Micro Lending Market Outlook:

Micro Lending Market size was valued at USD 108.96 billion in 2025 and is expected to reach USD 315 billion by 2035, expanding at around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of micro lending is evaluated at USD 119.94 billion.

Over the past two decades, the global microfinance industry has expanded quickly, taking the international financial sector by storm. There is a growing adoption of micro financing as many self-employed individuals and microenterprises in developing regions seek financial services that include microloans, microcredit, microinsurance, and money transfers. For instance, BRAC is one of the founding partners of the inaugural 60 Decibels Microfinance Index. The index report of BRAC Liberia Microfinance Company Ltd (BLMCL) published in 2022 showed the comparative social performance of 72 microfinance institutions (MFIs), based exclusively on the voices of nearly 18,000 clients. Collectively, these MFIs are serving more than 25 million clients in 41 countries, which is equivalent to more than 15% of all microfinance clients globally. Additionally, technological advancements, such as mobile banking and digital lending platform, have also played a significant role by making financial services more accessible and efficient.

Key Micro Lending Market Insights Summary:

Regional Highlights:

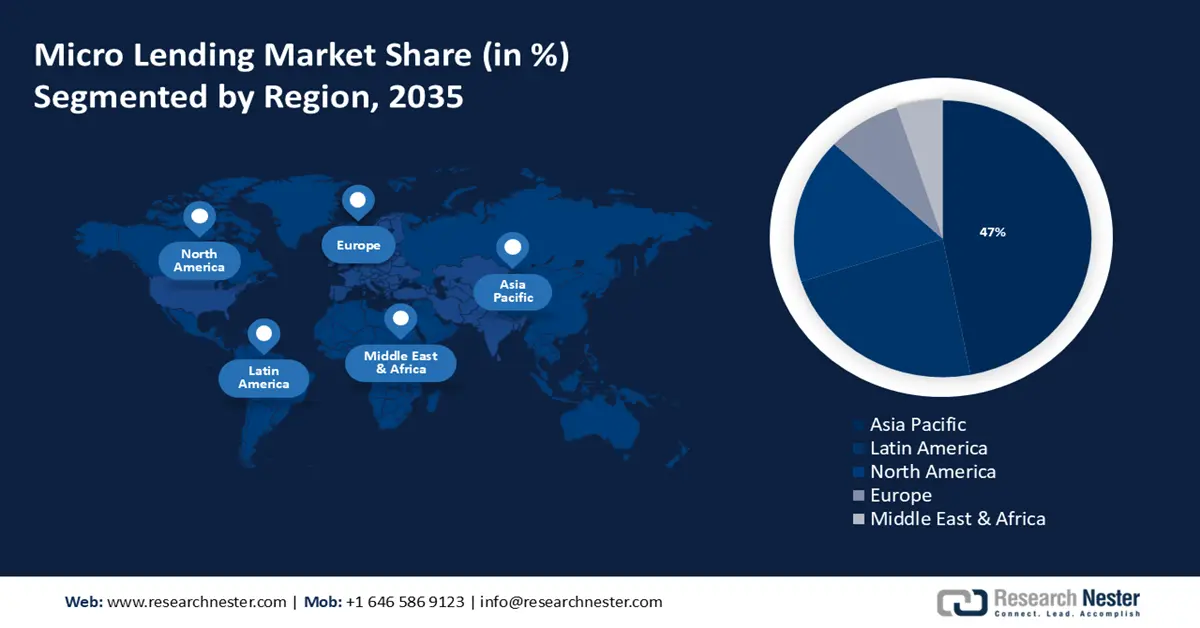

- The Asia Pacific micro lending market will dominate around 47% share by 2035, driven by the large population, significant number of small businesses, and varying economic conditions.

- The Latin America market will register significant growth during the forecast timeline, driven by the notable rise in alternative finance, banking, and digital payments.

Segment Insights:

- The banks segment in the micro lending market is anticipated to hold a 55.10% share by 2035, driven by the expansion in banking services and increasing collaborations with micro lending providers.

