Parametric Insurance Market Outlook:

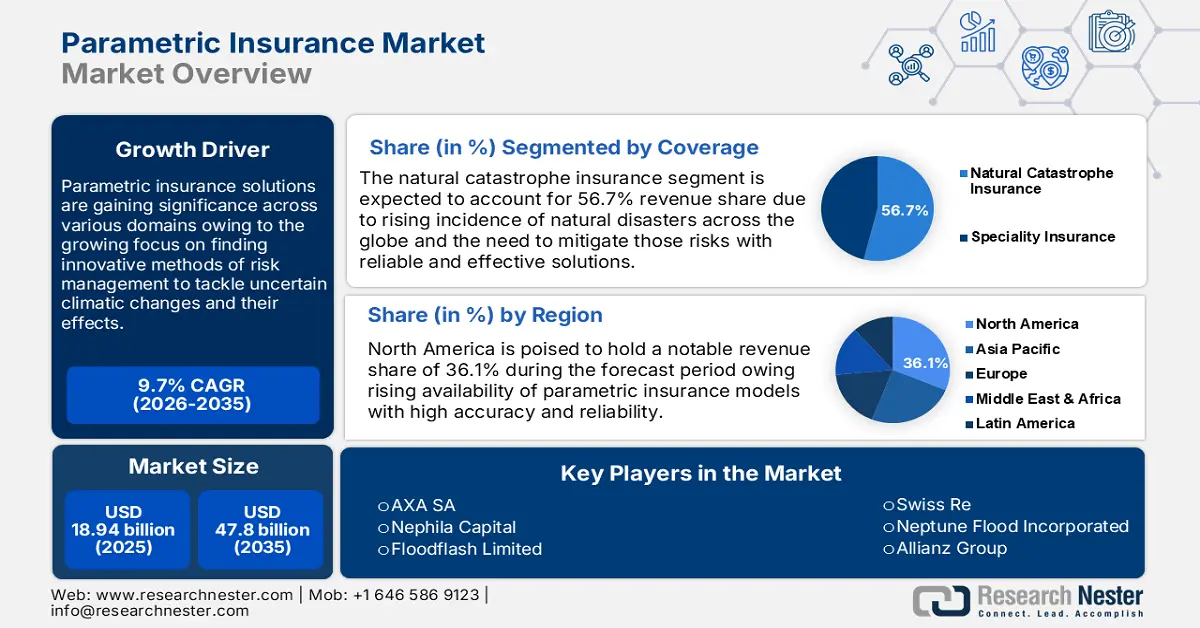

Parametric Insurance Market size was over USD 18.94 billion in 2025 and is anticipated to cross USD 47.8 billion by 2035, growing at more than 9.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of parametric insurance is assessed at USD 20.59 billion.

Parametric insurance is gaining traction in business and industry domains, with firms focusing more on derivation to innovative methods of risk management to tackle unforeseen climate and other related events. Contrasting with traditional method of compensation, parametric insurance offers a predetermined payout on an expected set of triggers, usually extreme weather events, natural disasters, or even other measurable occurrences. This streamlined approach allows for faster processing of claims and high transparency therefore, it holds a crucial place in the risk portfolio of those industries that face high environmental volatility and is driving high demand in the parametric insurance market.

Key drivers for this market are mounting natural disaster frequency and severity due to climate change, and increasing demand for quick financial recovery in agriculture, energy, construction, and tourism. Also, businesses are involving parametric insurance in their diversification strategy to manage rare. For instance, in September 2024, Tower, announced its partnership with CelciusPro to launch a trendsetting IT platform to streamline the parametric insurance distribution.

Key Parametric Insurance Market Insights Summary:

Regional Highlights:

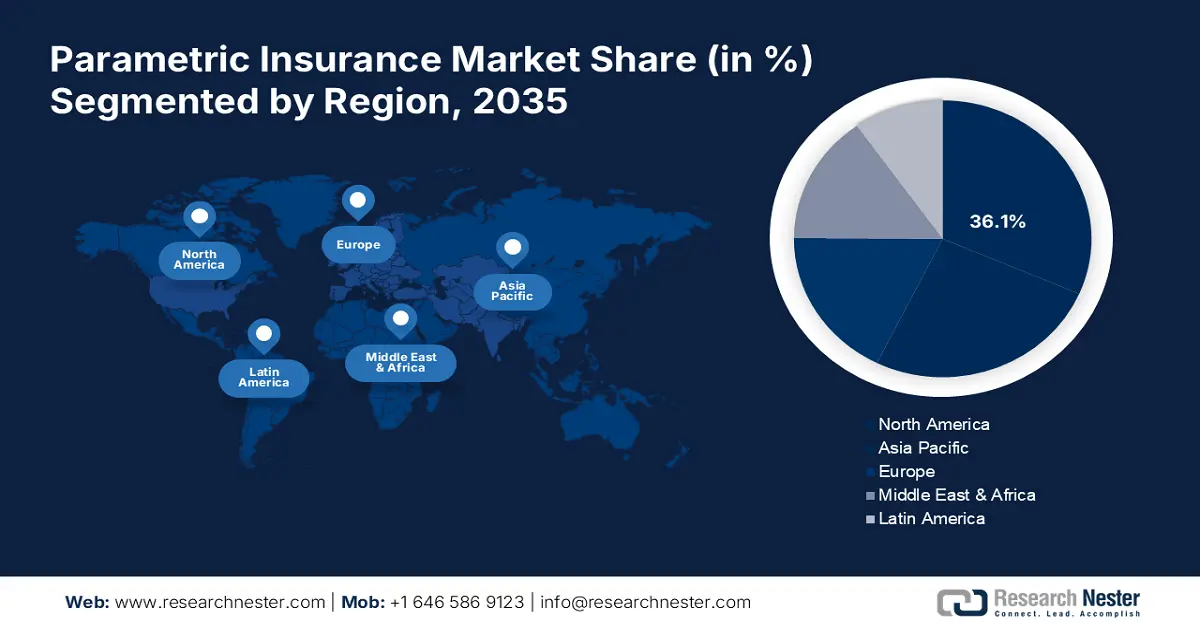

- North America parametric insurance market will account for 36.10% share by 2035, driven by technological progress, climate risks, and risk management needs.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by increasing disaster risk awareness and adoption of risk transfer solutions.

Segment Insights:

- The natural catastrophes segment in the parametric insurance market is expected to secure a 56.70% share by 2035, driven by increasing disaster risks and advancements in analytics and risk modeling.

- The corporates segment in the parametric insurance market is expected to experience rapid growth by 2026-2035, fueled by corporate needs for protection against disasters and business interruptions.

Key Growth Trends:

- Advanced technological innovations

- Increasing focus on risk management

Major Challenges:

- Changing guidelines and lack of standardization

- Limited data availability and insufficient structure

Key Players: Swiss Re Ltd., Munich Re, AXA SA, Allianz SE, Chubb Limited, Lloyd’s of London, Hiscox Ltd., Tokio Marine Holdings, Inc., Sompo Holdings, Inc., Beazley plc.

Global Parametric Insurance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.94 billion

- 2026 Market Size: USD 20.59 billion

- Projected Market Size: USD 47.8 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Japan, China

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Parametric Insurance Market Growth Drivers and Challenges:

Growth Drivers

- Advanced technological innovations: The cutting-edge technologies evolving in the parametric insurance market have significantly enhanced it to be more efficient, accurate, and customer-friendly. Advancements in data analytics and predictive modeling tools assisted by artificial intelligence (AI) and machine learning (ML) allow insurers to evaluate and manage risk more effectively. Applications of IoT sensors and devices enhance real-time monitoring of environmental conditions to respond to disaster events.

Blockchain technologies provide secure, transparent, and tamper-proof storage and transmission of data, thereby reducing the risks of cybersecurity. The use of geographic information systems and geospatial technology enhances risk mapping and assessment. These developments will empower real-time risk assessment, automated claims processing, and enhanced customer experience all with potential growth in the market. - Increasing focus on risk management: The market for parametric insurance is highly derived from the need for risk management owing to climatic changes, natural disasters, regulatory requirements, technological advancement, and growing demand for proactive risk management. This shift is fastening delivery in pay-outs, reducing administrative costs, and offering greater transparency leading to substantial market growth. Furthermore, rising awareness regarding the adoption across several domains such as agriculture, infrastructure, public sector, energy, and transportation is driving investments in advanced risk modeling, AI-powered underwriting, and data analytics to enhance their parametric insurance offerings and reliable solutions.

- Changing climatic conditions: As climate-related risks are escalating, the need for parametric insurance is experiencing lucrative growth opportunities. Additionally, the rising frequency and severity of natural disasters such as floods, wildfires, hurricanes, and earthquakes make the need for parametric insurance instrumental to mitigate risks. Other significant drivers are advancement in climate modeling, risk assessment activities, increasing adoption of parametric insurance platforms, and inclination towards sustainable infrastructure to cope with disasters. The growing research and development activities to discover innovative solutions to assess risks and climate modeling further advance the market growth.

Challenges

- Changing guidelines and lack of standardization: One of the challenges in the parametric insurance market is changing guidelines and standardization norms. This dynamic market environment requires incessant changes to emerging guidelines, regulations, and industry norms. Moreover, the growing demand for climate-resilient and sustainable insurance solutions, managing a rapidly evolving regulatory landscape, building and revising risk models with the associated assessment tools, and staying abreast of shifting norms in the marketplace collectively make it difficult to render authentic and enabled solutions.

- Limited data availability and insufficient structure: Data availability problems such as limited access to real-time data and insufficient data infrastructure and storage are key factors expected to hamper overall market growth. Additionally, the communication problems related to data collection, especially in remote or inaccessible areas, and reliance on third-party data suppliers, add to the challenges. Along with these, factors such as inaccurate risk evaluation and price dislodging, the increased risk of false or delayed payout, and the decline of customer trust and confidence can negatively affect market growth going ahead.

