Operator Training Simulator Market Outlook:

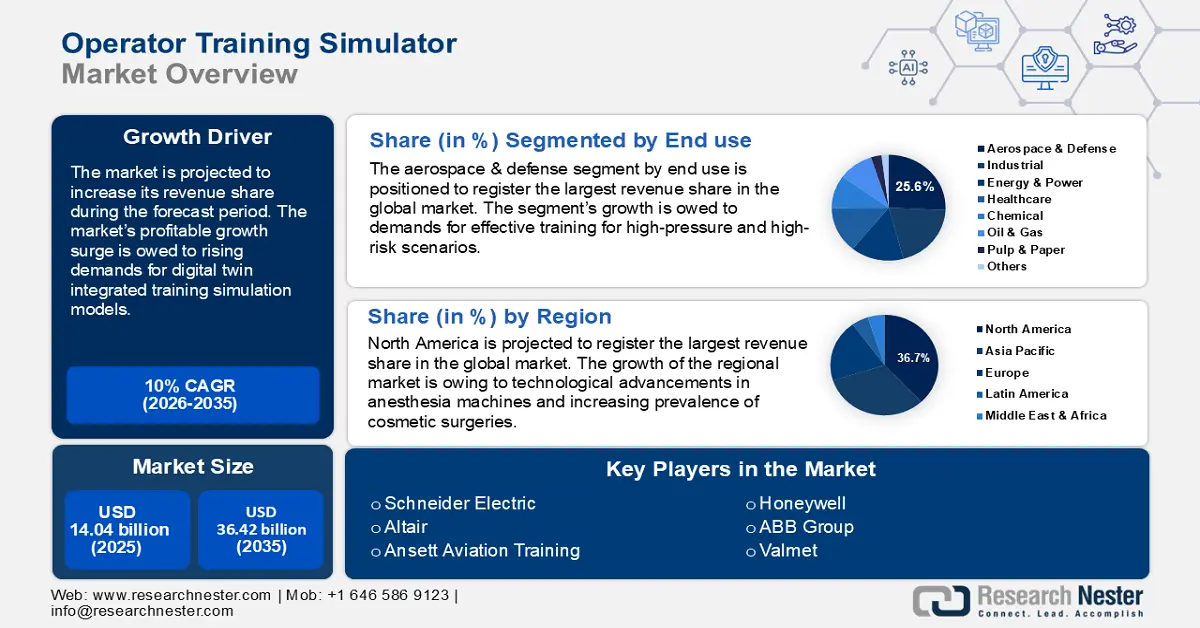

Operator Training Simulator Market size was valued at USD 14.04 billion in 2025 and is likely to cross USD 36.42 billion by 2035, expanding at more than 10% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of operator training simulator is assessed at USD 15.3 billion.

The growth of the OTS sector is attributed to industries prioritizing safety and skill development of workers. Industries are seeking to prioritize worker skill development over hiring new talents, owing to the cost-effectiveness of investing in internal skill development. Operator training simulators provide an effective solution to upskilling workers by providing risk-free environments for operators to gain hands-on experience.

Sectors such as manufacturing, oil & gas, healthcare, etc., are experiencing rapid adoption of automation that drives the need for worker training. This is fueling the adoption of OTS solutions as effective simulators replicating real-world scenarios. Businesses can cut down on operational risks by implementing OTS solutions by mimicking high-pressure situations for workers. Additionally, the advent of virtual reality (VR) and augmented reality (AR) boosts the realism of the simulators, benefiting the growth of the operator training simulator sector. For instance, in November 2022, Airbus announced the Virtual Procedure Trainer (VPT) that will allow trainees to practice procedures in a fully interactive cockpit to build procedural knowledge and muscle memory. The company announced Lufthansa group as its first customer for VPT.

The operator training simulator market is poised to provide profitable revenue opportunities for global and local businesses. With the increased traction for cloud-based deployment models, small and medium-sized enterprises (SMEs) are set to benefit from cost-effective training solutions and avoid incurring significant costs from investments in physical infrastructure. The integration of machine learning (ML) into OTS platforms allows accurate analysis of operator performance and customize individual training sessions if necessary. Additionally, new revenue streams in emerging economies in Africa and APAC are poised to benefit the sector’s growth. For instance, in September 2024, Ansett Aviation Training (AAT) announced that its training centers have the capability to support African operators with Airbus A320, ATR600, or Boeing B737NG training infrastructure.

