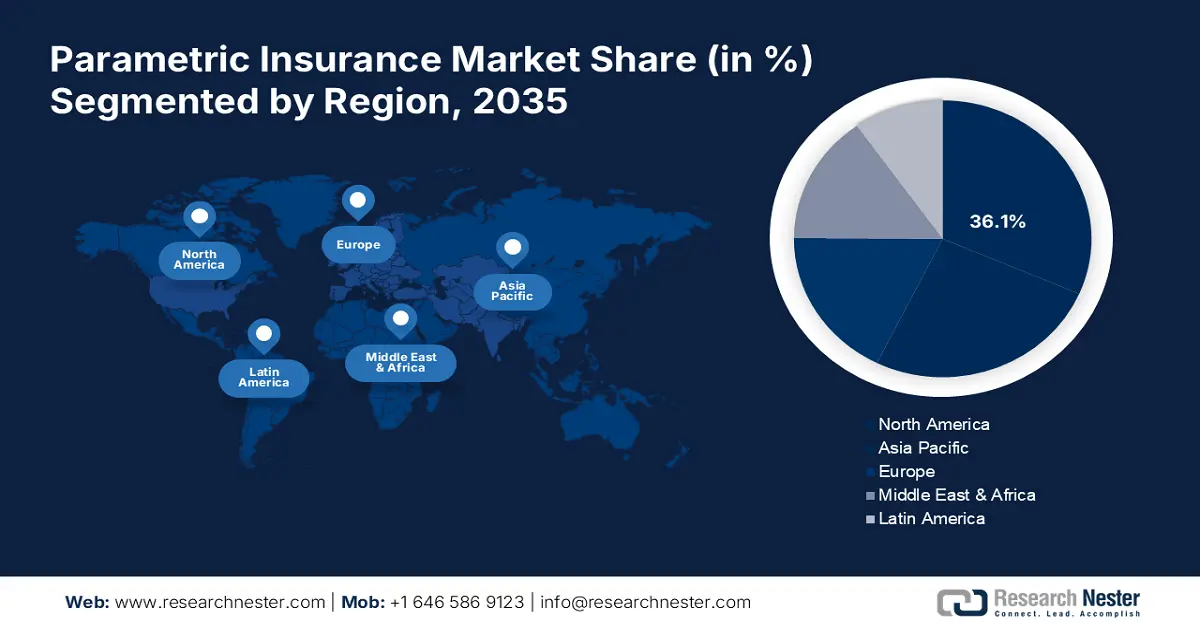

Parametric Insurance Market Regional Analysis:

North America Market Insights

North America industry is poised to hold largest revenue share of 36.1% by 2035. It has the highest growth parameters that drive the market, including the rising availability of parametric insurance models with high accuracy and reliability, along with technological progress and advanced data analytics. Moreover, the intensifying issue of climate change and its after-effects is compelling companies to look for new techniques of risk management in the region.

Companies are rapidly embracing parametric insurance to hedge the impact of climate-related risks to remain financially stable when lots of uncertainty faces an economy. Furthermore, the increased interest of regulatory bodies and the entry of insurance firms into the market has accelerated the growth of the parametric insurance market. The innovation developed by these entities along with the increasing availability of parametric products are making it more lucrative for the end users in the region

The U.S. parametric insurance market is expected to witness massive growth between 2026 and 2035 owing to the rising incidence of natural disasters, the presence of leading insurance companies providing parametric insurance, and rapid advancements in AI and data analytics that quickly assess risks and automate payouts. Insurers saw the costliest SCS year on record, with total claims exceeding USD 50 billion. Also, Florida is particularly vulnerable as it is a hurricane-prone area and the spiraling cost of insuring a property. The Insurance Information Institute claimed that in 2022, Florida residents paid an average of USD 4,231 in annual premiums, nearly three times the national average.

Asia Pacific Market Insights

The Asia Pacific is the fastest-growing region in the parametric insurance market, attributed to rising consciousness towards catastrophic risks, increasing demand for reliable risk management solutions, diverging infrastructure and economies of scale, and advancement in data analytics. Also, the region is prone to frequent and numerous natural disasters thus to compensate for the damage parametric insurance renders prompt financial compensation for these calamities.

Moreover, the government is encouraging risk transfer solutions to transform disaster resilience which further helps in mitigating the effect of natural disasters. The population in the region is inclining towards safe and secure options using parametric insurance as a tool as it is tailored with an innovative approach to a diverse range of clients. Thus, the demand for parametric insurance is likely to witness exponential growth by offering effortless financial relief.

The parametric market in India is expected to register rapid revenue growth during the forecast period owing to high susceptibility to natural disasters such as floods, earthquakes, and droughts in many parts of India, rising awareness about the importance of parametric insurance, and favorable government support. For instance, the government in association with General Insurance Corporation (GIC) has developed parametric and hydroelectric insurance pools to enhance the efficacy of disaster protection measures.