Methyl Cellulose Market Outlook:

Methyl Cellulose Market size was valued at USD 466.79 billion in 2025 and is expected to reach USD 704.37 billion by 2035, registering around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of methyl cellulose is evaluated at USD 484.43 billion.

The methyl cellulose market is expanding mainly due to its growing use in the construction industry. Methyl cellulose is a common constituent in building applications such as cement mortars, tile adhesives, and gypsum-based plasters because it enhances bonding and retains water effectively. The growth of the construction industry, particularly in emerging economies, has increased the demand for methyl cellulose. Asia Pacific is experiencing significant growth, particularly in China, India, and Southeast Asia, which drives the demand for construction chemicals, including methyl cellulose. For instance, by 2025, the construction industry of India is projected to grow to USD 1.4 trillion. The country has allocated USD 1.4 trillion for infrastructure under NIP, with 24% going toward renewable energy, 18% toward roads and highways, 17% toward urban infrastructure, and 12% toward railroads.

High-performance building materials are becoming increasingly important as cities grow and construction activity increases. Moreover, developed economies are also investing in smart city projects and residential developments, further boosting the methyl cellulose market. Thus, the construction industry’s expansion, combined with technological advancements in construction chemicals, is a key growth driver for methyl cellulose market.

Key Methyl Cellulose Market Insights Summary:

Regional Highlights:

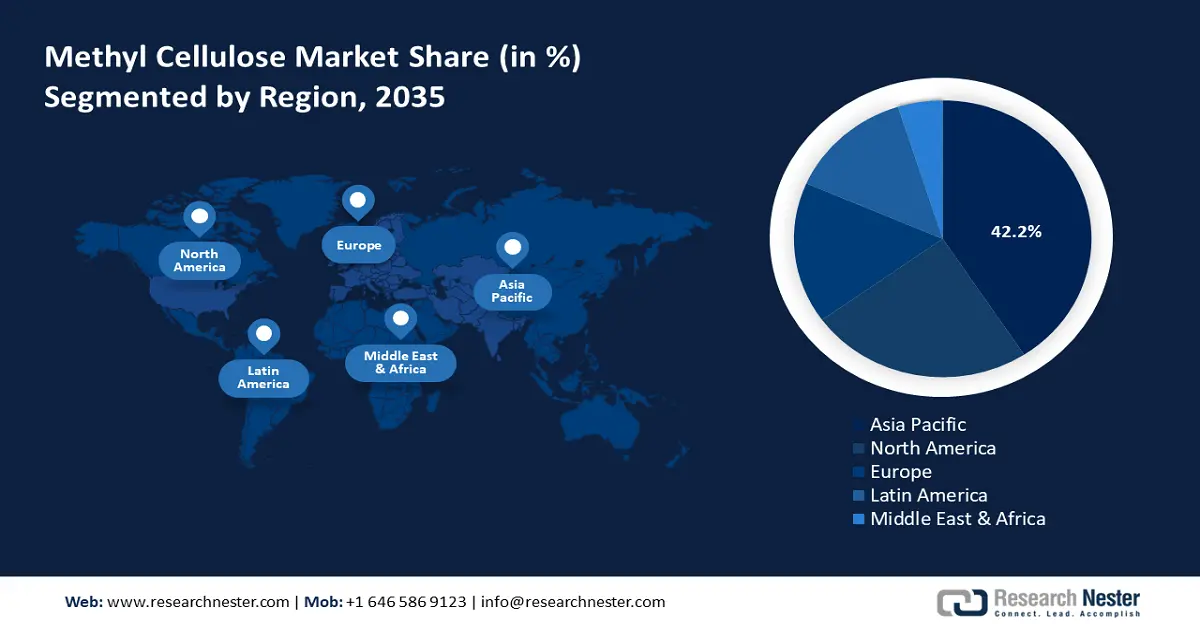

- Asia Pacific leads the Methyl Cellulose Market with a 42.2% share, fueled by industrial and residential construction expansion, raw material availability, and cost-effective labor, driving sustained growth through 2035.

- North America's methyl cellulose market is poised for substantial share growth by 2035, driven by increased R&D, strong manufacturing, and widespread lubricant use in industrial and automotive sectors.

Segment Insights:

- Construction Material segment is projected to account for a 36.4% share by 2035, driven by the use of methyl cellulose as a performance enhancer.

Key Growth Trends:

- Surging demand in the pharmaceutical industry

- Growing use in the food sector

Major Challenges:

- Stringent regulations

- Fluctuating raw materials prices

- Key Players: The Dow Chemical Company, Ashland Inc., Signa-Aldrich Co., LLC, Zhejiang Kehong Chemical Co., Ltd., BASF SE, LOTTE Fine Chemical, Reliance Cellulose Products Ltd., SE-Tylose GmbH & Co., Hercules Tianpu Chemicals Company Limited, Celotech Chemical Co., Ltd.

