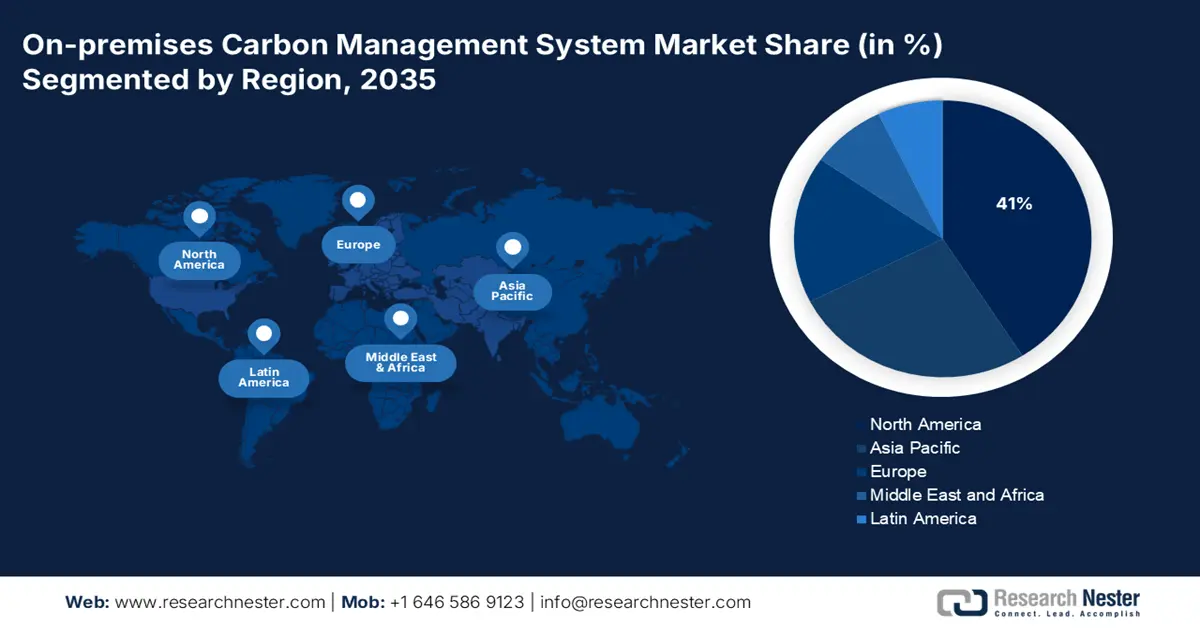

On-premises Carbon Management System Market - Regional Analysis

North America Market Insights

North America on-premises carbon management system market is set to dominate revenue share of around 41% by the end of 2035. Strategic management of corporate sustainability has driven the growth of this region. Organizations such as data centers have paved the path of cost savings by utilizing these carbon-controlling tools. Consumers now utilize its energy efficiency and waste reduction features while managing CO2 emissions. Industries including manufacturing, energy, and transportation are also adopting these solutions to manage their increased carbon footprints. According to a 2022 EPA report, the United States was one of the top 10 countries, representing 67% of total greenhouse gas emissions in 2020.

The U.S. consolidates a leading position in the market and is expected to offer lucrative opportunities. According to a report published by the DOE in April 2023, the U.S. requires an annual 400 to 1,800 Mt CO2 storage capacity. It has the potential to offer around USD 600 billion worth of investment opportunities to meet the energy transition goal by 2050. Further, improvement in data analytics and software abilities is enhancing carbon management systems to support this surge.

Canada has set a steady future growth in the market by standardizing these tools for effective usage. Research institutions such as IISD are paving the scope of R&D in this sector. In January 2024, IISD released VSICMs for implementation in private companies, NGOs, and universities. The voluntary measures can guide the sector-specific tools to deliver accuracy in application. Moreover, these initiatives influence service providers to incorporate new technologies for more efficient carbon emission reporting.

APAC Market Insights

The Asia Pacific on-premises carbon management system market is estimated to grow faster during the forecast period. Increased regulatory pressure and CO2 impact on climate change have prompted businesses to adopt these emission controls. The massive use of coal to produce energy has increased GHG emissions. According to a 2022 IEA report, the developing economies in Asia witnessed a 4.2% increment in emissions. In the same year, half of the region’s intensity came from coal-powered facilities. Heavy investments in building clean energy sources require carbon monitoring systems. These tools help renewable power generators to keep track of energy utility and CO2 footprint.

The energy transition in India is majorly increasing awareness about carbon management. This further influenced concerned authorities to invest in the market. Adoption from the country’s big IT leaders including TCS and Wipro is encouraging other industries to explore the benefits of these tools. Government initiatives have helped to dilute the economic barrier to implementation in small and medium-sized enterprises. Continued technological advancements such as machine learning, AI, cloud, and IoT are also contributing to enhancing the overall performance of such systems.

The high carbon density in China is driving notable growth in the market. Government efforts to decline carbon emissions have influenced companies to invest in development in this sector. The country is now proactively drafting plans and projects to achieve net-zero targets. For instance, in May 2024, the Ministry of Ecology and Environment announced its plan to build a unified carbon management system. This program aims to standardization of 100 key products by 2027 and 200 by 2030. Moreover, China is aiming to participate in the carbon emission trading market by developing innovative emission reduction mechanisms.