Oilseed Market Outlook:

Oilseed Market size was over USD 268.53 billion in 2025 and is poised to exceed USD 401.33 billion by 2035, witnessing over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oilseed is estimated at USD 278.44 billion.

The oilseed market is driven by the rising consumption of vegetable oil. Per capita consumption of vegetable oil is set to grow at 0.8% per annum due to increasing demand for saturated foods in developed and emerging countries. China’s present consumption is 29 kg per capita and Brazil's is 26 kg per capita, which is comparable to those of developed countries where it has leveled off at 28 kg per capita, but growing at 0.3% per annum. India is the world’s number one importer and second-largest consumer of vegetable oil. The country is projected to observe a high per capita consumption rate of 2.6%, reaching 14 kg by 2030. This is expected to boost domestic production of crushed oilseed and palm oil imports mainly from Indonesia and Malaysia. Changes in dietary habits and a shift toward processed foods with a high content of vegetable oil are fostering market expansion.

Key Oilseed Market Insights Summary:

Regional Highlights:

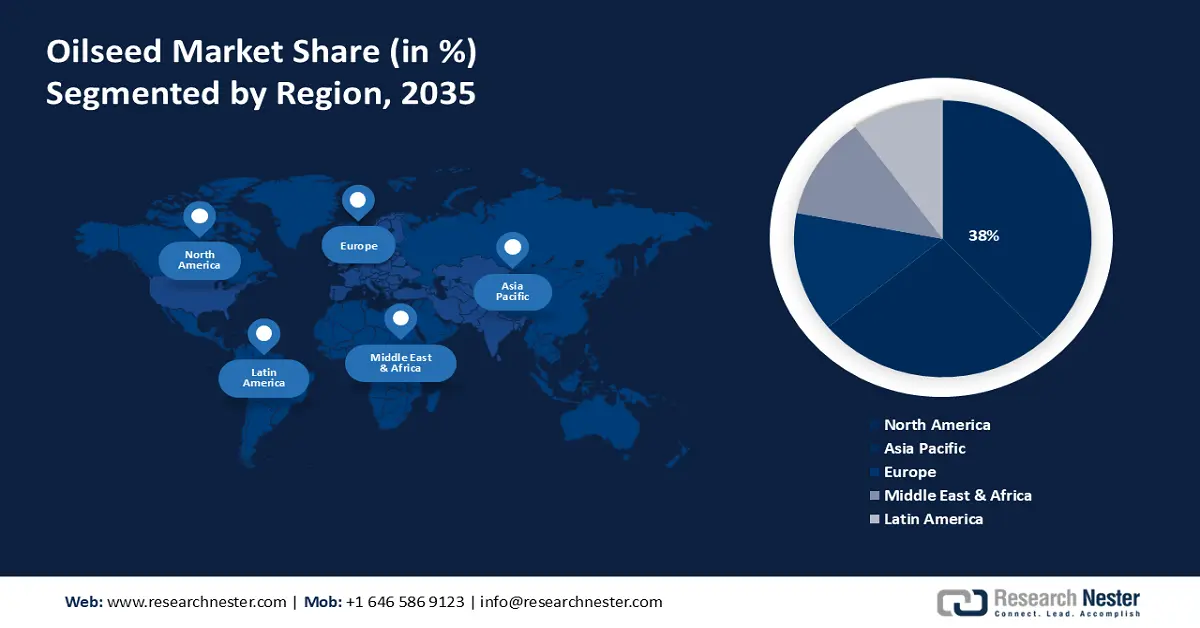

- The North America oilseed market will secure over 38% share by 2035, driven by increasing demand for cooking oil requiring high oilseed production.

- The Asia Pacific market will account for 30% share by 2035, driven by the growing food and beverage industry with a high CAGR.

Segment Insights:

- The genetically modified segment in the oilseed market is expected to capture a 61% share by 2035, driven by enhanced traits like herbicide and pest resistance.

- The soybean segment in the oilseed market is forecasted to achieve notable growth till 2035, attributed to the fueled demand for animal feed in developing nations.

Key Growth Trends:

- High nutritional value

- Global increase in oilseed trade

Major Challenges:

- Decrease in oilseed plantation

- Issues in meeting the demand

Key Players: ASTON, BASF SE, Bayer AG, Burrus Seed Farms, Inc., Cargill Incorporated, Corteva Agriscience, Gansu Dunhuang Seed Industry Group Co., Ltd., KWS SAAT SE & Co., Mahyco Seeds Ltd, Syngenta Crop Protection AG.