Global Methyl Cellulose Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 466.79 billion

- 2026 Market Size: USD 484.43 billion

- Projected Market Size: USD 704.37 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 13 August, 2025

Methyl Cellulose Market Growth Drivers and Challenges:

Growth Drivers

- Surging demand in the pharmaceutical industry: A crucial pharmaceutical excipient, methyl cellulose stabilizes medicine formulations by halting the deterioration of active ingredients with moisture, heat, and light. It helps drugs with long-term dosage requirements due to their controlled-release characteristics, which provide steady therapeutic effects. Adjusting to sophisticated formulations improves bioavailability and makes customized drug delivery systems possible.

Methylcellulose-containing solutions are replaced if the normal production of tears or saliva is disrupted. Additionally, they are used to treat diverticulosis, hemorrhoids, constipation, and irritable bowel syndrome. A recent study by the National Institutes of Health (NIH) reported that hemorrhoids affect 50%-85% of people worldwide. They can impact people of any age and gender.Therefore, the prevalence of bowel disorders has increased the demand for methyl cellulose for treatment. - Growing use in the food sector: Cellulose, a key component of plant cell walls, is the source of methyl cellulose, a non-toxic, odorless, and tasteless substance. It is created by processing cellulose with sodium hydroxide and methyl chloride. By changing the structure of cellulose, this chemical process gives methyl cellulose special qualities like increased water solubility and thickening capacity, making it an indispensable ingredient in various food applications. It is widely used as a thickening and stabilizing agent in sauces, dressings, and dairy alternatives.

Moreover, methyl cellulose is emerging as a savior for those suffering from celiac disease, as it replicates the viscoelastic qualities of gluten by acting as a binder and texturizer in gluten-free baking. It enhances the overall structure of baked products including bread, cakes, and cookies, and the handling of dough and gas retention. As of 2024, Celiac disease is one of the most common lifelong disorders in the world, with a prevalence of 0.7% to 2.9% in the general population and a higher frequency in females and well-defined at-risk groups, such as affected individuals' relatives and patients with autoimmune comorbidities. - Growing focus on sustainability: Methyl cellulose is derived from cellulose, a naturally occurring polymer found in plant fibers, making it biodegradable and environmentally friendly. As industries shift away petroleum-based chemicals methyl cellulose offers a sustainable alternative in various applications like construction, food, cosmetics, and pharmaceuticals. Government and international organizations are encouraging the adoption of sustainable materials through regulations and incentives. Methyl cellulose being a low-impact material, benefits from such policies.

Challenges

- Stringent regulations: The use of methyl cellulose in various industries, particularly food and pharmaceuticals, is strictly regulated to guarantee the quality and safety of the final product. These rules specify the acceptable amounts, purity, and application of additives and are established by regulatory bodies such as the Food and Drug Administration (FDA) and other international organizations. Manufacturers need to manage intricate compliance standards, which may call for changes to labeling, ingredient procurement, and formulation procedures. Compliance with these regulations is essential to protect consumer health and prevent possible legal repercussions. Therefore, meeting stringent laws may hinder the methyl cellulose market from growing.

- Fluctuating raw materials prices: Cellulose, mostly derived from wood pulp or cotton liners, is converted into methyl cellulose. By increasing the entire cost of manufacturing, changes in the price of these raw materials can affect the market price and profitability of methyl cellulose.

Methyl Cellulose Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 466.79 billion |

|

Forecast Year Market Size (2035) |

USD 704.37 billion |

|

Regional Scope |

|

Methyl Cellulose Market Segmentation:

Application (Construction Material, Cosmetic & Personal Care, Paints & Coatings, Pharmaceutical)

Construction material segment is set to dominate around 36.4% methyl cellulose market share by the end of 2035. The market growth can be attributed to the growing use of methyl cellulose as a performance enhancer in construction materials. It is added to dry mortar mixtures to enhance the mortar's workability, water retention, viscosity, adherence to surfaces, and open and adjustment times, among other qualities. Both gypsum and cement can be used as building materials. Tile adhesives, EIFS, insulating plasters, hand-trowelled and machine-sprayed plaster, stucco, self-leveling flooring, extruded cement panels, skim coatings, joint & crack fillers, and tile grouts are notable instances of dry mixed mortars that use methyl cellulose.

