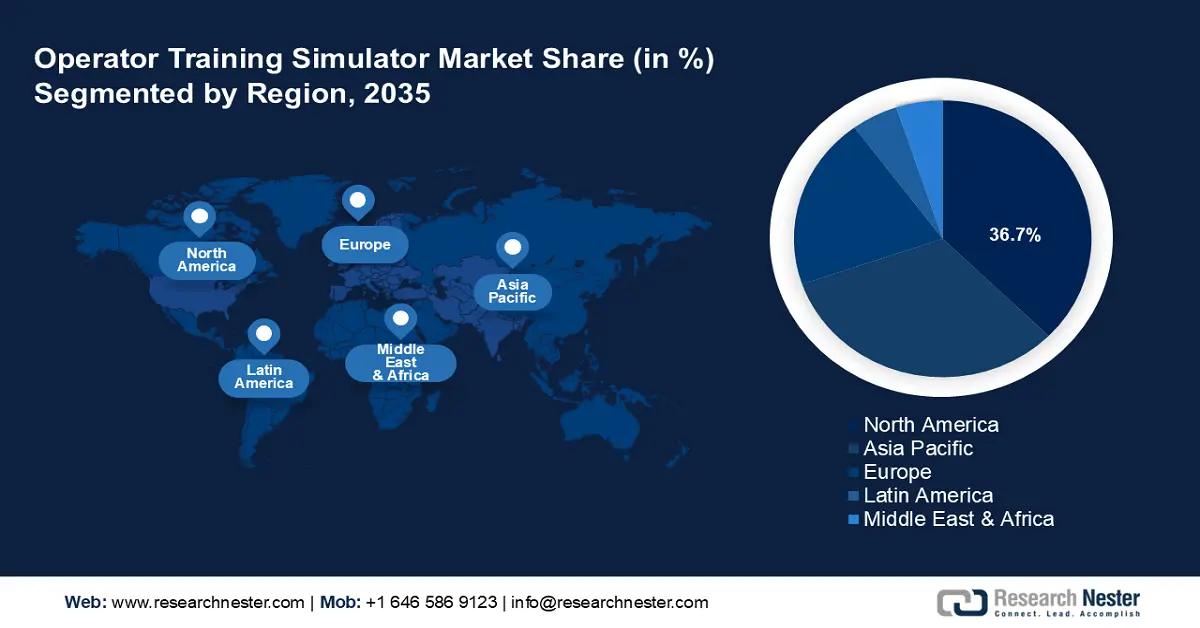

Operator Training Simulator Market Regional Analysis:

North America Market Forecast

North America operator training simulator market is predicted to dominate revenue share of over 36.7% by 2035. The region’s revenue share is led by the U.S. and Canada. The presence of a robust industrial infrastructure in the region drives demands for operator training simulations. The emphasis on worker safety and upskilling is poised to grow in the next decade owing to rising awareness. Additionally, the rise of cloud-based solutions providing simulation training services is projected to increase the reach of domestic businesses in North America. For instance, in February 2023, Ansys extended its long-term strategic collaboration with Microsoft to accelerate virtual product design via its cloud-based simulation solutions.

The U.S. is projected to account for the largest revenue share in the operator training simulator sector of North America. The presence of robust industries in the country creates multiple end-users for training simulation solutions providers. The surging demands from industries such as manufacturing, oil & gas, aerospace, healthcare, etc., are poised to create steady demands for operator training simulator solutions. For instance, in January 2024, CAE healthcare and GIGXR announced a strategic alliance to improve the efficiencies of multimodal training models for clinical simulation.

Additionally, the advent of AI, VR, and digital twins has heightened efficacies of simulation training models, boosting value-based pricing of the solutions. The trends indicate a profitable growth of the market in the U.S. by the end of the forecast period.

Canada is projected to increase its revenue share in the operator training simulator market of North America. A major growth driver in the country is the surging growth of renewable energy infrastructure in the country that necessitates training solutions for the workforce. For instance, in August 2024, the government of Canada reported wind energy and solar PV to be the fastest growing sources of electricity in the country. Businesses are positioned to leverage the opportunities by providing simulation solutions for wind farms and solar projects. For instance, in March 2022, Siemens announced collaboration with NVIDIA digital twin platform to simulate wind farms with physics-informed machine learning.

Additionally, government investment in workforce development programs, such as the Indigenous Workforce Development Stream, for indigenous communities in resource intensive regions, is poised to create new revenue streams for the OTS market.

APAC Market Analysis

APAC is projected to exhibit the fastest revenue growth in the operator training simulator sector. The operator training simulator market’s growth is owed to increasing industrialization across the region and rapid adoption of automation. The revenue share in APAC is led by China, India, Japan, and South Korea. Additionally, the region has positioned itself as a hub for manufacturing activities for various industries and remains an integral part of the global manufacturing supply chain, driving demands for effecting OTS solutions to upskill workforce.

Middle-and-low-income countries in APAC are investing to upgrade their defense sectors, and workforce to meet global standards. For instance, in June 2024, Meteksan announced export of damage control simulators to the navy of Indonesia.

China is poised to register the largest revenue share in the operator training simulator market of APAC. The growth of the market in China is owed to its robust manufacturing sector driving demands for workforce training simulators. Businesses are poised to leverage demands by providing effective simulation software as there is increasing investments on modernizing workforce. Additionally, the Make in China 2025 initiative is positioned to be a significant driver for OTS solutions as China seek to position itself in a dominant position in the global high-tech manufacturing sectors.

The rise of smart factories and electric vehicle manufacturing in China is positioned to amplify further demands for simulation-based training. For instance, in February 2024, BYD partnered with NTUC Learning Hub to launch an EV training simulation center.

India is projected to register a significant revenue share in the operator training simulator market of North America. Key market players in OTS market can leverage the profitable opportunities in India owing to growing industrial diversification and emphasis on skill development. The country is home to a large percentage of workforce and is on track to increase the workforce from 423.7 million to 457.6 million by 2028.

Additionally, government initiatives such as Skill India and Make in India, are poised to assist the growth of the operator training simulator market by promoting industrial growth and upskilling. For instance, in February 2024, a state-of-the-art skills lab was inaugurated at AIIMS Jodhpur and the advanced lab will include human patient simulator and virtual task trainers to improve practical skills, and clinical proficiency.