On-premises Carbon Management System Market Outlook:

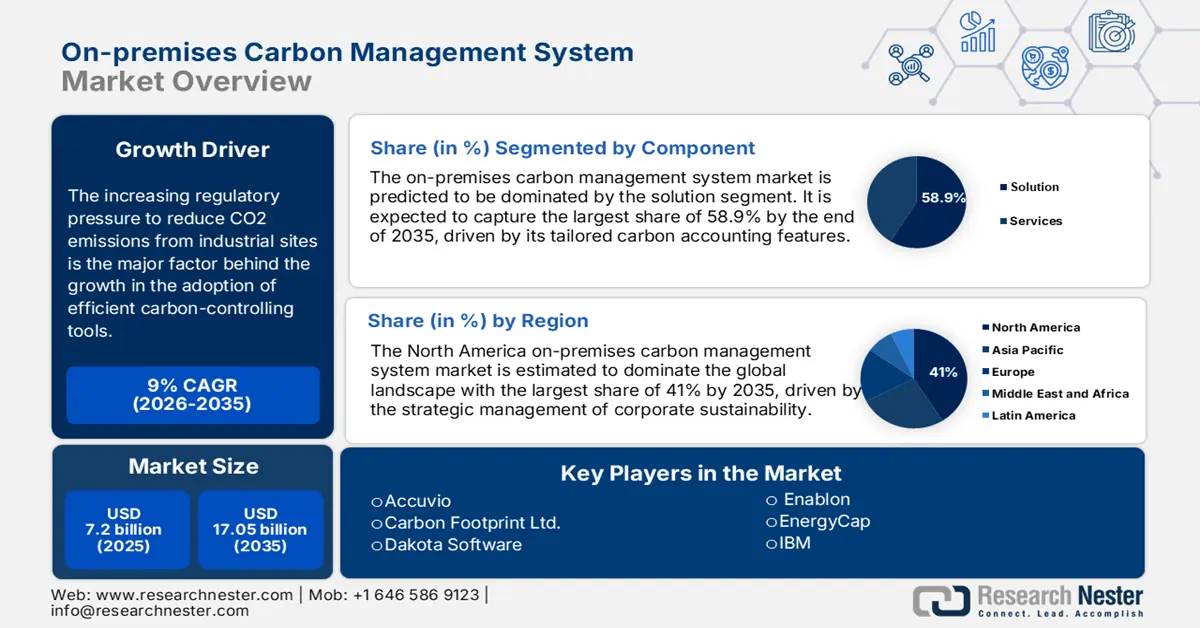

On-premises Carbon Management System Market size was valued at USD 7.2 billion in 2025 and is set to exceed USD 17.05 billion by 2035, registering over 9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of on-premises carbon management system is estimated at USD 7.78 billion.

The increasing regulatory pressure to reduce CO2 emissions from industrial sites is the major factor behind the growth. The effects of greenhouse gases on the environment are resulting in global warming and other natural disasters. The amount of GHG emissions from industrial and commercial sites is concerning. According to an IEA report published in March 2023, global energy-related carbon emissions grew by 0.9% in 2022.

Many heavy metal industries and other hard-to-avoid carbon emission sectors are positively responding to government policies. This further creates demand for the on-premises carbon management system market. The benefits of implementing such technologies are inspiring more companies to invest in this sector. Additionally, it creates the opportunity for innovation to improve outcomes. The strict standardization of carbon emissions is pushing organizations to adopt effective management solutions. The revised ISO 14060 family of standards released voluntary guidelines, mandating efficient management and reduction of GHG emissions. The document also determined the baseline for organization-level monitoring, quantifying, and reporting of project emissions.

Key On-premises Carbon Management System Market Insights Summary:

Regional Highlights:

