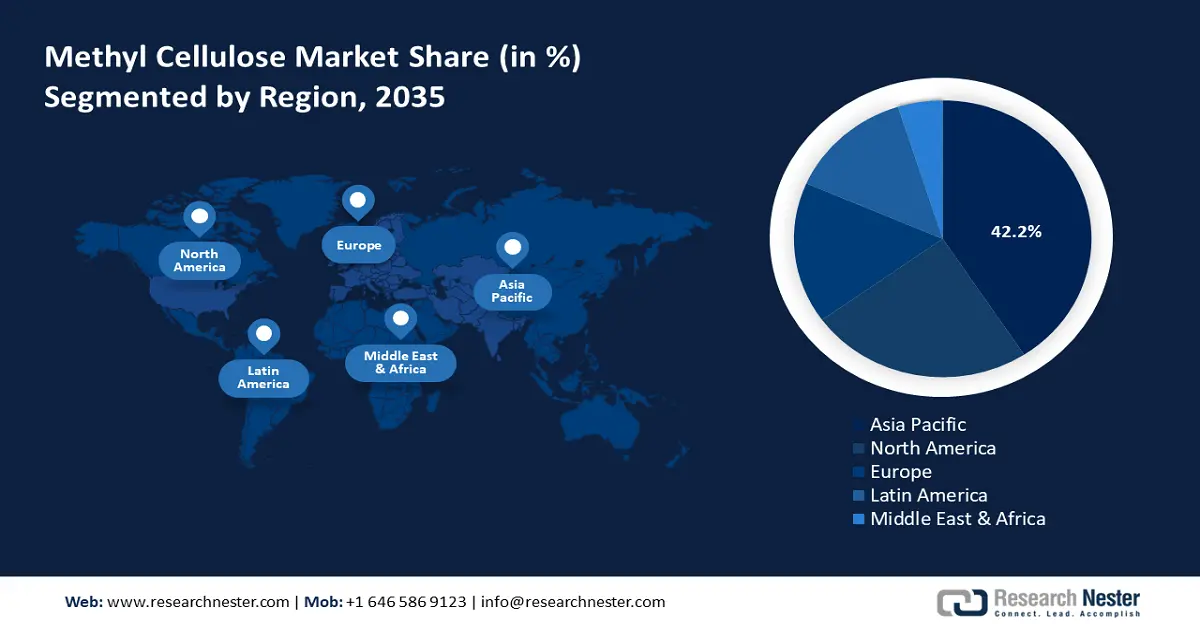

Methyl Cellulose Market Regional Analysis:

APAC Market Statistics

Asia Pacific methyl cellulose market is estimated to hold the largest share of 42.2% during the forecast period. The growing industrial and residential construction sectors in developing Asia-Pacific nations including China, Vietnam, Bangladesh, and India will drive the demand for methyl cellulose. Furthermore, the ease of obtaining raw materials, rising purchasing power, a strict but reasonable regulatory environment, low labor costs, and better development strategies to meet the demand for methyl cellulose in expanding applications are propelling its growth in the region.

The construction industry in China is experiencing significant growth, due to favorable government initiatives aimed at supporting infrastructure development, consequently driving the growth of methyl cellulose market. According to the International Trade Administration, China's 14th Five-Year Plan has a strong emphasis on new urbanization, water systems, energy, and transportation infrastructure projects. The 14th Five-Year Plan period (2021–2025) is expected to see an overall investment in new infrastructure of over USD 4.2 trillion.

In India, major methyl cellulose market players are expanding the paint and coating sectors due to rapidly increasing consumer demand and per capita income. According to leading paint producer Akzo Nobel India, in the next five years, the paints and coatings sector is anticipated to grow to USD 12.22 billion. Also, the demand from the real estate industry has increased as a result of the post-pandemic boom in investments and infrastructure development.

North America Market Analysis

North America methyl cellulose market will gain a substantial share by 2035. The market growth can be attributed to the increased expenditure on research & development activities in the region. Additionally, since lubricants are widely utilized in both general and automotive industries, the market will continue to rise due to growing general industry and automobile production and sales. Trading Economics stated that in 2024, the number of vehicles sold in the U.S. climbed from 15.80 million in September to 16 million in October.

Furthermore, due to their strong manufacturing and end-use sectors, the U.S. and Canada are two of the main contributors to the regional methyl cellulose market growth and are predicted to have considerable regional market growth. Moreover, the presence of major key players such as Dow Chemical Company, Ashland, Inc., and Sigma-Aldrich Co., LLC are accelerating the methyl cellulose market expansion in the countries.