Key Operator Training Simulator Market Insights Summary:

Regional Highlights:

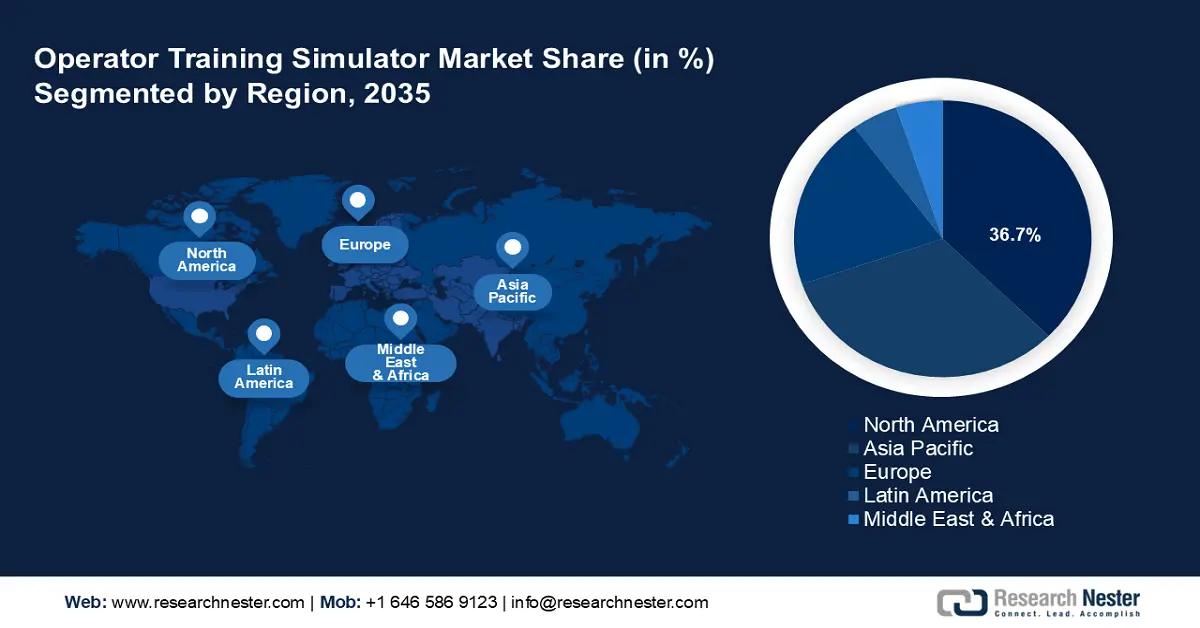

- North America dominates the Operator Training Simulator Market with a 36.7% share, supported by robust industrial infrastructure and rising emphasis on worker safety, driving growth through 2026–2035.

- The APAC operator training simulator market is set for the fastest growth by 2035, attributed to increasing industrialization and rapid adoption of automation.

Segment Insights:

- The component segment is set for substantial growth from 2026-2035, due to surging demands for its ability to replicate real-world environments.

- The aerospace & defense segment is projected to hold over 25.6% market share by 2035 due to rising need for precision and safety in high-risk environments necessitates advanced training simulator models for the defense & aerospace sector.

Key Growth Trends:

- Rise of digital twin technology

- Adoption of cloud-based training solutions

Major Challenges:

- Customization complexity for diverse industries

- Technological advancements outpacing adoption

- Key Players: Schneider Electric, Altair, Ansett Aviation Training, Airbus, Honeywell, Siemens, Aveva Group PLC, ABB Group, Andritz Automation, Nippon Yuisha.

Global Operator Training Simulator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.04 billion

- 2026 Market Size: USD 15.3 billion

- Projected Market Size: USD 36.42 billion by 2035

- Growth Forecasts: 10% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Operator Training Simulator Market Growth Drivers and Challenges:

Growth Drivers

-

Rise of digital twin technology: The growth of the digital twin sector is expected to drive the operator training simulator market by positioning surge in adoption of digital twin OTS training models by creating highly accurate replicas of physical systems. For instance, in March 2022, ETAP and Schneider Electric announced the integration of EcoStruxure Power Operation with ETAP Operator Training Simulator, thereby significantly reducing operational risks. Additionally, the technology facilitates predictive analysis, helping trainees anticipate potential challenges and practice responses accordingly.

Sectors such as aerospace, automotive, energy, etc., can benefit from reduced downtimes and improved training outcomes. Key players operating in the operator training simulator market can promote digital twin OTS solutions in business to business (B2B) settings to increase adoption rates. - Adoption of cloud-based training solutions: The rising popularity of cloud-based training solutions creates a fertile ground for expansion of the operator training simulator sector. Cloud-based solutions improve scalability and cost-effectiveness, improving access to small and medium-sized businesses (SMEs). Improvements in accessibility create more end users for the operator training simulator market, boosting revenue streams. Cloud-based solutions facilitate training modules remotely, eliminating requirements for businesses to invest in on-site infrastructure.

