Massive Open Online Courses Market Outlook:

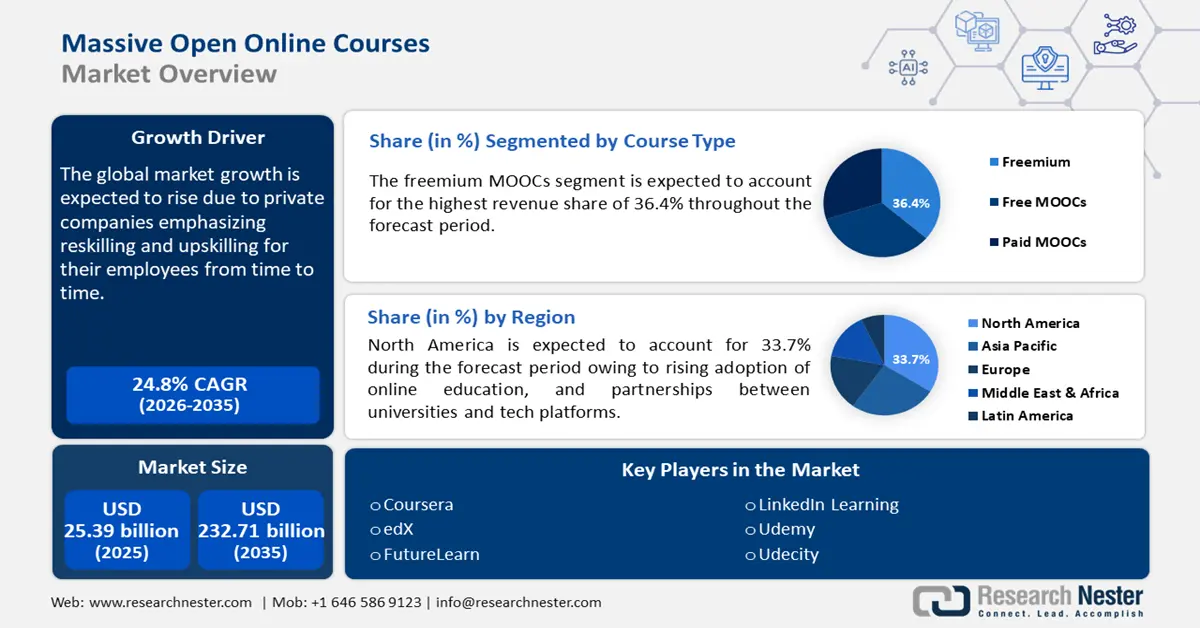

Massive Open Online Courses Market size was over USD 25.39 billion in 2025 and is projected to reach USD 232.71 billion by 2035, witnessing around 24.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of massive open online courses is evaluated at USD 31.06 billion.

Key factors fueling the MOOC market growth include the rising penetration of the internet and smartphones, the rapidly evolving job market, and the constant need for upskilling and reskilling to remain competitive. The growing acceptance of online education, particularly post-pandemic, further accelerated the adoption of MOOCs as institutions and learners sought remote education solutions. As per a report published by Harvard Online, in May 2024, 60% of all undergraduates enrolled in at least one online course, with 28% exclusively enrolled in online courses, post-pandemic. Furthermore, government support and initiatives for access to free and freemium courses are further fueling the massive open online courses (MOOC) market growth in both developed and developing countries. In addition, universities are collaborating with MOOC providers to enhance their offerings further.

Key Massive Open Online Courses (MOOC) Market Insights Summary:

Regional Highlights:

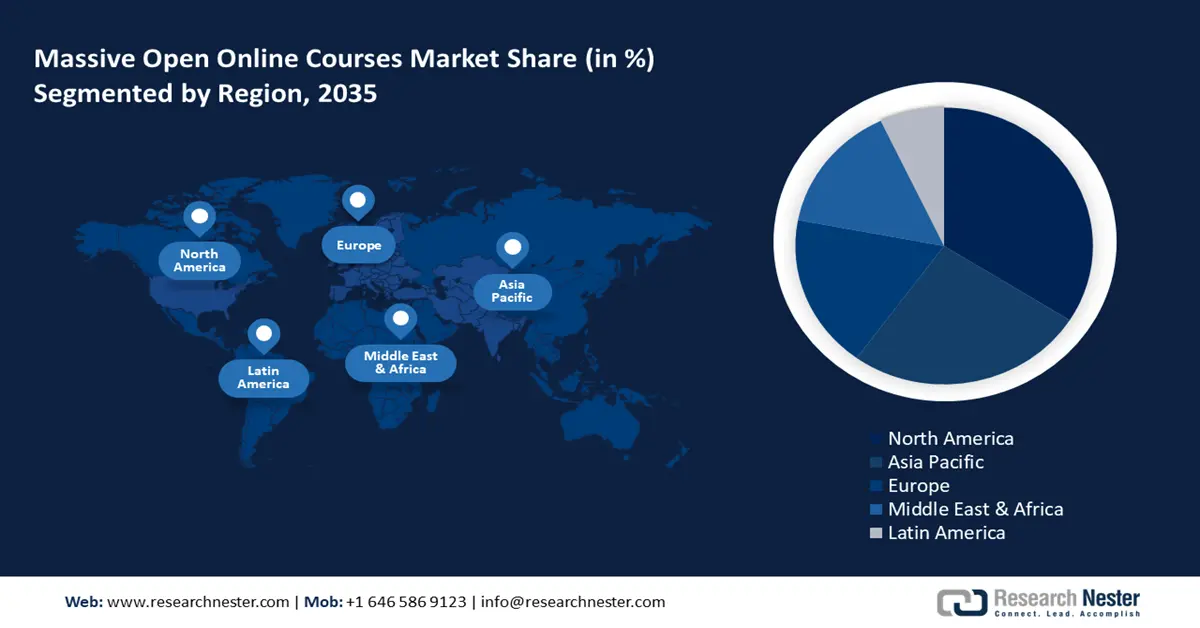

- North America massive open online courses (MOOC) market will account for 33.70% share by 2035, driven by advanced digital infrastructure and rising demand for flexible learning.

Segment Insights:

- The freemium moocs segment in the massive open online courses market is forecasted to achieve significant growth till 2035, driven by the offering of free access with optional paid features attracting broad audiences.

Key Growth Trends:

- Increasing demand for affordable education

- Rising acceptance of online credentials

Major Challenges:

- Limited interaction and engagement

- Lack of personalization

Key Players: Coursera, Inc., edX Inc. (2U, Inc.), Udemy, Inc., FutureLearn Limited, Khan Academy, Alison, LinkedIn Learning (Microsoft), Pluralsight, Inc., MasterClass, Inc., Udacity, Inc.

Global Massive Open Online Courses (MOOC) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.39 billion

- 2026 Market Size: USD 31.06 billion

- Projected Market Size: USD 232.71 billion by 2035

- Growth Forecasts: 24.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Canada

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Massive Open Online Courses Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for affordable education: With rising tuition costs and other financial barriers associated with traditional education, learners globally are seeking cost-effective alternatives. Governments in developing economies are helping the underprivileged with access to several paid and freemium MOOCs to meet their desired educational and career goals. For instance, in February 2023, UGC announced the launch of four Swayam MOOCs Courses hosted by the University for Buddhist Courses, Central Institute of Tibetan Studies. The platform is aimed at providing quality education to students, and professionals who can access the courses, anywhere and at any time, at a comparatively lower price.

MOOC enables individuals from diverse backgrounds to acquire new skills and knowledge without the burden of debt. The rapidly changing job market is propelling individuals globally to upskill through affordable online platforms. MOOCs are an attractive solution for regions lacking access to quality education mainly due to the financial drawbacks. This is projected to drive the MOOC market growth significantly during the forecast period, backed by new course launches, and expanding access to extremely rural regions. - Rising acceptance of online credentials: As employers significantly recognize the value of skill-based learning and digital certifications, learners are turning to MOOCs as a credible alternative to traditional degrees. Online platforms now offer specialized courses, professional certificates, and accredited degrees from renowned institutions, making them a viable option for career advancements. The growing legitimacy of online credentials is helping to establish MOOCs as a mainstream pathway for development, further fueling the MOOC market growth.

