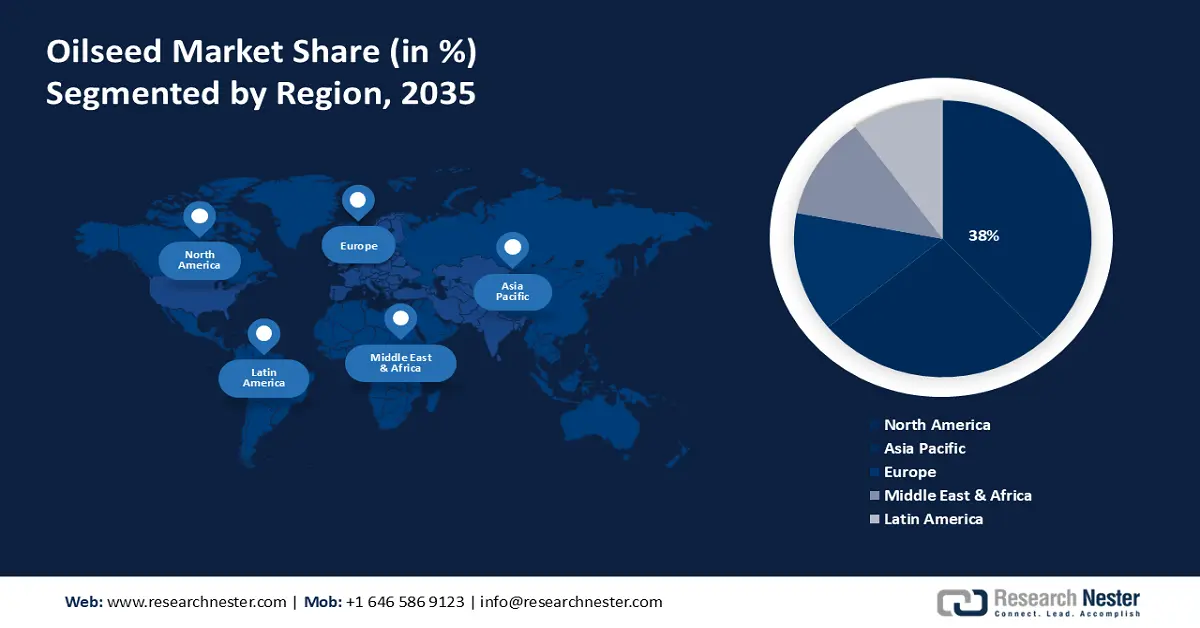

Oilseed Market Regional Analysis:

North America Market Insights

North America industry is estimated to hold largest revenue share of 38% by 2035. The U.S. Department of Agriculture estimated in 2024, the farm output of the U.S. increased by about 190% between 1948 to 2021.

In the U.S., there is an increasing demand for cooking oil which demands high oilseed production. A report by Research Nester in 2024, that soybean oil was the most used edible oil in the United States in 2023, wherein Americans consumed about 12.3 million metric tons of soybean oil and about 1.9 million metric tons of palm oil in 2023.

A 2024 report by Farm Credit Canada states that the preference for oilseed is increasing and was estimated to show a gain of about 7.8% between 2014 and 2018. Canada is a major producer and the largest exporter of rapeseed. As per the Organization for Economic Cooperation and Development (OECD) estimations, Canada is set to increase its oilseed production by a CAGR of 1.2% by 2030.

APAC Market Insights

Asia Pacific in oilseed market is set to dominate around 30% revenue share by the end of 2035, and will account for the second position owing to the growing food industry. Research by Leatherhead Food Research in 2020 stated that the food and beverage industry in APAC increased, with a CAGR of about 11% from 2020 to 2024. The vegetable oil aggregate includes coconut, palm kernel, and cottonseed oils. Coconut oil is primarily produced in the Indonesia, and Oceanic islands, and the Philippines.

In China, there has been an increase in soybean production as per a MPDI released a report in 2022. It stated that the soybean production increased to 18 million tons in 2019 from 5.11 million tons in 1949 with a substantial growth rate of 3.63%. China accounts for more than a quarter of global protein meal demand and is therefore shaping global demand development. Growth in China’s demand for compound feed is expected to be slower than in the previous decade due to declining growth rates for animal production and the existing large share of compound feed-based production. The protein meal content in China’s compound feed is expected to remain stable as it surged in the last decade and considerably exceeds at present the levels of the United States and the European Union. As pig herds are being rebuilt in China following the outbreak of ASF, larger scale feed-based production systems have been installed. This could lead to an additional shift in demand for protein meal due to further intensification of the Chinese pigmeat production.

Japan is predicted to have the highest health-related food industry and was credited to be the third largest globally by USDA Foreign Agriculture Service in 2020, which is expected to be about USD 13 billion in 2018. Additionally, the ever-increasing food manufacturing landscape coupled with the fast-paced busy lifestyle is also expected to act as a growth factor for oilseed market.