The surging growth of software-as-a-service enterprises is poised to improve operator training simulator models. Additionally, cloud-based training simulators facilitate training of multiple operators across various geographic locations and can ensure regular updates in training content to maintain relevancy. For instance, in August 2024, Rackspace Technology introduced Rackspace Lab Services (RLS), i.e., a cutting-edge cloud software as a service (SaaS) solution for training, testing, and demonstration environments catering to organizations worldwide. - Advancements in VR and AR technologies: The operator training simulator market is positioned to benefit from advancements in AR and VR technologies. The integration of these technologies creates immersive and interactive training experiences, enabling optimum skill development of trainees. Active engagement with ultra-realistic 3D environments allows employees in defense, aerospace, and healthcare sectors to better understand high-risk scenarios. Additionally, industries seek to recapture lost experience due to retirement of tenured workforce and interactive VR and IR integrated OTS solutions are poised to benefit the mobile-first generation of the industrial workforce.

Businesses are actively leveraging AR and VR integration in training simulator models driving demands for advanced OTS solutions. For instance, in February 2024, Honeywell announced the integration of augmented reality in its immersive field simulator (IFS) to provide targeted, on-demand training for the industrial workforce.

Challenges

-

Customization complexity for diverse industries: Operator training simulators must cater to the unique operational requirements of diverse industries. Operators cannot develop standardized training simulator models for diverse industries, and creating customized solutions aligned with diverse workflows requires expertise and considerable effort. The complexity can delay the timelines of implementation and drive costs, potentially delaying adoption of OTS solutions.

-

Technological advancements outpacing adoption: The operator training simulator market benefits from rapid technological advancements, but the market can face challenges if the advancements outpace the rate of adoption. In such cases, OTG training modules can become obsolete. Key market players must invest to keep customized training simulator modules updated with the surging advancements in various industrial sectors.

Operator Training Simulator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 14.04 billion |

|

Forecast Year Market Size (2035) |

USD 36.42 billion |

|

Regional Scope |

|

Operator Training Simulator Market Segmentation:

End use (Aerospace & Defense, Industrial, Energy & Power, Healthcare, Chemical, Oil & Gas, Pulp & Paper, Others)

Aerospace & defense segment is anticipated to dominate around 25.6% operator training simulator market share by the end of 2035. The surging need for precision and safety in high-risk environments necessitates advanced training simulator models for the defense & aerospace sector. OTS solutions integrated with VR is being adopted extensively to train pilots, ground crew, and military personnel. Realistic simulations of aircrafts and combat scenarios minimizes operational risks significantly, and improves workforce skill.

Additionally, the OTS sector finds multiple revenue streams within the aerospace & defense sector to offer advanced training modules. For instance, astronaut training, commercial & military aviation training, and aircraft logistics training are experiencing growing adoption of training simulator models. The current operator training simulator market trends position businesses to leverage the surging demands by providing simulation services. For instance, in August 2024, Airways International Ltd., signed a three-year contract with the air navigation service provide (ANSP) air services Australia for air traffic control simulation service.

The industrial segment of the operator training simulator market is projected to increase its revenue share by the end of the forecast period. The growth is fueled by surging adoption of automation and upgraded machinery across multiple industries. Worker safety concerns necessitate adoption of efficient training simulator models, while investing in upskilling ensures industries can considerably reduce operational downtimes.

Additionally, operators can gain hands-on experience in troubleshooting and optimizing operations without disrupting workflows, boosting increased adoption of OTS models. For instance, in June 2024, Transfr Inc., announced the results of their efficacy studies based on VR-based training solutions in healthcare training, and indicated that learning gains of trainees using VR model were significantly higher than those who used read-only slide presentations.

Component (Hardware, Services)

By component, the hardware segment of the operator training simulator market is positioned to increase its revenue share during the forecast period. Immersive simulation hardware is experiencing surging demands for its ability to replicate real-world environments. Control simulators within the hardware segment allow operators to train on an interactive platform and boost ability to manage equipment seamlessly.

Additionally, process simulators are experiencing growing demands to simulate industrial workflows and improve troubleshooting training. The segment is positioned to assist the robust growth of the operator training simulator market by mimicking on-site conditions for effective training for a significantly large percentage of workforce. Businesses are set to leverage the surging demands by expanding their simulation portfolios. For instance, in September 2022, Altair announced the release of simulation 2022.1 software update that will reduce errors in design lifecycle, saving both time and money.

