Oil Immersed Shunt Reactor Market Outlook:

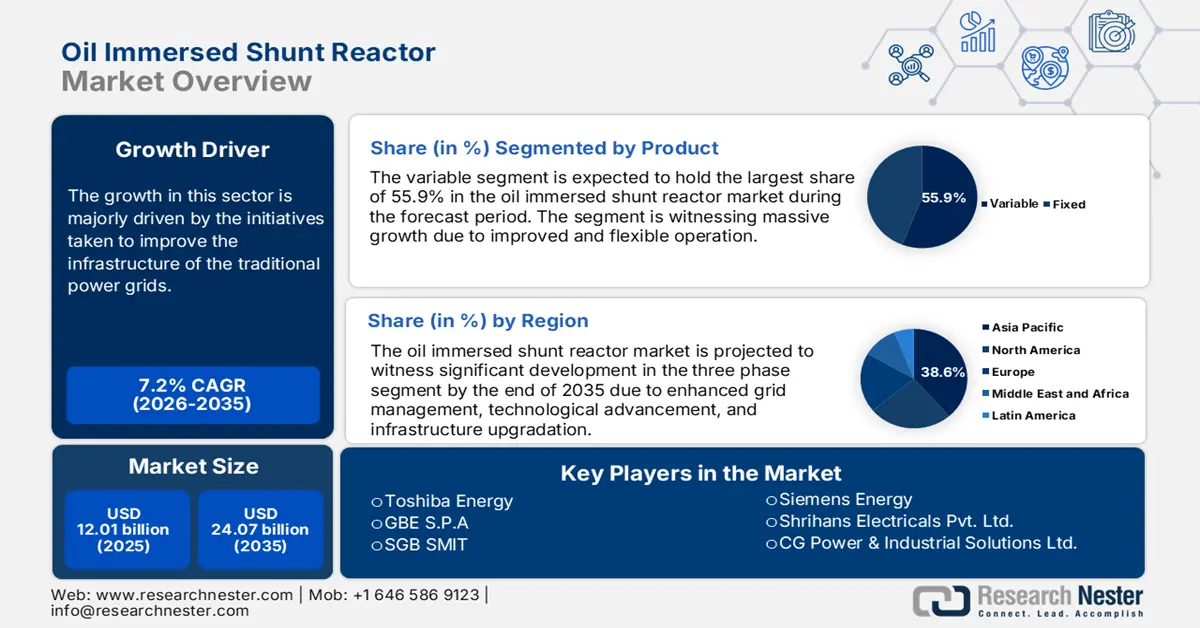

Oil Immersed Shunt Reactor Market size was over USD 12.01 billion in 2025 and is poised to exceed USD 24.07 billion by 2035, witnessing over 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil immersed shunt reactor is estimated at USD 12.79 billion.

The growth in this sector is majorly driven by the initiatives taken to improve the infrastructure of the traditional power grids. The growing population and industries are creating pressure on the countries to accommodate an efficient power supply. The equipment such as shunt reactors helps to upgrade the electrical infrastructure to resolve the issue.

The effectiveness of this equipment has propelled a surge in the oil immersed shunt reactor market. Many countries are now adopting such solutions to empower their electricity distribution with more stability in an environment-friendly way. For instance, in December 2023, NTDC installed a shunt reactor in the 500-kV Guddu-Rahim Yar Khan Transmission Line. After doing all the tests at the spot of installation, Bay-2 of the transmission project, they energized the reactor successfully to enhance power system stability in the south region. The accepting nature of these public authorities towards new technologies is inspiring other countries to seek such sustainable solutions.

Key Oil Immersed Shunt Reactor Market Insights Summary:

Regional Highlights:

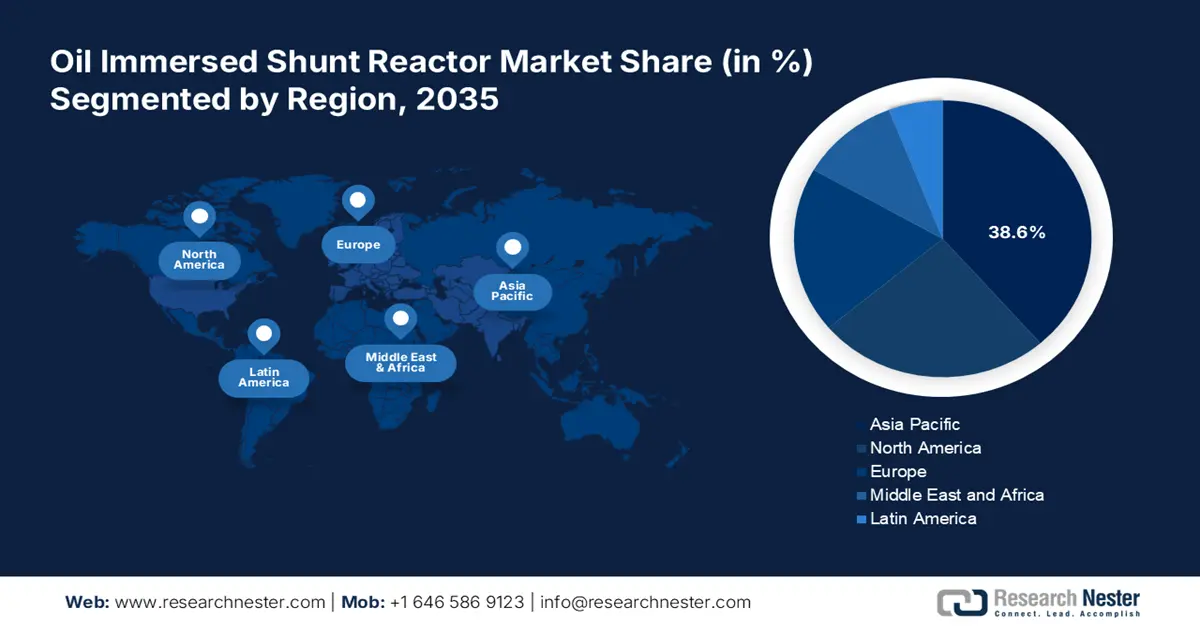

- Asia Pacific oil immersed shunt reactor market will account for 38.60% share by 2035, driven by the capability of oil immersed shunt reactors to optimize power transmission in high-voltage grids across countries like India, China, and Japan.

Segment Insights:

- The variable segment segment in the oil immersed shunt reactor market is anticipated to achieve a 55.90% share by 2035, attributed to improved operational flexibility, innovations in materials, and adoption of compact, durable reactors.

Key Growth Trends:

- Increasing power demand

- Technological development

Major Challenges:

- Competition with alternatives

- Inefficient infrastructure

Key Players: GBE S.p.A, SGB Smit, Siemens Energy, Shrihans Electricals Pvt. Ltd., CG Power & Industrial Solutions Ltd., WEG, Hitachi Energy Ltd, Getra S.P.A., Tmc Transformers Manufacturing Company, Hyosung Heavy Industries, GE.

Global Oil Immersed Shunt Reactor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.01 billion

- 2026 Market Size: USD 12.79 billion

- Projected Market Size: USD 24.07 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Oil Immersed Shunt Reactor Market Growth Drivers and Challenges:

Growth Drivers

- Increasing power demand: The inflating global electricity consumption is driving the need for more investments in the oil immersed shunt reactor market. According to a report published by IEA in 2024, the amount of electricity consumed worldwide grew by 2.2% in 2023. The report further states that power demand is estimated to rise faster with an annual growth rate of 3.4% by 2026. The reactors are capable of stabilizing voltage and improving efficiency in power systems, optimizing energy usage. This increases the demand for reactors in countries, particularly the ones with high-voltage transmission. Further, it is influencing companies to participate in this sector.

- Technological development: The increasing pressure on power grids is pushing countries to improve and expand their network of power supply and transmissions. These further influence them to invest in the oil immersed shunt reactor industry for stabilizing and optimizing the operations. The innovation also allows the integration of renewable energy in the central power system, mitigating voltage fluctuations and promoting the usage of clean energy sources. For instance, in April 2022, Hitachi launched OceaniQ products, services, and solutions for efficient harvesting and integration of wind power into the world’s energy system.

Challenges

- Competition with alternatives: Increasing environmental concerns are forcing companies to shift towards dry-type technologies, restricting adoption in the oil immersed shunt reactor market. In addition, the stringent regulations may contribute to the factor by highlighting the risks of oil usage, disposal, and potential contamination. This can further limit the investment as companies are mandated to obtain compliance. Moreover, the safety standards applied to the application may push consumers to switch to alternatives.

- Inefficient infrastructure: Lack of reliable associate equipment is one of the major setbacks in the market. Many per-installed transmission systems are unable to support the operations of such advanced reactor technology. This may restrict optimum adoption as the proper utilization is obstructed. Additionally, old shunt reactors are failing to deliver their best performance due to expensive refurbishment or replacement. This can prevent small-scale operators from adopting upgraded versions of these reactors, creating hurdles in further development.

Oil Immersed Shunt Reactor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 12.01 billion |

|

Forecast Year Market Size (2035) |

USD 24.07 billion |

|

Regional Scope |

|

Oil Immersed Shunt Reactor Market Segmentation:

Product Segment Analysis

By 2035, variable segment is anticipated to capture oil immersed shunt reactor market share of over 55.9%. The segment is witnessing massive growth due to improved and flexible operation. The ongoing innovations in materials, design, and cooling technologies have led to significant adoption. The new compact, efficient, and durable reactors are attracting more investment in this sector. This has further inspired global leaders to introduce advanced solutions for this segment. For instance, in October 2024, Hitachi elevated the scale of variable shunt reactor application up to 500 kV, supporting the onshore wind farm in Uzbekistan. The project aims to reduce carbon emissions while cost-effectively delivering flexible control over voltage stability.

