Oil Immersed Shunt Reactor Market Regional Analysis:

APAC Market Insights

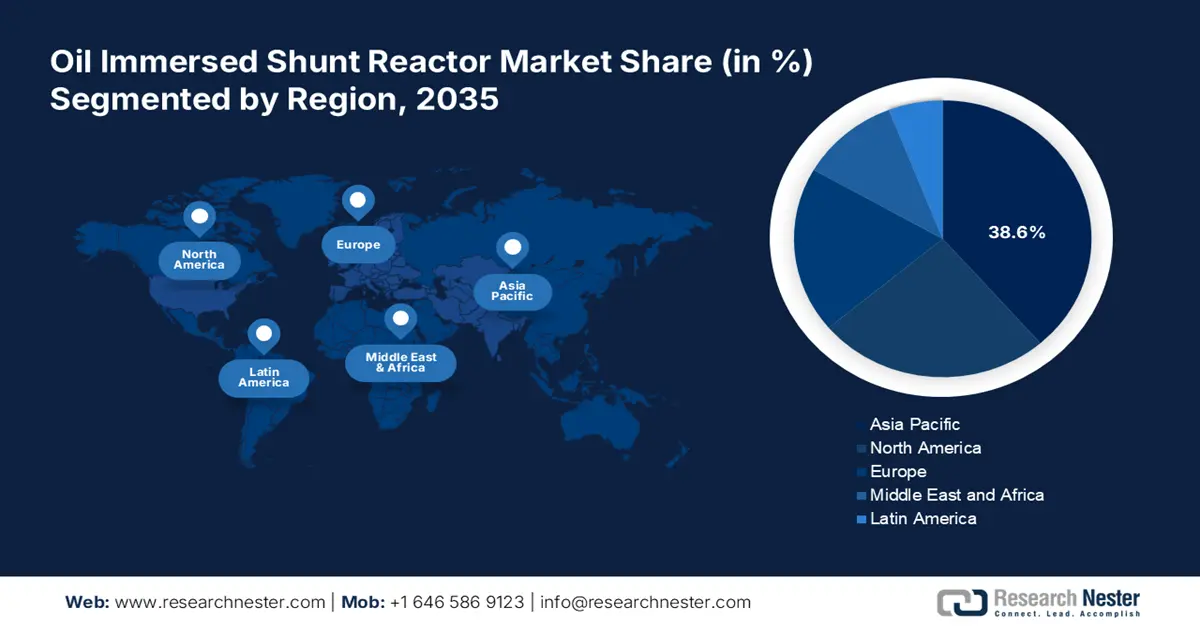

By the end of 2035, Asia Pacific oil immersed shunt reactor market is projected to dominate around 38.6% revenue share. The growing population of this region is creating pressure on the power grid due to high electricity consumption. Massive amounts of traditional power generation are further increasing CO2 emissions, hindering its goal of achieving neutrality. According to the 2022 IEA report, 56% of the electricity in the Asia Pacific countries was generated from coal, resulting in 27% of emissions in the same year. Thus, the demand for these reactors is increasing due to their capability to optimize power transmission in countries such as India, China, and Japan with high-voltage grids.

India is emerging to be a leading country in the market due to its initiatives in implementing renewal power sources in the general electricity grid. The equipment is bringing sustainability to its energy usage and distribution channels, inflating the demand in this sector. For instance, in February 2024, GE Vernova received an order for 765kV shunt reactors worth USD 43.7 million. from the Power Grid Corporation of India (PGCIL). The supply aims to facilitate the integration of renewable energy into the national electricity grid and enhance electricity transmission within the country.

China projected to create great investment opportunities for global leaders in the market due to the rising electricity demand. According to an IEA report published in 2022, China ranked on top in electricity production with the major source being coal with 61.7% in the same year. This is further forcing the government to implement alternative power sources to cope with the surge. The country is investing heavily in equipping its transmission system with advanced equipment such as shunt reactors to reduce emissions with seamless integration of renewable sources.

North America Market Insights

North America is expected to present remarkable growth in the oil immersed shunt reactor market with the contribution of the global leaders in its domestic landscape. The region’s focus on developing its electricity infrastructure has fostered great potential for the companies to participate in introducing efficient equipment. The government is also taking part in such improvement based on its projection for the increasing power consumption. According to a report published by the U.S. Energy Information Administration, in December 2023, the amount of electricity consumed in the U.S. was around 4 trillion kWh in 2022. This indicates the growing need for upgraded power transmission and distribution systems in this region.

The growing contribution of wind farms in electricity generation in the U.S. is creating business opportunities for global leaders in the oil immersed shunt reactor sector. The electricity-generating operators are now partnering with equipment suppliers to increase their efficiency in distribution, reducing power losses. For instance, in June 2020, Siemens collaborated with Mayflower Wind LLC to provide high-voltage electrical equipment for the ESP, including three 275 kV / 265 MVAr shunt reactors. The supply aims to become a reliable vendor for the major offshore wind projects in the U.S., solidifying its position.

Canada is proactively participating in upgrading their power grid, contributing to the growth in the oil immersed shunt reactor market. The country is heavily investing in installing advanced operating systems for electricity generation. This is also attracting leading power generators to upgrade their operations. For instance, in May 2024, SaskPower announced an investment plan of USD 1.6 billion to modernize and decarbonize the grid. The outline for investing in the provincial electricity system during the 2024-25 fiscal year aims to provide consumers with a reliable source of electricity in the country.