Moreover, collaborations between MOOC providers, universities, and industry giants are playing crucial roles in increasing online credentials’ credibility. As institutes and corporations endorse and co-create courses, the value of MOOC certifications continues to rise. Additionally, advancements in technology such as blockchain for verifiable digital credentials, are enhancing the trustworthiness of online certifications.

Challenges

- Limited interaction and engagement: MOOCs often house thousands of participants making it difficult to foster meaningful connections between learners and instructors. This lack of real-time interaction reduces opportunities for active discussions, personalized feedback, and collaborative learning, which are key to keeping students motivated. Consequently, learners disengage, leading to high dropout rates and reduced course completion, which undermines the perceived value of MOOCs.

- Lack of personalization: Most MOOCs offer a one-size-fits-all approach, failing to adapt to the individual learning needs, paces, and preferences of students. Without tailored support, learners generally struggle with topics or feel unchallenged, resulting in lower satisfaction. Hence, personalization is essential for effective learning, and its absence in MOOCs can hinder learner retention and limit the courses’ ability to cater to diverse global audiences.

Massive Open Online Courses Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.8% |

|

Base Year Market Size (2025) |

USD 25.39 billion |

|

Forecast Year Market Size (2035) |

USD 232.71 billion |

|

Regional Scope |

|

Massive Open Online Courses Market Segmentation:

Course Type

The freemium model segment in the massive open online courses (MOOC) market is projected to dominate with a share of 36.4% in 2035, owing to its offerings for free access to course content with optional paid features. This approach allows users to explore and engage with basic learning resources at no cost while providing the opportunity to upgrade for additional benefits. These benefits include certificates, graded assignments, or exclusive materials. The flexibility of freemium courses attracts a broad audience, including those seeking casual learning, and professionals pursuing certifications. This makes it a powerful driver of user engagement and growth of the segment in the market. In July 2024, Jaro Education announced the launch of Industry-Oriented Freemium Courses under the Lifelong Learning Initiative, designed specifically to prepare the Indian workforce for the future. Such factors are anticipated to further drive the massive open online courses market growth.

Business Model

The subscription-based segments in the business model are gaining traction as these models offer unlimited access to a wide range of courses for a recurring monthly or annual fee. Subscription plans appeal to users who are committed to continuous learning and skill development, providing a cost-effective way to access multiple courses, rather than paying individually. This approach fosters long-term user engagement, as learners are incentivized to explore diverse subjects and stay active on the platform. In September 2021, Scaler Academy announced the launch of a subscription-based upskilling program that was aimed at recreating a college campus-like experience for tech professionals. Market activities, such as this, are boosting the segment’s growth and adoption considerably.

Our in-depth analysis of the massive open online courses (MOOC) market includes the following segments

|

Platform Type |

|

|

Subject Area |

|

|

Course Type |

|

|

Learner Type |

|

|

Provider |

|

|

Delivery Mode |

|

|

Language |

|

|

Business Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Massive Open Online Courses Market Regional Analysis:

North America Market Insights

North America industry is anticipated to hold largest revenue share of 33.7% by 2035. The region benefits from advanced digital infrastructure, high internet penetration, and a strong tradition for higher education. The MOOC market is characterized by the presence of top global platforms, partnerships with prestigious universities, and a rising demand for flexible, cost-effective learning solutions. For instance, Google partnered with Coursera to allow U.S.-based organizations who are eligible, to provide access to as many as five Google Professional Certificates on Coursera through December 31, 2025. It caters to a diverse range of learners, including students, professionals, and businesses. Integration of technologies such as AI, VR, and data analytics to enhance the learning experience is also driving the market growth in the region.

The U.S. is the largest massive open online courses (MOOC) market in North America due to the high digital literacy rate, and presence of major MOOC platforms. Universities including Harvard, MIT, and Stanford are pioneers in the MOOC movement, and platforms including Coursera and edX originated in the U.S. The U.S. state and federal governments are supporting online education programs to bridge the skills gap and help citizens transition into new careers. Companies and organizations facing talent shortages are sponsoring MOOCs for employees to help them develop new competencies.

