Material-based Hydrogen Energy Storage Market Outlook:

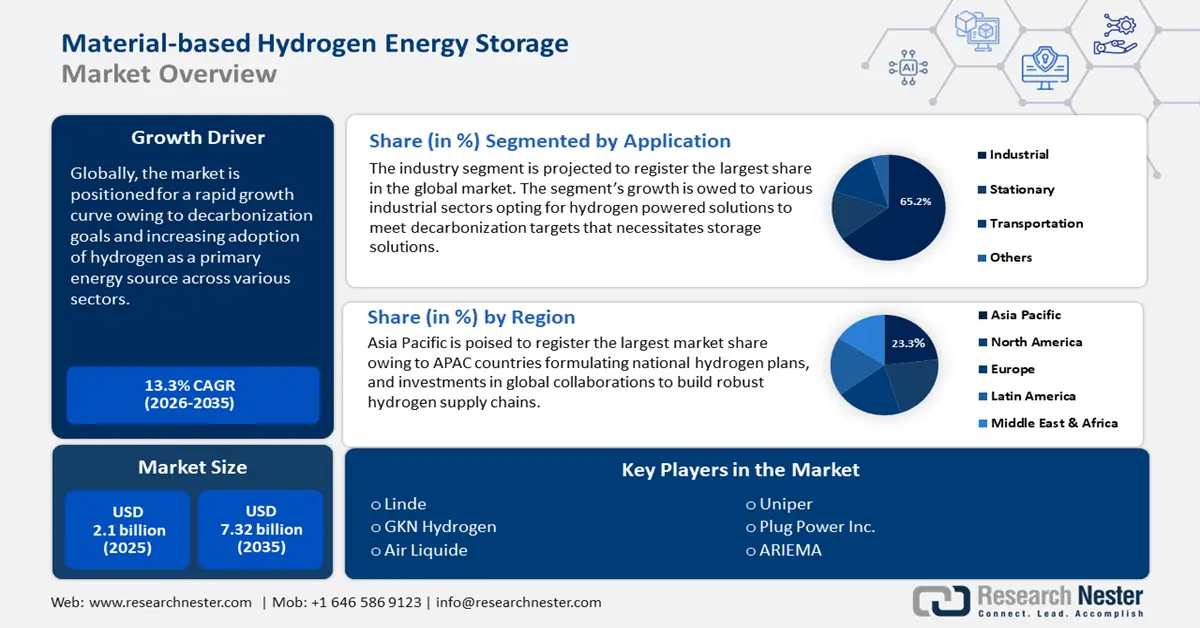

Material-based Hydrogen Energy Storage Market size was valued at USD 2.1 billion in 2025 and is set to exceed USD 7.32 billion by 2035, registering over 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of material-based hydrogen energy storage is estimated at USD 2.35 billion.

The market’s growth is attributed to rising demands for scalable energy storage solutions in various sectors. The global shift towards prioritizing clean energy sources boosts the demand for hydrogen as a preferred energy carrier, fueling the market’s growth. Additionally, advancements in materials science have led to the discovery of new and improved properties for hydrogen storage.

A major driver for the material-based hydrogen energy storage market is the change in global trends towards green hydrogen production and storage. Globally, numerous countries have announced commitment towards achieving net-zero emissions. More than 140 countries, including the world's largest polluters - China, the United States, India, and the European Union - have set a net-zero objective, which accounts for around 88% of worldwide emissions. The commercial production of hydrogen has increased over the years. The International Renewable Energy Agency (IRENA) estimated global hydrogen production at 75 MtH2/yr as pure hydrogen and 45 MtH2/yr as part of mixed gases in 2022, and the production was equivalent to 3% of global final energy demand. Additionally, IRENA estimated that hydrogen could contribute up to 10% of mitigation and 12% of final energy demand.

By the next decade, the use of hydrogen as an energy storage is poised to surge in transport applications, industrial manufacturing, and residential power systems. Hydrogen fuel cell vehicles are poised to benefit from advanced storage materials by enabling efficient storage and recycling, boosting demands for hydrogen energy storage. The key market players in the material-based hydrogen energy storage market are projected to benefit from new revenue opportunities in steel manufacturing and ammonia production industries to reduce reliance on non-renewable resources and curtail carbon emissions. As material-based storage solutions continue to become essential parts of the hydrogen-based energy ecosystem, the sector is positioned to continue its profitable growth curve by the forecast period.

