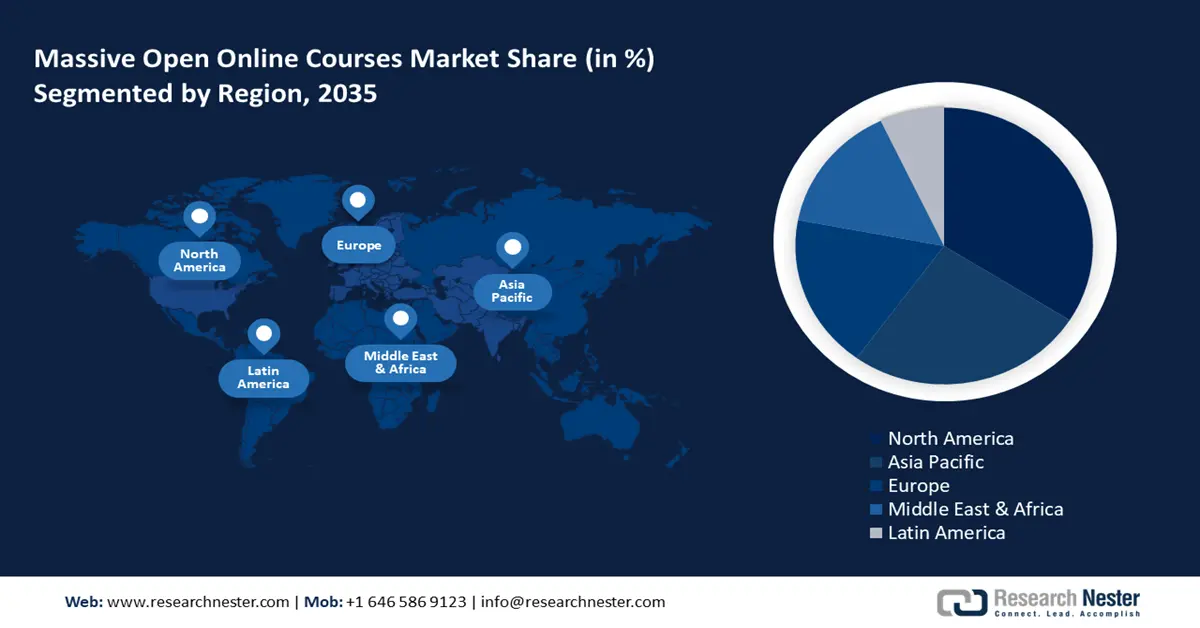

Massive Open Online Courses Market Regional Analysis:

North America Market Insights

North America industry is anticipated to hold largest revenue share of 33.7% by 2035. The region benefits from advanced digital infrastructure, high internet penetration, and a strong tradition for higher education. The MOOC market is characterized by the presence of top global platforms, partnerships with prestigious universities, and a rising demand for flexible, cost-effective learning solutions. For instance, Google partnered with Coursera to allow U.S.-based organizations who are eligible, to provide access to as many as five Google Professional Certificates on Coursera through December 31, 2025. It caters to a diverse range of learners, including students, professionals, and businesses. Integration of technologies such as AI, VR, and data analytics to enhance the learning experience is also driving the market growth in the region.

The U.S. is the largest massive open online courses (MOOC) market in North America due to the high digital literacy rate, and presence of major MOOC platforms. Universities including Harvard, MIT, and Stanford are pioneers in the MOOC movement, and platforms including Coursera and edX originated in the U.S. The U.S. state and federal governments are supporting online education programs to bridge the skills gap and help citizens transition into new careers. Companies and organizations facing talent shortages are sponsoring MOOCs for employees to help them develop new competencies.

Universities and educational institutions in Canada are offering online courses to complement traditional learning, majorly in technology, business management, and healthcare. Government support in digital initiatives is making MOOCs accessible across the country, including remote areas. Companies offer courses in both English and French to cater to the diverse Canadian population. The flexible modular learning options, allowing learners to acquire new skills throughout their careers, are driving Canada’s workforce to adopt more of these courses.

APAC Market Insights

APAC massive open online courses market is fueled by the large and youthful population, rapid digital transformation, and urbanization. Government initiatives promoting e-learning, and rising demand for upskilling are further boosting the MOOC market growth. Countries including China, India, and other Southeast Asia nations are witnessing a massive rise in smartphone penetration, allowing access to online learning platforms and engaging educational content, particularly in rural areas. Governments in the regions are actively promoting online education to bridge gaps in quality education access and to support workforce development. In January 2022, the World Economic Forum published an article stating highest rate of new learner growth online came from emerging economies. It further states that Asia Pacific witnesses a student presence of 28 million new online learners enrolling for 68 million courses on the learning platform.

Furthermore, the region’s growth is attributed to government initiatives supporting e-learning and a large population of young learners. As per an article released in August 2024 by Forbes, U.S., 23.9% take exclusively online courses, and 30.5% take both online and on-campus courses. At the graduate level, 38.7% enroll fully online, while 14.8% take classes in a hybrid format. Owing to the demand for flexible and affordable education, in addition to the growing popularity of micro-credentials, the massive open online courses market (MOOCs) is anticipated to witness significant growth in the forthcoming years.

India represents one of the largest potential markets for MOOCs, owing to the large population, and rising digital skills emphasis. International platforms such as Coursera, and edX have a strong foothold in the country, partnering with leading institutions, including the IITs. Furthermore, the government of India is also supportive of online courses, majorly helping the underprivileged in rural areas. For instance, India’s own MOOC platform SWAYAM, launched by the government, ensures access to the best teaching and learning resources to all, including the most underprivileged.

China is the most rapidly expanding market for MOOCs in the Asia Pacific. Rising demand for tech and business skills is driving the MOOC market in the country. Several platforms partner with top universities to offer localized content, as the population is majorly inclined towards science, and technology, in addition to entrepreneurship. The country has a high rate of digital literacy, and MOOCs are increasingly integrated into formal education systems as well as corporate training programs.