Phase Segment Analysis

In terms of phase, the oil immersed shunt reactor market is projected to witness significant development in the three phase segment by the end of 2035. The growth in this segment is cumulated by several drivers such as enhanced grid management, technological advancement, and infrastructure upgradation. The increasing need for power network expansion has created a surge in high-voltage transmission. These three phase reactors are designed for industrial and utility-scale applications, making them preferable for three-phase power systems. Moreover, the ability to maintain a stable transmission of these high-end equipment has heightened its demand for reactive power compensation and voltage regulation.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Phase |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil Immersed Shunt Reactor Market Regional Analysis:

APAC Market Insights

By the end of 2035, Asia Pacific oil immersed shunt reactor market is projected to dominate around 38.6% revenue share. The growing population of this region is creating pressure on the power grid due to high electricity consumption. Massive amounts of traditional power generation are further increasing CO2 emissions, hindering its goal of achieving neutrality. According to the 2022 IEA report, 56% of the electricity in the Asia Pacific countries was generated from coal, resulting in 27% of emissions in the same year. Thus, the demand for these reactors is increasing due to their capability to optimize power transmission in countries such as India, China, and Japan with high-voltage grids.

India is emerging to be a leading country in the market due to its initiatives in implementing renewal power sources in the general electricity grid. The equipment is bringing sustainability to its energy usage and distribution channels, inflating the demand in this sector. For instance, in February 2024, GE Vernova received an order for 765kV shunt reactors worth USD 43.7 million. from the Power Grid Corporation of India (PGCIL). The supply aims to facilitate the integration of renewable energy into the national electricity grid and enhance electricity transmission within the country.

China projected to create great investment opportunities for global leaders in the market due to the rising electricity demand. According to an IEA report published in 2022, China ranked on top in electricity production with the major source being coal with 61.7% in the same year. This is further forcing the government to implement alternative power sources to cope with the surge. The country is investing heavily in equipping its transmission system with advanced equipment such as shunt reactors to reduce emissions with seamless integration of renewable sources.

North America Market Insights

North America is expected to present remarkable growth in the oil immersed shunt reactor market with the contribution of the global leaders in its domestic landscape. The region’s focus on developing its electricity infrastructure has fostered great potential for the companies to participate in introducing efficient equipment. The government is also taking part in such improvement based on its projection for the increasing power consumption. According to a report published by the U.S. Energy Information Administration, in December 2023, the amount of electricity consumed in the U.S. was around 4 trillion kWh in 2022. This indicates the growing need for upgraded power transmission and distribution systems in this region.

The growing contribution of wind farms in electricity generation in the U.S. is creating business opportunities for global leaders in the oil immersed shunt reactor sector. The electricity-generating operators are now partnering with equipment suppliers to increase their efficiency in distribution, reducing power losses. For instance, in June 2020, Siemens collaborated with Mayflower Wind LLC to provide high-voltage electrical equipment for the ESP, including three 275 kV / 265 MVAr shunt reactors. The supply aims to become a reliable vendor for the major offshore wind projects in the U.S., solidifying its position.

Canada is proactively participating in upgrading their power grid, contributing to the growth in the oil immersed shunt reactor market. The country is heavily investing in installing advanced operating systems for electricity generation. This is also attracting leading power generators to upgrade their operations. For instance, in May 2024, SaskPower announced an investment plan of USD 1.6 billion to modernize and decarbonize the grid. The outline for investing in the provincial electricity system during the 2024-25 fiscal year aims to provide consumers with a reliable source of electricity in the country.

Oil Immersed Shunt Reactor Market Players:

- GBE S.P.A

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SGB Smit

- Siemens Energy

- Shrihans Electricals Pvt. Ltd.

- CG Power & Industrial Solutions Ltd.

- WEG

- Getra S.P.A.

- Tmc Transformers Manufacturing Company

- Hyosung Heavy Industries

- GE

The current trend in the global oil immersed shunt reactor sector is highly influenced by the massive investments from regional power grids to upgrade their systems. For instance, in April 2020, ABB gained a contract from Interconexion Electrica S.A. E.S.P. (ISA) to supply reliable shunt reactors worth USD 100 million to strengthen their grid. With such collaboration, ABB aims to offer affordable, reliable, sustainable, and modern energy for consumers in South America by implementing its technologies. The leaders are now focusing more on developing innovative solutions to mitigate issues related to the operations, increasing demand in the sector. Such key players include:

Recent Developments

- In February 2024, GE Vernova received an order of 765 kV shunt reactors from PGCIL to accelerate the energy transformation in India. The multi-million oil-filled equipment aims to support various transmission system projects in India, integrating renewable energy into the country’s traditional power grid.

- In July 2022, WEG announced the successful delivery of its transformers and shunt reactors for a wind farm project in northern Colombia. The equipment is specially designed to offer 500kV, supporting the operation in the 492MW power generation capacity.

- Report ID: 6798

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oil Immersed Shunt Reactor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.