Key Material-Based Hydrogen Energy Storage Market Insights Summary:

Regional Highlights:

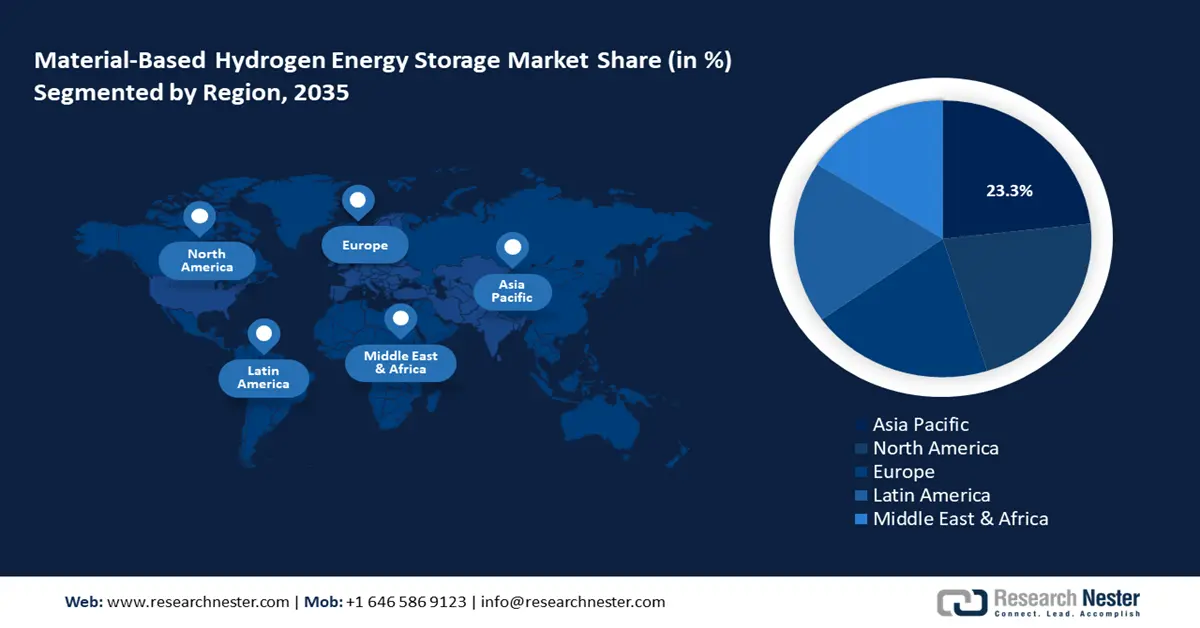

- Asia Pacific material-based hydrogen energy storage market will account for 23.30% share by 2035, driven by investments in sustainability initiatives and advanced material-based hydrogen storage technologies.

- North America market will exhibit the fastest growth during the forecast period 2026-2035, attributed to rising investments in green energy infrastructure and hydrogen fuel cell vehicle deployment.

Segment Insights:

- Industrial segment in the material-based hydrogen energy storage market is anticipated to achieve 65.20% growth by the forecast year 2035, driven by increasing hydrogen adoption in industrial sectors like chemical production, refineries, and steel manufacturing.

- Industrial segment in the material-based hydrogen energy storage market is anticipated to achieve 65.20% growth by the forecast year 2035, driven by increasing hydrogen adoption in industrial sectors like chemical production, refineries, and steel manufacturing.

Key Growth Trends:

- Rising adoption in transportation

- Favorable regulatory ecosystem and decarbonization targets

Major Challenges:

- Challenge in supply chain due to limited infrastructure

- Weight-to-volume ratio and hydrogen embrittlement

Key Players: Linde, Cummins Inc., GKN Hydrogen, Air Liquide, FuelCell Energy, Plug Power Inc., McPhy, Uniper, Engie, ITM Power, and ARIEMA.

Global Material-Based Hydrogen Energy Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.35 billion

- Projected Market Size: USD 7.32 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (23.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Material-based Hydrogen Energy Storage Market Growth Drivers and Challenges:

Growth Drivers

- Rising adoption in transportation: The transportation sector is witnessing increasing adoption of hydrogen as a clean fuel alternative to traditional fossil fuels. Industries such as heavy-duty vehicles, aviation, and maritime sectors are set to benefit from the growth of the material-based hydrogen energy storage market. Storage systems such as metal hydrides or carbon nanomaterials are ideal for hydrogen fuel cell electric vehicles owing to their ability to store hydrogen in lightweight form. The market’s robust growth is owed to automobile companies leveraging hydrogen energy-based solutions owing to a reduction in refueling time. For instance, in September 2024, Hyundai Motor and Skoda Group signed a memorandum of understanding (MoU) to cooperate in establishing a hydrogen economy to boost a sustainable future mobility ecosystem.

- Favorable regulatory ecosystem and decarbonization targets: National governments and international organizations are pushing for decarbonization targets owing to a net-zero emissions goal by 2050. The decarbonization trends create profitable revenue opportunities for the global material-based hydrogen energy storage market. Government tax breaks and incentives make it lucrative for businesses to invest in research on hydrogen energy storage and adopt hydrogen energy-based solutions in their sectors by creating a favorable regulatory ecosystem. For instance, the Inflation Reduction Act of 2022 (IRA) in the U.S. provides incentives such as clean energy tax credits to increase domestic renewable energy production.

