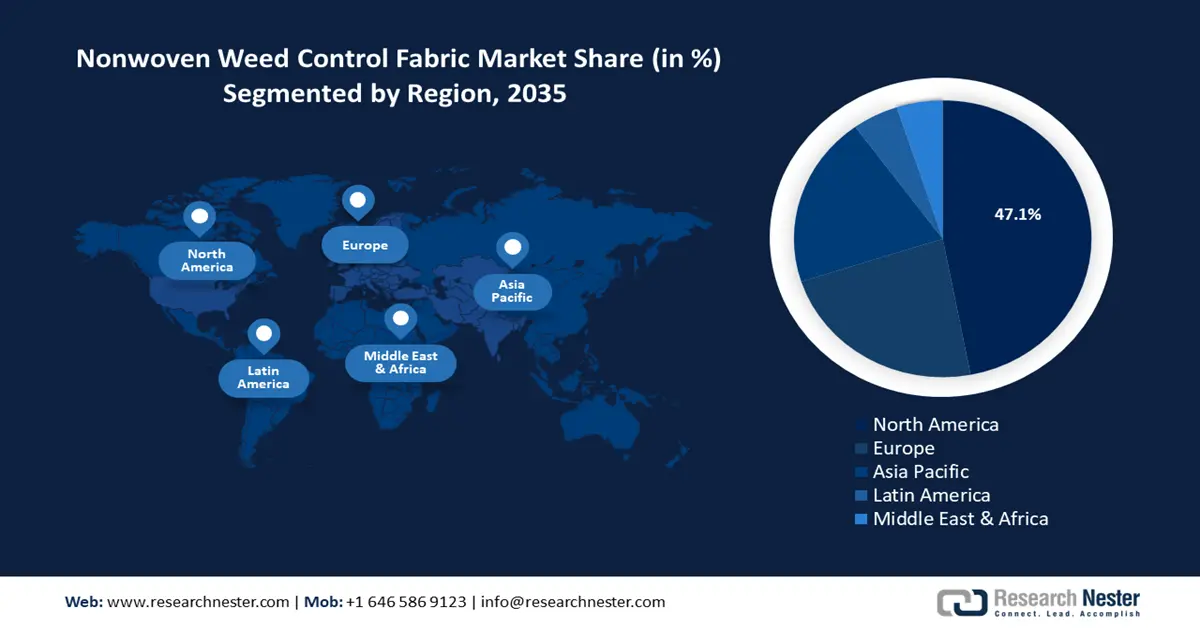

Nonwoven Weed Control Fabric Market Regional Analysis:

North America Market Forecast

By 2035, North America nonwoven weed control fabric market is likely to hold more than 47.1% share. The market’s growth in North America is attributed to increasing adoption in agriculture, urban gardening, landscaping, and roadside maintenance projects. The spun-bonded and needle-punched variants of nonwoven fabrics are experiencing surging demands for applications to reduce dependence on herbicides.

Furthermore, the advent of UV-resistant materials such as polyethylene and chemical-resistant polypropylene is positioned to assist the sector’s growth in North America for dual usage in erosion control and soil health improvement. In June 2024, Industrial Fabrics Inc., invested USD 8 million to build a new erosion control production facility in the U.S., and the new facility is expected to assist the sector by bolstering the supply chain for nonwoven weed control fabric.

The U.S. holds a dominant revenue share in the North America nonwoven weed control fabric market. The rapid growth in urban green initiatives is a major driver of the sector in the country. In July 2023, the Bezos Earth Fund announced USD 12 million for urban green spaces in Los Angeles, U.S., as part of its Greening American Cities initiative. The rising prevalence of investments in green city projects is poised to create lucrative opportunities for nonwoven weed control fabric manufacturers.

In October 2024, USD 60 million was granted for transformational green infrastructure projects in New York City. Along with rising demands in the agriculture sector, sustainable green housing initiatives are projected to create a profitable market segment for the nonwoven weed control fabric sector by the end of the forecast period.

Canada is poised to increase its revenue share in the North America nonwoven weed control fabric market owing to the nation’s expanding greenhouse farming and horticulture industry. Additionally, the stringent environmental regulations of Canada accelerate the adoption of recyclable fabrics in commercial farming operations. In October 2024, the government announced a grant of USD 6.8 million in investment to advance sustainable farming practices in the organic sector of Canada. The favorable regulatory ecosystem incentivizing the growth of sustainable farming practices is positioned to support the growth curve of the Canada nonwoven weed control fabric market.

Europe Market Forecast

The Europe nonwoven weed control fabric market is estimated to experience rapid growth during the forecast period. The European Union’s (EU) push to reduce plastic waste creates a burgeoning demand for eco-friendly weed control fabrics. Furthermore, the rapid modernization of the agricultural sector across Europe has created multiple burgeoning markets that manufacturers of nonwoven fabrics can tap into. In December 2024, the European Investment Bank (EIB) announced USD 3.15 billion worth of financing for farmers and the bioeconomy that is expected to fuel the weed control market’s growth. The green initiatives are positioned to create a steady demand for nonwoven weed control fabrics in Europe.

The nonwoven weed control fabric market in Germany is positioned to expand during the forecast period. The presence of industry-leading companies such as the Freudenberg group boosts the sector’s growth in Germany. The country has pushed to increase funding for organic farming which is poised to create opportunities within the sector. For instance, in February 2022, Clean Energy Wire highlighted that the country plans to apply USD 1 billion of a total of USD 2.10 billion for climate, environmental, and biodiversity protection objectives in the 2023 to 20237 funding period. Furthermore, plans to channel more funding to organic farming across the country via voluntary eco-schemes have been proposed. The trends are favorable for nonwoven weed control fabric manufacturers to increase production and support organic farming in the country.

The France nonwoven weed control fabric market is poised to exhibit a profitable expansion during the forecast period. The circular economy roadmap has been instrumental in promoting the use of eco-friendly nonwoven weed control fabric. The manufacturers in France can expand their revenue share by investing in thermal bonding to improve the efficiency of nonwoven fabrics. Additionally, companies from other sectors such as pet care are expanding into regenerative agriculture to boost the pet food supply chain across Europe as the demand for healthy pet food rises. For instance, in December 2024, Mars, Incorporated announced partnerships to support regenerative agriculture transition across the European food supply chain.