Methyl cellulose helps reduce material wastage by improving adhesion, workability, and shelf-life, making it a cost-effective choice for manufacturing and contractors. Moreover, rapid urbanization and infrastructure development are driving the demand for construction materials. Large-scale residential, commercial and industrial projects require high-performance construction additives, boosting the use of methyl cellulose.

Derivation (Hydroxyethyl Methyl Cellulose, Hydroxybutyl Methyl Cellulose, Hydroxypropyl Methyl Cellulose)

The hydroxypropyl methyl cellulose (HPMC) segment in methyl cellulose market is poised to garner a notable share in the forecast period. The segment is growing owing to its excellent film-forming properties, which makes it suitable for various applications such as tablet coatings, encapsulation, and controlled-release formulations. Both aqueous and nonaqueous solvents can be used since HPMC is soluble in polar organic solvents. It is soluble in hot and cold organic solvents, with special solubility characteristics. Due to its thermoplasticity and organo-solubility, HPMC is superior to its counterparts in methyl cellulose. Moreover, HPMC is generally recognized as safe (GRAS) by regulatory bodies, making it a preferred choice for use in diverse industries.

Our in-depth analysis of the global methyl cellulose market includes the following segments:

|

Derivation |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Methyl Cellulose Market Regional Analysis:

APAC Market Statistics

Asia Pacific methyl cellulose market is estimated to hold the largest share of 42.2% during the forecast period. The growing industrial and residential construction sectors in developing Asia-Pacific nations including China, Vietnam, Bangladesh, and India will drive the demand for methyl cellulose. Furthermore, the ease of obtaining raw materials, rising purchasing power, a strict but reasonable regulatory environment, low labor costs, and better development strategies to meet the demand for methyl cellulose in expanding applications are propelling its growth in the region.

The construction industry in China is experiencing significant growth, due to favorable government initiatives aimed at supporting infrastructure development, consequently driving the growth of methyl cellulose market. According to the International Trade Administration, China's 14th Five-Year Plan has a strong emphasis on new urbanization, water systems, energy, and transportation infrastructure projects. The 14th Five-Year Plan period (2021–2025) is expected to see an overall investment in new infrastructure of over USD 4.2 trillion.

In India, major methyl cellulose market players are expanding the paint and coating sectors due to rapidly increasing consumer demand and per capita income. According to leading paint producer Akzo Nobel India, in the next five years, the paints and coatings sector is anticipated to grow to USD 12.22 billion. Also, the demand from the real estate industry has increased as a result of the post-pandemic boom in investments and infrastructure development.

North America Market Analysis

North America methyl cellulose market will gain a substantial share by 2035. The market growth can be attributed to the increased expenditure on research & development activities in the region. Additionally, since lubricants are widely utilized in both general and automotive industries, the market will continue to rise due to growing general industry and automobile production and sales. Trading Economics stated that in 2024, the number of vehicles sold in the U.S. climbed from 15.80 million in September to 16 million in October.

Furthermore, due to their strong manufacturing and end-use sectors, the U.S. and Canada are two of the main contributors to the regional methyl cellulose market growth and are predicted to have considerable regional market growth. Moreover, the presence of major key players such as Dow Chemical Company, Ashland, Inc., and Sigma-Aldrich Co., LLC are accelerating the methyl cellulose market expansion in the countries.

Key Methyl Cellulose Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ashland Inc.

- Signa-Aldrich Co., LLC

- Zhejiang Kehong Chemical Co., Ltd.

- BASF SE

- LOTTE Fine Chemical

- Reliance Cellulose Products Ltd.

- SE-Tylose GmbH & Co.

- Hercules Tianpu Chemicals Company Limited

- Celotech Chemical Co., Ltd.

The methyl cellulose market is fiercely competitive, with manufacturers dedicating significant efforts to enhancing their products. A wealth of experience and expertise in the sector has enabled these manufacturers to secure substantial market shares. Through various strategic initiatives and key decisions, leading companies have successfully expanded their presence and built a large customer base.

Recent Developments

- In February 2023, Ashland introduced Benecel MX 100 methylcellulose, a high-volume, large-scale production solution for meat replacement products that enhance the consumer experience. The new solution for the nutrition business expands the company's award-winning Benecel MX portfolio of plant-based protein meal formulations.

- In January 2020, Nouryon agreed to acquire J.M. Huber Corporation's carboxymethyl cellulose (CMC) business, accelerating its growth goals. The transaction will significantly expand Nouryon's product portfolio in CMC, a biodegradable, water-soluble polymer used as a thickener, binder, stabilizer, and film forming. The companies have essentially complementary roles in CMC end areas such as home and personal care, mining, food, medicines, and paper and packaging.

- Report ID: 6827

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Methyl Cellulose Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.