Nonwoven Weed Control Fabric Market Outlook:

Nonwoven Weed Control Fabric Market size was over USD 1.78 billion in 2025 and is poised to exceed USD 3.31 billion by 2035, witnessing over 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nonwoven weed control fabric is estimated at USD 1.88 billion.

The nonwoven weed control fabric market is fueled by the global push for sustainable agricultural practices. The agriculture industry trends indicate that farmers are increasingly adopting eco-friendly solutions to mitigate environmental impact, and nonwoven feed control fabric offers a solution in this pursuit. Nonwoven weed control fabrics offer the ability to conserve soil moisture and heighten crop yields, which is driving adoption across the agricultural industry. For instance, in September 2024, the National Sustainable Agricultural Coalition from the U.S. published promising conservation results from a 2022 census that highlights the increasing use of practices such as cover crops, indicating a favorable ecosystem for the growth of the nonwoven weed control fabric market.

Furthermore, the rising consumer demand is poised to increase the scope of organic farming. The organic revolution has solidified consumer perception of the health benefits, prompting larger agricultural areas dedicated to organic farming, and nonwoven has proven to be effective as it boosts soil health. In November 2024, the U.S. Department of Agriculture published a report that certified organic land for growing crops had increased from 1.8 million in 2000 to 4.9 million in 2021. Similarly, global trends indicate a rise in organic farming. For instance, in February 2024, the Research Institute of Organic Agriculture stated that the global stated an increase in global farming area dedicated to organic agriculture, as by the end of 2022, 96.4 million hectares were under organic management, representing an increase of 26.6 percent or 20.3 million hectares compared to 2021. The trends are favorable for the increasing adoption of nonwoven weed control fabrics.

The nonwoven weed control fabric market promises significant opportunities in developed and emerging economies. The advent of green buildings is positioned to provide lucrative opportunities in the future as the adoption of nonwoven weed fabrics rises in green construction. For instance, the Freudenberg Group, a significant player in the nonwoven fabrics sector, released their FY2023 reported USD 13 billion worth of sales. The trends augur well for the growth potential of the sector by the end of the forecast period.

Key Nonwoven Weed Control Fabric Market Insights Summary:

Regional Highlights:

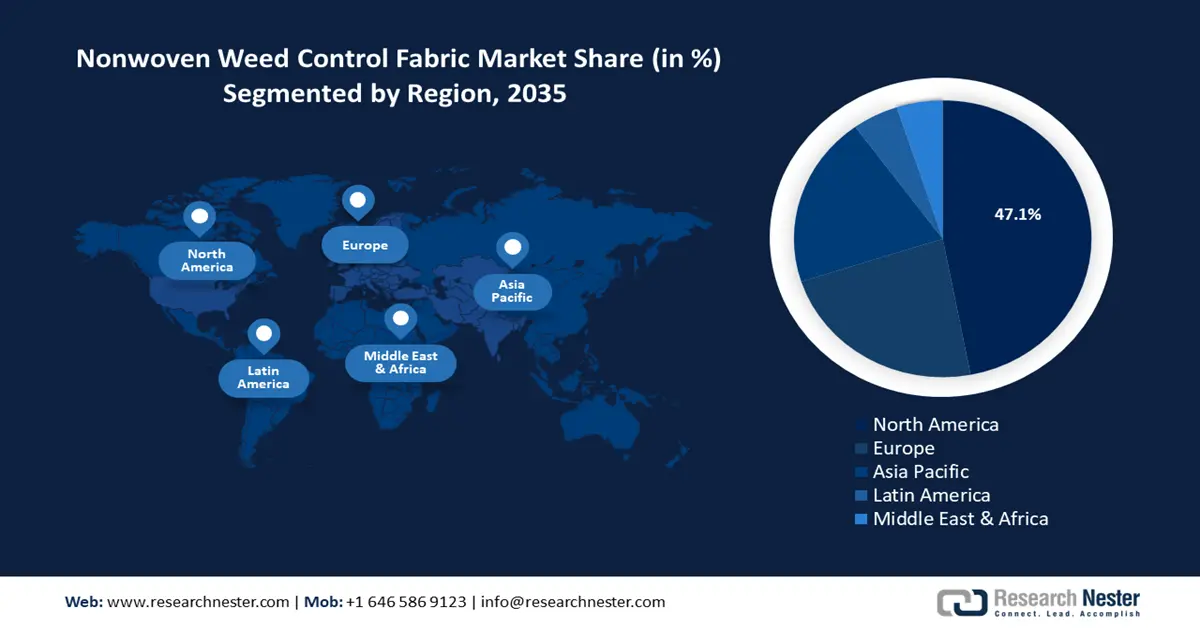

- North America's 47.1% share in the Nonwoven Weed Control Fabric Market is driven by increasing adoption in agriculture, landscaping, and erosion control, strengthening its lead in 2026–2035.

- Europe’s nonwoven weed control fabric market anticipates rapid growth through 2026–2035, fueled by EU initiatives reducing plastic waste and promoting eco-friendly materials.

Segment Insights:

- The Polypropylene segment is anticipated to capture a substantial share by 2035, driven by increasing demand for long-term weed suppression in agriculture.

- The Agriculture segment is poised for major growth from 2026-2035, driven by the multifunctional benefits of nonwoven fabric for crop management.

Key Growth Trends:

- Expansion of the landscaping industry

- The increasing demand for precision agriculture

Major Challenges:

- Challenges in durability in extreme weather

- Customization challenges for diverse applications

- Key Players: Freudenberg Group, Trevira GmbH, DowDuPont, Berry Global, Ahlstorm, Kimberly-Clark, DuPont, Toray Industries, Zhejiang Kingsafe Nonwovens.

Global Nonwoven Weed Control Fabric Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.78 billion

- 2026 Market Size: USD 1.88 billion

- Projected Market Size: USD 3.31 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Canada

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 13 August, 2025

Nonwoven Weed Control Fabric Market Growth Drivers and Challenges:

Growth Driver

- Expansion of the landscaping industry: The rapid expansion of the landscaping industry with rising demand for landscaping services in residential and commercial settings has driven the adoption of nonwoven weed control fabric. The moisture conservation and soil structure improvement features offered by nonwoven weed control fabrics create a burgeoning demand to be used in landscaping projects. Key players in the market are expanding their production line of nonwoven fabrics to heighten the supply chain for landscaping service providers. In March 2024, Gardien introduced new lines of landscape fabrics at the National Hardware Show 2024, indicating companies leveraging profitable opportunities due to the expansion of the landscaping demands to provide effective nonwoven fabric solutions.

- The increasing demand for precision agriculture: The growing prevalence of precision agriculture augurs well for the nonwoven weed control fabric market. Nonwoven weed control fabrics assist farmers in maximizing crop yield by effectively preventing weed growth by allowing nutrients and water to pass through to crops. In February 2023, the U.S. Department of Agriculture published a report stating that adoption of automated guidance for precision agriculture has experienced a sharp spike in the past 20 years, with application on over 50% of the acreage planted to cotton, rice, sorghum, soybeans, corn, and winter wheat.

Furthermore, the advent of digital agricultural practices for precision farming is positioned to create demand for nonwoven weed control fabric, as farmers are poised to benefit from remote monitoring solutions. Companies can benefit from emerging opportunities by providing nonwoven fabric solutions for precision targeting of weed-prone areas within and field and enable farmers to decrease dependence on herbicides. - The rising demand from the horticulture sector: The growth of the horticulture industry is driving demand for nonwoven weed control fabrics. The rising global food demand augurs well for the expansion of horticultural practices, and the growing government investments in green horticulture are poised to drive further demands for nonwoven weed control fabric. For instance, in October 2024, the U.S. Department of Agriculture (USDA) announced USD 1.7 billion for the purchase of regionally produced foods for emergency food assistance. The grant is meant to boost horticultural practices to heighten regional production.

Additionally, government support in devising efficient weed-killing methods is poised to assist the nonwoven weed control fabric market. For instance, in September 2024, a USD 1 million USDA grant to perfect the weed-killing method in organic crop production was announced, indicating favorable opportunities for manufacturers of nonwoven fabrics to invest in R&D to increase the scope of the fabrics and leverage the grants.