Global Oilseed Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 268.53 billion

- 2026 Market Size: USD 278.44 billion

- Projected Market Size: USD 401.33 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Brazil, Argentina, Canada

- Emerging Countries: China, India, Brazil, Argentina, Indonesia

Last updated on : 17 September, 2025

Oilseed Market Growth Drivers and Challenges:

Growth Drivers

-

High nutritional value- Oilseeds contain significant amounts process of essential nutrients, including minerals, oil, vitamins, fatty acids, protein, and fiber. In 2023, the Food and Agriculture Organization in their report stated that oilseed covers a large amount of global protein meal output, which is estimated to witness a growth of about 0.9% each year and is predicted to surpass 405 metric tons by 2032. Furthermore, the nutrient-dense pulp that is left over after oilseeds are extracted is converted into oilcake or meals to feed dairy farm animals.

-

Global increase in oilseed trade- Of all agricultural commodities, vegetable oil accounts for a trade share of 41.0%. Indonesia and Malaysia, the leading suppliers of palm oil, are projected to continue to dominate the vegetable oil trade by exporting over 70% of their combined production and collectively capturing approximately 60% of global exports. India, the world’s biggest vegetable oil importer, is anticipated to maintain its high import CAGR of 3.4%. According to the Observatory of Economic Complexity (OEC), in 2022 the countries with the largest oilseed export trade value were Ukraine (USD 5.53 billion), Russia (USD 3.0 billion), Argentina (USD 1.51 billion), Bulgaria (USD 1.17 billion), and Hungary (USD 849 million). The countries that had the largest import trade value include India (USD 2.85 billion), Iraq (USD 832 million), Italy (USD 780 million), China (USD 733 million), and Germany (USD 559 million).

Over 42% of global soybean production is traded internationally, which constitutes a key ingredient for protein meal. In 2023-2024, several factors eased global soybean and protein meal availability.First, a rebound in Argentina's soybean production facilitated crush to return to normal levels. Furthermore, record Brazil soybean meal exports and rising U.S. crush production increased global exportable supplies and lowed meal prices. The expansion in Mexico livestock industry has fueled demand for protein meals in 2023-2024. This boosted the country’s soybean meal imports by 24%. The 2024-2025 outlook is bound by many of the same fundamentals. High Brazil soybean production and U.S. soybean crush are expected to continue to grow as compared to other agricultural commodities. - Rising government initiatives- Local governments are stepping up to influence oilseed production and reduce expensive vegetable oil imports. According to the Food and Agriculture Organization in 2023, about 2/3rd of the global soybean production was done by the U.S., which accounts for about 80% of the soybean export worldwide.

Challenges

-

Decrease in oilseed plantation- A reduction in oilseed plantation leads to decreased supply of oilseeds. This scarcity can drive up prices if demand remains constant or increases, thus impacting overall market growth. This impact has broader implications for economic stability, sustainability, and industry innovation, all of which are crucial for the long-term growth of the oilseed market.

-

Issues in meeting the demand- The demand for edible oil are surpassing the oilseed production rates. Because of the competing demands of different crops on agricultural land, demand for oilseed production can only be met if productivity rises and farmers earn substantially better prices for their produce. At the global level, palm oil supplies are projected to expand at an annual rate of 1.3%. Increasingly stringent environmental policies from the major importers of palm oil and sustainable agricultural norms (e.g. in the context of the 2030 Agenda for Sustainable Development) are expected to slow the expansion of the oil palm area in Indonesia and Malaysia. This implies that growth in production comes increasingly from productivity improvements, including an acceleration of replanting activities. These two countries account for more than one-third of the world’s vegetable oil production.

Oilseed Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 268.53 billion |

|

Forecast Year Market Size (2035) |

USD 401.33 billion |

|

Regional Scope |

|

Oilseed Market Segmentation:

Type Segment Analysis

By 2035, soybean segment in oilseed market is expected to account for around 44.9% revenue share. The segment's tremendous growth rate can be augmented by their fueled demand for animal feed, particularly in developing nations including China, Brazil, India, Korea, and others where the average consumer's ability to eat more meat is being rapidly increased due to rising living standards. In addition, a report by the International Institute for Sustainable Development in 2024 estimated that for dairy production and animal feed for meat, about 76% of the soybean production is used which acts as a quality protein at a low cost.

Breeding Type Segment Analysis

Genetically modified segment is projected to dominate around 61% oilseed market share by the end of 2035. Genetically modified (GM) oilseeds are developed through biotechnological methods to introduce specific genes that confer traits such as herbicide resistance, pest resistance, improved oil composition, or enhanced yield potential. GM oilseed crops undergo genetic modification to achieve desired characteristics not naturally present. According to a 2019 report published by the International Service for the Acquisition of Agri-biotech Applications stated that 190.4 million hectares of genetically modified crops were grown in 29 countries in 2019.

