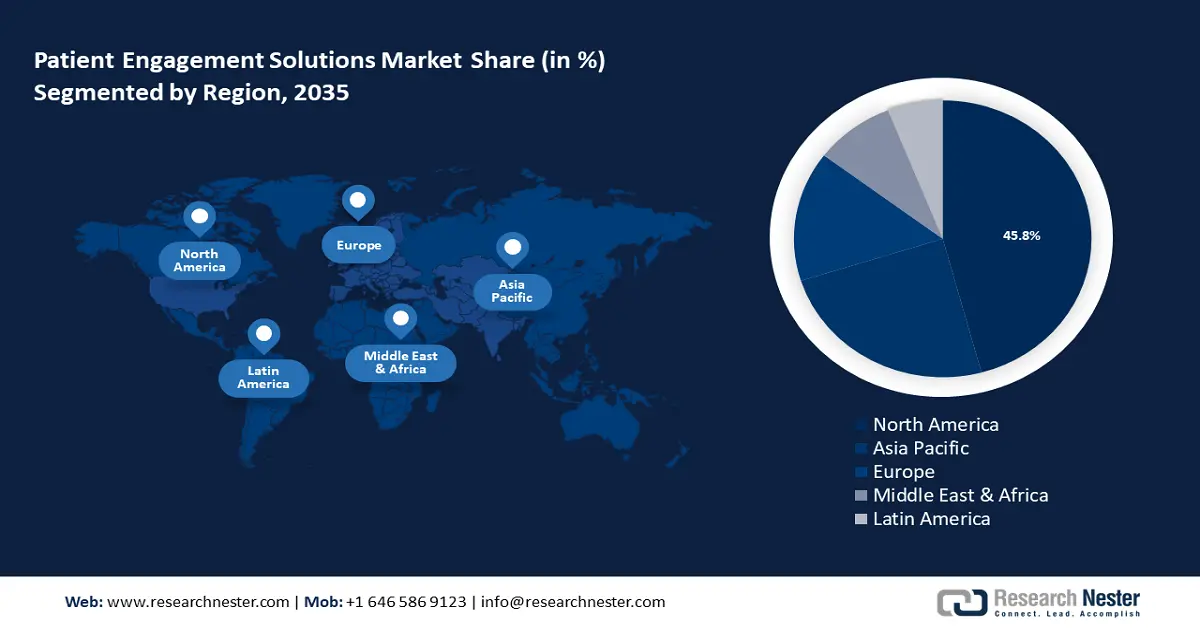

Regional Highlights:

- North America leads the Patient Engagement Solutions Market with a 45.8% share, fueled by rapid IoT integration, infrastructural development, and government support for patient engagement tools, ensuring strong growth through 2026–2035.

Segment Insights:

- The Software segment is anticipated to hold over 70.3% market share by 2035, propelled by the widespread use of digital platforms enabling personalized healthcare experiences.

Key Growth Trends:

- Technological advancement in healthcare

- Rising demand for remote and preventive care

Major Challenges:

- Lack of technological literacy

- Stringent regulatory suppression

- Key Players: American Well Corporation, Athenahealth, Cerner Corporation, Epic Systems, Garmin, Lincor Inc., McKesson, MEDHOST, Oracle, Orion Health, Teladoc Health, Veradigm LLC.

Global Patient Engagement Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.69 billion

- 2026 Market Size: USD 32.33 billion

- Projected Market Size: USD 152.46 billion by 2035

- Growth Forecasts: 18.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Canada, Japan

- Emerging Countries: India, China, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

Patient Engagement Solutions Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancement in healthcare: Advanced technologies in the medical sector including EHR and telehealth services have influenced the patient engagement solutions market. The enhanced communication between patients and healthcare service providers encourages users to adopt such systems. Leading companies are now designing user-friendly engagement solutions for direct interaction. In August 2023, LG launched a patient engagement board for effective communication in hospitals. The 43-inch FHD model empowers the hospital rooms with PoE capability, catering to diverse hospital room needs.