Various governments are increasingly giving similar subsidies to encourage companies to ramp up production of green energy. In December 2023, fourteen companies in India, such as Bharat Petroleum Corp, JSW Energy, Sembcorp Green Hydrogen, Acme Cleantech, etc., submitted their bids for tax incentives under the green hydrogen mission of India. - Technological advancements in hydrogen storage materials: Increasing investments in research on storage materials such as carbon-based nanomaterials, metal hydrides, and alloys are positioned to improve the efficiency of hydrogen energy storage systems. For example, a September 2024 study by the Royal Society of Chemistry noted that supramolecular crystals have the potential for storing hydrogen owing to their molecular structure, which is made of interconnected organic materials in a honeycomb pattern. This structure makes the material more stable and allows it to store 53.7 g of hydrogen per liter.

Ongoing research aiming to increase storage capacity and remain lightweight is projected to boost the revenue surge of the material-based hydrogen energy storage market. Additionally, the commercialization of advanced materials is poised to reduce the cost of hydrogen energy storage, further fueling the market’s rapid growth.

Challenges

- Challenge in supply chain due to limited infrastructure: The hydrogen production, transportation, and storage infrastructure can be underdeveloped in emerging economies which can pose a challenge to the market’s growth. Additionally, the supply chain is affected owing to limited infrastructure in certain regions. A volatile supply chain can affect the scope of penetration in new markets as well as the global market. Logistical bottlenecks and delays can curtail the market’s growth curve.

- Weight-to-volume ratio and hydrogen embrittlement: The market’s growth curve can be affected due to hydrogen embrittlement as metals can become brittle and prone to failure. This can lead to limitations in materials that can effectively store hydrogen energy in high-pressure applications. Additionally, achieving an optimal weight-to-volume ratio is a challenge for manufacturers in the material-based hydrogen energy storage market. The U.S. Department of Energy (DoE) set a target for hydrogen energy storage systems, i.e., the weight of stored hydrogen should be, at the very minimum, 6.5% of the total system. Achieving strict standards can cause challenges for the market.

Material-based Hydrogen Energy Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 7.32 billion |

|

Regional Scope |

|

Material-based Hydrogen Energy Storage Market Segmentation:

Application Segment Analysis

Industrial segment is anticipated to capture material-based hydrogen energy storage market share of over 65.2% by 2035. The segment is poised to increase its profit share by the end of the forecast period owing to the increasing adoption of hydrogen in various industrial sectors such as chemical production, refineries, steel manufacturing, etc. Owing to stringent environmental regulations and a global push for decarbonization, industries are leveraging hydrogen to reduce reliance on non-renewable fuels. This has necessitated effective hydrogen energy storage solutions boosting the applications in the industrial segment. For instance, in December 2023, GKN Hydrogen and Mitsubishi Corporation signed a memorandum of understanding (MoU) to bring GKN hydrogen’s metal hydride hydrogen storage to Japan.

The stationary segment is projected to increase its revenue share in the material-based hydrogen energy storage sector by the end of 2035. The segment’s growth curve is attributed to the rising deployment of solar and wind power that require reliable energy storage solutions. The increase in demand boosts the application of material-based hydrogen energy storage solutions owing to their ability to convert excess renewable energy to hydrogen and store it for future use. These applications are ideal as backup power solutions and as requirements to stabilize renewable energy grids to ensure long-duration energy storage increases, the segment will continue to witness growth. For instance, in September 2024, hydrogen-storage solution company H2MOF reported a breakthrough in storing solid-state hydrogen at ambient temperatures and low pressure, and the tech is projected to undergo industrial testing soon.

Our in-depth analysis of the material-based hydrogen energy storage market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Material-based Hydrogen Energy Storage Market Regional Analysis:

APAC Market Insights

By 2035, Asia Pacific material-based hydrogen energy storage market is anticipated to account for around 23.3% share. The market’s growth in APAC is attributed to investments in sustainability initiatives. The market’s growth is led by China, Japan, South Korea, and India by investing heavily in advanced material-based hydrogen storage technologies. Additionally, the Observatory of Economic Complexity (OEC) reported 3 APAC countries, i.e., China, Japan, and South Korea, as the global top importers of hydrogen in 2022. As APAC countries continue to build robust and reliable hydrogen supply chains, the demand for advanced storage materials for hydrogen energy storage is expected to boom.

