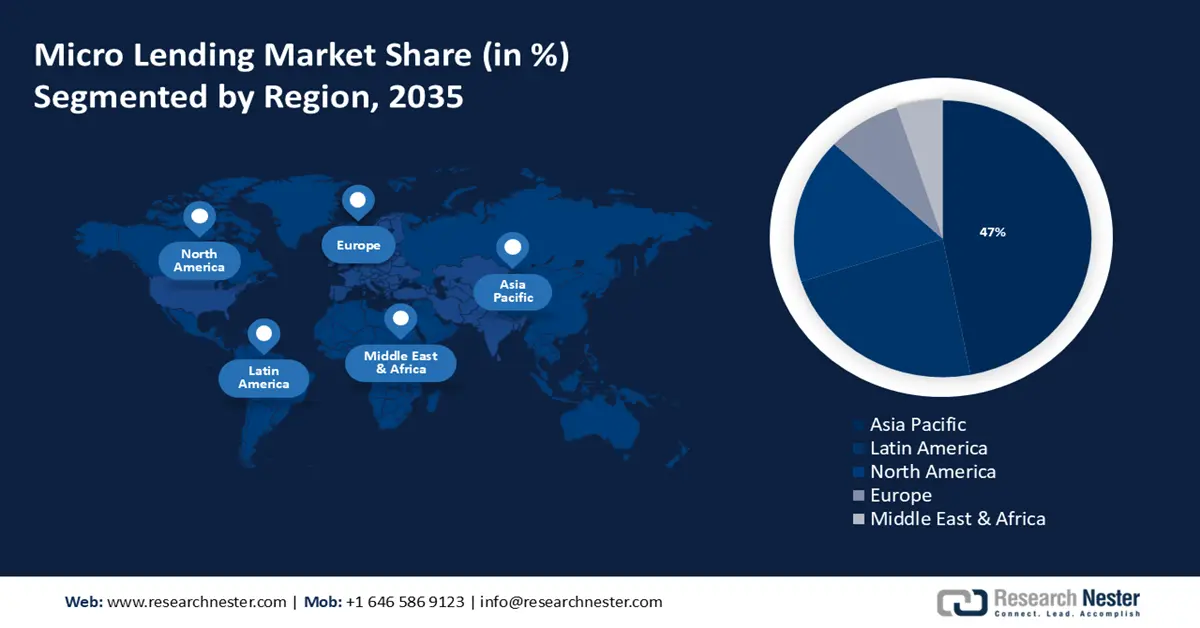

Micro Lending Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 47% by 2035. The region has a substantial market for micro lending due to its large population, significant number of small businesses, and varying economic conditions. According to United Nations Population Fund, Asia Pacific is home to 60% of the world’s population, and includes the world’s most populous countries China and India.

In India various government initiatives and schemes, such as the Pradhan Mantri MUDRA Yojana (PMMY) and the Ajeevika Microfinance Yojana (AMY), support financial framework for expanding micro lending activities. For instance, in 2023, according to the Ministry of Finance, loans amounting to USD 3.2 billion have been disbursed under the Pradhan Mantri MUDRA Yojana (PMMY) till date, and over 470 million small and new entrepreneurs have benefitted from the scheme.

Moreover, there is significant potential for micro lending focused on rural and agricultural sectors, providing loans for farming activities and rural development projects in the country.

The micro lending market in China is regulated by multiple government bodies, including the China Banking and Insurance Regulatory Commission (CBIRC) and the People’s Bank of China (PBOC). Regulations have been evolving to address risks and ensure financial stability.

Latin America Market Insights

Latin America region is expected to register significant growth till 2035, owing to the increasing number of fintech companies characterized by a notable rise in alternative finance, banking, and digital payments. For instance, in 2022, more than 1,200 fintech businesses were registered in Latin America, a remarkable 46% increase from the year before. Financial technology solutions have proliferated in the region, which is expected to help in several ways to meet the needs of the rural market, including financial inclusion and easy access to loans. Financial technology, or FinTech, has revolutionized the conventional lending process, making loans more accessible and giving micro lending clients better access to capital.

Brazil has a significant need for micro loans due to its large number of small businesses, low-income individuals, and underserved population. Many local banks offer micro lending products, often through specialized departments or partnerships with MFIs. Banks like Banco do Brasil and Banco Itaú Unibanco S.A have micro lending programs targeting small businesses and low income borrowers.

In addition to encouraging economic growth, self-employment, and financial empowerment, the microfinance industry in Mexico has seen tremendous transformation and evolution. It has also helped women take on more decision-making roles and has significantly increased women's ability to escape poverty and maintain their way of life.