Parametric Insurance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 18.94 billion |

|

Forecast Year Market Size (2035) |

USD 47.8 billion |

|

Regional Scope |

|

Parametric Insurance Market Segmentation:

Coverage Segment Analysis

The natural catastrophes segment is expected to account for 56.7% share of the global parametric insurance market during the forecast period owing to the high frequency and severity of natural disasters, the economic costs of natural catastrophes, and government initiatives in terms of disaster risk management and resilience. In addition, advancements in data analytics and modeling, precision in risk assessment, and pricing are expected to fuel segment growth going ahead. Natural catastrophes are destructive, posing threats to economies and societies anywhere in the world, therefore, parametric insurance has an outstanding chance for dynamic growth.

End use Segment Analysis

The corporate segment in the parametric insurance market is anticipated to register rapid revenue growth during the forecast period. The probability of a natural catastrophe, a business interruption, or market volatility is high among corporation giants with heavy assets, complex supply chains, and international operations. These companies can tap into financial protection against the ravages of natural disasters and business interruptions through parametric insurance. With the ever-increasing complexity and interconnectivity of an increasingly complex risk landscape, parametric insurance appeals to corporations through certainty and resilience.

Our in-depth analysis of the parametric insurance market includes the following segments:

|

Coverage |

|

|

Distribution Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Parametric Insurance Market Regional Analysis:

North America Market Insights

North America industry is poised to hold largest revenue share of 36.1% by 2035. It has the highest growth parameters that drive the market, including the rising availability of parametric insurance models with high accuracy and reliability, along with technological progress and advanced data analytics. Moreover, the intensifying issue of climate change and its after-effects is compelling companies to look for new techniques of risk management in the region.

Companies are rapidly embracing parametric insurance to hedge the impact of climate-related risks to remain financially stable when lots of uncertainty faces an economy. Furthermore, the increased interest of regulatory bodies and the entry of insurance firms into the market has accelerated the growth of the parametric insurance market. The innovation developed by these entities along with the increasing availability of parametric products are making it more lucrative for the end users in the region

The U.S. parametric insurance market is expected to witness massive growth between 2026 and 2035 owing to the rising incidence of natural disasters, the presence of leading insurance companies providing parametric insurance, and rapid advancements in AI and data analytics that quickly assess risks and automate payouts. Insurers saw the costliest SCS year on record, with total claims exceeding USD 50 billion. Also, Florida is particularly vulnerable as it is a hurricane-prone area and the spiraling cost of insuring a property. The Insurance Information Institute claimed that in 2022, Florida residents paid an average of USD 4,231 in annual premiums, nearly three times the national average.

Asia Pacific Market Insights

The Asia Pacific is the fastest-growing region in the parametric insurance market, attributed to rising consciousness towards catastrophic risks, increasing demand for reliable risk management solutions, diverging infrastructure and economies of scale, and advancement in data analytics. Also, the region is prone to frequent and numerous natural disasters thus to compensate for the damage parametric insurance renders prompt financial compensation for these calamities.

Moreover, the government is encouraging risk transfer solutions to transform disaster resilience which further helps in mitigating the effect of natural disasters. The population in the region is inclining towards safe and secure options using parametric insurance as a tool as it is tailored with an innovative approach to a diverse range of clients. Thus, the demand for parametric insurance is likely to witness exponential growth by offering effortless financial relief.

The parametric market in India is expected to register rapid revenue growth during the forecast period owing to high susceptibility to natural disasters such as floods, earthquakes, and droughts in many parts of India, rising awareness about the importance of parametric insurance, and favorable government support. For instance, the government in association with General Insurance Corporation (GIC) has developed parametric and hydroelectric insurance pools to enhance the efficacy of disaster protection measures.

Parametric Insurance Market Players:

- AXA SA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AIG (American International Group)

- Berkshire Hathaway

- Lloyd's of London

- Nephila Capital

- Neptune Flood Incorporated

- Global Parametrics Limited

- Floodflash Limited

The parametric insurance market is highly competitive comprising several companies, operating and global and regional levels. These key players are transforming the parametric insurance market by addressing the associated risks and are providing reliable and customizable solutions to customers. These companies are focused on strategizing innovative methods such as mergers and acquisitions, partnerships, and joint ventures to edge over the competition and enhance their product base. Some leading companies fueling global parametric insurance market growth include:

Recent Developments

- In February 2024, MIC Global, a provider of embedded microinsurance solutions, partnered with WRMS Global, a leader in climate and agricultural risk management, to launch a flood resilience insurance product for India's gig economy workers and merchants.

- In June 2020, Global reinsurer Swiss Re helped Nagaland to secure parametric insurance for excess rainfall events that could result in devastating flooding. The parametric framework is designed to cover the entire state of Nagaland through six distinct zones, with a progressive payment system that ensures funds are allocated where losses occur and in proportion to the quantity of recorded rainfall, to match its impact.

- Report ID: 6467

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Parametric Insurance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.