Key Growth Trends:

- Flourishing agriculture industry

- Growing empowerment and autonomy of women

Major Challenges:

- High cost of loan administration

- Exorbitant credit risk

Key Players: Accion International, ESAF Small Finance Bank, Ujjivan Small Finance Bank Ltd., Fincare Small Finance Bank Ltd., Fusion Micro Finance Ltd., Bajaj Finserv Ltd., Bandhan Bank Ltd., Bluevine Capital Inc., Equitas Small Finance Bank Ltd., ICICI Bank Ltd.

Global Micro Lending Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 108.96 billion

- 2026 Market Size: USD 119.94 billion

- Projected Market Size: USD 315 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, United Kingdom, Germany

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Micro Lending Market Growth Drivers and Challenges:

Growth Drivers

- Flourishing agriculture industry - As agriculture becomes more intensive and technologically advanced the demand for financial services increases. Micro lending can provide small-scale loans to farmers and agribusinesses, helping them invest in seeds, fertilizers, equipment, infrastructure, and other resources. This, in turn, can boost agricultural productivity and sustainability.

Moreover, many government and non-government schemes that provide agricultural funds play a significant role in driving the micro lending market. For instance, in 2023, the Agriculture Infrastructure Fund (AIF) under the Department of Agriculture & Farmers Welfare (Government of India) has stated that around USD 12 billion will be provided by banks and financial institutions as loans to Primary Agricultural Credit Societies (PACS), Marketing Cooperative Societies, Organizations (FPOs), self-help groups (SHGs), farmers, Joint Liability Groups (JLG), multipurpose cooperative societies, agri-entrepreneurs, startups and Central/State agencies or local body sponsored public-private partnership projects, state agencies, agricultural produce market committees, national & state federations of cooperatives, and federations of Farmer Produce Organizations (FPOs). This scheme will be disbursed from FY 2020-21 to FY2025-26, and the support under the scheme will be provided for FY 2020-21 to FY 2032-2033. - Growing empowerment and autonomy of women - Empowered women, especially in developing regions, are increasingly seeking financial services to start and grow businesses. Several micro lending initiatives enable women to recognize their potential and take charge of their financial decision-making, which helps expand the demand for microloans. As per a report published in 2022 by the UN Women, laws and regulations that completely support the economic empowerment of 1.6 billion women and girls have been implemented in 44 nations.

- Surging adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) - AI tools analyze customer data to provide insights into borrower needs and preferences, allowing lenders to engage more effectively and improve customer satisfaction. Moreover, automation of routine tasks such as application processing, document verification, and customer service improves operational efficiency and reduces costs for lenders.

Challenges

- High cost of loan administration – The high cost of loan administration can be a significant barrier to the growth of the market. Micro lending typically involves small loan amounts and a a large number of transactions, which can lead to disproportionately high administrative costs relative to the loan size. This can include costs related to loan processing, credit assessment, collection, and customer service.

- Exorbitant credit risk – Micro lending often involves borrowers with limited credit histories or financial stability, increasing the likelihood of defaults. High default rates can erode the lender’s profitability and overall sustainability.

Micro Lending Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 108.96 billion |

|

Forecast Year Market Size (2035) |

USD 315 billion |

|

Regional Scope |

|

Micro Lending Market Segmentation:

Provider Segment Analysis

Banks segment is likely to dominate over 55.1% micro lending market share by 2035, on account of the expansion in banking services, along with increasing collaborations of banks with other micro lending service providers. For instance, in 2022, the Asian Development Bank (ADB) and HSBC India (HSBC) agreed to develop a USD 100 million partial guarantee program to serve over 400,000 micro-borrowers and largely women-owned microenterprises across India. Moreover, expanded banks can utilize their extensive data and sophisticated risk management systems to better assess and mitigate the risks associated with micro lending. This improves the overall sustainability and reliability of micro lending programs.

In addition, the global demand for peer-to-peer lending a type of crowdsourcing where loans are raised and repaid with interest is anticipated to fuel the microfinance institutes (MFIs) segment's expansion. P2P lending is seeing a rise in demand from small and medium-sized enterprises as well as in a variety of industries, including real estate and student loans.

