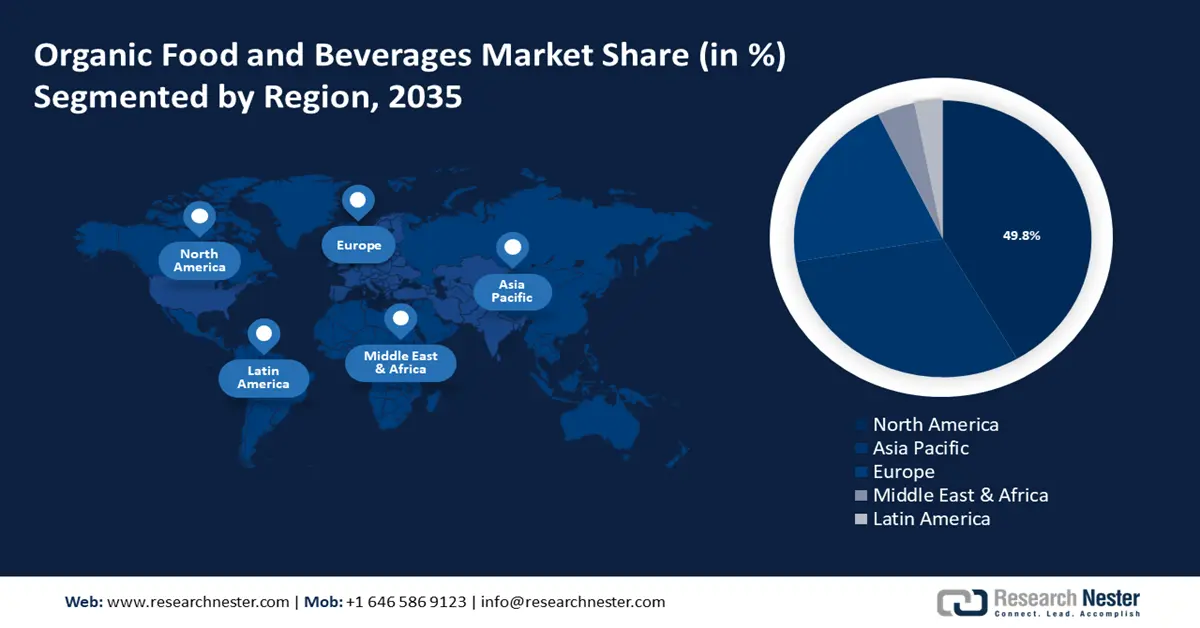

Organic Food and Beverages Market Regional Analysis:

North America Market Insights

North America industry is estimated to dominate majority revenue share of 49.8% by 2035, owing to rising public awareness and demands for organic food and beverages to supplement healthier living and increasing levels of disposable income allowing consumers to purchase premium organic products.

The U.S. is poised to remain the organic food and beverages market leader in North America. The demand for organic vegetables and fruits is considerably high in the country. As per a Research Nester report, in 2022, 30% of American customers preferred to buy organic over conventionally produced goods. The demand for organic meat is also growing in the country. For instance, in 2020, Craft Cow, renowned for organic meat announced a USD 8 million funding. Another marker of consumer preference for organic food and beverages in the U.S. is the Pew Research Center report that stated 73% of Americans preferred to buy locally grown food and vegetables while 44% bought food that was labeled as non-GMO free. These trends are expected to continue to drive the demand for organic products.

In Canada, the demand for organic products is rising owing to consumer awareness of health, growing calls for sustainability, and a high rate of import of organic products. As per an Export Development Canada report, the demand for organic products in Canada is growing at 8% annually. The farming of organic vegetables has grown in the country with Quebec accounting for three-quarters of certified organic vegetables. There is also a surge in the import of organic vegetables to Canada since the demand is surging more than the produce within the country. New product launches have been boosted due to consumer demand. For instance, in August 2024, Guru Organics released an organic Peach Mango Punch in Canada.

APAC Market Insights

Asia Pacific is projected to witness a massive surge in the organic food and vegetables market due to rising disposable incomes, improving the affordability of premium organic products, large population numbers, and increasing demand for organic produce due to wellness concerns.

India is the leading organic food producer in the world. The consumer base in India has a growing awareness of health which has boosted the demand for organic food along with a trend in consumer behavior to support local organic produce. In addition, there has been a sustained effort by the government to promote organic farming in the country. For instance, Paramparagat Krishi Vikas Yojana promotes organic farming with certification and monetary grants.

The startup ecosystem in the country has also seen the foray of new emerging players in the organic food and beverages market by leveraging the rich organic history of various regions. For instance, Diaspora Co. raised USD 2 million in financing in 2021. In 2022, NE Origins, a Sikkim-based startup raised USD 2 million pre-seed funding.

In China, the organic farming market is export-oriented with 28% of its agricultural land devoted to organic farming. Health is a key issue in China that boosts the demand for organic products. As per the U.S. Agricultural Trade Office in Guangzhou, most supermarkets in China have doubled floor space for organic goods.

Japan is a significant player in APAC that is poised to grow its revenue share during the forecast period, owing to increasing public awareness of organic products and a robust regulatory framework that ensures quality control. The government has focused on promoting organic consumption by planning to convert 1 million hectares of agricultural land to dedicated organic farming by 2050.

South Korea is a bourgeoning market, expected to steadily expand during the forecast period. The driving factors are a high focus on health and well-being and a call for ethical consumption by the millennial and Gen Z demographics. Key players in the market are focused on increasing their production and acquisitions to increase market share. For instance, in 2021, Maeil Dairies purchased land and assets from Corio Bay Dairy Group for USD 13.5 million.