Challenges

- Challenges in durability in extreme weather: Nonwoven weed control fabrics can face challenges in extreme weather conditions that can limit the scope of application. Furthermore, prolonged exposure to UV radiation can limit the lifespan causing challenges in widespread adoption of the fabric.

- Customization challenges for diverse applications: Nonwoven weed control fabrics come in standard thicknesses, which can cause challenges in catering to the specific requirements of diverse crops. Custom solutions can drive costs and can cause issues in supply bottlenecks limiting the scope of the nonwoven weed control fabric market.

Nonwoven Weed Control Fabric Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 1.78 billion |

|

Forecast Year Market Size (2035) |

USD 3.31 billion |

|

Regional Scope |

|

Nonwoven Weed Control Fabric Market Segmentation:

Material (Polypropylene, Polyethylene, Polyester, Nylon)

Polypropylene segment is set to account for more than 46.4% nonwoven weed control fabric market share by the end of 2035. The segment’s growth is attributed to increasing demand for long-term use in agriculture for weed suppression. Polypropylene fabrics are moisture and chemical-resistant, boosting their adoption. Furthermore, advancements in polypropylene technology are poised to assist the segment’s growth. For instance, in June 2024, Stratasys Ltd. announced the commercial availability of a groundbreaking new material, i.e., SAF Polypropylene (PP). The advancements in polypropylene are poised to boost recyclability and drive increased market adoption.

The polyethylene segment of the nonwoven weed control fabric market is poised to expand its revenue share during the forecast period. Polyethylene's UV stability drives its use in the manufacturing of nonwoven weed control fabrics. The nonwoven weed control market faces challenges in reduced lifespan due to prolonged UV exposure, and the polyethylene segment effectively solves the market’s pain point by offering UV-resistant solutions. The increase in large-scale landscaping projects is poised to create a steady stream of market opportunities for manufacturers. In March 2024, Dow Scientists announced the development of a novel polyethylene architecture that holds promise for reduced carbon emissions in industry-scale polyethylene production. The trends are beneficial for an increase in polyethylene production that is poised to benefit the nonwoven weed control fabric market.

Application (Agriculture, Horticulture, Landscape Design, Roadside Maintenance)

By application, the agriculture segment is poised to hold a major share in the nonwoven weed control fabric market. The multifunctional benefits offered by nonwoven fabric for crop management ensure that the agriculture segment experiences the largest application. Nonwoven weed control fabrics solve a prominent pain point plaguing the global agricultural industry, i.e., the increasing use of crop protection chemicals by providing an alternative eco-friendly solution.

Manufacturers are poised to find emerging opportunities in APAC, Middle East, and Africa as agricultural activities boom in these regions. For instance, in April 2024, the World Economic Forum estimated a USD 1 trillion food economy in Africa, and the African Development Bank forecasts a surge in the food & agriculture market from USD 280 billion annually to USD 1 trillion by 2030.

Our in-depth analysis of the global nonwoven weed control fabric market includes the following segments:

|

Material |

|

|

Application |

|

|

Weight |

|

|

Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nonwoven Weed Control Fabric Market Regional Analysis:

North America Market Forecast

By 2035, North America nonwoven weed control fabric market is likely to hold more than 47.1% share. The market’s growth in North America is attributed to increasing adoption in agriculture, urban gardening, landscaping, and roadside maintenance projects. The spun-bonded and needle-punched variants of nonwoven fabrics are experiencing surging demands for applications to reduce dependence on herbicides.

Furthermore, the advent of UV-resistant materials such as polyethylene and chemical-resistant polypropylene is positioned to assist the sector’s growth in North America for dual usage in erosion control and soil health improvement. In June 2024, Industrial Fabrics Inc., invested USD 8 million to build a new erosion control production facility in the U.S., and the new facility is expected to assist the sector by bolstering the supply chain for nonwoven weed control fabric.

The U.S. holds a dominant revenue share in the North America nonwoven weed control fabric market. The rapid growth in urban green initiatives is a major driver of the sector in the country. In July 2023, the Bezos Earth Fund announced USD 12 million for urban green spaces in Los Angeles, U.S., as part of its Greening American Cities initiative. The rising prevalence of investments in green city projects is poised to create lucrative opportunities for nonwoven weed control fabric manufacturers.