Our in-depth analysis of the global operator training simulator market includes the following segments:

|

End use |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Operator Training Simulator Market Regional Analysis:

North America Market Forecast

North America operator training simulator market is predicted to dominate revenue share of over 36.7% by 2035. The region’s revenue share is led by the U.S. and Canada. The presence of a robust industrial infrastructure in the region drives demands for operator training simulations. The emphasis on worker safety and upskilling is poised to grow in the next decade owing to rising awareness. Additionally, the rise of cloud-based solutions providing simulation training services is projected to increase the reach of domestic businesses in North America. For instance, in February 2023, Ansys extended its long-term strategic collaboration with Microsoft to accelerate virtual product design via its cloud-based simulation solutions.

The U.S. is projected to account for the largest revenue share in the operator training simulator sector of North America. The presence of robust industries in the country creates multiple end-users for training simulation solutions providers. The surging demands from industries such as manufacturing, oil & gas, aerospace, healthcare, etc., are poised to create steady demands for operator training simulator solutions. For instance, in January 2024, CAE healthcare and GIGXR announced a strategic alliance to improve the efficiencies of multimodal training models for clinical simulation.

Additionally, the advent of AI, VR, and digital twins has heightened efficacies of simulation training models, boosting value-based pricing of the solutions. The trends indicate a profitable growth of the market in the U.S. by the end of the forecast period.

Canada is projected to increase its revenue share in the operator training simulator market of North America. A major growth driver in the country is the surging growth of renewable energy infrastructure in the country that necessitates training solutions for the workforce. For instance, in August 2024, the government of Canada reported wind energy and solar PV to be the fastest growing sources of electricity in the country. Businesses are positioned to leverage the opportunities by providing simulation solutions for wind farms and solar projects. For instance, in March 2022, Siemens announced collaboration with NVIDIA digital twin platform to simulate wind farms with physics-informed machine learning.

Additionally, government investment in workforce development programs, such as the Indigenous Workforce Development Stream, for indigenous communities in resource intensive regions, is poised to create new revenue streams for the OTS market.

APAC Market Analysis

APAC is projected to exhibit the fastest revenue growth in the operator training simulator sector. The operator training simulator market’s growth is owed to increasing industrialization across the region and rapid adoption of automation. The revenue share in APAC is led by China, India, Japan, and South Korea. Additionally, the region has positioned itself as a hub for manufacturing activities for various industries and remains an integral part of the global manufacturing supply chain, driving demands for effecting OTS solutions to upskill workforce.

Middle-and-low-income countries in APAC are investing to upgrade their defense sectors, and workforce to meet global standards. For instance, in June 2024, Meteksan announced export of damage control simulators to the navy of Indonesia.

China is poised to register the largest revenue share in the operator training simulator market of APAC. The growth of the market in China is owed to its robust manufacturing sector driving demands for workforce training simulators. Businesses are poised to leverage demands by providing effective simulation software as there is increasing investments on modernizing workforce. Additionally, the Make in China 2025 initiative is positioned to be a significant driver for OTS solutions as China seek to position itself in a dominant position in the global high-tech manufacturing sectors.

The rise of smart factories and electric vehicle manufacturing in China is positioned to amplify further demands for simulation-based training. For instance, in February 2024, BYD partnered with NTUC Learning Hub to launch an EV training simulation center.

India is projected to register a significant revenue share in the operator training simulator market of North America. Key market players in OTS market can leverage the profitable opportunities in India owing to growing industrial diversification and emphasis on skill development. The country is home to a large percentage of workforce and is on track to increase the workforce from 423.7 million to 457.6 million by 2028.

Additionally, government initiatives such as Skill India and Make in India, are poised to assist the growth of the operator training simulator market by promoting industrial growth and upskilling. For instance, in February 2024, a state-of-the-art skills lab was inaugurated at AIIMS Jodhpur and the advanced lab will include human patient simulator and virtual task trainers to improve practical skills, and clinical proficiency.

Key Operator Training Simulator Market Players:

- Schneider Electric

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Altair

- Ansett Aviation Training

- Airbus

- Honeywell

- Valmet

- Siemens

- Aveva Group PLC

- ABB Group

- Andritz Automation

The global operator training simulator market is poised to increase its revenue share during the forecast period. Key players in the market are investing to expand simulation portfolio and AI integrated training simulation models as B2B solutions.

Here are some key players in the operator training simulator market:

Recent Developments

- In November 2024, Loft Dynamics launched a suite of new features for VR flight simulation and training. The flight simulation training suite is poised to address global pilot shortage and reduce high rates of training related mishaps.

- In November 2024, Nationwide Platforms incorporated an advanced virtual reality training technology into its practice designed to improve on-site safety and operator convenience. The VR Simulator offers 23 task-specific scenarios focused on working around aircraft, including modules on APU bay-access, crown and tail access, doors access, etc.

- Report ID: 6793

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Operator Training Simulator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.