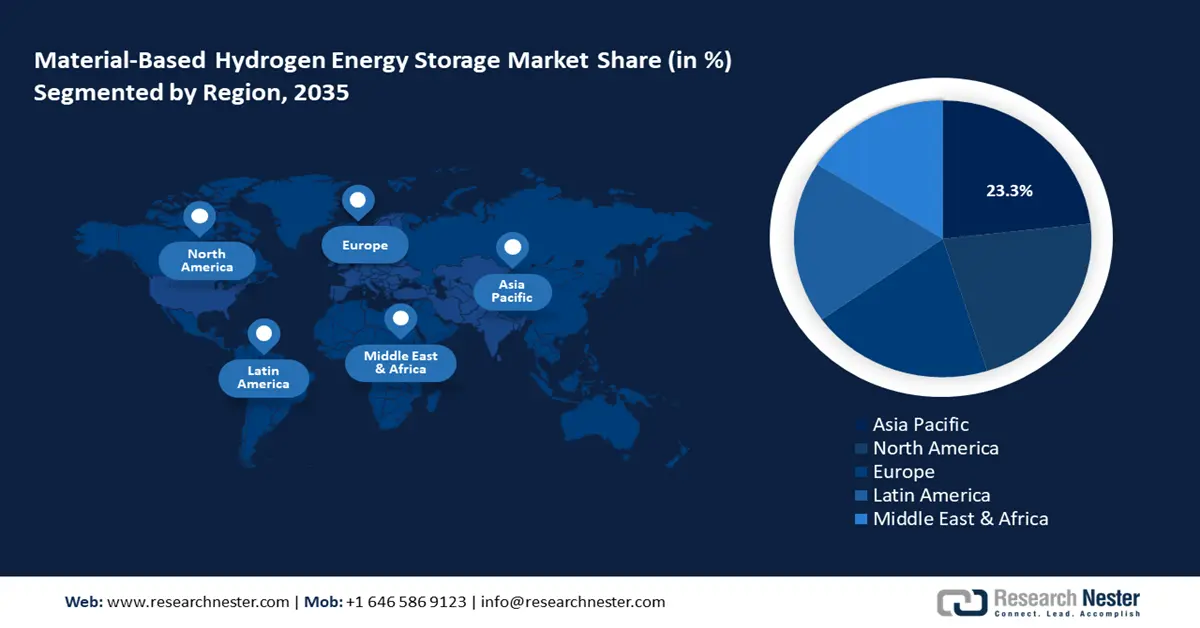

Material-based Hydrogen Energy Storage Market Regional Analysis:

APAC Market Insights

By 2035, Asia Pacific material-based hydrogen energy storage market is anticipated to account for around 23.3% share. The market’s growth in APAC is attributed to investments in sustainability initiatives. The market’s growth is led by China, Japan, South Korea, and India by investing heavily in advanced material-based hydrogen storage technologies. Additionally, the Observatory of Economic Complexity (OEC) reported 3 APAC countries, i.e., China, Japan, and South Korea, as the global top importers of hydrogen in 2022. As APAC countries continue to build robust and reliable hydrogen supply chains, the demand for advanced storage materials for hydrogen energy storage is expected to boom.

China is leading the market’s growth in APAC owing to large-scale industrial applications for hydrogen in the country. China has made considerable investments in building a robust hydrogen infrastructure. The OEC reported in 2022, that China imported USD 3.46 billion worth of hydrogen. The material-based hydrogen energy storage sector in the country benefits from a favorable regulatory ecosystem as the country as the government has created a medium- and long-term development plan for hydrogen from 2021 to 2035 and targets to bring 5000 hydrogen fuel cell vehicles on the road by 2025 while also building multiple hydrogen refueling stations. With the country aiming to become a leader in hydrogen fuel-cell automobile solutions, the hydrogen energy storage sector is positioned to witness large-scale demands. In April 2023, the China Southern Power Grid (CSG) launched a hydrogen energy development project to solve the bottleneck of storing hydrogen in solid form under regular temperature conditions.

Japan is positioned to exhibit rapid growth in the material-based hydrogen energy storage sector owing to favorable regulatory conditions pushing for hydrogen to become an energy source to reduce dependency on fossil fuels. Japan was at the forefront of identifying the potential of hydrogen by drafting a national hydrogen strategy in 2017 and released a revised strategy in 2023 seeking international cooperation in building a robust hydrogen supply chain. The revised national hydrogen strategy focuses on the commercialization of Japan-developed hydrogen-related technology, which is poised to increase revenue opportunities for domestic players supplying material-based hydrogen energy storage solutions.

The favorable regulatory ecosystem is boosting corporations to invest in developing efficient hydrogen energy storage systems to leverage the burgeoning opportunities in the sector. For instance, in April 2024, the chemicals firm Tokuyama began mass production of magnesium hydride that the company claims can output twice as much hydrogen than it originally stored.

North America Market Insights

The North America market for material-based hydrogen energy storage is poised to register the fastest growth during the forecast period owing to rising investments in building green energy infrastructure in the region. The U.S. and Canada lead the market’s revenue growth in North America with both the countries among the top 5 hydrogen importers globally in 2023 as per the World Integrated Trade Solution. As the transportation sector welcomes the increasing deployment and investment in hydrogen fuel cell electric vehicles, the sector is positioned to maintain its rapid growth curve.

The U.S. holds the largest share in the material-based hydrogen energy storage sector in North America. In 2023, the World Integrated Solution reported U.S. was the second largest importer of hydrogen globally behind the Netherlands with a trade value of around USD 68 billion. The growing need for hydrogen-powered solutions in the country necessitates effective hydrogen energy storage solutions, boosting the growth of the sector. The U.S. Department of Energy (DOE) indicated ongoing research and development on metal hydride, chemical hydrogen storage, and sorbents for efficient material-based hydrogen energy storage solutions for automobiles in the country. The U.S. is investing to build a robust hydrogen refueling station infrastructure to cater to burgeoning demands. For instance, in May 2024, Air Products announced plans to build a network of commercial-scale hydrogen refueling stations with the ability to fuel 200 heavy-duty trucks and 2000 light-duty vehicles per day. The trends are poised to benefit domestic manufacturers supplying material-based hydrogen storage solutions.

Canada is projected to increase its revenue share by the end of the forecast period in the material-based hydrogen energy storage sector. The market’s growth in Canada is attributed to increasing investments in building a renewable energy infrastructure to meet decarbonization targets by 2050. In 2023, the World Integrated Trade Solutions positioned Canada to be 6th in global hydrogen imports with an estimated USD 6.7 billion worth of trade value. The country is also home to promising research breakthroughs in hydrogen storage solutions. For instance, in October 2021, Canadian Nuclear Laboratories (CNL) developed a new magnesium-based alloy that is capable of storing over 6% of its weight in hydrogen. Additionally, a favorable regulatory ecosystem providing investments in energy transition programs boosts the market’s growth. For instance, in August 2022, Air Products announced that it would receive approximately USD 355 million in funding from government energy transition programs to build a net-zero hydrogen energy complex.