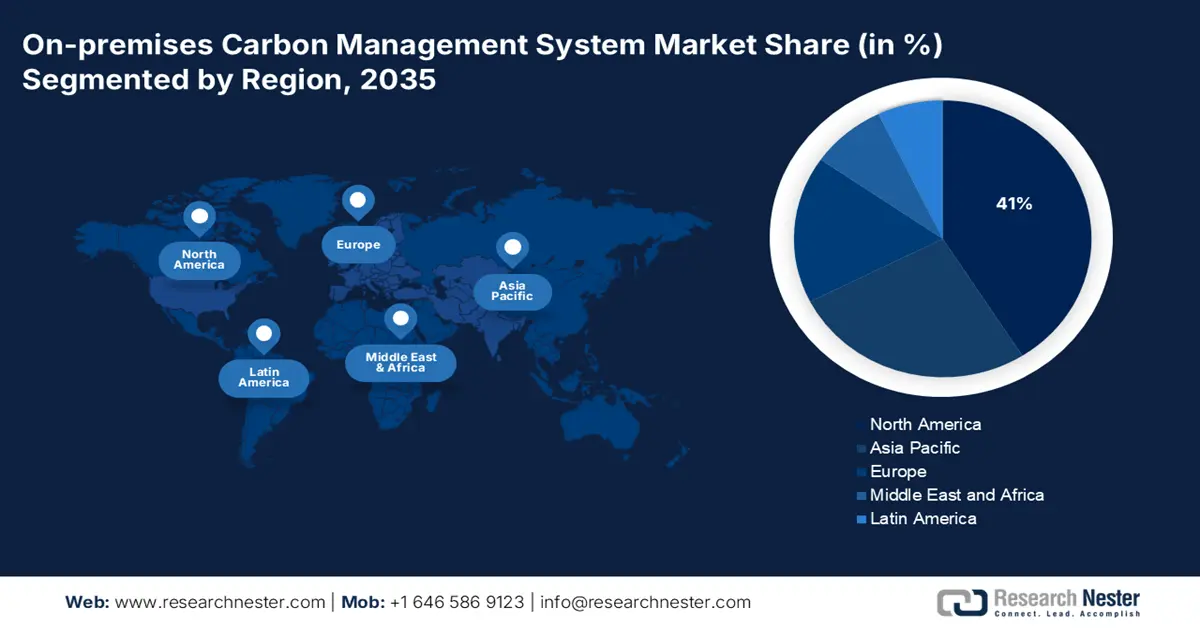

- By 2035, North America is poised to command nearly 41% share of the on-premises carbon management system market, upheld by the strategic management of corporate sustainability initiatives.

- By 2035, the Asia Pacific region is anticipated to expand at the fastest pace, encouraged by rising regulatory pressure and the climate impact of CO₂ emissions.

Segment Insights:

- By 2035, the solution segment is projected to capture over 58.9% share of the on-premises carbon management system market, propelled by tailored carbon accounting features.

- By 2035, the energy & utilities segment is expected to record substantial growth, supported by escalating emission levels in energy production.

Key Growth Trends:

- Ambitious goal of achieving net zero carbon

- Technological advancements

Major Challenges:

- Expensive installation

- Shortage of skilled operators

Key Players: Accuvio, Carbon Footprint Ltd., Dakota Software, Enablon, EnergyCap, Engie, Enviance, Envirosoft, ESP, IBM, Intelex, Isometrix, Locus Technologies, NativeEnergy, Salesforce, SAP, Schneider Electric, Trinity Consultants.

Global On-premises Carbon Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 17.05 billion by 2035

- Growth Forecasts: 9%

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Australia, United Arab Emirates

Last updated on : 2 December, 2025

On-premises Carbon Management System Market - Growth Drivers and Challenges

Growth Drivers

-

Ambitious goal of achieving net-zero carbon: The goal of the on-premises carbon management system market is to achieve zero carbon in every sector. The robust solutions can effectively track, analyze, and report emissions. This further helps organizations mitigate climate change and corporate sustainability. The enhanced control and management tools can facilitate carbon reduction and performance monitoring at the same time. Such transparent reporting practices improve the environmental impact of businesses to meet regulatory alignment and stakeholder expectations. Government strategies to obtain sustainability across the supply chain also drive demand for comprehensive solutions.

-

Technological advancements: Integration of IoT and AI technologies has simplified the user interface of these managing systems. This further influences the landscape of the market. Features such as real-time data collection and top-notch security make organizations strive for these solutions. Service providers are developing cloud-based monitoring tools to offer automotive and cost-effective on-premise facilities. This further, increases the adoption of new technologies by consumers for precise carbon management. For instance, in July 2023, IBM launched a Cloud Carbon Computer for organizations to compute and address GHG emissions. The AI-powered dashboard of the tool helps to access accurate emission data.

Challenges

-

Expensive installation: The initial cost of implementation on-premises requires significant upfront investment. The additional expense of infrastructure and technology may refrain organizations from adoption. Further, restricts growth progress in the market. Up-scaling the solutions for a larger data set demands the integration of new technologies. This can further add to the operational budget, forcing consumers to switch to affordable cloud-based alternatives.

-

Shortage of skilled operators: The complex IT operations need skilled professionals to handle data. Often it becomes difficult to find such personnel with an understanding of both carbon management and technical aspects. This may further refrain organizations from investing in the market. Being up-to-date according to the evolving technologies may become challenging for technicians, who are used to traditional methods. This may hamper the proper utilization of these systems.

On-premises Carbon Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9% |

|

Base Year Market Size (2025) |

USD 7.2 billion |

|

Forecast Year Market Size (2035) |

USD 17.05 billion |

|

Regional Scope |

|

On-premises Carbon Management System Market Segmentation:

Component Segment Analysis

In terms of components, solution segment is expected to account for more than 58.9% on-premises carbon management system market share by the end of 2035. The growth of this segment is driven by its tailored carbon accounting features, designed to address specific needs. These automated reporting solutions can easily integrate with the existing ERP and supply chain of the business. For instance, in June 2022, Alibaba Cloud launched Energy Expert, providing actionable insights and energy-saving suggestions. The data management software also facilitates compliance with regulations and standards. Further, accumulating consumer preference for maximum adoption. Solutions that come along with training and supportive services are more in demand for their hassle-free experience.