In October 2024, USD 60 million was granted for transformational green infrastructure projects in New York City. Along with rising demands in the agriculture sector, sustainable green housing initiatives are projected to create a profitable market segment for the nonwoven weed control fabric sector by the end of the forecast period.

Canada is poised to increase its revenue share in the North America nonwoven weed control fabric market owing to the nation’s expanding greenhouse farming and horticulture industry. Additionally, the stringent environmental regulations of Canada accelerate the adoption of recyclable fabrics in commercial farming operations. In October 2024, the government announced a grant of USD 6.8 million in investment to advance sustainable farming practices in the organic sector of Canada. The favorable regulatory ecosystem incentivizing the growth of sustainable farming practices is positioned to support the growth curve of the Canada nonwoven weed control fabric market.

Europe Market Forecast

The Europe nonwoven weed control fabric market is estimated to experience rapid growth during the forecast period. The European Union’s (EU) push to reduce plastic waste creates a burgeoning demand for eco-friendly weed control fabrics. Furthermore, the rapid modernization of the agricultural sector across Europe has created multiple burgeoning markets that manufacturers of nonwoven fabrics can tap into. In December 2024, the European Investment Bank (EIB) announced USD 3.15 billion worth of financing for farmers and the bioeconomy that is expected to fuel the weed control market’s growth. The green initiatives are positioned to create a steady demand for nonwoven weed control fabrics in Europe.

The nonwoven weed control fabric market in Germany is positioned to expand during the forecast period. The presence of industry-leading companies such as the Freudenberg group boosts the sector’s growth in Germany. The country has pushed to increase funding for organic farming which is poised to create opportunities within the sector. For instance, in February 2022, Clean Energy Wire highlighted that the country plans to apply USD 1 billion of a total of USD 2.10 billion for climate, environmental, and biodiversity protection objectives in the 2023 to 20237 funding period. Furthermore, plans to channel more funding to organic farming across the country via voluntary eco-schemes have been proposed. The trends are favorable for nonwoven weed control fabric manufacturers to increase production and support organic farming in the country.

The France nonwoven weed control fabric market is poised to exhibit a profitable expansion during the forecast period. The circular economy roadmap has been instrumental in promoting the use of eco-friendly nonwoven weed control fabric. The manufacturers in France can expand their revenue share by investing in thermal bonding to improve the efficiency of nonwoven fabrics. Additionally, companies from other sectors such as pet care are expanding into regenerative agriculture to boost the pet food supply chain across Europe as the demand for healthy pet food rises. For instance, in December 2024, Mars, Incorporated announced partnerships to support regenerative agriculture transition across the European food supply chain.

Key Nonwoven Weed Control Fabric Market Players:

- Freudenberg Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Trevira GmbH

- DowDuPont

- Berry Global

- Ahlstorm

- Kimberly-Clark

- DuPont

- Toray Industries

- Zhejiang Kingsafe Nonwovens

The nonwoven weed control fabric market is poised to expand during the forecast period. Leading players in the sector are focused on diverse strategies to expand their revenue share to cater to rising end use in landscaping, horticulture, and agricultural sectors. R&D investments enable companies to leverage advanced manufacturing technologies to produce fabrics with superior durability, which can increase the scope of application.

Additionally, firms are strengthening their global distribution networks by forming partnerships with agricultural cooperatives and retail chains. For instance, in October 2023, Ag Partners Coop announced a collaboration with Indigo Ag to launch a groundbreaking program aimed at providing premiums and quantifying the environmental benefits of sustainably grown corn by Globally Responsible Production (GRP)-certified farmers.

Here are some key players in the nonwoven weed control fabric market:

Recent Developments

- In June 2024, Beaulieu Textiles launched the latest trends in woven ground covers for all containerfields at GreenTech Amsterdam 2024. The re-designed range of weed control ground covers by the company sets a new sustainability benchmark in the industry.

- In February 2023, the Tampere University of Applied Sciences announced that the sustainable fit-for-purpose nonwovens project boosts the competitiveness and broadens the export potential of the Finnish nonwovens sector in the growing markets. SUSTAFIT will support global industrial and societal goals of replacing unsustainable processes and petroleum-based materials with more environmentally friendly solutions.

- Report ID: 6854

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nonwoven Weed Control Fabric Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.