Universities and educational institutions in Canada are offering online courses to complement traditional learning, majorly in technology, business management, and healthcare. Government support in digital initiatives is making MOOCs accessible across the country, including remote areas. Companies offer courses in both English and French to cater to the diverse Canadian population. The flexible modular learning options, allowing learners to acquire new skills throughout their careers, are driving Canada’s workforce to adopt more of these courses.

APAC Market Insights

APAC massive open online courses market is fueled by the large and youthful population, rapid digital transformation, and urbanization. Government initiatives promoting e-learning, and rising demand for upskilling are further boosting the MOOC market growth. Countries including China, India, and other Southeast Asia nations are witnessing a massive rise in smartphone penetration, allowing access to online learning platforms and engaging educational content, particularly in rural areas. Governments in the regions are actively promoting online education to bridge gaps in quality education access and to support workforce development. In January 2022, the World Economic Forum published an article stating highest rate of new learner growth online came from emerging economies. It further states that Asia Pacific witnesses a student presence of 28 million new online learners enrolling for 68 million courses on the learning platform.

Furthermore, the region’s growth is attributed to government initiatives supporting e-learning and a large population of young learners. As per an article released in August 2024 by Forbes, U.S., 23.9% take exclusively online courses, and 30.5% take both online and on-campus courses. At the graduate level, 38.7% enroll fully online, while 14.8% take classes in a hybrid format. Owing to the demand for flexible and affordable education, in addition to the growing popularity of micro-credentials, the massive open online courses market (MOOCs) is anticipated to witness significant growth in the forthcoming years.

India represents one of the largest potential markets for MOOCs, owing to the large population, and rising digital skills emphasis. International platforms such as Coursera, and edX have a strong foothold in the country, partnering with leading institutions, including the IITs. Furthermore, the government of India is also supportive of online courses, majorly helping the underprivileged in rural areas. For instance, India’s own MOOC platform SWAYAM, launched by the government, ensures access to the best teaching and learning resources to all, including the most underprivileged.

China is the most rapidly expanding market for MOOCs in the Asia Pacific. Rising demand for tech and business skills is driving the MOOC market in the country. Several platforms partner with top universities to offer localized content, as the population is majorly inclined towards science, and technology, in addition to entrepreneurship. The country has a high rate of digital literacy, and MOOCs are increasingly integrated into formal education systems as well as corporate training programs.

Massive Open Online Courses Market Players:

- Coursera

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- edX

- FutureLearn

- Khan Academy

- LinkedIn Learning

- Udacity

- Udemy

Companies in the MOOC market are strategically partnering and collaborating with top universities, corporations, and other educational institutions. These strategies are aimed at offering a range of high-quality courses, for professional certifications, degrees, and specialized skill-building programs. For instance, in November 2023, the NBSOIL webinar marked the launch of MOOC on Nature-Based Solutions for Soil Management. The platforms mainly attract lifelong learners and professionals looking to upskill and reskill. Additionally, these platforms are developing more adaptive learning technologies, using AI to enhance personalization and improve learner outcomes. By integrating interactive elements including live sessions, project-based learning, and peer discussions, they aim to increase engagement and retention.

Recent Developments

- In May 2024, FutureLearn announced a strategic partnership with the National eLearning Center (NeLC) of Saudi Arabia, aiming to integrate FutureLearn’s extensive educational resources into the FutureX platform.

- In April 2023, Google announced the availability of Advanced Data Analytics and Business Intelligence certificates on Coursera, designed for learners who have already completed the entry-level certifications or hold a similar experience.

- In April 2023, 2U, Inc. announced the launch of Try It courses which include 1–2-hour free online introductory courses. These courses are designed to give learners exposure to foundational skills in a variety of high-demand topics, such as Python, UI/UX Design Thinking, HTML, GitHub, and more.

- In February 2023, edX, 2U, inc., and Degreed announced an expanded partnership to offer organizations quality content and platform solutions for education that drive skills-based learning.

- Report ID: 6499

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Massive Open Online Courses (MOOC) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.