Industry Segment Analysis

Based on industry, the on-premises carbon management system market is estimated to witness remarkable growth in the energy & utilities segment. Increased emission rates in energy production are driving the demand for effective controlling tools. According to an IEA report, the global energy-related CO2 emission accounted for a new record of 37.4 Gt in 2023. 65% of the increase was due to coal usage during power generation. Thus, it is evident that this segment has the potential to generate remarkable revenue for carbon emission tools. Advanced EMS solutions can also optimize energy usage and efficiency across utility operations. This further helps reduce the carbon footprint.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

On-premises Carbon Management System Market - Regional Analysis

North America Market Insights

North America on-premises carbon management system market is set to dominate revenue share of around 41% by the end of 2035. Strategic management of corporate sustainability has driven the growth of this region. Organizations such as data centers have paved the path of cost savings by utilizing these carbon-controlling tools. Consumers now utilize its energy efficiency and waste reduction features while managing CO2 emissions. Industries including manufacturing, energy, and transportation are also adopting these solutions to manage their increased carbon footprints. According to a 2022 EPA report, the United States was one of the top 10 countries, representing 67% of total greenhouse gas emissions in 2020.

The U.S. consolidates a leading position in the market and is expected to offer lucrative opportunities. According to a report published by the DOE in April 2023, the U.S. requires an annual 400 to 1,800 Mt CO2 storage capacity. It has the potential to offer around USD 600 billion worth of investment opportunities to meet the energy transition goal by 2050. Further, improvement in data analytics and software abilities is enhancing carbon management systems to support this surge.

Canada has set a steady future growth in the market by standardizing these tools for effective usage. Research institutions such as IISD are paving the scope of R&D in this sector. In January 2024, IISD released VSICMs for implementation in private companies, NGOs, and universities. The voluntary measures can guide the sector-specific tools to deliver accuracy in application. Moreover, these initiatives influence service providers to incorporate new technologies for more efficient carbon emission reporting.

APAC Market Insights

The Asia Pacific on-premises carbon management system market is estimated to grow faster during the forecast period. Increased regulatory pressure and CO2 impact on climate change have prompted businesses to adopt these emission controls. The massive use of coal to produce energy has increased GHG emissions. According to a 2022 IEA report, the developing economies in Asia witnessed a 4.2% increment in emissions. In the same year, half of the region’s intensity came from coal-powered facilities. Heavy investments in building clean energy sources require carbon monitoring systems. These tools help renewable power generators to keep track of energy utility and CO2 footprint.

The energy transition in India is majorly increasing awareness about carbon management. This further influenced concerned authorities to invest in the market. Adoption from the country’s big IT leaders including TCS and Wipro is encouraging other industries to explore the benefits of these tools. Government initiatives have helped to dilute the economic barrier to implementation in small and medium-sized enterprises. Continued technological advancements such as machine learning, AI, cloud, and IoT are also contributing to enhancing the overall performance of such systems.

The high carbon density in China is driving notable growth in the market. Government efforts to decline carbon emissions have influenced companies to invest in development in this sector. The country is now proactively drafting plans and projects to achieve net-zero targets. For instance, in May 2024, the Ministry of Ecology and Environment announced its plan to build a unified carbon management system. This program aims to standardization of 100 key products by 2027 and 200 by 2030. Moreover, China is aiming to participate in the carbon emission trading market by developing innovative emission reduction mechanisms.

On-premises Carbon Management System Market Players:

- Accuvio

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carbon Footprint Ltd.

- Dakota Software

- Enablon

- EnergyCap

- Engie

- Enviance

- Envirosoft

- ESP

- IBM

- Intelex

- Isometrix

- Locus Technologies

- NativeEnergy

- Salesforce

- SAP

- Schneider Electric

- Trinity Consultants

The on-premises carbon management system market is shifting towards automation to compete with digital services. Industry leaders are now integrating advanced data processing systems to deliver timely and accurate reports. Tech companies are now focusing on building platforms to support on-premises operations. In September 2024, RESET Carbon and Sweep partnered to provide innovative software for the corporate sector of Asia. The SaaS technology is aimed to offer efficient management of carbon emissions with enhanced navigation and compliance. Such innovations are helping businesses achieve carbon neutrality, influencing them to invest more in this sector. These key players include:

Recent Developments

- In September 2024, Schneider Electric launched the Building Decarbonization Calculator to help building owners reduce their carbon footprint. The in-house tool possesses around 500,000 building performance models to deliver compared data with CRREM pathways.

- In June 2023, IBM Turbonomic launched an energy and carbon emission tool for businesses. Its on-premises host and virtual machines help to track the carbon footprint of IT applications.

- Report ID: 6637

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

On-premises Carbon Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.