Additionally, after genetically modifying and using biotechnology in agriculture, the tolerance to environmental conditions increases, that makes the plant able to grow in conditions such as drought while making them resistant to diseases and pests. This could help in the growth of the agriculture biologicals value during the forecasted period.

Biotech Trait Segment Analysis

By 2035, herbicide tolerant segment is expected to account for remarkable the oilseed market market share and is likely to remain the largest segment in the biotech trait of the oilseed sector propelled by the herbicide-tolerant oilseeds and crops that are genetically modified are able to withstand several herbicides, while removing the undesirable weeds that surround them.

According to a report by MDPI in 2023, about 96 types of crops were reported to be herbicide-resistant in about 72 countries. Herbicide-tolerant crop cultivation gives farmers the freedom to apply herbicides to their crops whenever the number of weeds considerably rises, shielding the crops from the herbicide's effects.

Our in-depth analysis of the global oilseed market includes the following segments:

|

Type |

|

|

Breeding Type |

|

|

Biotech Trait |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oilseed Market Regional Analysis:

North America Market Insights

North America industry is estimated to hold largest revenue share of 38% by 2035. The U.S. Department of Agriculture estimated in 2024, the farm output of the U.S. increased by about 190% between 1948 to 2021.

In the U.S., there is an increasing demand for cooking oil which demands high oilseed production. A report by Research Nester in 2024, that soybean oil was the most used edible oil in the United States in 2023, wherein Americans consumed about 12.3 million metric tons of soybean oil and about 1.9 million metric tons of palm oil in 2023.

A 2024 report by Farm Credit Canada states that the preference for oilseed is increasing and was estimated to show a gain of about 7.8% between 2014 and 2018. Canada is a major producer and the largest exporter of rapeseed. As per the Organization for Economic Cooperation and Development (OECD) estimations, Canada is set to increase its oilseed production by a CAGR of 1.2% by 2030.

APAC Market Insights

Asia Pacific in oilseed market is set to dominate around 30% revenue share by the end of 2035, and will account for the second position owing to the growing food industry. Research by Leatherhead Food Research in 2020 stated that the food and beverage industry in APAC increased, with a CAGR of about 11% from 2020 to 2024. The vegetable oil aggregate includes coconut, palm kernel, and cottonseed oils. Coconut oil is primarily produced in the Indonesia, and Oceanic islands, and the Philippines.

In China, there has been an increase in soybean production as per a MPDI released a report in 2022. It stated that the soybean production increased to 18 million tons in 2019 from 5.11 million tons in 1949 with a substantial growth rate of 3.63%. China accounts for more than a quarter of global protein meal demand and is therefore shaping global demand development. Growth in China’s demand for compound feed is expected to be slower than in the previous decade due to declining growth rates for animal production and the existing large share of compound feed-based production. The protein meal content in China’s compound feed is expected to remain stable as it surged in the last decade and considerably exceeds at present the levels of the United States and the European Union. As pig herds are being rebuilt in China following the outbreak of ASF, larger scale feed-based production systems have been installed. This could lead to an additional shift in demand for protein meal due to further intensification of the Chinese pigmeat production.

Japan is predicted to have the highest health-related food industry and was credited to be the third largest globally by USDA Foreign Agriculture Service in 2020, which is expected to be about USD 13 billion in 2018. Additionally, the ever-increasing food manufacturing landscape coupled with the fast-paced busy lifestyle is also expected to act as a growth factor for oilseed market.

Oilseed Market Players:

- ASTON

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Gansu Dunhuang Seed Industry Group Co., Ltd.

- Bayer AG

- Burrus Seed Farms, Inc

- Cargill Incorporated

- Corteva Agriscience

- KWS SAAT SE & Co.

- Mahyco Seeds Ltd

- Syngenta Crop Protection AG.

High prices and increasing demands are driving investments in bigger, better oilseed processing plants around the world as facilities try to keep pace with ongoing growth. Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this sector and are estimated to be the major key players in this landscape.

Recent Developments

- In November 2021, ASTON Along with Vandeputte Huilerie SA announced a joint venture for conducting oil-producing activities coupled with linseed processing in the Russian Federation's territory.

- In June 2024, Syngenta Crop Protection AG announced that they will provide rights to do academic research worldwide which aims to enable the growth of sustainability in food and agriculture.

- Report ID: 6288

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oilseed Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.