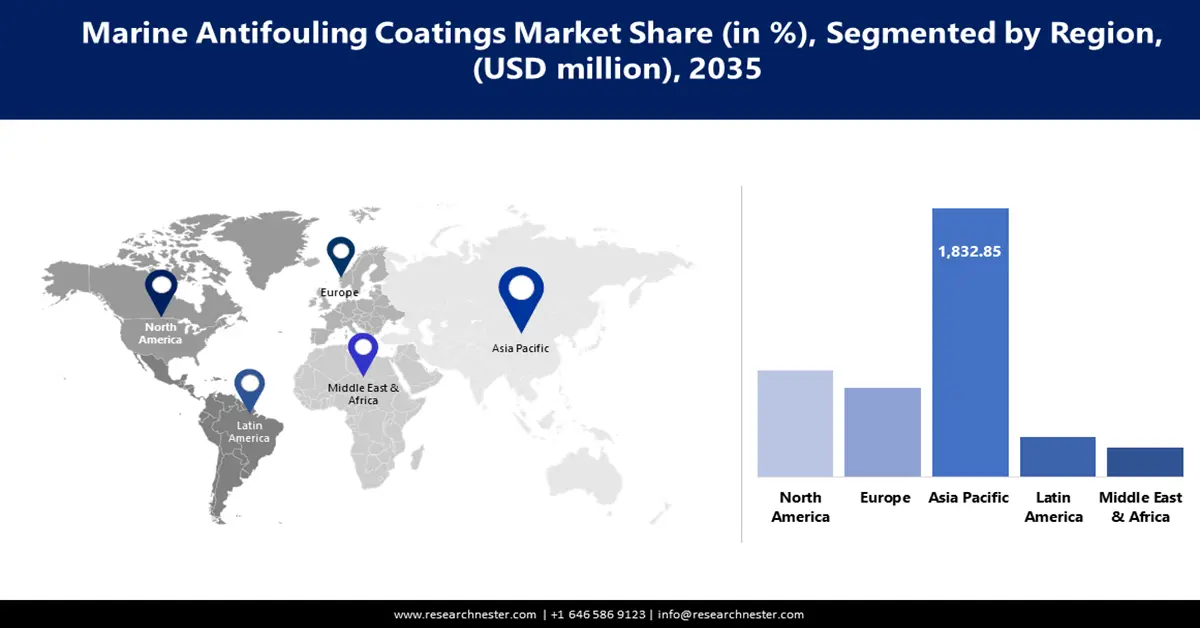

Marine Antifouling Coatings Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is poised to dominate majority revenue share of 56.5% by 2035. The region dominates the market due to its massive shipbuilding industry and large-scale maritime affairs. In 2023, over 50% of the shipping fleet in the world was concentrated in Asia Pacific, according to the United Nations Conference on Trade and Development (UNCTAD). This indicates a huge demand for antifouling coatings to protect the fleet and keep it operational.

In China, the market growth is elevated by governmental support provided to the maritime industry. The China government announced in March 2023 an increase in investments being channeled toward sustainable shipping technologies that would eventually stir the adoption of environmentally friendly, economically efficient advanced antifouling coatings. Major coating manufacturer Chugoku Marine Paints Ltd. announced its expansion in April 2023 to cater to the growing demand for high-performance antifouling coatings in the country.

India marine antifouling coatings market is witnessing steady expansion due to several positive government initiatives being instituted to modernize the country’s maritime infrastructure. For example, the Maritime India Vision 2030 launched by the Ministry of Ports, Shipping and Waterways in April 2023, focuses on responsible practices and technology in maritime operations. Such an initiative is likely to spur demand for antifouling products as the country positions itself to improve efficiencies and compliance within its shipping industry.

North America Market Analysis

North America marine antifouling coatings market is expected to witness a rapid CAGR till 2035, owing to continuous advances in technology along with increasing stress on environmental sustainability. The strict environmental regulations and greater awareness regarding the potential benefits of sustainable maritime practices increase the consumption rate of eco-friendly coating in this region.

Companies in the U.S. continue to invest heavily in research and development of advanced antifouling solutions. For example, in June 2023, Sherwin-Williams introduced SeaGuard Hybrid, an advanced antifouling coating based on the combination of biocide-free technology with strong durability that reduces fuel consumption, resulting in lower emissions of greenhouse gases. Such product launches indicate how companies are moving toward sustainable products that meet environmental standards while offering superior performance.

Canada is also among the key contributors to marine antifouling coatings market growth, making investments in maritime innovation. In May 2023, the Canada government announced key funding for research into antifouling coatings, among other marine technologies, showing its green maritime credentials. By investing in research and development for advanced antifouling coatings, Canada aims to support both local innovation and global maritime sustainability standards. These initiatives position Canada as a leader in promoting eco-friendly practices within the maritime industry, attracting attention from global stakeholders and businesses.