-

Rising demand for remote and preventive care: The post-pandemic scenario propelled the need for instant communicating systems with healthcare facilities. Mobile health applications and wearable monitoring devices are fueling the demand through enhanced accessibility. Surge for at-home health assistance is also requiring efficient platforms to establish connection with professionals. The patient engagement solutions market is supporting this need for self-management. In January 2021, Naunce launched a virtual assistant platform for patients to promote remote healthcare. The combination of EHR systems, CRM, and patient access systems helps to modernize clinical care.

Challenges

-

Lack of technological literacy: Operational illiteracy in patients and healthcare professionals can restrain the resources of required data. Technology barriers between the older population and these advanced platforms can prevent adoption for personal usage. Variable user interfaces can become a challenge to understand, leading to poor infrastructure in the patient engagement solutions market. Often users struggle to navigate through digital tools, impacting the effectiveness. The absence of reliable devices and operators in hospitals to process large databases can lead to disparities in care.

-

Stringent regulatory suppression: Strict healthcare regulations for patient safety may hinder the process of development. Standards such as HIPPA can be demanding to ensure compliance. Complex regulatory frameworks can refrain investors from participating in the patient engagement solutions market. Facilities without access to advanced technologies may become unable to adopt innovations. Implementing and managing sensitive patient information may raise a concern for data security. Further, creating hurdles in adopting patient-engaging practices in organizations.

Patient Engagement Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.6% |

|

Base Year Market Size (2025) |

USD 27.69 billion |

|

Forecast Year Market Size (2035) |

USD 152.46 billion |

|

Regional Scope |

|

Patient Engagement Solutions Market Segmentation:

Component (Software, Services)

Software segment is expected to hold patient engagement solutions market share of over 70.3% by the end of 2035 due to the availability of various applications and platforms. Easy patient login portals, user-friendly mobile apps, CDSS tools, and other platforms offer personalized experience. Healthcare providers prefer these software solutions to facilitate continuous monitoring and management. In April 2023, Athenahealth launched patient engagement measurement software and services for medical groups and health systems. The network-enabled digital index will provide an overview of the usage of digital tools by patients. The capability to redirect health-related analytical data to the patient at home has also enlarged its demand for remote use.

Application (Health Management, Home Healthcare, Financial Health Management, Social & Behavioral Health)

By application, the patient engagement solutions market is predicted to be majorly influenced by the health management segment. Technologically advanced tools and services play a vital role in the self-management of health at home. The segment is experiencing a surge in demand for improved patient outcomes in various sectors. Automated reminders for medication, appointments, and healthy practices are increasing the adoption of these engaging solutions. Designed programs are proven to be effective for managing symptoms of chronic diseases. Storing personal health records and access to sharing medical history with providers has inflated the demand for these tools for health management. For instance, in July 2021, Amwell launched Conversa Health to offer automated virtual healthcare for chronic disease management.

Our in-depth analysis of the market includes the following segments

|

Component |

|

|

Application |

|

|

Functionality |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Patient Engagement Solutions Market Regional Analysis:

North America Market Analysis

North America industry is expected to dominate majority revenue share of 45.8% by 2035. Rapid IoT integration in every industry of this region has influenced massive growth. Deployment of software has allowed infrastructural development in the healthcare sector. This is further influencing the government to take supporting initiatives for adopting EHRs and other patient engagement tools. Continued advancement in digitalization has also made a positive impression on the regional landscape. In August 2023, Orion Health launched an AI-powered digital front door, Virtuosa. The Orion-DFD is offering preventive, proactive, and predictive healthcare to the 15 million people of North America.