End-users Segment Analysis

The micro, small, and medium enterprises segment in micro lending market is projected to generate significant revenue in the coming years. This segment expansion is dominated by the growing number of SMEs that have extremely restricted access to credit facilities, deposits, and other forms of financial assistance. Particularly, in 2021, there were projected to be more than 330 million SMEs globally. Small and medium-sized enterprises (SMEs) are gaining more attention as a viable alternative to microcredit investment in the fight against poverty. These firms frequently require easier access to capital, hence micro lending plays a significant part in their funding to help these businesses get established, grow, and flourish. In developing and transitional nations, microfinance is seen as an essential instrument for expanding small businesses since it promotes the creation of new business models and assists in building economic infrastructure. For instance, small sums of money, usually between USD 4,000 and USD 48,000, are lent by microloan lenders to business owners who are unable to obtain operating capital from credit cards or other traditional financial institutions.

However, the share for solo entrepreneurs & individuals will also experience considerable development during the forecast period. Micro lending might assist solopreneurs with profitable opportunities and aid in launching new projects.

Our in-depth analysis of the global market includes the following segments:

|

Provider |

|

|

End-users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Micro Lending Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 47% by 2035. The region has a substantial market for micro lending due to its large population, significant number of small businesses, and varying economic conditions. According to United Nations Population Fund, Asia Pacific is home to 60% of the world’s population, and includes the world’s most populous countries China and India.

In India various government initiatives and schemes, such as the Pradhan Mantri MUDRA Yojana (PMMY) and the Ajeevika Microfinance Yojana (AMY), support financial framework for expanding micro lending activities. For instance, in 2023, according to the Ministry of Finance, loans amounting to USD 3.2 billion have been disbursed under the Pradhan Mantri MUDRA Yojana (PMMY) till date, and over 470 million small and new entrepreneurs have benefitted from the scheme.

Moreover, there is significant potential for micro lending focused on rural and agricultural sectors, providing loans for farming activities and rural development projects in the country.

The micro lending market in China is regulated by multiple government bodies, including the China Banking and Insurance Regulatory Commission (CBIRC) and the People’s Bank of China (PBOC). Regulations have been evolving to address risks and ensure financial stability.

Latin America Market Insights

Latin America region is expected to register significant growth till 2035, owing to the increasing number of fintech companies characterized by a notable rise in alternative finance, banking, and digital payments. For instance, in 2022, more than 1,200 fintech businesses were registered in Latin America, a remarkable 46% increase from the year before. Financial technology solutions have proliferated in the region, which is expected to help in several ways to meet the needs of the rural market, including financial inclusion and easy access to loans. Financial technology, or FinTech, has revolutionized the conventional lending process, making loans more accessible and giving micro lending clients better access to capital.

Brazil has a significant need for micro loans due to its large number of small businesses, low-income individuals, and underserved population. Many local banks offer micro lending products, often through specialized departments or partnerships with MFIs. Banks like Banco do Brasil and Banco Itaú Unibanco S.A have micro lending programs targeting small businesses and low income borrowers.

In addition to encouraging economic growth, self-employment, and financial empowerment, the microfinance industry in Mexico has seen tremendous transformation and evolution. It has also helped women take on more decision-making roles and has significantly increased women's ability to escape poverty and maintain their way of life.

Micro Lending Market Players:

- Bajaj Finserv Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Accion International

- ESAF Small Finance Bank

- Ujjivan Small Finance Bank Ltd.

- Fincare Small Finance Bank Ltd.

- Fusion Micro Finance Ltd.

- Bajaj Finserv Ltd.

- Bandhan Bank Ltd.

- Bluevine Capital Inc.

- Equitas Small Finance Bank Ltd.

- ICICI Bank Ltd.

- Fusion MicroFinance

Numerous important companies in the micro lending market are starting several tactical projects to increase their market share and strengthen their positions in the industry. It is predicted that the top five companies will control the majority of the market share by taking calculated risks, expanding, forming agreements, and participating in joint ventures.

Recent Developments

- In October 2023, Bajaj Finserv Ltd. an Indian non-banking financial services company announced the introduction of microfinance tractor and commercial vehicle lending to rank among the top three in its industry.

- In May 2024, Fusion MicroFinance announced that it is currently seeking growth finance from the US International Development Finance Corporation (DFC) to support the expansion of its loan portfolio and business operations.

- Report ID: 6295

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Micro Lending Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.