China is leading the market’s growth in APAC owing to large-scale industrial applications for hydrogen in the country. China has made considerable investments in building a robust hydrogen infrastructure. The OEC reported in 2022, that China imported USD 3.46 billion worth of hydrogen. The material-based hydrogen energy storage sector in the country benefits from a favorable regulatory ecosystem as the country as the government has created a medium- and long-term development plan for hydrogen from 2021 to 2035 and targets to bring 5000 hydrogen fuel cell vehicles on the road by 2025 while also building multiple hydrogen refueling stations. With the country aiming to become a leader in hydrogen fuel-cell automobile solutions, the hydrogen energy storage sector is positioned to witness large-scale demands. In April 2023, the China Southern Power Grid (CSG) launched a hydrogen energy development project to solve the bottleneck of storing hydrogen in solid form under regular temperature conditions.

Japan is positioned to exhibit rapid growth in the material-based hydrogen energy storage sector owing to favorable regulatory conditions pushing for hydrogen to become an energy source to reduce dependency on fossil fuels. Japan was at the forefront of identifying the potential of hydrogen by drafting a national hydrogen strategy in 2017 and released a revised strategy in 2023 seeking international cooperation in building a robust hydrogen supply chain. The revised national hydrogen strategy focuses on the commercialization of Japan-developed hydrogen-related technology, which is poised to increase revenue opportunities for domestic players supplying material-based hydrogen energy storage solutions.

The favorable regulatory ecosystem is boosting corporations to invest in developing efficient hydrogen energy storage systems to leverage the burgeoning opportunities in the sector. For instance, in April 2024, the chemicals firm Tokuyama began mass production of magnesium hydride that the company claims can output twice as much hydrogen than it originally stored.

North America Market Insights

The North America market for material-based hydrogen energy storage is poised to register the fastest growth during the forecast period owing to rising investments in building green energy infrastructure in the region. The U.S. and Canada lead the market’s revenue growth in North America with both the countries among the top 5 hydrogen importers globally in 2023 as per the World Integrated Trade Solution. As the transportation sector welcomes the increasing deployment and investment in hydrogen fuel cell electric vehicles, the sector is positioned to maintain its rapid growth curve.

The U.S. holds the largest share in the material-based hydrogen energy storage sector in North America. In 2023, the World Integrated Solution reported U.S. was the second largest importer of hydrogen globally behind the Netherlands with a trade value of around USD 68 billion. The growing need for hydrogen-powered solutions in the country necessitates effective hydrogen energy storage solutions, boosting the growth of the sector. The U.S. Department of Energy (DOE) indicated ongoing research and development on metal hydride, chemical hydrogen storage, and sorbents for efficient material-based hydrogen energy storage solutions for automobiles in the country. The U.S. is investing to build a robust hydrogen refueling station infrastructure to cater to burgeoning demands. For instance, in May 2024, Air Products announced plans to build a network of commercial-scale hydrogen refueling stations with the ability to fuel 200 heavy-duty trucks and 2000 light-duty vehicles per day. The trends are poised to benefit domestic manufacturers supplying material-based hydrogen storage solutions.

Canada is projected to increase its revenue share by the end of the forecast period in the material-based hydrogen energy storage sector. The market’s growth in Canada is attributed to increasing investments in building a renewable energy infrastructure to meet decarbonization targets by 2050. In 2023, the World Integrated Trade Solutions positioned Canada to be 6th in global hydrogen imports with an estimated USD 6.7 billion worth of trade value. The country is also home to promising research breakthroughs in hydrogen storage solutions. For instance, in October 2021, Canadian Nuclear Laboratories (CNL) developed a new magnesium-based alloy that is capable of storing over 6% of its weight in hydrogen. Additionally, a favorable regulatory ecosystem providing investments in energy transition programs boosts the market’s growth. For instance, in August 2022, Air Products announced that it would receive approximately USD 355 million in funding from government energy transition programs to build a net-zero hydrogen energy complex.

Material-based Hydrogen Energy Storage Market Players:

- Linde

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cummins Inc.

- GKN Hydrogen

- Air Liquide

- FuelCell Energy

- Plug Power Inc.

- McPhy

- Uniper

- Engie

- ITM Power

- ARIEMA

The material-based hydrogen energy storage market is projected to register a profitable growth curve during the forecast period. Key market players are investing to create favorable material-based hydrogen energy storage solutions that are lightweight and cost-effective for various sectors.

Here are some key players in the market:

Recent Developments

- In June 2024, the manufacturer of hydrogen storage systems, GKN Hydrogen, and global automotive supplier ZYNP signed a memorandum of understanding (MoU) to bring GKN Hydrogen’s metal hydride hydrogen storage to the market in China.

- In August 2023, Uniper Energy Storage announced the launch of a hydrogen storage research project that will investigate the feasibility of pore storage facilities for the storage of hydrogen.

- Report ID: 6631

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Material-Based Hydrogen Energy Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.