The U.S. is holding one of the biggest market spaces in this region due to its well-established healthcare system. The adoption of advanced facilities has helped this country to deliver world-class services globally. The U.S. government issued regulations including HITECH Act, encouraging hospitals to adopt patient engagement practices. According to a report published by OECD, in September 2023, patient engagement reduced cost and death rates in hospitals significantly in the U.S. In March 2023, Amwell partnered with DarioHealth to expand its digital clinical programs. The expansion is connecting patients with chronic diseases to offer personalized digital therapeutic solutions.

Canada also holds promising growth potential in the patient engagement solutions market in upcoming years. The country is allocating extensive investments in research and development to strengthen its healthcare infrastructure. Innovative technologies are being implemented to support disease procurement. Enhanced patient management capabilities are fostering advancement in data analytic systems. Strategic partnerships among companies are expanding their portfolio to supply such innovative solutions. For instance, in March 2022, UST partnered with Well-Beat to launch a digital patient engagement solution. The SaaS solution can replicate human behavior by using AI to deliver more sensible conversational guidelines to clinicians.

APAC Market Statistics

Asia Pacific is expected to hold a large consumer base for the patient engagement solutions market. The open market dynamics of this region create opportunities for global players to outstretch their reach. The increasing aging population demands remote healthcare solutions, increasing online patient engagement. Leading pharmaceutical companies are also collaborating with tech leaders to leverage the development using consumer feedback. For instance, in July 2022, MedAdvisor acquired 100% share of GuideLink to develop a digital platform for pharmacies in Australia. The platform allowed the consumer base in the Pharmacy Guild of Australia with patient bookings, clinical services, vaccinations, and medication management.

The patient engagement solutions market in India shows great potential to grow bigger with the influence of governmental initiatives. Programs such as the National Digital Health Mission focus on improving the healthcare infrastructure through patient engagement. Leaders including Practo, BestDoc, and Clinion are making strategic investments and partnerships to emphasize the domestic market. According to the 2024 financial report of Practo, it achieved a 90% improvement in EBITDA, marking a 22% growth in revenue than 2023. Such growth of individual companies is contributing to add-up in the country’s patient engagement industry.

The China patient engagement solutions market is growing due to the increasing demand for patient-centric healthcare services. The country’s medical industry is highly influenced by digital health integration. Mobile health apps and telemedicine platforms are transforming the way patients interact with healthcare providers. Government initiatives such as the Healthy China 2030 plan are contributing to improving access and efficiency of engagement solutions. Companies are utilizing patient-engaging solutions to offer digital mental health services. For instance, in May 2024, JD launched a series of AI-driven service projects to offer therapeutic and healing solutions to manage mental disorders.

Key Patient Engagement Solutions Market Players:

- American Well Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Athenahealth

- Cerner Corporation

- Epic Systems

- Garmin

- Lincor Inc.

- McKesson

- MEDHOST

- Oracle

- Orion Health

- Teladoc Health

- Veradigm LLC

Key players in the patient engagement solutions market are now focusing on introducing innovative systems for personalized and digital health care. The development of remote services is playing a major role in this case. They are also participating in patient education to empower them to make informed decisions about their health. Leveraging data to improve care management is becoming more prevalent. Moreover, the growth of this industry is contributing to enhancing patient experience and healthcare delivery. In August 2024, PatientPoint launched its new patient engagement system for both after and in between doctor visits. The list of such global leaders includes:

Recent Developments

- In August 2024, HEALWELL partnered with WELL Health Technologies to collaborate with their subsidiary tech solutions, Intrahealth and OceanMD. The integration will allow WEALWELL’s wide network of healthcare facilities to access OceanMD’s eReferral system. This will further enhance patient access to healthcare platforms.

- In July 2024, SAIGroup acquired Get Well, a leading company in the digital patient engagement market. This acquisition will allow SAIGroup’s clinical AI platform to possess Get Well’s huge consumer base. Get Well’s annual 10 million patient interactions with over 1000 healthcare institutions will expand SAIGroup’s portfolio.

- Report ID: 6600

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Patient Engagement Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.